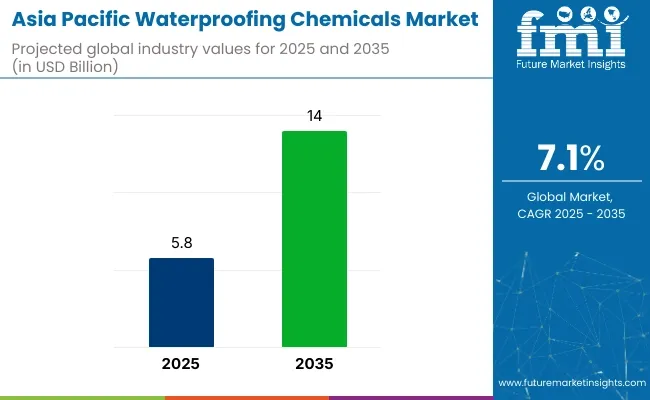

The Asia Pacific waterproofing chemicals market is projected to experience significant growth, expanding from USD 5.8 billion in 2025 to USD 14.0 billion by 2035, reflecting a robust CAGR of 7.1%. This expansion is primarily driven by rapid urbanization and large-scale infrastructure development across the region. Increasing construction activities in countries such as China and India are creating strong demand for effective waterproofing solutions that enhance the durability and longevity of buildings, bridges, and other critical infrastructure.

In 2025, the rising focus on climate resilience and sustainable construction practices is fueling demand for advanced waterproofing chemicals. Manufacturers are innovating to develop products that withstand harsh weather conditions and reduce environmental impact.

Digital technologies such as AI and automation are being integrated into production processes to improve product consistency and efficiency. Regional governments are also encouraging green building standards, increasing adoption of eco-friendly waterproofing materials.

Key developments in the market include the launch of nanotechnology-enhanced waterproofing coatings that provide superior water resistance while maintaining breathability. Additionally, polyurethane and silicone-based waterproofing chemicals with enhanced UV resistance and elasticity are gaining traction.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 5.8 Billion |

| Projected Market Size in 2035 | USD 14.0 Billion |

| CAGR (2025 to 2035) | 7.1% |

Companies are also focusing on solvent-free and low-VOC formulations to meet stricter environmental regulations. Strategic collaborations between chemical manufacturers and construction firms have accelerated the deployment of these innovations across both urban and rural infrastructure projects.

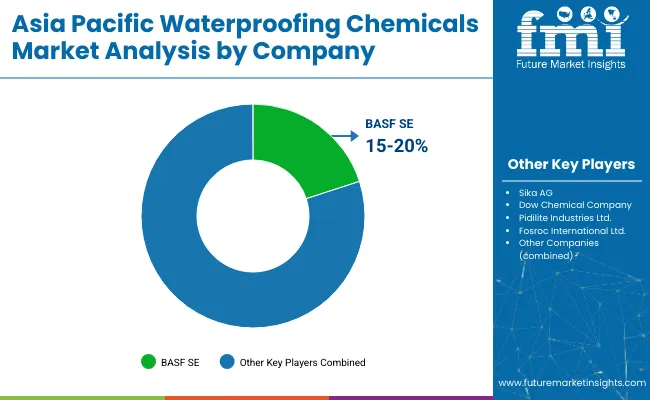

Key players leading the market include BASF SE and Sika AG, holding significant shares estimated between 15-20% and 12-16%, respectively. These companies invest heavily in research and development to deliver waterproofing solutions tailored to regional challenges.

Their ongoing innovation efforts and strategic partnerships are propelling market growth. The Asia Pacific waterproofing chemicals market is expected to maintain robust momentum through 2035, fueled by urban growth, regulatory pressures, and continuous technological advancement.

In the Asia Pacific region, the waterproofing chemicals market is largely driven by two main segments: bitumen membranes and polyurethane coatings, which together hold about 70% of the market share. Bitumen membranes command around 40% share due to their proven durability, water resistance, and cost-effectiveness. Widely used in residential, commercial, and infrastructure projects, bitumen membranes protect structures from moisture damage and extend their lifespan.

Leading manufacturers such as Sika, BASF, and GAF offer advanced bitumen membrane products. Polymer-modified bitumen membranes like SBS (Styrene-Butadiene-Styrene) and APP (Atactic Polypropylene) enhance flexibility, temperature resistance, and crack-bridging capability, making them suitable for harsh climatic conditions. Their increasing use in large-scale projects like roads, bridges, and tunnels-supported by government urban development initiatives in countries such as China and India-is propelling market growth.

Polyurethane coatings hold roughly 30% of the market and are favored for their seamless, liquid-applied coverage, flexibility, and excellent chemical resistance. Companies like RPM International, BASF, and Fosroc supply polyurethane waterproofing products used extensively on high-traffic surfaces and complex architectural structures, including industrial facilities, basements, and parking garages. Innovations such as fast-curing formulations (e.g., BASF’s MasterSeal PU) and nanotechnology-enhanced products improve application ease and durability, encouraging wider adoption across the region.

In the Asia Pacific waterproofing chemicals market, direct sales dominate, accounting for about 45% of the market share. Leading manufacturers such as BASF, Sika, and Asian Paints use this channel to maintain close relationships with large construction companies and infrastructure developers.

Through direct sales, these companies can provide tailored waterproofing solutions, offer technical training, and ensure correct product application on complex projects like commercial buildings, highways, and transport networks. This hands-on approach allows for better management of project-specific requirements and helps build strong customer loyalty, particularly for high-performance products that require expert guidance.

On the other hand, distributors and wholesalers hold approximately 25% of the market share. Companies including W.R. Grace & Co., RPM International, and Fosroc rely on these intermediaries to reach smaller contractors, local retailers, and regional markets across countries like India, Southeast Asia, and Australia.

Distributors offer essential services such as logistics support, inventory management, and faster product availability, making it easier for manufacturers to penetrate remote and fragmented markets where direct sales may not be feasible or cost-effective. This dual-channel strategy allows waterproofing chemical producers to maximize market coverage and meet diverse customer needs across the region.

Regulatory Compliance

The waterproofing chemical manufacturers face one of the biggest challenges in terms of navigating the various environmental and safety-related regulations that are often based on regional and international standards.

Countries in the Asia Pacific region are implementing strict guidelines for chemical formulations to deliver solutions that meet sustainability and health-specific requirements. Adhering to these regulations entails ongoing investments in research, development, and certification processes, which poses one of the primary challenges for market participants.

High Material Costs

The high cost of modern waterproofing materials, especially the environmentally friendly ones and high-performance varieties, is still a major concern in the industry and among customers. Such materials typically require expensive raw ingredients that are infeasible for price-sensitive markets.

Skilled Labour Shortages

Waterproofing chemicals require exact application, and this is something you may have no experience with. But there is a significant lack of trained experts who can adequately use these products, which can result in inefficiencies and the potential for poor application practices that could negatively affect product performance.

Technological Innovations

Innovative waterproofing materials development, such as smart coatings that respond to environmental factors and self-healing waterproofing solutions, opens new growth opportunities. Not only do these evolutions increases longevity of constructions, nevertheless also yield long run monetary benefits.

Sustainability Trends

The rise in the trend of sustainable construction methods has resulted in a demand for waterproofing solutions that comply with green building certifies. This trend will serve as a huge opportunity for manufacturers who are specifically dealing in biodegradable, non-toxic and energy efficient waterproofing chemicals.

Infrastructure Expansion

Due to strong investments from many countries in the Asia Pacific region in the modernization of infrastructure, there is an increased demand for waterproofing chemicals. The demand for efficient waterproofing solutions will only increase over the next decade, due to large scale infrastructure projects such as highways, bridges, tunnels and public transport systems.

The United States waterproofing chemicals market is increasingly growing due to construction activities on the rise, with investments both sustainable and in new developments, and advancements in waterproofing tech. The residential, commercial, and industrial construction sectors in the country are major end users of high-performance waterproofing chemicals such as polyurethane coatings, bitumen, and acrylic-based solutions.

