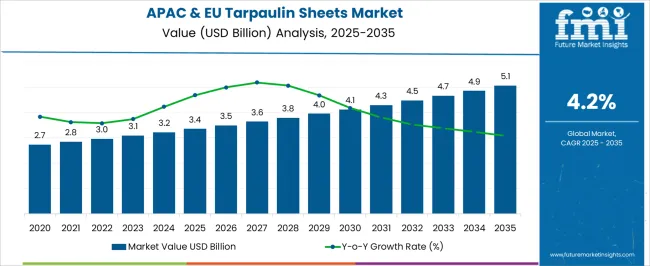

The Asia Pacific and Europe Tarpaulin Sheets Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Asia Pacific and Europe Tarpaulin Sheets Market Estimated Value in (2025 E) | USD 3.4 billion |

| Asia Pacific and Europe Tarpaulin Sheets Market Forecast Value in (2035 F) | USD 5.1 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The tarpaulin sheets market across Asia Pacific and Europe is expanding steadily due to rising demand in construction, logistics, agriculture, and industrial applications. Growing infrastructure projects, coupled with the need for durable and weather resistant materials, are driving wider adoption of tarpaulin sheets in the region.

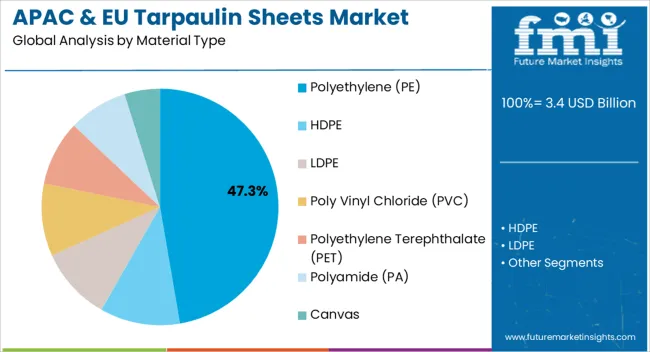

Polyethylene based products are gaining traction owing to their cost effectiveness, lightweight properties, and recyclability. Additionally, the demand for specialized products such as insulated tarps is increasing due to their ability to maintain temperature stability during transport and storage.

Rising environmental awareness has also influenced manufacturers to introduce eco friendly options, which is further reinforcing market growth. The outlook remains strong as industries continue to prioritize protective coverings for operational efficiency, resource preservation, and sustainability compliance.

Polyethylene material is expected to account for 47.30% of total revenue by 2025 within the material category, positioning it as the leading segment. Its dominance is attributed to affordability, lightweight nature, and resistance to water and UV exposure, which make it suitable across multiple end uses.

Ease of manufacturing and recyclability have further supported its widespread adoption, particularly in construction and agriculture applications.

The ability to offer both strength and cost efficiency continues to secure polyethylene’s strong market position.

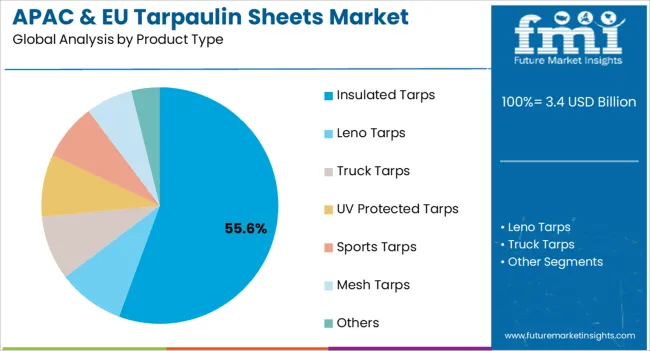

The insulated tarps segment is projected to represent 55.60% of total revenue by 2025 within the product type category, establishing it as the leading sub segment. Demand has been fueled by increased usage in cold chain logistics, perishable goods storage, and industrial processes requiring temperature control.

Their superior thermal retention properties and role in protecting goods from spoilage or temperature fluctuations have reinforced their adoption.

As global supply chains emphasize product quality and reduced waste, insulated tarps are gaining prominence as a vital product category.

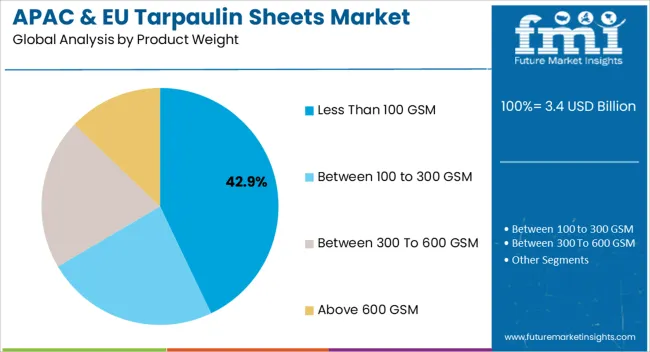

The less than 100 GSM segment is anticipated to hold 42.90% of the market by 2025 within the product weight category, making it the dominant weight class. This growth is being driven by their lightweight characteristics, portability, and suitability for temporary coverings and low intensity applications.

