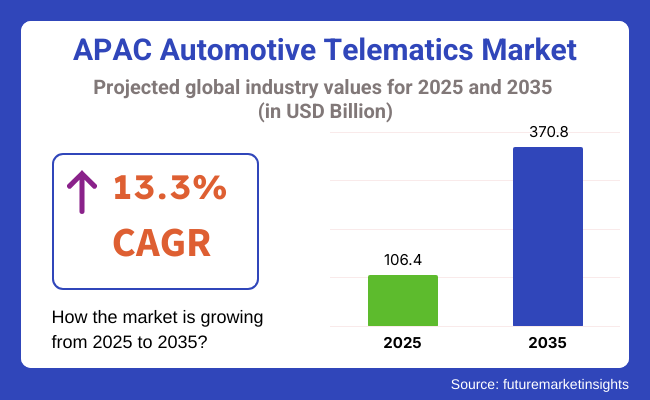

The APAC automotive telematics market is set for robust expansion, with its market size projected to rise from USD 106.4 billion in 2025 to USD 370.8 billion by 2035, reflecting a CAGR of 13.3%. The rapid adoption of connected vehicle technologies, stringent regulatory mandates for vehicle safety, and growing demand for fleet management solutions are major drivers propelling market growth.

Additionally, the increasing penetration of electric vehicles (EVs) and autonomous driving technologies across the Asia-Pacific region is further fueling market expansion.

The APAC automotive telematics market is witnessing exponential growth due to rising consumer demand for connected vehicle ecosystems, real-time data analytics, and advanced driver assistance systems (ADAS). Increasing government regulations mandating GPS tracking, emergency response systems, and vehicle diagnostics are further accelerating adoption across commercial and passenger vehicle segments.

Additionally, the rapid expansion of electric vehicles (EVs) and autonomous driving technologies is pushing telematics integration, enhancing safety, efficiency, and predictive maintenance. As 5G connectivity and AI-powered analytics evolve, the region’s telematics landscape is set to become more sophisticated and data-driven.

The automotive telematics solutions are witnessing a rapid increase in the boarding of various industry segments, such as passenger vehicles, commercial fleets, and shared mobility services. The integration of 5G connectivity, AI-driven predictive analytics, and cloud-based telematics platforms has made it possible to achieve vehicle safety, diagnostics, and real-time tracking to a whole new level.

Governments of China, India, Japan, and South Korea have been adopting very strict policies related to telematics, which, for instance, require commercial vehicles to be fitted with GPS and passenger cars to have emergency call services. Moreover, the emergence of mobility-as-a-service (MaaS) and the growing financing in smart transportation infrastructure have jointly fortified the telematics ecosystem.

The competition in the market is characterized by OEMs, telematics service providers (TSPs), and technology companies working together to extend connectivity, cyber security, and data monetization strategies. Companies are looking to the edge of computing and AI-driven analytics to offer the customer a better real-time vehicle insights and predictive maintenance capabilities.

Explore FMI!

Book a free demo

China stands as the largest automotive telematics market in Asia-Pacific region which is backed by government smart transportation initiatives, vehicle production, and 5G connectivity.

Under the framework of the Made in China 2025 program, the intelligent vehicle roadmap shall compel manufacturers, fleet operators, and rideshare platforms to employ AI-driven telematics solutions for driving efficiency, navigation, and automatic driving.

Currently, China has witnessed a New Energy Vehicle (NEV) boom which is a factor encouraging the development of EV-specific telematics applications which in turn will help it to the monitor battery use, implement smart charging, and analyse predictors of malfunctioning cars.

Key tech firms such as Baidu, Tencent, and Huawei are making forefront investments in software as a service (SaaS) telematics and vehicle-to-everything communication to aid in putting intelligent mobility solutions into action.

The telematics industry has benefited a lot from India’s extremely fast-growing automotive sector and the government’s orders for GPS being installed in the commercial vehicle segment. The Bharat Stage VI(BSVI) emission norms, the AIS-140 regulation on public transport, and the fleet digitization program are incentivizing telematics-based fleet management, predictive maintenance, and emergency response systems.

The booming of ride-hailing services, logistics platforms, and electric two-wheelers is bringing electric vehicles, mainly real-time tracking, defencing, and insurance telematics. The penetration of connected cars in India will accelerate with the deployment of more 5G infrastructure. This will, in turn, create new opportunities in AI-powered mobility solutions.

Japan and South Korea are the BDSM of automotive innovation forming the peak of telematics. The Japanese automakers such as, Toyota, Nissan, and Honda heavily invest in cloud-based navigation, autonomous driving features, and vehicle cybersecurity.

The zero-emission mobility push and smart city integration in Japan are propelling the demand for IoT-enabled telematics, EV fleet management, and autonomous ride-sharing solutions.

On the other hand, South Korea's massive 5G smart transportation technology projects, which are mainly developed by Hyundai and Samsung, advance the intelligent fleet management, vehicle-to-infrastructure (V2I) connectivity and the predictive analytics-based maintenance.

Southeast Asia's demand for ride-hailing services throughout the logistics landscape, and the government's investment in smart mobility technologies have positively impacted telematics companies which consequently experienced the growth of their services.

Countries like Singapore, Indonesia, and Thailand offer GPS tracking as part of their regulations for commercial vehicles thus boosting fleet monitoring, driver behaviour analysis, and telematics-driven insurance solutions.

Australia is also doing well in the connected fleet management area as it picked up the demand for real-time telematics, predictive analytics, and fuel efficiency monitoring in commercial transportation and mining industries.

Challenges

Data Privacy & Cybersecurity Risks

Data breaches and cybersecurity threats is one of the major challenges in the APAC automotive telematics market. Telemetric system, due to its nature of operation, are much conceptual and sensor based and prone to system attacks that can potentially eavesdrop on what by hackers can interfere with driving safety, breach personal privacy, and disrupt fleet operations.

Infrastructural connections among telematics systems also are susceptible which can easily outspread. Additionally, the issue regarding data ownership and cross-border data transfer is on legal and ethical grounds.

The companies need to what they people have been discussing for them to come off those hurdles then: Invest more on encryption, block chain security structures, threat detection based on AI Instead of the companies, body regulators need to implement strict cyber rules to protect consumer data and prevent possible telematics-related cyber trade.

High Implementation Costs & Infrastructure Limitations

The selling of advanced telematics solutions often demands an extremely high cost for hardware, software, and network infrastructures; hence this is a challenge for many auto manufacturers, fleet operators, and small businesses.

The original bleeds from telematics devices, cloud platforms, and analytics tools powered by AI cause high consumables expense; this is more common in developing economies such as India, Indonesia, and Vietnam, where the problem of cost-sharing is germinating

Notably, in certain areas, where the digital infrastructure is not as developed, lack of stable internet connectivity and widespread 5G availability is often an obstacle for the whole telematics integration. Distance coverage is an issue in many rural and semi-urban communities making it difficult to implement real-time vehicle tracking, predictive maintenance, and remote diagnostics.

Opportunities

The proliferation of 5G The AI-Driven Telematics Solutions

The quick expansion of 5G networks all over the Asia-Pacific region is providing new chances for the high-speed, and low-latency telematics solution.

With the take-off of a faster data transmission rate, real-time processing and 5G connectivity; V2X communication is much better which consequently engenders smarter navigation, predictive maintenance, and autonomous driving capabilities. China, Japan, and South Korea are the pioneers in 5G telematics which create opportunities for the connected car ecosystem and the intelligent fleet management solution.

Moreover, AI-powered telematics analytics the changing of the company's approach to fleets management, driver behaviour monitoring, and vehicle health prediction is unimaginable. The practicality of AI techniques to increase fuel efficiency, pinpoint irregularities, and automate predictive maintenance, decreased operational costs.

While car manufacturers and telematics service providers are delving into machine learning algorithms and cloud-based analytics, firms will be able to avail of real-time data insights for boosting vehicles efficiency, fostering road safety, and enhancing mobility services. The 5G rollout and the AI-driven telematics growth will be the two steps to a new era of transportation, which will be connected and autonomous.

ESG & Telematics-E Mobility with New Technologies

The quick acceptance of electric vehicles (EVs) in the APAC area telematics is battery monitoring, charging infrastructure management, and energy efficiency optimization. Governments in China, India, and Southeast Asia are heavily investing in the area to create the conditions for smart telematics solutions aimed at electric vehicles fleets.

EV telematics set help operators better visualise problems like battery life, charge range, and preventive maintenance data for better planning of resource allocation and thus, driving energy consumption down. Besides, a connected telematics platform can help in the process of locating charging stations, controlling loading times, and ensuring impeccable operation of the EV fleet.

Advocacy for energy-efficient transport means and reduction of carbon emissions has spurred demand green telematics solutions which include AI-driven route optimization, eco-driving analytics, and vehicle electrification strategies. A swift transition to the market driving the necessity of and intelligent telematics solutions supporting the energy efficiency, grid connectivity, and new kinds of smart charging will continue to augment the growth in this area.

The Asia-Pacific (APAC) automotive telematics market has experienced significant growth between 2020 and 2024, driven by increasing vehicle connectivity, rising consumer demand for in-car infotainment, and stringent regulatory requirements for vehicle safety.

The proliferation of electric vehicles (EVs), along with the growing deployment of 5G networks, has further accelerated telematics adoption. As the industry moves into the future, the integration of artificial intelligence (AI), edge computing, and advanced cybersecurity measures will redefine vehicle connectivity and fleet management solutions from 2025 to 2035.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Mandates for emergency response systems (eCall) and electronic toll collection systems. Governments push for compliance with APAC vehicle safety norms. |

| Technological Advancements | Expansion of cloud-based telematics, integration of IoT sensors, and the early adoption of 5G connectivity. |

| Industry-Specific Demand | Demand from fleet operators, insurance companies, and ride-hailing services. Growth in commercial vehicle telematics. |

| Sustainability & Circular Economy | Initial push for fuel efficiency, carbon footprint tracking, and electric vehicle (EV) telematics. |

| Production & Supply Chain | Localization of telematics hardware production, reliance on semiconductor supply chains, and software-driven vehicle architectures. |

| Market Growth Drivers | Increasing vehicle connectivity, regulatory mandates, insurance telematics adoption, and growing demand for vehicle safety features. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter data privacy regulations, expansion of connected vehicle mandates, and government-led smart city initiatives. |

| Technological Advancements | AI-driven predictive analytics, edge computing for real-time decision-making, block chain for data security, and vehicle-to-everything (V2X) communication. |

| Industry-Specific Demand | Autonomous vehicle telematics, intelligent fleet management systems, and rising integration of telematics in shared mobility platforms. |

| Sustainability & Circular Economy | Expansion of green telematics solutions, battery health monitoring for EVs, and AI-driven route optimization for lower emissions. |

| Production & Supply Chain | Fully integrated cloud-to-vehicle platforms, AI-driven supply chain forecasting, and greater emphasis on cybersecurity in the supply chain. |

| Market Growth Drivers | Mass deployment of autonomous and connected vehicles, AI-based mobility solutions, government-driven smart transportation policies, and advancements in 6G networks. |

The Indian automotive telematics market is projected to register a compound annual growth rate (CAGR) of 14.5%, which is primarily supported by government policies, the increasing use of connected vehicles, and the widespread acceptance of fleet management. The AIS-140 standard has made it mandatory for all commercial vehicles to be fitted with GPS track and emergency response systems, this has directly influenced the growth of telematics.

Meanwhile, the ever-expanding ride-hailing and logistics sectors increases the market demand for features like real-time vehicle monitoring and predictive maintenance. Urbanization and the growth of electric vehicle (EV) market are other factors that has contribution to the development of the telematics market.

Furthermore, the development of 5G and IoT allow for features like remote diagnostics and driver behaviour monitoring, improving connectivity. Also, the public's growing understanding of vehicle security and fuel efficiency is positive for the adoption of telematics solutions. On the other hand, problems like data privacy and price issues slow down the market entry.

Companies are following these strategies with the help of economical telematics services and variable subscription modes. OEMs and third-party providers are utilizing AI and cloud analytics to bolster telematics features. With the changes in infrastructure and regulations, India is expected to witness telematics development for a long time ahead.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 14.5% |

The automotive telematics market is predicted to achieve the 13.9% compound annual growth rate in China, which is to say that it will lead the financial results of Asia-Pacific. This growth is driven by the country's powerful electric vehicle (EV) market, the government's firm directions on vehicle connectivity, and the technical progress in AI and 5G.

The law that requires the tracking of the real time location in commercial and NEVs is the origin of the rapid adoption of such devices. Automotive manufacturers such as BYD and NIO are the ones that innovate the most by including features like AI-powered voice assistants, remote diagnostics, and predictive maintenance in their models.

Also, ride-hailing and logistics companies are putting in money on telematics for fleet optimization and cost-cutting. Smart city projects are also instrumental in the development that comes with connecting systems for traffic management with vehicles and thus achieve effective mobility.

But the major threats are data privacy issues and regulatory restrictions on cross-border data sharing. The companies mitigate the risk through strict data protection policies and strategic collaborations with authorities. The agricultural sequela of the 5G vesting in exclusive travel that is AI-like, therefore, it counts good on the telematics industry's growth over and above other countries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.8% |

China’s automotive telematics market is expected to grow at a 13.9% CAGR, leading the Asia-Pacific region. Growth is fueled by China’s massive EV market, strong government mandates for vehicle connectivity, and advancements in AI and 5G. Regulations requiring real-time tracking in commercial and new energy vehicles (NEVs) drive rapid adoption.

Automakers like BYD and NIO lead innovation by integrating AI-powered voice assistants, remote diagnostics, and predictive maintenance. Ride-hailing and logistics firms are also investing in telematics to optimize fleets and reduce costs.

Smart city projects further boost adoption by connecting traffic management systems with vehicles for efficient mobility. However, data privacy concerns and regulatory restrictions on cross-border data sharing pose challenges. To mitigate risks, companies are implementing strict data protection policies and fostering strategic collaborations with authorities. With the expansion of 5G and AI-driven mobility, China’s telematics market is poised for continued leadership, offering enhanced efficiency and performance.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 13.9% |

The automotive telematics industry in South Korea is anticipated to develop at a rate of 12.7% CAGR according to the analysis. This is mainly thanks to the company's outstanding technical infrastructure, vast population of 5G users, and the effort of the government in promoting connected mobility. Top automotive manufacturers Hyundai and Kia are embedding telematics with IoT, AI, and cloud computing with a view to improving vehicles' functionalities and user experiences.

Laws requiring commercial vehicles to be equipped with telematics as well as the increasing consumer demand for safety and convenience are the two main factors responsible for the market growth. The insurance sector has also contributed its fair share by advocating usage-based insurance (UBI) based on actual driving data.

In addition, the V2X technology brought by the internet of things, is advancing in South Korea which is a smart city, through real-time data, allowing better traffic management, and traffic reduction. Still, the challenges of cybersecurity and high implementation costs are the main issues.

These problems are partly alleviated by the technical solutions like advanced encryption, secure cloud platforms, and awareness campaigns. Due to progress in electric vehicles and autonomous telematics, South Korea is now positioned to be a major force in the telematics market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.7% |

Commercial Vehicles Drive Market Growth Due to Logistics and Fleet Management Demand

The commercial vehicle section is the most significant segment in the APAC automotive telematics sector, owing to the fleet management solution deployment in logistics, e-commerce, and public transportation.

The respective governments in countries like India and China have made it necessary for commercial fleets to have telematics installed as a means to improve safety and efficiency. GPS, route optimization, and vehicle diagnostics, together, provide a solution that cuts operational costs and helps meet regulatory compliance requirements.

The introduction of ride-hailing and delivery services has provided further momentum to the development of telematics. Again, the need for real-time, remote monitoring, predictive maintenance, and the insurance telematics solutions is the central factor for the growth of the market in this segment.

Passenger Vehicles Lead Telematics Adoption with Enhanced Connectivity

Passenger vehicles are a vital part of the APAC automotive telematics industry, more and more potential buyers looking for connected car alternatives.

The new in-car infotainment, navigation systems, and driver-assistance systems are being developed during integration which in turn improves user experience and safety. Car manufacturers, in particular, are concentrating on the development of telematics, autos including remote diagnostics, emergency assistance, and over-the-air (OTA) software updates.

The increase of consumer spending and urbanization in countries like China, Japan, and South Korea boosts the market for intelligent, connected vehicles. Car safety and pollutant emission monitoring laws moreover vehicle safety regulatory are the main reasons for the development of telematics in passenger cars, where this segment appears as the major driver for market growth.

Infotainment Enhances Consumer Experience and Connectivity

Infotainment is a key drive in the APAC automotive telematics market since users want easy-to-use in-car entertainment systems and real-time connectivity. The modern infotainment systems allow streaming services, hands-free communication, and AI-based voice assistants, which is a step forward to user engagement.

Automakers are entering partnerships with tech companies to provide cloud-based solutions, the integration of smartphones, and OTA updates. An emerging trend is the integration of infotainment with a 5G network in the rapidly growing market of China, improving the navigation and in-car experiences.

The increasing popularity of luxury vehicles and mid-range cars with advanced infotainment features in Japan and South Korea also positively help the market growth, hence infotainment becomes a key factor in the automotive telematics adoption.

Safety Telematics Gains Traction Amid Stringent Regulations

As a result of the rising road safety concerns and strict regulatory requirements, the safety telematics market in the APAC region is experiencing an uptick in popularity. Inaction taken by the governments is compelled by the emplacing of the policies mandating the implementation of the emergency call system, vehicle monitoring in real-time by GPS, as well as stating that the driver may use some assistance features in order to reduce a number of accidents happening In China and India).

Advanced Driver Assistance Systems (ADAS) and technologies for collision detection are in the public interest, thus becoming the default for newly manufactured vehicles. Car manufacturers are broadening their potential by introducing telematics into their product with help of the features.

Theft, geo-fencing, and accident response are the activities that security is provided for through telematics. But there is also a growing focus on monitoring driver behaviour and the insurances associated with these which is a factor driving the demand for telematics on safety in the automotive market of the APAC region.

The Asia-Pacific (APAC) automotive telematics market is expanding rapidly, thanks to the demand rise for connected vehicles, establishment of vehicle tracking as a must have, the surge of electric and autonomous vehicles, and more.

Telematics systems that are the combination of telecommunications and informatics, aim to convey better tracking, navigation, and fleet management. The most significant factors that are pushing the market forward are the deployment of AI dusting, 5G, and LPWAN solutions. The mandates set in laws, such as the standard AIS-140 for public transport that was introduced in India, drive further expansion.

This marketplace is discovered through the significant competition faced by APAC technology businesses, regional telematics providers, and automotive OEMs which are in a constant need to discover new paths. Digital change continues to shape the sector through increased investments by businesses in areas such as cybersecurity, cloud platforms, and predicative analytics which all intend to strengthen their market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 10-15% |

| Bosch Mobility Solutions | 8-12% |

| Harman International | 6-10% |

| Teltonika Telematics | 5-9% |

| Trimble Inc. | 4-8% |

| Other Players (Combined) | 50-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | Advanced in-vehicle infotainment, telematics control units, and vehicle-to-cloud connectivity. |

| Bosch Mobility Solutions | Fleet management solutions, predictive maintenance analytics, and cybersecurity integration. |

| Harman International | Cloud-based telematics platforms, AI-driven vehicle tracking, and automotive cybersecurity. |

| Teltonika Telematics | GPS tracking devices, real-time vehicle diagnostics, and asset monitoring solutions. |

| Trimble Inc. | Logistics and fleet optimization software, driver behavior analytics, and 5G-enabled telematics. |

Key Company Insights

Continental AG

Continental AG is a leader in automotive telematics in the APAC region, and it mainly focuses on the in-vehicle connectivity and fleet management solutions area of the business. The company, Continental, has initiated the development of V2X (Vehicle-to-Everything) communication systems that are aimed at improving road safety and traffic efficiency.

Continental’s telematics control units (TCUs) present real-time diagnostics and predictive maintenance that increase vehicle reliability. Also, the firm partners with significant OEMs and tech companies for the integration of AI and cloud computing in telematics solutions.

Imposing solid stress on cybersecurity, Continental performs the task of strong data encryption and protection with great success. The company is diversifying its operations in APAC by striking alliances with local automotive firms and channelling financial resources in R&D for next-gen mobility options.

Bosch Mobility Solutions

Bosch Mobility Solutions is a company committed to the connected vehicle ecosystem. They provide telematics and analytics solutions predictive. Also, they integrate artificial intelligence insights to make fleet operations more efficient and to improve safety features. Bosch’s solutions are IoT-based fleet management real-time vehicle diagnostics and cybersecurity frameworks. The company has a strong foothold in the APAC region, where Bosch is working alongside regulatory bodies to ensure compliance with government directives.

The firm also invests in 5G connectivity to improve vehicle communication networks. By using more advanced machine learning algorithms, Bosch is improving predictive maintenance and reducing vehicle downtime, which is why it is a preferred partner for commercial and passenger vehicle manufacturers in the region.

Harman International

Harman International is a company that connects to the Internet of other things and is a connected car and infotainment systems company. The firm has telematics solutions that are based on a cloud where the vehicle is tracked, AI-powered analytics are used, and real-time data is monitored.

Harman is a forerunner in the integration of 5G technology into the telematics, resulting in the vehicle-to-cloud communication being enhanced. The latter firm works with the major automakers to provide a seamless in-car experience with voice assistants and over-the-air (OTA) updates.

Harman handles cybersecurity by protecting data from being threatened by cyber threats and ensures its integrity. The company is widening its reach in APAC waters by means of collaboration with telecom operators and automotive OEMs to build better infrastructures for the connected vehicles.

Teltonika Telematics

Teltonika Telematics is recognized as one of the main players in the fleet management and GPS tracking segment serving both small and medium enterprises (SMBs) and large companies. The company offers the products necessary for reducing fuel consumption, tracking vehicles in real-time, and analysing driver behaviour.

The IoT-enabled devices are the latest innovation from Teltonika that grant vehicle security and theft prevention. The company is also mentioning the addition of telematics solutions for electric vehicles (EVs) to the product line, which is the latest innovation and optimization of battery performance and range management, respectively.

The company leverages big data analytics to assist fleet operators in achieving higher efficiency, which in turn reduces operations costs. Its strategic partnership with regional distributors and service providers is the major reason for the company's increased footprint in APAC.

Trimble Inc.

Trimble Inc. is a top notch logistics optimization and fleet analytics company that besides offering telematics solutions increases supply chain visibility driver performance monitoring. The firm's software, that is powered by artificial intelligence, helps fleet managers analyse route efficiency as well as reduce fuel consumption.

Trimble is putting its money on 5G-enabled telematics to deliver real-time vehicle tracking and predictive maintenance. The dashboard analytics that the company uses are really sophisticated and they help the fleet operators get the necessary insights into the vehicle health and operational trends.

Trimble provides compliance solutions as well that are aimed at helping companies follow the regional regulatory requirements. The company is developing its presence in the APAC by the means of partnerships with logistical firms and commercial fleet operators to improve the efficiency of transportation.

The APAC Automotive Telematics market is projected to reach USD 106.4 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 13.3% over the forecast period.

By 2035, the Automotive Telematics market is expected to reach USD 370.8 billion.

The commercial vehicle segment is expected to dominate the market, due to high commercial vehicle adoption, strong logistics growth, government mandates for fleet tracking, increasing safety concerns, and rising demand for fuel efficiency and route optimization drive commercial vehicle dominance.

Key players in the Automotive Telematics market include Continental AG, Bosch Mobility Solutions, Harman International, Teltonika Telematics, Trimble Inc.

In terms of Product Type, the industry is divided into Portable, Handheld

In terms of Application, the industry is divided into Velocity and Displacement Measurement, Vibration Monitoring

The report covers key country, including China, Japan, South Korea, India, ASEAN and Rest of APAC.

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Growth - Trends & Forecast 2025 to 2035

Automotive TCU Market Growth - Trends & Forecast 2025 to 2035

Automotive Wires Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.