As climate change and extreme weathers become more worrisome, there is a drive in the USA to use durable waterproofing materials that can help protect structures from moisture and the negative effects of leaks long for many years.

Highway and bridge rehabilitation projects and government institution infrastructure development initiatives are expected to increase the demand for waterproofing chemicals in road construction as well as tunnels and transportation infrastructure.

More than USD 20 billion, the USA roofing industry has remained one of the major movers of waterproofing chemicals, as demand for EPDM, TPO, and modified bitumen membranes continues to rise. In addition, technological advances in polymer-based waterproofing systems are enhancing chemical resistance, flexibility, and life.

There will be steady expansion of USA waterproofing chemicals market, driven by continued government investment in infrastructure projects, stringent building codes, and increasing demand for advanced waterproofing solutions

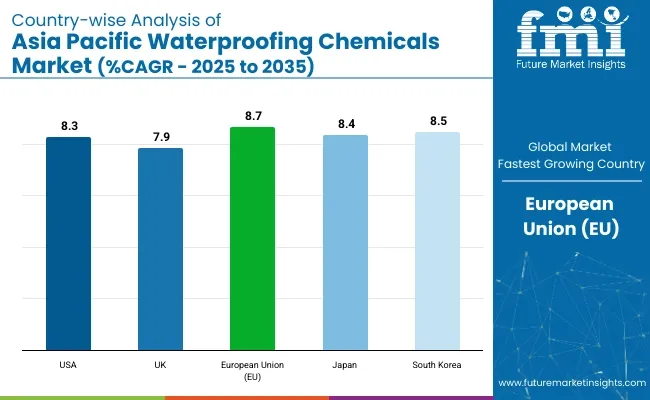

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

Factors such as stringent environmental regulations, increasing adoption of sustainable construction practices, and rising investments in urban infrastructure projects are driving the growth of the waterproofing chemicals business in the United Kingdom. Demand for sustainable waterproofing materials - such as water-based membranes, bio-based sealants and VOC-free coatings - is rising in response to the UK’s pledge to achieve net-zero emissions by 2050.

The UK residential sector is an important consumer of waterproofing chemicals, with growing use of roof waterproofing, basement insulation, and moisture-resistant coatings. It is anticipated that the growing urban housing developments and sustainable building projects will result in a greater demand for liquid-applied waterproofing membranes (LAMs) and self-adhesive waterproofing solutions.

The frequent occurrence of heavy rainfall and flooding create a strong demand for waterproofing solutions in road construction, underground tunnels, and bridge rehabilitation projects. The UK government is planning to invest 600 billion in infrastructure development in the upcoming 10 years which is anticipated to drive demand for waterproofing chemicals in highways, railways, and public buildings.

Nanotechnology-based waterproofing coating is also experiencing growing adoption due to rising demand for premium waterproofing materials across commercial real estate and smart building technologies. Moreover, the motion of repairing and retrofitting the existing infrastructures has been building a market for silicone-based sealants, and polymer-modified bitumen coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.9% |

Due to stringent sustainability policies, rising demand for high-efficiency waterproofing solutions, and growing urban infrastructure projects, the European waterproofing chemicals market is growing at a fast pace. Low-VOC, recyclable, and durable waterproofing materials have gained momentum as a result of the EU’s Green Deal and Circular Economy Action Plan across industries.

The waterproofing chemicals market is being driven by Europe’s construction sector, which is worth over 1.5 trillion. Strong demand for waterproofing membranes, acrylic coatings, and polymer-based solutions, in residential, commercial, and transportation infrastructure is being witnessed in Germany, France, and Italy.

With an increasing emphasis on energy-efficient buildings in the market and tight regulations in the EU to ensure the sustainability of construction materials, leading extensive demands the development of durable, fire resistant, and non-chemical based waterproofing products.