Cost advantages and flexibility in handling have supported their adoption in agricultural coverings, short term storage, and protective wrapping.

Their ability to balance affordability with adequate protection ensures continued preference in the market.

Asia Pacific tarpaulin sheets market witnessed a CAGR of 3.3% during the historical period. It stood at a market value of USD 2,953.5 million in 2025 from USD 2,358.6 million in 2020.

Europe market showcased a CAGR of 1.6% from 2020 to 2025. It reached a market value of USD 2,026.0 million in 2025 from USD 1,817.2 million in 2020.

Growing populations in countries such as China, India, and Japan have led to a significant increase in demand for infrastructure development, housing, and commercial buildings. Rapid growth of the construction sector in these countries has led to a corresponding increase in the demand for tarpaulin sheets. Tarpaulin sheets are used in construction for covering scaffolding, creating temporary shelters, and protecting construction materials during transit & storage.

Expanding agriculture sector in Asia Pacific has also contributed to growth in the tarpaulin sheets industry. Increasing adoption of advanced farming techniques such as greenhouse farming, vertical farming, and hydroponics has led to a higher demand for tarpaulin sheets. Tarpaulin sheets are used in agriculture for covering crops, protecting them from external elements such as rain & sunlight, and creating temporary shelters for livestock.

Surging transportation and logistics sector in Europe has also contributed to growth. Tarpaulin sheets are widely used in this sector for covering goods during transit and storage, as well as protecting them from external elements such as rain and sunlight.

Adoption of advanced manufacturing processes has enabled manufacturers to produce high-quality tarpaulin sheets that meet specific needs of various sectors. A few of these processes include computer-aided design (CAD) and computer-aided manufacturing (CAM). This is a crucial factor that would push demand in the market.

Rising Demand for Waterproof and Durable Materials in Transportation Sector to Propel Growth

Tarpaulin sheets are set to be widely used in the transportation sector to cover goods being transported by various modes of transport such as trucks, trains, cargo, and ships. As they provide protection from weather elements such as rain, snow, and wind, and prevent damage to the goods being transported, demand would rise.

Use of tarpaulin sheets ensures that the goods being transported arrive at their destination in good condition, thereby reducing the risk of damage and loss. Transportation in Europe is a crucial sector that plays a significant role in the economy by transporting goods across the continent and beyond. With increasing demand for efficient and secure transportation of goods, the region is set to showcase high growth.

Tarpaulin sheets are essential in protecting goods from harsh weather conditions, especially during transportation over long distances. In Europe, where there are frequent rain and snowstorms, tarpaulin sheets made of durable materials are highly preferred.

Sheets made of polyethylene, polypropylene, and PVC would gain momentum due to their resistance to water and chemicals. They also offer protection against theft and damage to goods during transportation. By covering the goods with tarpaulin sheets, the cargo is less visible to potential thieves, further reducing the chances of theft.

Expanding Construction Sector to Create Lucrative Growth Outlook

Tarpaulin sheets are used in various applications in the construction sector due to their ability to provide protection against weather elements, debris, and other hazards. Their ability to provide protection from weather elements would drive demand.

Tarpaulin sheets are widely used to cover building materials, machinery, and tools on construction sites, protecting them from rain, wind, and snow. This helps prevent damage to the materials and reduces the need for replacements and repairs, saving construction companies time and money.

Construction sites can be dangerous places for workers, and debris and dust can pose significant hazards to their health and safety. Tarpaulin sheets can be used to cover construction sites and protect workers and materials from debris, dust, and other hazards.

As per the International Trade Administration, China’s urbanization rate is among the highest in the world. Data from the American Institute of Architects (AIA) Shanghai reports that by 2025, China will have constructed the equivalent of 10 New York-sized cities.

China's infrastructure & construction development investment from 2024 to 2025 is estimated at USD 4.2 trillion. It is projecting a significant growth outlook for the construction sector.

