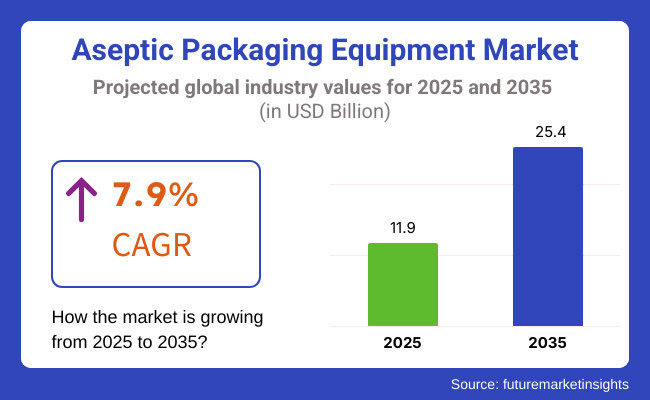

The Aseptic Packaging Equipment Market is poised to experience great growth from 2025 to 2035, owing to the increased demand for longer shelf life, food safety, and stricter regulations on sustainable packaging. The market will grow to USD 11.9 billion in 2025 and reach USD 25.4 billion by 2035, with a compound annual growth rate (CAGR) of 7.9% for the period.

Increase in usage of advanced aseptic processing technology, automation, and green packaging are also leading to remarkable growth of the market. Industries including food & beverages, pharmaceuticals, and dairy are adopting aseptic packaging equipment, given advancements in high-speed filling machines, sterilization techniques, and smart monitoring systems, among others, which are expected to result in improved product quality and shelf stability.

The demand for minimally processed products, strict government regulations on food safety, and the growing consumer preference for convenience packaging also influence the market. Market growth is also driven by supportive regulations promoting aseptic processing standards, sustainable packaging materials, reducing food waste, and increasingly investing in automated packaging solutions and digital tracking technologies.

Partnerships between companies, regulators and end-user industries globally, the innovation of aseptic packaging is increasing, with partnerships between packaging companies, regulatory bodies, and end-user industries to improve efficiency and compliance.

However, hurdles such as high initial investments, complex integration of aseptic technologies, and operational expenses need well-defined strategic interventions to surmount them. With such initiatives, companies are working towards the provision of better AI-driven quality control solutions, robotic automation, and energy-efficient aseptic processing systems to boost productivity without compromising efficiency.

Explore FMI!

Book a free demo

North America is the leader in the aseptic packaging equipment market owing to growing demand for longer shelf-life products, tightening food safety regulations, and technology advancements in packaging solutions.

North America had the largest market share in the region due to the United States and Canada; significant market participants are focusing on expanding their investments towards automation, high-speed filling machines, and sustainable packaging innovations for improving overall efficiency without inserting any risk of contamination in the production process.

Increased consumption of dairy products, drinks, and pharmaceutical products drives the need for aseptic packaging gear. Regulatory frameworks like the FDA’s food safety standards and a focus on food waste reduction are driving manufacturers to turn to aseptic processing technologies.

Yet the steep initial investment and complex operating requirements of many local industries are a stumbling block for small to medium businesses. This trend of usage of sustainable packaging and recyclable material is likely to contribute to the growth of the market in the coming years.

Europe remains an important market for aseptic packaging equipment, specifically countries such as Germany, France and the United Kingdom, which have stringent food and pharmaceutical safety laws that will only further promote uptake. Innovations in aseptic processing technologies are also influenced by the region's focus on eco-friendly packaging solutions.

Market growth is supported by the growing requirement for sterile and contamination-free food and beverage products as well as the rigorous packaging directives set forth by the European Union. Aseptic packaging machines with energy-saving capability, bio-based packaging materials, digital monitoring systems, etc. are a few examples of how companies are focusing more on enhancing efficiency of their production line while complying with regulations.

Market forecast and trends it's crucial to only fund companies that have invested in aseptic processing capabilities and regulatory-compliant quality systems since the technology is still a high-cost hurdle to entry for new players. To remain competitive, European manufacturers are focusing on automation and green initiatives.

Asia-Pacific is the fastest-growing region of aseptic packaging equipment market, attributed to robust industrialization, the increasing urban population, and rising demand of packaged food and pharmaceutical products in several countries such as China, Japan, India, and South Korea. Rising middle-class population and changing lifestyles of consumers are propelling the demand for aseptic packaging solutions.

Government efforts to enhance food safety and pharmaceutical manufacturing processes and delivery methods benefit the market, as will growing foreign direct investments in the packaging sector. Automated aseptic filling systems, smart packaging technologies, and flexible packaging materials are expected to adopt.

Well, these asymmetries and high capital sunk costs are barriers to market entry. Future growth is also likely to be spurred by initiatives to improve cost-effective aseptic packaging solutions and regulatory harmonization.

High Initial Investment and Complex Regulatory Compliance

The aseptic packaging equipment market is hindered by the costly initial investment required for the installation of state-of-the-art aseptic processing systems. Meeting strict global food safety and pharmaceutical standards adds to the complexity of adoption especially for small and mid-sized manufacturers.

Maintaining sterility takes a lot of equipment and technology, and becomes costly on operations. Technology’s role in the energy transition: How it will change the game for the climate transitioning to a more sustainable future is not without its challenges, however.

Advancements in Automation and Sustainable Packaging

There is a huge opportunity from the growing acceptance of automation & digital monitoring in aseptic packaging. Enhancements in efficiency and reduction in contamination risks include AI-driven quality control, IoT-enabled real-time monitoring and robotic processing.

Furthermore, rising demand for eco-friendly and recyclable aseptic package materials is driving investment to the sustainable packaging solutions. Thus, companies that adopt state-of-the-art automation and sustainability into their aseptic packaging equipment will remain ahead of the competition.

Based on the end use industry, the food and beverage is estimated to continue to make the largest contributions to the continuous flow market through 2024, accounting for rapid growth from 2020 to 2024 due to increasing demand for longer-life products over the forecast period.

High-speed aseptic filling machines have been widely adopted, and the sterilization technology has continued to improve, improving the safety and efficiency of the product. Nevertheless, high costs associated with implementation and regulatory compliance remained as key challenges for manufacturers.

From 2025 to 2035, the market will undergo a transformation powered by AI-driven automation, smart aseptic monitoring systems, and sustainable packaging solutions. Advances in robotics, predictive maintenance, and block chain enabled traceability will also refine aseptic packaging processes. Also, the movement toward biodegradable and recyclable materials will propel sustainability initiatives across the sector.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter food and pharmaceutical safety regulations |

| Technological Advancements | Faster filling machines and better sterilization |

| Industry Adoption | Wealthiest, increasingly in the food and drug industries |

| Supply Chain and Sourcing | Dependence on traditional aseptic materials |

| Market Competition | Dominated by established packaging equipment manufacturers |

| Market Growth Drivers | Meeting Safety Compliance + Demand for Shelf-Life Products |

| Sustainability and Energy Efficiency | The company is also exploring eco-friendly aseptic materials as an early-stage adoption. |

| Integration of Smart Monitoring | Basic sterilization tracking and quality control |

| Advancements in Aseptic Processing | Use of conventional sterilization techniques |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized global aseptic packaging compliance measures |

| Technological Advancements | Using AI for automation, monitoring using the IoT, as well as robotics |

| Industry Adoption | Expansion into new industries including cosmetics and nutraceuticals |

| Supply Chain and Sourcing | Shift to biodegradable and recyclable aseptic packaging solutions |

| Market Competition | Rise of AI and sustainability-focused aseptic equipment providers |

| Market Growth Drivers | More investment in automation, efficiency and sustainable packaging |

| Sustainability and Energy Efficiency | Comprehensive adaptability of packaging solutions that are recyclable and energy-efficient |

| Integration of Smart Monitoring | AI-based predictive maintenance and real-time contamination detection |

| Advancements in Aseptic Processing | Smart aseptic monitoring, blockchain-enabled traceability, and sustainable innovations |

North America is a prominent player in the aseptic packaging market due to growing demand for longer shelf-life products in the food and beverage industry, and stringent FDA regulations in terms of packaging in the pharmaceutical industry. The increasing evolution of the dairy, juice and plant-based beverage segments has also attracted the adoption of aseptic processing solutions to safeguard the products for an extended shelf-life without use of preservatives.

The USA pharmaceutical industry is undergoing substantial growth in biologics and vaccines, requiring sophisticated sterile packaging solutions. Key players are now incorporating automation in aseptic packaging lines in combination with monitoring systems based on IoT, to advance compliance with regulatory standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.5% |

The aseptic packaging equipment market in the United Kingdom is expected to grow at a CAGR of around 7% during the forecast period (2023 to 2028). The growing sustainability movement is getting companies to embrace eco-friendly aseptic materials that reduce waste but don’t compromise the integrity of the product.

Due to intermediaries like the UK Medicines and Healthcare products Regulatory Agency (MHRA), the growing demand for grow & pack environments is fuelling investments in higher aseptic filling machines and sterilization infrastructures. Moreover, the rising popularity of ready-to-drink (RTD) beverages and functional health beverages is driving up the market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.2% |

Aseptic packaging equipment market in the European Union (EU) is anticipated to grow significantly as EU regulatory frameworks like the European Medicines Agency (EMA) standards for sterile mai pharmaceutical packaging and the European Food Safety Authority (EFSA) guidelines for food safety ensure regulatory compliance.

Germany, France, and Italy are the front runners in Europe for incorporating novel aseptic processing technologies, with a primary focus on dairy, baby food, and high-end pharmaceuticals.

Manufacturers are also focusing on sustainable products, investing in recyclable aseptic packaging solutions to align with the EU’s circular economy objectives. The rise in demand for minimally processed and organic food products has also propelled the adoption of aseptic filling and sealing equipment in the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.4% |

The Japan aseptic packaging equipment market is expanding against the backdrop of rising consumption of ready-to-drink beverages, dairy products and high-quality pharmaceutical products. India nurtures a healthy dose of innovation with robotics and AI driven quality control systems being implemented in aseptic processing lines.

The pharmaceutical industry, especially the manufacture of injectable and biologics, is a strong engine of growth for advanced sterile packaging. Apart from new food concepts, aseptic packaging is being introduced by Japan´s food industry for convenience foods, in line with the rising demand for safe and long shelf-life food items from the quickly aging population.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.3% |

The aseptic packaging equipment in South Korea is surfacing demand for pharmaceutical and beverage in the country. Investments in advanced aseptic filling and sterilization systems are driven by the growing production of shelf-stable foods, functional health drinks, and dairy alternatives.

Rising food safety policies of the government and stringent regulations regarding pharmaceutical packaging are the key drivers pushing the demand for high-end aseptic processing solutions. In addition, the increasing trends of K-beauty and nutraceuticals that need clean, and contamination-free packaging, are also boosting the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

High speed, accuracy, and contamination-free packaging solutions offered by fully-automatic filling machines are the major factors contributing its dominance over the aseptic packaging equipment market by type. In aseptic packaging, fully-automatic filling machines provide continuous, seamless, and sterilized processing, which is essential for bulk production and minimizing human-robot interaction to maintain high hygienic control, making them well-suited for many industries.

The reason for the high demand in food and beverage, pharmaceutical, and medical devices because sterility is the nature and nature of life, needs to be maintained, in order to meet with microbial species and to ensure the quality of foodstuffs and drugs. The evolution of fully-automatic filling machines has drastically improved the efficiency of production lines, facilitating optimal filling processes through advanced robotics, AI-driven automation, and IoT-enabled monitoring systems.

Packagers get machines with integrated self-cleaning and sterilization-in-place (SIP) technologies that minimize downtime while meeting stringent regulatory guidelines concerning aseptic packaging. With manufacturers increasingly designing fully-automatic machines with eco-friendly materials, energy-efficient mechanisms and intelligent packaging controls, they are moving towards sustainability and waste optimisation, while exceeding relevant safety regulations.

Furthermore, with the rising usage of advanced packaging solutions, such as RFID tracking, real-time quality monitoring, and automatic defective detection, the requirement for fully automatic aseptic filling machines is expected to propel sales. Yet, factors like high upfront investment costs, the difficulty of integrating new machines into existing production lines and the need for skilled technicians are significant barriers.

Manufacturers are bolstering modular and configurable machine designs that provide both flexibility and scalability to address such issues at hand to the industry trends. As a part of this landscape, with APAC and Emerging markets getting a growing embrace of hygienic and efficient packaging solutions, the fully-automatic filling machine segment is projected to continue its annual growth - as a key player in aiding using higher rate of aseptic packaging in efficient way across various industries.

The largest end-user segment of the aseptic packaging equipment market was food and beverages segment, due to growing demand for longer shelf life, preservative-free products, and increased safety standards for packaged food and beverages.

The increasing consumer inclination towards natural, uncomplicated, and conveniently consumable goods has thus rendered aseptic packaging into an enabler when it comes to retaining freshness devoid of refrigeration or chemical preservatives.

This works in favour of aseptic carton packaging, pouches, and PET bottles, whose usage is increasing in the dairy, juice, plant-based beverages, and baby food segments, as these segments need to maintain product quality and sterility of the product packed.

As such, prominent food and beverage manufacturers are adopting advanced sterilization systems such as degerming to hydrogen peroxide treatment and steam-based decontamination in high-speed aseptic filling equipment to preserve the integrity of perishable products.

The growth of e-commerce of food delivery services and the increasing tendency of consumers to eat on the go has also boosted the adoption of aseptic packaging equipment to ensure freshness in consumers' hands while deterring contamination during the journey.

Moreover, regulatory bodies are enforcing stringent safety and labelling regulations, which compel manufacturers to invest in cutting-edge aseptic packaging machinery that ensures adherence to food safety standards. The focus on using biodegradable films, recyclable PET containers, and plant-based barrier coatings is one of the major growth drivers in this segment, as these materials not only reduce environmental impact but also use environmentally friendly packaging that meets consumer demand.

While aseptic packaging machines are capital-intensive and bear high operating and maintenance costs, the industry can target these factors in response to costs some way with energy-efficient automation, AI-enabled predictive maintenance, and robotics-driven filling solutions for newer machinery.

The increasing demand for aseptic packaging equipment in this sector is anticipated to drive the growth of this market over the coming years, as the industry continues to move toward safer, cleaner, and more sustainable food and beverage packaging.

Owing to the rising demand for extended shelf-life packaging, stringent food safety regulations, and advancements in packaging technology, the aseptic packaging equipment market is growing at an extremely rapid pace. Growth in aseptic processing in food, beverage, and pharmaceutical industries has propelled investments in high-efficiency aseptic packaging equipment.

The core innovations comprise of automatic filling and sealing machines, high-barrier packaging materials, and intelligent sterilization technologies for safety and quality assurance of the product. Moreover, the increasing shift towards sustainable packaging solutions is leading manufacturers to develop eco-friendly aseptic packaging equipment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tetra Pak | 20-25% |

| SIG Combibloc Group | 15-20% |

| Krones AG | 12-16% |

| GEA Group | 10-14% |

| Robert Bosch GmbH | 8-12% |

| Other Industry Players (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Tetra Pak | Showcases advanced aseptic filling systems, carton-packaged solutions and smart sterilization technologies. |

| SIG Combibloc Group | Handles development of high speed aseptic filling machines, sustainable packaging materials and digital packaging solutions. |

| Krones AG | Focuses on providing aseptic PET bottle filling, integrated packaging lines, and sterile systems driven by automation. |

| GEA Group | Offers aseptic processing and filling solutions for dairy, beverages, and pharmaceuticals products to maintain product safety. |

| Robert Bosch GmbH | It is specialized in the pharmaceutical and food aseptic packaging equipment using advanced sterilization and automation technologies. |

Key Company Insights

Tetra Pak (20-25%)

The innovative filling systems and unique packaging technologies, Tetra Pak is especially strong in aseptic packaging equipment that ensures the safety of packaged products and extends their shelf life. By concentrating on sustainable aseptic packaging alternatives, the firm solidified its foothold in the market.

SIG Combibloc Group (15-20%)

The packaging systems used in the food and beverage industry varies and SIG Combibloc Group is a key player in the industry that provides aseptic packaging systems designed with approach that focuses on efficiency, sustainability, and high-speed process capabilities.

Krones AG (12-16%)

Krones AG has been developing an efficient aseptic PET packaging process and integrated aseptic filling lines, utilizing automation and advanced sterilization methods to improve overall production efficiency.

GEA Group (10-14%)

Aseptic packaging is where GEA Group has one of its leading roles, with the most up to date processing and filling systems, meeting the exacting standards set by the food and pharmaceutical authorities.

Robert Bosch GmbH (8-12%)

Robert Bosch GmbH aseptic packaging equipment is designed for pharmaceutical and food applications, and combines smart sterilization and automation-driven processes to ensure high safety standards.

Other Key Players (25-35% Combined)

Robotics-assisted aseptic filling, AI-driven quality control, sustainable packaging floating materials, etc. are some new facilities transforming the image of aseptic packaging equipment. Notable contributors include:

The overall market size for the aseptic packaging equipment market was USD 11.9 billion in 2025.

The aseptic packaging equipment market is expected to reach USD 25.4 billion in 2035.

The aseptic packaging equipment market is expected to grow at a CAGR of 7.9% during the forecast period.

The demand for the aseptic packaging equipment market will be driven by increasing demand for extended shelf-life packaging, rising concerns over food and beverage safety, advancements in packaging technology, growth in the pharmaceutical sector, and stringent regulatory requirements.

The top five countries driving the development of the aseptic packaging equipment market are the USA, China, Germany, Japan, and India.

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Neoprene Coffee Sleeves Market Growth - Demand & Forecast 2025 to 2035

Mailer Boxes Market Growth – Demand & Forecast 2025 to 2035

Metal Aerosol Packaging Market Growth - Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.