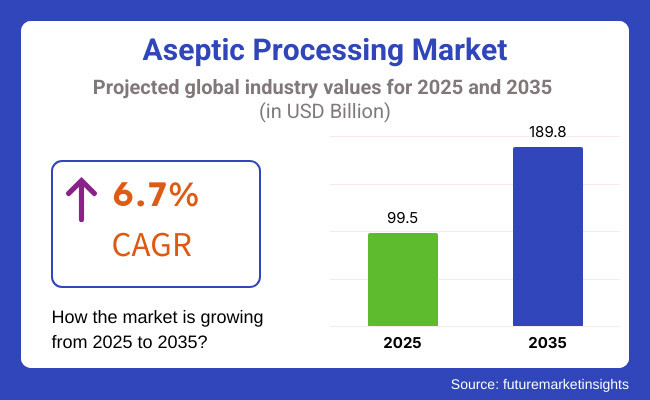

Aseptic processing market is poised to grow at a high rate between 2025 and 2035 due to the increased demand for shelf life extension, food safety, and growing regulations on the sterile processing. The market size is estimated to arrive at USD 99.5 billion in 2025 and increase to USD 189.8 billion by 2035 at a compound annual growth rate (CAGR) of 6.7% during the forecast period.

Increasing adoption of advanced aseptic processing technologies, automation, and biodegradable materials are also expected to contribute considerably towards the growth of this market. As filling machines, sterilization methods, and intelligent monitoring systems have improved, aseptic processing has been increasingly employed for product quality and stability in the food & beverages, pharmaceuticals and biotechnology industries.

Other drivers of the market include increasing demand for minimally processed products, stringent government policies on food safety, and rising consumer preference for convenience packaging.

Supportive regulations that encourage aseptic processing standards, sustainable materials, and lower contamination risks, combined with growing investments in automated processing solutions and digital tracking technologies, are further boosting market growth. Collaboration between manufacturers of processing equipment, regulatory agencies and industries that use the world is also improving overall aseptic processing efficiency, compliance, and innovation.

Nonetheless, high up-front investments, complex integration of aseptic technologies, and operation costs are the hurdles to overcome that demand for strategic interventions. This has led to a number of key innovations, most notably the use of AI-based quality control solutions, robotic automation, and energy-efficient aseptic processing systems to achieve greater productivity and lower costs.

Explore FMI!

Book a free demo

Aseptic processing market is mainly dominated by North America, due to its high demand for longer shelf-life food and beverages, strict food safety regulations, and innovations in processing technologies. Key regional players of aseptic processing market are investing in innovations related to high speed aseptic processing systems, automated sterilization solutions, sustainability of processing in North America.

The increasing consumption of dairy products, ready-to-drink beverages, and pharmaceutical products leads to the demand for aseptic processing solutions. Regulatory frameworks like the FDA’s Food Safety Modernization Act (FSMA) and maturing packaging specifications compel manufacturers to implement aseptic practices that preserve both product integrity and compliance.

Nonetheless, system performance high capital investment cost and operational complexity is hindering adoption among small and medium-sized enterprises. Smart monitoring systems and sustainable processing technologies are being integrated into the trend, which is anticipated to prevail in the coming years, leading to further expansion of the market.

Europe accounts for prominent market share in aseptic processing, especially in the countries such as Germany, France, and the United Kingdom owing to stringent regulations and rigorous focus on food safety, sustains as the ideal market to invest. Advances in environmentally friendly aseptic processing technologies are also driven by the region’s dedication to sustainability.

Market expansion is supported by the increasing demand for contamination-free dairy, beverage and pharmaceutical products coupled with regulatory enforcements like the General Food Law Regulation of the European Union.

To ensure high levels of production efficiency and compliance with stringent regulatory standards, advanced digitalisation is being employed by companies with investments in energy-efficient aseptic processing equipment, biodegradable sterilization methods, and digital quality control systems.

Nonetheless, the intricacies involved with regulatory approvals and the investment costs associated with aseptic processing equipment can deter market entrants. To remain competitive, European manufacturers are making automation and sustainability initiatives their top priorities.

The aseptic processing market in Asia-Pacific is growing at the highest rate due to factors such as rapid industrialization, increasing urbanization, and growing demand for packaged food and pharmaceutical products in markets such as China, India, Japan, and South Korea. The growth of the middle-class population and changing consumer outlooks are some of the factors fuelling the uptake of aseptic processing solutions.