Construction sector is one of the largest consumers of tarpaulin sheets. Increasing demand for these sheets in the construction sector is boosting growth in the tarpaulin sheets industry.

| Country | China |

|---|---|

| Market Share (2025) | 37.3% |

| Market Share (2035) | 36.1% |

| BPS Analysis | -120 |

| Country | India |

|---|---|

| Market Share (2025) | 27.1% |

| Market Share (2035) | 28.5% |

| BPS Analysis | 150 |

| Country | Japan |

|---|---|

| Market Share (2025) | 14.9% |

| Market Share (2035) | 15.5% |

| BPS Analysis | 60 |

| Country | South Korea |

|---|---|

| Market Share (2025) | 5.0% |

| Market Share (2035) | 4.2% |

| BPS Analysis | -80 |

| Country | Association of Southeast Asian Nations Countries |

|---|---|

| Market Share (2025) | 8.9% |

| Market Share (2035) | 9.6% |

| BPS Analysis | 70 |

| Country | Australia & New Zealand |

|---|---|

| Market Share (2025) | 2.7% |

| Market Share (2035) | 2.4% |

| BPS Analysis | -30 |

| Country | Germany |

|---|---|

| Market Share (2025) | 16.5% |

| Market Share (2035) | 15.8% |

| BPS Analysis | -70 |

| Country | Italy |

|---|---|

| Market Share (2025) | 11.8% |

| Market Share (2035) | 13.1% |

| BPS Analysis | 130 |

| Country | France |

|---|---|

| Market Share (2025) | 13.5% |

| Market Share (2035) | 12.7% |

| BPS Analysis | -80 |

| Country | United Kingdom |

|---|---|

| Market Share (2025) | 10.9% |

| Market Share (2035) | 12.1% |

| BPS Analysis | 120 |

| Country | Spain |

|---|---|

| Market Share (2025) | 7.6% |

| Market Share (2035) | 7.1% |

| BPS Analysis | -50 |

| Country | BENELUX |

|---|---|

| Market Share (2025) | 5.5% |

| Market Share (2035) | 6.1% |

| BPS Analysis | 60 |

| Country | Nordics |

|---|---|

| Market Share (2025) | 4.6% |

| Market Share (2035) | 4.8% |

| BPS Analysis | 30 |

| Country | Russia |

|---|---|

| Market Share (2025) | 20.9% |

| Market Share (2035) | 19.7% |

| BPS Analysis | -120 |

| Country | Poland |

|---|---|

| Market Share (2025) | 5.1% |

| Market Share (2035) | 4.8% |

| BPS Analysis | -30 |

Plastic Tarpaulin Sheets to Showcase High Demand in Construction Sector in Germany

According to the Federal Ministry of the Interior and Community, construction sector is one of the key sectors of the German economy. It generated an output of around USD 2.7 billion in 2020, and is currently employing about 2 million people.

It is a crucial sector in terms of economic and employment policy, as it is closely interconnected with numerous other sectors such as manufacturing, energy, and transportation. Germany is expected to hold 15.8% of the tarpaulin sheets market share by the end of 2035.

Government of Germany works closely with the construction sector to promote innovation and modernization in the sector. The government also provides funding and support for research & development projects. These are aimed at improving the quality, efficiency, and sustainability of construction practices & materials.

With growth of the construction sector, there is a rising demand for tarpaulin sheets to protect construction materials, equipment, and other goods from weather elements. A few of these include rain, snow, and wind. Tarpaulin sheets are also widely used in the transportation of construction materials, as they provide protection and prevent damage during transit.

Farmers across India to Adopt PE Tarpaulin Sheets by 2035

Demand for tarpaulin sheets in the agricultural sector is growing with the need to increase crop yields and reduce losses due to weather-related incidents. Tarpaulin sheets provide an affordable and effective solution to protect crops and livestock. It translates to increased productivity and profitability for farmers.

As per Press Information Bureau-Government of India, in 2025, India witnessed a remarkable milestone in its agricultural sector as exports reached an unprecedented record of USD 50 billion. This historic achievement was primarily driven by exceptional performance in staple crops such as rice, wheat, sugar, other cereals, and meat, which experienced the highest levels of exportation ever recorded.

Agricultural sector of India is a significant contributor to the country's economy, accounting for around 16% of its GDP and employing around 50% of the country's workforce. The sector has been experiencing steady growth over the past few years.

It is mainly driven by factors such as rising demand for food, increasing population, and favorable government policies. Tarpaulin sheets are also used in the storage of agricultural produce such as fruits, vegetables, and grains.

Tarpaulin sheets help to keep the produce dry and protect it from pests & other contaminants. They ensure that the produce remains fresh and of high quality.

HDPE to Be Extensively Utilized for the Production of Waterproof Tarpaulin Sheets

HDPE material is estimated to account for around 78.6% of the Europe tarpaulin sheets market by 2035. This material segment is expected to reach a valuation of USD 5.1 million by 2035 in Asia Pacific.

Tarpaulin sheets made from high-density polyethylene (HDPE) have resistance to UV radiation. They are highly resistant to degradation caused by prolonged exposure to sunlight, making them ideal for outdoor use.

HDPE tarpaulin sheets are also lightweight, making them easy to handle and transport. It has excellent chemical resistance, which makes it resistant to several chemicals, including acids, alkalis, and solvents.

Its property makes tarpaulin sheets made up of high-density polyethylene (HDPE) suitable for use in harsh chemical environments such as agriculture and chemical sectors. Due to its excellent properties such as high tensile strength, resistance to tearing, and puncture, it is set to be an ideal choice for use in tarpaulin sheets manufacturing.

Tarpaulin Sheets to be Demanded from Agricultural Sector in Europe and Asia Pacific

By end use, the agriculture segment is projected to dominate the Asia Pacific & Europe tarpaulin sheets market. Asia Pacific and Europe are set to capture around 22.8% and 26.8% of share in 2035, respectively.

Tarpaulin sheets play a crucial role in crop protection across the agricultural sector. They serve as a versatile solution for shielding crops against pests, soil erosion, and adverse weather conditions.

Such protective sheets effectively safeguard crops from the detrimental effects of heavy rain and strong winds, preventing potential damage. Tarpaulin sheets find application in the establishment of greenhouses and shade houses, creating optimal environments for crop cultivation.

In the realm of agriculture storage, these sheets are utilized to cover hay and other agricultural products, safeguarding them against moisture and pests. Additionally, tarpaulin sheets are essential for covering silage pits, preserving the nutritional value of the silage and preventing spoilage.

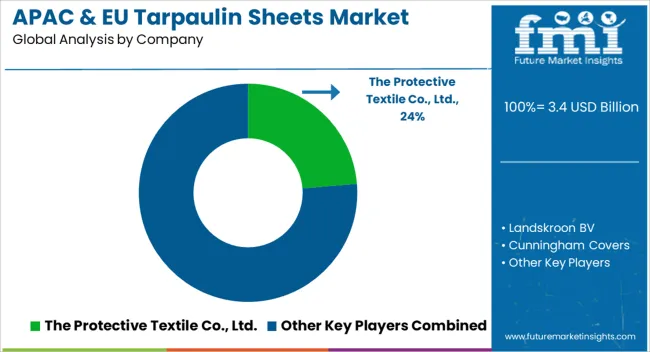

Key companies in the Asia Pacific & Europe tarpaulin sheets market are concentrating on developing sustainable solutions and innovations. They are also seeking to execute the merger and acquisition strategy. In order to accommodate increasing demand, a few other firms are creating different products.

For instance:

| Attribute | Details |

|---|---|

| Asia Pacific Estimated Market Size (2025) | USD 3,079.5 million |

| Europe Estimated Market Size (2025) | USD 2,078.9 million |

| Asia Pacific Projected Market Valuation (2035) | USD 4,354.5 million |

| Europe Projected Market Valuation (2035) | USD 2,571.3 million |

| Asia Pacific Value-based CAGR (2025 to 2035) | 4.4% |

| Europe Value-based CAGR (2025 to 2035) | 2.7% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) |

| Segments Covered | Material Type, Product Type, Product Weight, Lamination Type, End-use, Country |

| Key Countries Covered | China, India, Japan, South Korea, Association of Southeast Asian Nation Countries, Australia & New Zealand, Rest of Asia Pacific, Germany, Italy, France, United Kingdom, Spain, BENLUX, Nordics (Scandinavia), Russia, Poland, Rest of Europe |

| Key Companies Profiled | The Protective Textile Co., Ltd.; Landskroon BV; Cunningham Covers; J Clemishaw 1870 Ltd; Harsh UK; Puyoung Industrial Corporation, Ltd.; Rhino Textile Products; Del Tarpaulins Ltd; TELFORD TARPAULINS; Schreiber S.A.; Schleswiger Tauwerkfabrik Oellerking GmbH & Co. KG; THRACE PLASTICS Co. S.A.; Tom Morrow Tarpaulins Ltd.; John Attwooll & Co (Tents) Ltd; Ponyvamester Ltd.; Baches de France; Hacom Trading B.V.; Mehler Texnologies (Freudenberg Performance Materials); Icopal (Monarflex); P + Z Planen und Zelte GmbH; Transcover; Verseidag-Indutex GmbH; Narmada Polyfab; Korea Tarpia Co., Ltd.; POLIPLAS GROUP |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

The global Asia Pacific and Europe tarpaulin sheets market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the Asia Pacific and Europe tarpaulin sheets market is projected to reach USD 5.1 billion by 2035.

The Asia Pacific and Europe tarpaulin sheets market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in Asia Pacific and Europe tarpaulin sheets market are polyethylene (pe), hdpe, ldpe, poly vinyl chloride (pvc), polyethylene terephthalate (pet), polyamide (pa) and canvas.

In terms of product type, insulated tarps segment to command 55.6% share in the Asia Pacific and Europe tarpaulin sheets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Asia Neopentyl Glycol (NPG) Market Analysis and Forecast for 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

Asia Pacific Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Asia Pacific Tartrazine Market Analysis – Trends, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA