With growing demand from electronics, automotive, aerospace, and medical device manufacturing sectors, the assembly tray market is growing gradually. To improve productivity and reduce costs and thereby stimulate further market growth, major companies are focusing on enhancing material durability, sustainability, and automation in production processes.

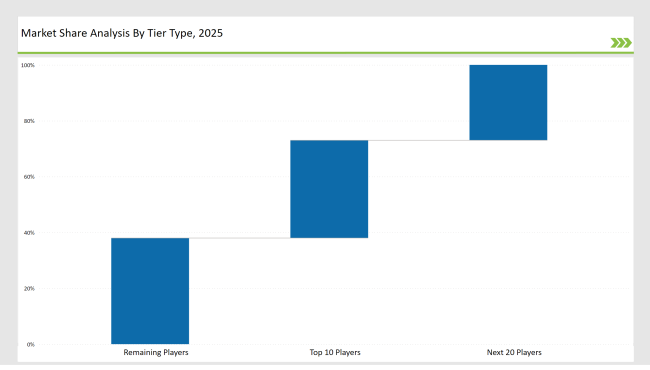

Tier 1: Leading companies such as Conductive Containers, Keter, and Nelson Plastics dominate 35% of the market, leveraging advanced materials, robust distribution networks, and continuous innovation in reusable and ESD-safe assembly trays.

Tier 2: Companies like UFP Technologies, Plastiform, and Flexcon control 27% of the market. These firms cater to mid-sized consumers by offering high-performance tray solutions with a focus on affordability, customization, and regulatory compliance.

Tier 3: Regional and niche manufacturers specializing in specialty trays for medical, electronics, and industrial applications account for the remaining 38% of the market. These players focus on tailored solutions with localized distribution strategies.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Conductive Containers, Keter, Nelson Plastics) | 18% |

| Rest of Top 5 (UFP Technologies, Plastiform) | 12% |

| Next 5 of Top 10 (Flexcon, PolyFlex, ThermoPro, Molded Fiber, Sonoco) | 5% |

The assembly trays market serves multiple industries, driven by the need for organized, protective, and sustainable tray solutions.

To meet industry expectations, companies are focusing on durable materials, reusability, and precision engineering.

There has been competition on increased due to improvements in design engineering, use of environmentally friendly materials, and automatic production of tray fabrication. There has been the provision of financial means in manufacturing, doing researches on designing high durable and environment-friendly assembling trays.

Year-on-Year Leaders

Technology suppliers should focus on integrating smart manufacturing, sustainability, and material innovation to remain competitive. Collaboration with raw material providers will further enhance innovation.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Conductive Containers, Keter, Nelson Plastics |

| Tier 2 | UFP Technologies, Plastiform, Flexcon |

| Tier 3 | PolyFlex, ThermoPro, Molded Fiber, Sonoco |

Leading manufacturers are expanding their production capabilities, incorporating sustainable materials, and developing high-precision engineering in response to evolving industry demands.

| Manufacturer | Latest Developments |

|---|---|

| Conductive Containers | Launched an advanced line of ESD-safe trays for electronics (March 2024). |

| Keter | Developed ultra-durable reusable trays for automotive assembly (August 2023). |

| Nelson Plastics | Introduced cost-effective, high-strength trays for industrial use (May 2024). |

| UFP Technologies | Expanded its medical tray production with FDA-compliant materials (November 2023). |

| Plastiform | Released thermoformed trays with precision molding for aerospace (February 2024). |

As the competitive landscape in the assembly trays market evolves, key players are prioritizing innovation, sustainability, and automation to maintain a strong market presence.

The assembly trays market will continue growing through advancements in automation, sustainable materials, and high-precision engineering. Companies will invest in AI-driven design, biodegradable materials, and durable reusable trays to align with industry demands. Increasing regulatory requirements on sustainability will further shape the industry's direction.

Leading players include Conductive Containers, Keter, Nelson Plastics, UFP Technologies, and Plastiform.

The top 3 players collectively control 18% of the global market.

The market exhibits medium concentration, with top players holding 35%.

Key drivers include sustainability, automation, material innovation, and regulatory compliance.

Explore Packaging Formats Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.