Another driving force is the transportation and infrastructure market, which indirectly supports growth, owing to the increasing investments in sophisticated solutions including railways, bridges and smart city projects are expected to be the prominent driving forces behind the demand for advanced waterproofing solutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.7% |

Japan Technological innovation, earthquake-resistant construction, and the increasing adoption of energy-efficient building materials are driving the steady growth of the Japanese waterproofing chemicals market. As natural disasters including typhoons, extreme rain, and earthquakes have been common in Japan, there is great demand for advanced waterproofing solutions that are also improving structural durability and resilience.

The phenomenon has spurred Japan’s urban construction sector, editing everything from high-rise buildings and commercial centers to smart infrastructure projects to adopt polyurethane coatings, EPDM membranes and polymer-based waterproofing solutions.

Vinyl’s construction, chemical corrosion and final finishing features have been further promoting the market growth from the government's focus on infrastructure modernization and disaster-resistant construction.

Moreover, the growth of Japan’s smart city and real estate initiatives has also fuelled the demand for eco-friendly waterproofing chemicals, particularly low-maintenance and long-lasting materials. Moreover, with its robust industrial base, especially in the automotive and electronics sectors, Japan is witnessing opportunities for specialized waterproofing solutions in factories, storage and production plants.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.4% |

The South Korean waterproofing chemicals market is growing steadily due to urbanisation activities, government investments towards smart cities and adoption towards more sustainable building materials.

The booming residential and commercial construction industry of South Korea is also augmenting the demand for durable waterproofing solutions such as polyurethane coating, elastomeric membranes, and acrylic sealants. Demand for low-VOC and recyclable waterproofing products is on the rise within the country, a response to the focus on lowering carbon emissions from the construction industry.

South Korea’s waterproofing chemicals market is expanding steadily over the forecast period due to government-oriented infrastructure modernization and growing consumer preference for energy-efficient buildings.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.5% |

The increasing demand for infrastructure development, urbanization and sustainable construction materials are the primary factors that drive the Asia Pacific waterproofing chemicals market. By employing advanced polymer-based waterproofing solutions, col environmentally friendly coatings, and AI-driven performance monitoring within the materials, companies are increasing waterproofing effectiveness, structural longevity, and energy efficiency.

Global chemical manufacturers, as well as regional products, contribute to the innovation of waterproofing membranes (membrane systems- sheets, membranes, etc.), sealants and liquid applied coatings to the market.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 5.8 billion |

| Projected Market Size (2035) | USD 14.0 billion |

| CAGR (2025 to 2035) | 7.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Technology Types Analyzed (Segment 1) | Membrane Type, Coatings, Injection Grouting, Integral System |

| Sales Channels Analyzed (Segment 2) | Direct Sales, Retail Stores, Distributors and Wholesalers, Online, DIY |

| End Users Analyzed (Segment 3) | Commercial Sector, Residential Sector, Infrastructure Sector, Industrial Sector, Others |

| Regions Covered | Asia Pacific |

| Countries Covered | China, India, Japan, South Korea, Australia, New Zealand, Indonesia, Vietnam, Thailand, Malaysia, Philippines |

| Key Players influencing the Asia Pacific Waterproofing Chemicals Market | BASF SE, Mapei S.p.A., Wacker Chemie AG, Akzo Nobel N.V., Evonik Industries, Sika AG, W.R. Grace and Company, H.B. Fuller, Pidilite Industries Limited, Jiahua Chemicals Inc. |

| Additional Attributes | Technological advancements in sustainable waterproofing solutions, Adoption of liquid applied membranes and crystalline waterproofing systems, DIY and e-commerce growth in residential applications, Public-private investments in smart cities and infrastructure projects driving chemical demand |

| Customization and Pricing | Customization and Pricing Available on Request |

In 2025, the Asia Pacific Waterproofing Chemicals Market total revenue was USD 5.8 Billion.

Asia Pacific Waterproofing Chemicals Market will reach USD 14.0 Billion by 2035.

Fast urbanism, boosting framework of action, expanding building works, and growing attentiveness about the strength of the structure will spur the Asia Pacific waterproofing chemicals market demand as fundamental waterproof initiatives in residential, business, and industry branches.

The top 5 countries which contributes to the growth of Asia Pacific Waterproofing Chemicals Market are USA, UK, Europe Union, Japan and South Korea.

Drive Pack by Bitumen Membrane and Polyurethane Coating Market Share to dominate throughout the forecast period.

Table 1: Market Value (USD million) Forecast by Region, 2020 to 2035

Table 2: Market Volume (tons) Forecast by Region, 2020 to 2035

Table 3: Market Value (USD million) Forecast by Technology Type, 2020 to 2035

Table 4: Market Volume (tons) Forecast by Technology Type, 2020 to 2035

Table 5: Market Value (USD million) Forecast by Sales Channel, 2020 to 2035

Table 6: Market Volume (tons) Forecast by Sales Channel, 2020 to 2035

Table 7: Market Value (USD million) Forecast by End User, 2020 to 2035

Table 8: Market Volume (tons) Forecast by End User, 2020 to 2035

Table 9: Thailand Market Value (USD million) Forecast by Country, 2020 to 2035

Table 10: Thailand Market Volume (tons) Forecast by Country, 2020 to 2035

Table 11: Thailand Market Value (USD million) Forecast by Technology Type, 2020 to 2035

Table 12: Thailand Market Volume (tons) Forecast by Technology Type, 2020 to 2035

Table 13: Thailand Market Value (USD million) Forecast by Sales Channel, 2020 to 2035

Table 14: Thailand Market Volume (tons) Forecast by Sales Channel, 2020 to 2035

Table 15: Thailand Market Value (USD million) Forecast by End User, 2020 to 2035

Table 16: Thailand Market Volume (tons) Forecast by End User, 2020 to 2035

Table 17: Malaysia Market Value (USD million) Forecast by Country, 2020 to 2035

Table 18: Malaysia Market Volume (tons) Forecast by Country, 2020 to 2035

Table 19: Malaysia Market Value (USD million) Forecast by Technology Type, 2020 to 2035

Table 20: Malaysia Market Volume (tons) Forecast by Technology Type, 2020 to 2035

Table 21: Malaysia Market Value (USD million) Forecast by Sales Channel, 2020 to 2035

Table 22: Malaysia Market Volume (tons) Forecast by Sales Channel, 2020 to 2035

Table 23: Malaysia Market Value (USD million) Forecast by End User, 2020 to 2035

Table 24: Malaysia Market Volume (tons) Forecast by End User, 2020 to 2035

Table 25: Indonesia Market Value (USD million) Forecast by Country, 2020 to 2035

Table 26: Indonesia Market Volume (tons) Forecast by Country, 2020 to 2035

Table 27: Indonesia Market Value (USD million) Forecast by Technology Type, 2020 to 2035

Table 28: Indonesia Market Volume (tons) Forecast by Technology Type, 2020 to 2035

Table 29: Indonesia Market Value (USD million) Forecast by Sales Channel, 2020 to 2035

Table 30: Indonesia Market Volume (tons) Forecast by Sales Channel, 2020 to 2035

Table 31: Indonesia Market Value (USD million) Forecast by End User, 2020 to 2035

Table 32: Indonesia Market Volume (tons) Forecast by End User, 2020 to 2035

Table 33: Vietnam Market Value (USD million) Forecast by Country, 2020 to 2035

Table 34: Vietnam Market Volume (tons) Forecast by Country, 2020 to 2035

Table 35: Vietnam Market Value (USD million) Forecast by Technology Type, 2020 to 2035

Table 36: Vietnam Market Volume (tons) Forecast by Technology Type, 2020 to 2035

Table 37: Vietnam Market Value (USD million) Forecast by Sales Channel, 2020 to 2035

Table 38: Vietnam Market Volume (tons) Forecast by Sales Channel, 2020 to 2035

Table 39: Vietnam Market Value (USD million) Forecast by End User, 2020 to 2035

Table 40: Vietnam Market Volume (tons) Forecast by End User, 2020 to 2035

Table 41: Guatemala Market Value (USD million) Forecast by Country, 2020 to 2035

Table 42: Guatemala Market Volume (tons) Forecast by Country, 2020 to 2035

Table 43: Guatemala Market Value (USD million) Forecast by Technology Type, 2020 to 2035

Table 44: Guatemala Market Volume (tons) Forecast by Technology Type, 2020 to 2035

Table 45: Guatemala Market Value (USD million) Forecast by Sales Channel, 2020 to 2035

Table 46: Guatemala Market Volume (tons) Forecast by Sales Channel, 2020 to 2035

Table 47: Guatemala Market Value (USD million) Forecast by End User, 2020 to 2035

Table 48: Guatemala Market Volume (tons) Forecast by End User, 2020 to 2035

Figure 1: Market Value (US$ million) by Technology Type, 2023 to 2033

Figure 2: Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 3: Market Value (US$ million) by End User, 2023 to 2033

Figure 4: Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Market Volume (tons) Analysis by Region, 2018 to 2033

Figure 7: Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Market Value (US$ million) Analysis by Technology Type, 2018 to 2033

Figure 10: Market Volume (tons) Analysis by Technology Type, 2018 to 2033

Figure 11: Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 12: Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 13: Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 14: Market Volume (tons) Analysis by Sales Channel, 2018 to 2033

Figure 15: Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 16: Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 17: Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 18: Market Volume (tons) Analysis by End User, 2018 to 2033

Figure 19: Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 20: Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 21: Market Attractiveness by Technology Type, 2023 to 2033

Figure 22: Market Attractiveness by Sales Channel, 2023 to 2033

Figure 23: Market Attractiveness by End User, 2023 to 2033

Figure 24: Market Attractiveness by Region, 2023 to 2033

Figure 25: Thailand Market Value (US$ million) by Technology Type, 2023 to 2033

Figure 26: Thailand Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 27: Thailand Market Value (US$ million) by End User, 2023 to 2033

Figure 28: Thailand Market Value (US$ million) by Country, 2023 to 2033

Figure 29: Thailand Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: Thailand Market Volume (tons) Analysis by Country, 2018 to 2033

Figure 31: Thailand Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: Thailand Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: Thailand Market Value (US$ million) Analysis by Technology Type, 2018 to 2033

Figure 34: Thailand Market Volume (tons) Analysis by Technology Type, 2018 to 2033

Figure 35: Thailand Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 36: Thailand Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 37: Thailand Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 38: Thailand Market Volume (tons) Analysis by Sales Channel, 2018 to 2033

Figure 39: Thailand Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 40: Thailand Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 41: Thailand Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 42: Thailand Market Volume (tons) Analysis by End User, 2018 to 2033

Figure 43: Thailand Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 44: Thailand Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 45: Thailand Market Attractiveness by Technology Type, 2023 to 2033

Figure 46: Thailand Market Attractiveness by Sales Channel, 2023 to 2033

Figure 47: Thailand Market Attractiveness by End User, 2023 to 2033

Figure 48: Thailand Market Attractiveness by Country, 2023 to 2033

Figure 49: Malaysia Market Value (US$ million) by Technology Type, 2023 to 2033

Figure 50: Malaysia Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 51: Malaysia Market Value (US$ million) by End User, 2023 to 2033

Figure 52: Malaysia Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Malaysia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Malaysia Market Volume (tons) Analysis by Country, 2018 to 2033

Figure 55: Malaysia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Malaysia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Malaysia Market Value (US$ million) Analysis by Technology Type, 2018 to 2033

Figure 58: Malaysia Market Volume (tons) Analysis by Technology Type, 2018 to 2033

Figure 59: Malaysia Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 60: Malaysia Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 61: Malaysia Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 62: Malaysia Market Volume (tons) Analysis by Sales Channel, 2018 to 2033

Figure 63: Malaysia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 64: Malaysia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 65: Malaysia Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 66: Malaysia Market Volume (tons) Analysis by End User, 2018 to 2033

Figure 67: Malaysia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 68: Malaysia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 69: Malaysia Market Attractiveness by Technology Type, 2023 to 2033

Figure 70: Malaysia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: Malaysia Market Attractiveness by End User, 2023 to 2033

Figure 72: Malaysia Market Attractiveness by Country, 2023 to 2033

Figure 73: Indonesia Market Value (US$ million) by Technology Type, 2023 to 2033

Figure 74: Indonesia Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 75: Indonesia Market Value (US$ million) by End User, 2023 to 2033

Figure 76: Indonesia Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Indonesia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Indonesia Market Volume (tons) Analysis by Country, 2018 to 2033

Figure 79: Indonesia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Indonesia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Indonesia Market Value (US$ million) Analysis by Technology Type, 2018 to 2033

Figure 82: Indonesia Market Volume (tons) Analysis by Technology Type, 2018 to 2033

Figure 83: Indonesia Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 84: Indonesia Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 85: Indonesia Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 86: Indonesia Market Volume (tons) Analysis by Sales Channel, 2018 to 2033

Figure 87: Indonesia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 88: Indonesia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 89: Indonesia Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 90: Indonesia Market Volume (tons) Analysis by End User, 2018 to 2033

Figure 91: Indonesia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 92: Indonesia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 93: Indonesia Market Attractiveness by Technology Type, 2023 to 2033

Figure 94: Indonesia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 95: Indonesia Market Attractiveness by End User, 2023 to 2033

Figure 96: Indonesia Market Attractiveness by Country, 2023 to 2033

Figure 97: Vietnam Market Value (US$ million) by Technology Type, 2023 to 2033

Figure 98: Vietnam Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 99: Vietnam Market Value (US$ million) by End User, 2023 to 2033

Figure 100: Vietnam Market Value (US$ million) by Country, 2023 to 2033

Figure 101: Vietnam Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: Vietnam Market Volume (tons) Analysis by Country, 2018 to 2033

Figure 103: Vietnam Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Vietnam Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Vietnam Market Value (US$ million) Analysis by Technology Type, 2018 to 2033

Figure 106: Vietnam Market Volume (tons) Analysis by Technology Type, 2018 to 2033

Figure 107: Vietnam Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 108: Vietnam Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 109: Vietnam Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 110: Vietnam Market Volume (tons) Analysis by Sales Channel, 2018 to 2033

Figure 111: Vietnam Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 112: Vietnam Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 113: Vietnam Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 114: Vietnam Market Volume (tons) Analysis by End User, 2018 to 2033

Figure 115: Vietnam Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Vietnam Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Vietnam Market Attractiveness by Technology Type, 2023 to 2033

Figure 118: Vietnam Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Vietnam Market Attractiveness by End User, 2023 to 2033

Figure 120: Vietnam Market Attractiveness by Country, 2023 to 2033

Figure 121: Guatemala Market Value (US$ million) by Technology Type, 2023 to 2033

Figure 122: Guatemala Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 123: Guatemala Market Value (US$ million) by End User, 2023 to 2033

Figure 124: Guatemala Market Value (US$ million) by Country, 2023 to 2033

Figure 125: Guatemala Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: Guatemala Market Volume (tons) Analysis by Country, 2018 to 2033

Figure 127: Guatemala Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: Guatemala Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: Guatemala Market Value (US$ million) Analysis by Technology Type, 2018 to 2033

Figure 130: Guatemala Market Volume (tons) Analysis by Technology Type, 2018 to 2033

Figure 131: Guatemala Market Value Share (%) and BPS Analysis by Technology Type, 2023 to 2033

Figure 132: Guatemala Market Y-o-Y Growth (%) Projections by Technology Type, 2023 to 2033

Figure 133: Guatemala Market Value (US$ million) Analysis by Sales Channel, 2018 to 2033

Figure 134: Guatemala Market Volume (tons) Analysis by Sales Channel, 2018 to 2033

Figure 135: Guatemala Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 136: Guatemala Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 137: Guatemala Market Value (US$ million) Analysis by End User, 2018 to 2033

Figure 138: Guatemala Market Volume (tons) Analysis by End User, 2018 to 2033

Figure 139: Guatemala Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 140: Guatemala Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 141: Guatemala Market Attractiveness by Technology Type, 2023 to 2033

Figure 142: Guatemala Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: Guatemala Market Attractiveness by End User, 2023 to 2033

Figure 144: Guatemala Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Waterproofing Chemicals in Asia Pacific Size and Share Forecast Outlook 2025 to 2035

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA