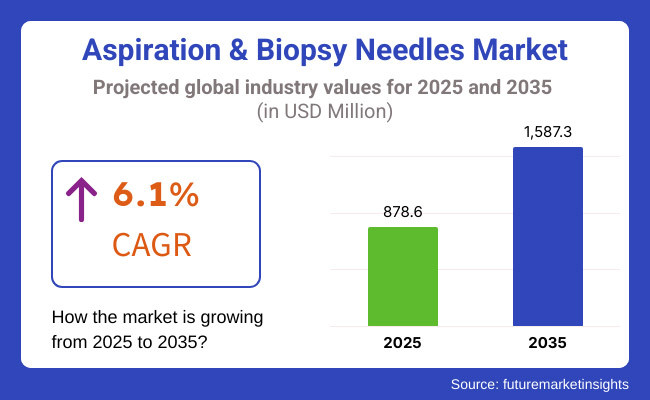

The aspiration & biopsy needles market will witness steady growth during 2025 to 2035, led by technological advancements in minimally invasive diagnostic procedures, growing prevalence of cancer, and rising use of image-guided biopsy procedures. The market will grow from USD 878.6 million in 2025 to USD 1,587.3 million in 2035, demonstrating a compound annual growth rate (CAGR) of 6.1% during the forecast period.

Aspiration and biopsy needles are essential tools in oncology, pathology, and interventional radiology by allowing for accurate tissue sampling for the diagnosis of a variety of conditions, particularly cancer, infectious diseases, and inflammatory disorders. The increasing need for early disease detection, personalized medicine, and targeted therapies is driving market growth.

Moreover, developments in technology like needle design and ultrasound and CT-guided biopsy techniques as well as robotic-assisted procedures are enhancing diagnostic accuracy and improving patient outcomes. Furthermore, growing awareness regarding cancer screening programs, favourable government initiatives, and increasing healthcare expenditure is also expected to fuel market growth.

But also, risk of complications, procedural costs, and availability of complementary diagnostic methods could limit their applicability. Major market players are emphasizing the advancement of precision-engineered biopsy needles, portfolio expansion, and strategic partnerships with healthcare institutions to combat such challenges.

Explore FMI!

Book a free demo

North America dominates the aspiration & biopsy needles market owing to the increasing prevalence of cancer, growing adoption of minimally invasive procedures, and technological advancements in biopsy procedures. Key countries in general market: United States and Canada hold largest share in the region, as leading medical device manufacturers focus heavily on development of precision biopsy needles and image-guided aspiration technologies.

Increasing prevalence of breast, lung, and prostate cancers also ignites the market expansion for early cancer diagnosis. Supportive regulatory environment from the FDA and reinforcing reimbursement policy that strengthens accessibility to biopsy procedures.

Yet, high procedural costs and the risk for complications present barriers for widespread use. Continued innovations in needle design, robotic-assisted biopsy procedures and AI integration in imaging diagnostics are likely to move the needle further forward if you’ll excuse the pun and improve patient outcomes.

Countries such as Germany, France, and the United Kingdom will hold a significant market share for aspiration & biopsy needles owing to advanced healthcare systems as well as well-established medical research infrastructure promoting market growth in the region. The presence of major medical devices companies and rising adoption of biopsy and aspiration procedures for early detection of cancers are among the factors driving demand for this market.

The growing prevalence of cancers coupled with regulations of medical device safety ensuring quality standards and patient safety by (EMA) European Medicines Agency. Also, the emergence of real-time imaging and minimally invasive biopsy methods fosters the market expansion.

Yet, strong regulatory approvals and diverse access to healthcare resources in different countries can affect market penetration. Aiming towards future expansion of the potential market, efforts have been made to improve reimbursement policies and diagnostic capabilities.

The aspiration & biopsy needles market in Asia-Pacific is expected to witness the highest growth over the forecast period owing to factors such as growing investments in healthcare, rising awareness regarding early diagnosis of cancer and improving medical infrastructure in China, India, Japan and South Korea. An increasing burden of cancer and government initiatives to develop diagnostic facilities will propel the demand for advanced biopsy techniques.

Driven by the technological developments and growing collaborations between international and local medical device manufacturers, the adoption of ultrasound-guided and CT-guided biopsy procedures is at an uptick.

Nonetheless, factors, such as restricted infiltration to specialized healthcare facilities, regulatory complexities, and cost constraints could hinder the market growth. Efforts to further increase affordability, further simplify regulatory processes, and continuously expand healthcare access in the region will also continue to drive market growth.

Challenge: Accuracy and Safety Concerns in Needle Biopsy Procedures

One of the key factors hindering the growth of aspiration & biopsy needles market is the high risk of complications associated with needle biopsy procedures. While these minimally invasive approaches are a cornerstone in diagnosing many diseases, including cancer, the inadequacy of tissue sampling, drifting of the needle and potential sequelae, such as hemorrhage or infection, remains high.

Knowledge of the potentially hazardous IFNGAPs in conjunction with ultrasound imaging, needle aspect ratio (AR), procedural standardization, will ensure a substantial decrease in associated complications and an improvement in the diagnostic quality.

Opportunity: Technological Advancements in Biopsy Needle Design and Imaging Integration

Emerging biopsy needle technology and imaging integration are expected to offer factor for growth of the aspiration & biopsy needles market. Advances like robotic-assisted biopsy systems and AI-enhanced imaging for precision targeting, in addition to minimally invasive needle engineering, are enhancing yield of diagnosis and improving patient outcomes.

The growing integration of liquid biopsy methods and real-time tissue analysis methods also is driving the market, as these techniques offer new opportunities for timely diagnosis.

During the period from 2020 to 2024, the market advanced by leaps and bounds due to the rising prevalence of cancer, increasing adoption of minimally invasive diagnostic procedure, and technological advancements in ultrasound and CT-guided needle biopsy. High procedural costs, shortages of skilled workforces, and restrictions in access to advanced diagnostic facilities in developing regions have prevented widespread adoption, however.

The market will transform during 2025 to 2035 with AI-enabled diagnostic assistance, next-gen biopsy needle materials, and robotic automation. The combination of smart needles with real-time tissue characterization and molecular diagnostics will improve biopsy accuracy even more. Increased investments in portable and point-of-care biopsy solutions will further promote accessibility and efficiency in the early disease detection market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strict approvals for biopsy needle technologies |

| Technological Advancements | Growth in ultrasound and CT-guided needle biopsies |

| Industry Adoption | High adoption in cancer diagnostics and hospital settings |

| Supply Chain and Sourcing | Dependence on traditional biopsy needle manufacturers |

| Market Competition | Dominated by key medical device manufacturers |

| Market Growth Drivers | Rising cancer cases and demand for minimally invasive diagnostics |

| Sustainability and Energy Efficiency | Limited efforts in eco-friendly manufacturing |

| Integration of Smart Monitoring | Basic imaging-guided biopsy procedures |

| Advancements in Personalized Treatment | Standardized biopsy procedures for various conditions |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined regulations for AI-integrated and robotic biopsy solutions |

| Technological Advancements | AI-assisted imaging, robotic-guided biopsies, and smart needle innovations |

| Industry Adoption | Expansion into outpatient clinics, portable biopsy solutions, and telemedicine integration |

| Supply Chain and Sourcing | Development of next-generation materials and customized biopsy solutions |

| Market Competition | Entry of AI-driven diagnostic firms and biotech innovators |

| Market Growth Drivers | Adoption of real-time biopsy analysis, molecular profiling, and precision medicine |

| Sustainability and Energy Efficiency | Expansion of biodegradable biopsy needles and sustainable medical device production |

| Integration of Smart Monitoring | AI-enhanced tissue analysis, real-time feedback systems, and remote biopsy assistance |

| Advancements in Personalized Treatment | AI-driven personalized biopsy approaches, targeted diagnostics, and liquid biopsy advancements |

High prevalence of cancer along with increasing number of minimally invasive diagnostic procedures boosts the aspiration and biopsy needles market in the United States. Surge in demand for early cancer detection and advancements in biopsy techniques including fine-needle aspiration (FNA) and core needle biopsy (CNB) considerably drive the market growth.

Moreover, technological advancements in needle design that are driven by bulk-size medical device manufacturers are also aiding the market growth, as they are now more accurate and comfortable for patients as compared to earlier needles.

Additionally, government-backed initiatives introducing cancer screening programs and positive reimbursement policies for biopsy procedures supplement the aseptic market growth. Rising volume of robotic-assisted biopsy procedures performed at prominent hospitals and diagnostic centres is also propelling the robotic-assisted biopsy market in terms of precision and efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

The aspiration and biopsy needles market in the United Kingdom is gradually growing, led by the surging burden of cancer cases and the escalating use of minimally invasive diagnostic procedures. Early cancer detection programs are actively promoted by the National Health Service (NHS), which is also contributing toward the demand for biopsy procedures. Introduction of advanced imaging techniques, including ultrasound-guided and MRI-guided biopsy, is improving diagnostic precision and ultimately patient prognosis.

Moreover, UK-based research institutes are working closely with medical device manufacturers to create advanced biopsy needles with enhanced accuracy and safety features. Market growth is also being propelled by the existence of established healthcare facilities and a growing awareness surrounding the importance of early detection of diseases.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.5% |

Needles segment to lead in the European Union during Forecast Period. Germany, France, and Italy are some of the leading contributors, thanks to their strong healthcare infrastructures and high adoption rates of advanced biopsy technologies. The region is witnessing the presence of major medical device manufacturers focusing on developing novel biopsy solutions that ensure increased safety and precision.

Furthermore, strict regulatory frameworks laid down by the European Medicines Agency (EMA) ensure the availability of quality-assured and effective biopsy needles. The intervention of government-supported cancer screening programs and increasing investment in research, thereby contributing towards the overall growth of market in the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.6% |

Japan biopsy needled-market is growing, owing to increasing aging population and increasing chronic diseases including cancer and respiratory disorders. Imagine a nation leading the world in medical tech, with the precision of lifesaving diagnostics and the delicacy of minimally invasive interventions.

Pharmaceutical company Japanese healthcare AI Imaging Solutions Biopsy .Also, more clinical trials and research cooperation between medical universities and device manufacturers have helped stimulate innovation in the design of biopsy needles. Moreover, government programs supporting early cancer detection programs and improved healthcare access are driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.4% |

The aspiration and biopsy needles market in South Korea is being propelled by rising investments in the healthcare system and progressing diagnostic technologies. Increasing awareness about early cancer screening and the country's well-functioning medical infrastructure is boosting demand for biopsy procedures.

Treatment - South Korea gets great number of medical tourists as international patients look for good diagnostic and treatment facilities .Now, with the combination of robotic systems and AI diagnostics imaging, everything is becoming more precise and more efficient. Market growth is anticipated in the coming years due to government initiatives regarding the expansion of cancer screening programs and the accessibility of healthcare.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.7% |

Based on the product type, the biopsy needles segment accounted for the largest share in the aspiration and biopsy needles market due to the increasing global incidence of cancer and the demand for minimally invasive diagnostic procedures. Cancer represents one of the most common life-threatening diseases globally and has rendered biopsy-based testing a keystone for cancer management.

Introduction: Biopsy needles are an essential part of the tissue acquisition process used for histopathological assessment for the diagnosis, staging, and treatment planning of various types of neoplasms including malignancies. This transition to image-guided procedures for biopsy, such as ultrasound, CT, and MRI guided biopsy, has ultimately improved the safety and effectiveness of tissue sampling whilst minimising associated IAT complications.

The increasing focus toward early cancer screening programs, along with the growing awareness of the need for timely diagnosis, has resulted in a rise in the use of biopsy needles in diagnostic laboratories, hospitals, and specialty clinics.

Advancements in technology have continuously shaped the field, from developing more refined imaging techniques to elaborate needle designs, like core needle biopsy (CNB), fine needle aspiration biopsy (FNAB), and vacuum-assisted biopsy (VAB), increasing both the efficiency of sampling with maintain tissue integrity and resulting in decreased pain and morbidity.

Furthermore, the use of robotic-assisted biopsy systems has increased over the past several years, allowing for increased precision and real-time navigation, decreasing procedural errors and rendering improved diagnostic quality.

The increasing use of biopsy based diagnostics for personalized medicine and targeted therapy selection has also fortified the demand for advanced biopsy needle solutions. Given the rising investments in cancer research, molecular pathology, and precision oncology, the Biopsy Needles segment is set to fuel strong growth.

In addition, the trend towards increasing incidence of lifestyle-associated diseases, environmental risk factors and genetic predisposition to tumorigenesis is likely to ensure the long-term need for biopsy based cancer diagnosis approaches.

The segment which includes biopsy needles will continue to be a most important contributing factor to growth in the Aspiration & Biopsy Needles Market as researchers and health care specialists are putting their efforts into providing patient non-invasive, high-precision diagnostic solutions.

Based on application, the tumour/cancer applications segment is anticipated to contribute the largest share, as the burden of cancer cases is increasing due to a variety of causes, and the need for biopsy-based diagnostics (which represent the gold standard for tumour detection and classification) has been highlighted.

As one of the leading causes of death worldwide along with millions of new cases reported each year, there is a pressing need for advanced diagnostic tools to facilitate early detection and proper treatment of this disease. The widespread adoption of FNA and CNB procedures for diagnosing several malignancies such as breast cancer, lung cancer, prostate cancer, and several gastrointestinal tumours has driven the demand for biopsy and aspiration needles.

With the advent of real-time imaging techniques, like PET-CT and MRI fusion guided biopsies, tumour localization and sample accuracy have improved, limiting the necessity for multiple procedures, with a direct impact on the patient's outcome.

Moreover, advances in liquid biopsy technologies, AI-based histopathology evaluation, and next-generation sequencing (NGS) have also expanded the pivotal role of biopsy and aspiration needles in precision medicine. These advances make it possible to identify tumour-specific biomarkers, genetic mutations, and molecular fingerprints, empowering oncologists to formulate customized therapeutics for individual patients.

A growing uptake of clinical research programs and pharmaceutical trials for new cancer therapies has further spurred demand for biopsy-based tissue analysis. Along with immunohistochemically staining, detection of genetic alteration for molecular profiling, and considerations of drug resistance, bio banking include needle biopsies that are employed to obtain and preserve tumour tissues for various studies to identify optimal therapies based on the data obtained by the tissue through clinical conferring with pathology and molecular biology.

Vacuum-assisted biopsy (VAB) systems have enhanced efficiency and safety in the tumour biopsy space with the emergence of robotic-assisted biopsy platforms, which have also improved the user experience in this previously complex area of medicine, making tumour biopsies routine clinical procedures.

Governments and health care organizations across the globe are paying extra focus and making investments in cancer prevention, screening, and diagnostic infrastructure, thus increasing the demand for biopsy needles of superior quality.

The anticipated advancements in the market would be fuelled by adopting universal healthcare policies, beneficial reimbursement frameworks, and national cancer screening programs. As oncology continues to be a global priority in healthcare strategies, the Tumour/Cancer Applications segment will also develop further and will play an important role in the Aspiration & Biopsy Needles Market for many years ahead.

The rising number of cancer cases globally and demand for minimally invasive diagnostic are two of the key factors boosting the growth of aspiration & biopsy needles market and will continue in the near future. The increasing preference for needles used for biopsy procedures, especially ultrasound-guided biopsy and CT-guided biopsy is fuelling the growth of any type of aspiration and biopsy needles with better quality.

To enhance their market presence, major players in the market are providing with innovation, new product launches such as novel needle designs and advancements in precision and security of the patient. Additionally, increasing awareness and screening programs for cancer and other chronic diseases act as key contributors for the market growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BD (Becton, Dickinson and Company) | 22-26% |

| Medtronic plc | 18-22% |

| Boston Scientific Corporation | 14-18% |

| Argon Medical Devices, Inc. | 10-14% |

| Cook Medical | 8-12% |

| Other Industry Players (Combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| BD (Becton, Dickinson and Company) | Provides a full array of aspiration and biopsy needles that are specifically designed for precision, safety and reliability. |

| Medtronic plc | Focussing on advanced biopsy needle design & technology. |

| Boston Scientific Corporation | Focused on giving advanced biopsy needles and imaging functionality for greater accuracy. |

| Argon Medical Devices, Inc. | Expert in ergonomically designed soft tissue biopsy and aspiration needles for clinician comfort. |

| Cook Medical | Commonly on developing innovative biopsy needle technology to improve sampling and diagnostic yield. |

Key Company Insights

BD (Becton, Dickinson and Company) (22-26%)

BD is the market leader in the aspiration & biopsy needles market with a broad set of biopsy and aspiration needle solutions. Its innovation-driven focus on patient safety has positioned the company as an industry leader.

Medtronic plc (18-22%)

Medtronic: This company is a global leader in biopsy needles and offers ultra-precision needles that aid in accurate diagnosis and reduce patient discomfort.

Boston Scientific Corporation (14-18%)

Boston Scientific develops biopsy needles that incorporate imaging capabilities, allowing clinicians to visualize the desired site in real time, increasing procedural accuracy.

Argon Medical Devices, Inc. (10-14%)

Argon Medical specializes in biopsy needle solutions especially in soft tissue biopsy procedures and ergonomically designed needles.

Cook Medical (8-12%)

We are committed to innovations in biopsy needle technology that help ensure diagnostic and procedural precision all to help patients.

Other Key Players (20-30% Combined)

However, the market also faces challenges such as high procedure costs and limited availability of trained professionals in the field. Market growth is partly thanks to developing companies and research-driven organizations such as:

The overall market size for the aspiration & biopsy needles market was USD 878.6 million in 2025.

The aspiration & biopsy needles market is expected to reach USD 1,587.3 million in 2035.

The aspiration & biopsy needles market is expected to grow at a CAGR of 6.1% during the forecast period.

The demand for the aspiration & biopsy needles market will be driven by the rising prevalence of cancer and chronic diseases, increasing demand for minimally invasive procedures, advancements in needle technologies, growing awareness about early disease detection, and expanding healthcare infrastructure.

The top five countries driving the development of the aspiration & biopsy needles market are the USA, Germany, China, Japan, and India.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.