The growth of the market is expected to be aided by Government initiatives to enhance food safety standards and improve pharmaceutical manufacturing practices, as well as the inflow of foreign investments in the processing sector.

There is rapid adoption of automated sterilization systems, smart processing technologies, and flexible aseptic processing. Regulatory inconsistencies and need for up-front investment cost present significant challenges to wider adoption in the market. Future expansion is likely to be fuelled by the need to improve cost-effective aseptic processing solutions and regulatory harmonization.

High Costs and Stringent Regulatory Compliance

High costs of aseptic processing technologies and stringent regulatory compliance for food and pharmaceutical products are major drawbacks of the aseptic processing market. Achieving total sterility during production requires the latest processing equipment and rigorous safety protocols, a costly endeavour that presents challenges for smaller manufacturers.

Regulatory is another complexity that varies across regions to impact market expansion. On the heels of these bottlenecks, businesses need cheap, scalable solutions and they should strive for global regulatory harmony.

Integration of Automation and Sustainable Practices

Aseptic processing market is taking place across sectors, so does a golden big opportunity with rising automation and digital technology adoption across industries. These systems harness AI for process optimization, leverage IoT for monitoring, and utilize robotics for automation to improve operational efficiencies and reduce contamination risk.

Moreover, the increasing demand for sustainable aseptic processing solutions is fostering innovation in eco-friendly materials and energy-efficient processing techniques. Investors can also stay ahead of the curve, as businesses that adopt automation and sustainability initiatives will have an edge over their competitors and reduce their risk of falling behind industry advances in regulation.

The aseptic processing market grew significantly from 2020 to 2024 driven by the rising demand for products with longer shelf-life and contamination-free manufacturing. The invention of new technologies like rapid sterilization and superior aseptic filling mediated efficiency and safety. Industry players still experienced roadblocks in the form of higher implementation costs, as well as regulatory landscape complexities.

If we turn our eyes into the future, 2025 to 2035, the market will be AI powered automation, predictive analytics and block chain based traceability. The rise of smart monitoring systems, real-time quality control, and sustainable aseptic packaging alternatives will shape the future of the industry even more. Investing in bio-materials and energy-efficient processing methods will also align with global sustainability goals.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stringent safety regulations and compliance hurdles |

| Technological Advancements | Microwaves sterilization and aseptic filling |

| Industry Adoption | Growth in food and pharmaceutical sectors |

| Supply Chain and Sourcing | Dependence on traditional sterilization procedures |

| Market Competition | A long established world of processing equipment manufacturers |

| Market Growth Drivers | Demand for contamination-free, long-shelf-life products |

| Sustainability and Energy Efficiency | Early-stage development of eco-friendly aseptic processes |

| Integration of Smart Monitoring | Basic contamination tracking and manual inspections |

| Advancements in Aseptic Technologies | Use of conventional sterilization techniques |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Guidelines for Standardizing Global Aseptic Processing |

| Technological Advancements | Artificial Intelligence (AI) based automation along with the Internet of Things (IoT) powered monitoring and robotics |

| Industry Adoption | Increased use can be seen in cosmetics, nutraceuticals and biotechnology |

| Supply Chain and Sourcing | Transition to aseptic packaging that is biodegradable and energy efficient |

| Market Competition | Gen AI led sustainable aseptic processing solutions |

| Market Growth Drivers | Increased investment in automation, efficiency, and sustainability |

| Sustainability and Energy Efficiency | Full-scale integration of sustainable aseptic technologies |

| Integration of Smart Monitoring | AI-based predictive maintenance and real-time contamination analytics |

| Advancements in Aseptic Technologies | Smart aseptic processing, block chain-enabled traceability, and sustainability innovations |

The aseptic processing market in the United States is growing steadily as the demand for extended shelf-life food and beverage products increases, particularly in the pharmaceutical industry. The country's rigorous FDA regulations require high-quality sterile processing standards and drive manufacturers to implement advanced aseptic technologies.

Driven by the demand for aseptic processing solutions, the beverage industry was the most in demand segment for aseptic market with a share of 35.3% in 2020, including dairy alternatives, fruit juices and ready-to-drink (RTD) coffee.

Also, the pharmaceutical sector is in constant growth, with an increase in biologics, injectable, and vaccines all demanding high-level aseptic techniques. Integration of aseptic technologies in manufacturing facilities -technological advancements like, robotics and AI monitoring, these technologies are making aseptic production facilities more efficient and compliant.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.3% |

In the UK, the aseptic processing market is growing because consumers and the pharmaceutical industry are calling for high-quality, contamination-free products. Niche market drivers include stringent MHRA regulatory environment and increasing demand for minimally processed, preservative-free food among consumers.

Aseptic processing techniques have become more widespread due to the growth in UK dairy, organic beverage and plant-based food industries. Also pharmaceutical manufacturers are pouring’s millions into sterile production facilities both for biologics and injectable drugs. Sustainability issues are also motivating greater use of recyclable aseptic packaging materials, consistent with the UK environmental agenda.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.1% |

The aseptic market in the European Union is increasingly robust owing to the stringent EMA and EFSA regulations surrounding food safety and pharmaceutical products. Germany, France and Italy lead aseptic processing innovations for dairy, organic food and specialty pharmaceuticals. Companies have increasingly focused on sustainable initiatives with eco-friendly aseptic processing methods reducing energy use and waste stream.

Growing consumption of premium beverages, functional drinks and high-value pharmaceuticals is additionally fuelling the market growth. Aseptic processing has also become more commonplace due in part to the trend towards plant-based diets in Europe, bringing about products such as alternative dairy and protein-based products.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.2% |

Japan's aseptic processing market is growing as a result of a raising demand for high-quality, long-shelf-life food and pharmaceutical products. The genomic processing and technological innovations in advanced manufacturing and sterilization techniques have positioned Japan as a global leader of aseptic processing.

Aseptic processing in food & beverage industry of functional beverages, dairy and convenience food are gaining momentum to maintain product integrity, meet the stringent quality standards. Demand is also growing in the pharmaceutical segment, as a rising number of biopharmaceuticals and sterile injectable will need to be produced aseptically. Smart monitoring systems combined with robotics will also continue to help improve production efficiency in aseptic facilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

The aseptic processing market in South Korea is growing due to the demand for high-quality of food and pharmaceutical products that is contamination free. So, the growing popularity of K-beauty nutraceuticals, functional beverages, and dairy alternatives has spurred greater adoption of aseptic processing technologies. Government regulations emphasizing food safety and pharmaceutical sterility have provided impetus for the market expansion as well.

In addition, South Korea's advanced technology infrastructure has enabled the implementation of automation and real-time monitoring in aseptic manufacturing plants, achieving high production efficiency. The increasing demand for clean-label, minimally processed and organic food products is another driver boosting the requirement for the aseptic processing solutions market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Based on the Segment, the market is segmented into Processing and packaging. The Processing segment is the leading segment because of the growing demand for contamination-free, sterile, and shelf-life-enhanced solutions during the process from food, beverage, and pharmaceutical production. It is accomplished through thermal sterilization and different filtration processes to remove deathly microorganisms without affecting nutrients, flavour, and consistency in the end result.

This technique is popular with liquid products like dairy items, juices, soups, babies' food and also pharmaceutical medicines, as they have a potential harmful bacteria that should be kept safe from any disease and this method makes them able to sky for consuming without using refrigeration or other chemical preservatives.

As regulatory requirements for food safety, pharmaceutical sterility and consumer health grow, manufacturers are spending money on high-tech aseptic processing equipment including ultra-high-temperature (UHT) processing, sterile filtration and microwave-assisted sterilization. These innovations assist in increasing product stability, minimizing waste, increasing production efficiency, and promoting compliance with worldwide safety standards.

The rise in consumption of minimally processed, preservative-free foods has further propelled the use of aseptic processing, particularly within the organic, clean-label, and functional food segments. With biologics, injectable drugs, and vaccines on the rise within the pharmaceutical sector, there is even more pressure to ensure aseptic processing technologies that prevent contamination so that the output is both sterile and efficacious.

Principles of automation, AI-based process monitoring, robotic principles of aseptic processing have helped tremendously improving aseptic processing efficiency as it has enabled real-time contamination detection and precision control to improve the quality of production.

Though aseptic processing systems have high upfront costs, the long-term cost benefits, lower spoilage rates, and better quality products are driving the adoption of these technologies by companies. The Processing segment is anticipated to be a major contributor to the overall growth of the Aseptic Processing Market, with demand for safe, preservative-free, and quality products in various parts of the world trending significantly upward.

The growing demand for eco-friendly, recyclable and biodegradable packaging solutions, the paper and paperboard segment is gaining traction as a preferred material choice in the aseptic processing market. With the around the world anxiety towards plastic waste, and environmental sustainability increasing, makers are moving in the direction of fiber-based packaging materials for aseptic items, which gives eco-friendliness without trading off with high boundary assurance.

Paper-based aseptic cartons are widely used for liquid food and beverage products, such as noncarbonated beverages, dairy and plant-based beverages, fruit juices, and soups, owing to long shelf life, lightweight design, and excellent recyclability. Key players are focusing on multilayer paperboard technology to include bio-based barrier coating and limited plastics that will enable product safety, sterility, and longevity.

Clean label and organic trends in the industry are also driving growth on the aseptic packaging products market for paper and paperboard aseptic packaging as consumers seek to lead a cleaner and greener lifestyle and are now opting for plastic-free packaging alternatives.

Also, government regulations and sustainability policies for brands are urging them to shift towards renewable and compostable packaging materials, thus boosting investment in paper-based aseptic producing solutions. Moisture resistance, structural integrity, and production costs are challenges that still limit the widespread use of this technology.

Without detail, consumers can be sceptical of new packaging technologies, but next-generation fiber-based packaging solutions such as nano-cellulose coatings, plant-based laminates, and biodegradable barrier layers have manufacturers focusing on not only increasing functional properties but maximizing positive perception by the consumer.

With sustainability a growing point of differentiation in the food, beverage and pharmaceutical sectors, rapid growth in the Paper and Paperboard segment will further position it as a key driver in the Aseptic Processing Market.

The Aseptic Processing Market is being propelled by the increasing need for contamination-free and extended shelf life products in the food, beverage and pharmaceutical sectors. Growing concern for the product safety, minimal preservative usage and regulatory compliance have increased the importance given to aseptic processing technologies.

Essential developments encompass impression process, automation-powered filling framework, and environment-conscious aseptic packaging system. Market dynamics are also shaped by the transition to sustainable production methods, as well as the increasing use of smart aseptic processing systems, among others.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tetra Pak | 22-26% |

| SIG Combibloc Group | 16-20% |

| Krones AG | 12-16% |

| GEA Group | 10-14% |

| Robert Bosch GmbH | 8-12% |

| Other Industry Players (Combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Tetra Pak | Provides aseptic processing solutions, such as UHT processing and automated sterilization systems. |

| SIG Combibloc Group | High Performance, Low Environmental Impact Integrated Carton Packaging Solutions |

| Krones AG | Focuses on PET solid waste processing, automated PET filling lines, and robotics aided aseptic sterilization technologies. |

| GEA Group | Delivers aseptic processing for dairy, beverages and pharmaceutical technologies that meet all safety codes, so products can be exported anywhere. |

| Robert Bosch GmbH | Covers aseptic processing equipment for pharmaceutical and food applications and also smart sterilization and automated filling. |

Key Company Insights

Tetra Pak (22-26%)

Tetra Pak is at the forefront of the aseptic processing market, with the most advanced UHT processing, filling, and sterilization technologies so that improve product safety and shelf life. The competitive advantage of the company has been further enhanced by its innovations in sustainable aseptic packaging.

SIG Combibloc Group (16-20%)

SIG Combibloc Group is one of the world's largest suppliers of aseptic carton packaging & processing systems, with a specialism in fast production, sustainability, and smart manufacturing integration.

Krones AG (12-16%)

Combining aseptic PET processing and filling solutions with robotics and automated sterilization techniques enables Krones AG to deliver state-of-the-art efficiency and safety in your products.

GEA Group (10-14%)

In aseptic processing, GEA Group IV delivers cutting-edge sterilization and filling systems, especially for dairy and pharmaceutical sectors.

Robert Bosch GmbH (8-12%)

Robert Bosch GmbH provides aseptic processing equipment integrated with advanced automation and quality control for the pharmaceutical and food industries.

Other Key Players (25-30% Combined)

The aseptic processing market is changing with new sterilization methods, AI-enhanced quality assurance, and sustainable aseptic production. Notable contributors include:

The overall market size for the aseptic processing market was USD 99.5 billion in 2025.

The aseptic processing market is expected to reach USD 189.8 billion in 2035.

The aseptic processing market is expected to grow at a CAGR of 6.7% during the forecast period.

The demand for the aseptic processing market will be driven by increasing demand for extended shelf-life products, advancements in sterilization technologies, stringent food and beverage safety regulations, rising pharmaceutical applications, and growing consumer preference for minimally processed foods.

The top five countries driving the development of the aseptic processing market are the USA, China, Germany, Japan, and India.

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Industrial Temperature Controller Market Analysis - Size & Industry Trends 2025 to 2035

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.