The global aseptic fillers market will keep developing between 2025 and 2035 due to safe and sanitary packaging solutions on the rise in most companies. Aseptic fillers ensure product safety against contamination during filling, product shelf life, and quality assurance of the products.

Consumers' pressure in demanding low-processing and preservative-free medicine and drinks has been a major inducement to manufacturers to introduce aseptic filling technology in their products so as to reduce product safety risk to the barest minimum, provide constancy, and make the environment efficient.

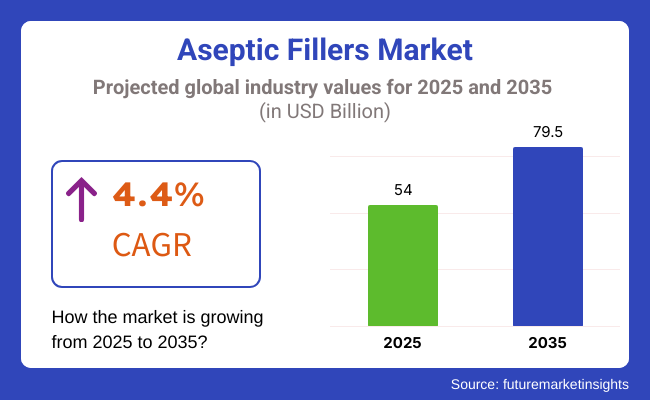

Aseptic fillers market in 2025 was USD 54.0 Billion. It is anticipated to be USD 79.5 Billion by 2035 with a 4.4% compound annual growth rate (CAGR). The market is boosted by the continuous development in the technology of the aseptic filling machines, i.e., greater automation, high accuracy, and higher productivity. Besides that, the application of green processing technology and environment-friendly packaging materials is constantly boosting the market growth.

Explore FMI!

Book a free demo

North America remains a key market for aseptic fillers because of the fast-growing pharmaceutical, food, and beverage sectors on the continent. The consumer need for safe long-term products has prompted American and Canadian manufacturers to invest in state-of-the-art aseptic filling equipment.

The strong regulatory environment in North America supplemented by food safety regulation has also helped drive innovation in the aseptic process through the development of sterile and quality products as well as waste reduction during manufacturing.

Europe's aseptic fillers market is dominated by focus on sustainability and the need to stay compliant with strict health and safety standards. Europe's strong dairy, beverage, and pharmaceutical sectors are increasingly embracing aseptic technologies in an attempt to satisfy the demand for preservative-free, high-quality products from consumers.

Germany, the UK, and France are developed country infrastructure and supply chain nations that assist them in taking advantage of uninterrupted demand for aseptic fillers. European companies are also at the forefront in implementing green material and green production approaches.

Asia-Pacific is expanding the most in the aseptic fillers market due to increasing food and beverages industry, increasing population, and increasing disposable income. China, India, and Japan are investing significantly in aseptic filling lines in a bid to counter increasing demand for ready-to-drink beverages, dairy, and pharma products.

In addition, e-commerce market development throughout the region has enhanced packaged shelf-stable food market demand and thereby bettered the utilization of aseptic filling technology. New production processes are being emphasized by corporate firms and government bodies, leading to enhanced total market growth as well.

Costs of High Equipment and Stringent Sterilization Standards

However, factors such as stringent sterilization regulations and high upfront investment costs, along with the specialized operational expertise required to operate aseptic fillers, are expected to restrain the growth of the Aseptic Fillers Market. Industries such as pharmaceuticals, food and beverages, and biotechnology require aseptic filling to ensure sterility and product integrity is maintained.

Yet, validation of systems against regulatory frameworks such as FDA, EU GMP, and ISO 13408 ads layers of complexity to the system design and validation workflows. Furthermore, the capital-intensive content of aseptic filling lines, such as advanced filtration, decontamination, and robotic automation, restricts adoption by small and mid-sized manufacturers.

Addressing these challenges requires a multidimensional shift towards more modular and scalable aseptic filling systems, real-time contamination detection, and flexible cost-effective packaging solutions to improve affordability and compliance.

Instead, it is focused on growth in biopharmaceuticals and innovations in sustainable packaging.

The increasing demand for biopharmaceuticals and ready-to-drink (RTD) beverages, as well as sustainable packaging solutions, create substantial opportunities for the Aseptic Fillers Market. Now, for the first time, the advances in biologics, cell therapies and parenteral drugs have led to a greater demand for non-contaminable filling solutions that extend shelf life, increase product stability.

Additionally, development of sustainable and environmentally friendly packaging materials such as recyclable and biodegradable cartons is propelling the aseptic processing market. Those that embrace smart sensors, AI-driven process automation and environmentally-friendly aseptic filling technologies will emerge as leaders in their fields. Further innovation in high-speed, contactless filling systems and digitalized cleanroom monitoring is paving the way for optimised operational efficiency and product safety.

The Aseptic Fillers Market is expected to witness a pump in revenue between 2020 and 2024, due to rising demand for shelf-stable food and pharmaceutical products. As aseptic filling technology was implemented, the ready-to-use and injectable drug, dairy alternative, and plant-based beverages was a segment of the market that drove demand.

Challenges including high equipment costs, disruptions to the supply chain, and the need for ongoing validation of the process prevented wider adoption. To cope up, companies introduced improved flexibility of systems, AI-enabled contamination detection, and non-contact sterilization technologies to increase efficiency and to minimize wastage.

Future Horizons (2025 to 2035): The market will witness significant transformations in areas including automation, AI-enhanced sterility assurance, and sustainable filling innovations. Robotic aseptic filling, real-time microbiological monitoring and block chain-based traceability will transform quality assurance.

Moreover, it will minimize the risk of cross-contamination and reduce operating costs through the implementation of single-use filling systems and high-efficiency sterilization methods. The future of aseptic filling technology will be guided by manufacturers that adhere to next-generation contamination control, sustainable production, and digitalized process monitoring as worldwide regulatory authorities impose stricter sterility and packaging regulations.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | In line with FDA, EU GMP, and ISO aseptic standards |

| Technological Advancements | Growth in high-speed filling and advanced sterilization |

| Industry Adoption | Rising application in biopharmaceutical, dairy and RTD beverages |

| Supply Chain and Sourcing | Reliance on pharmaceutical-grade components and exact fitment |

| Market Competition | Dominance of established aseptic equipment manufacturers |

| Market Growth Drivers | Rising demand for long-shelf-life food and sterile pharmaceutical filling |

| Sustainability and Energy Efficiency | Initial adoption of low-energy sterilization methods |

| Integration of Smart Monitoring | Limited AI-driven process monitoring and contamination detection |

| Advancements in Filling Innovation | Use of conventional aseptic fillers with rigid packaging |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI compliance informing regulations better-AI-driven compliance supervision, fast-acting sterility validation |

| Technological Advancements | Expansion of robotic aseptic filling, AI-assisted process control, and smart contamination detection. |

| Industry Adoption | Entering personalized medicine, plant-based nutrition and sustainable packaging solutions. |

| Supply Chain and Sourcing | Move towards local production, recyclable aseptic packaging, and responsible sourcing of raw materials Provide end-to-end solutions |

| Market Competition | Rise of AI-driven packaging start-ups, eco-friendly filling solutions, and modular aseptic processing firms. |

| Market Growth Drivers | Increased investment in biologics, zero-waste packaging, and automated cleanroom technology. |

| Sustainability and Energy Efficiency | Widespread use of carbon-neutral aseptic packaging, energy-efficient sterilization, and smart waste reduction strategies. |

| Integration of Smart Monitoring | Full-scale deployment of IoT-enabled aseptic filling systems with predictive maintenance and real-time sterility tracking. |

| Advancements in Filling Innovation | Development of flexible, single-use filling systems, self-cleaning nozzles, and high-precision robotic dispensing. |

The United States aseptic fillers market has steadily expanded due to the burgeoning demand for sterile packaging in the dairy, beverage, and pharmaceutical domains. Strict sterilization and food safety directives from regulatory agencies including the Food and Drug Administration and United States Department of Agriculture have catalysed adoption of aseptic filling technologies.

The ready-to-drink beverage sector and burgeoning plant-based milk industry are heavy consumers of high-velocity aseptic fillers for carton, PET, and flexible pouch containers. Additionally, the pharmaceutical arena, notably in vaccine and biological drug development, has invested in progressive sterile filling remedies.

With continuous progress in automated filling platforms and escalating needs for high-efficiency sterile packaging, experts anticipate that the United States aseptic fillers industry will sustain steady growth. Advanced robotic technology and regulatory guidelines promoting sterilization underpin the expected perpetuation of this critical healthcare and consumer goods sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.7% |

The United Kingdom aseptic filling industry has certainly seen noteworthy progression as needs rise for sustainable and sterile food packaging choices from food and drink makers along with medical sectors. Rigorous observation from administrative bodies like the UK Food Standards Agency as well as Medicines and Healthcare Products Regulatory Agency regarding sterilization and wrapping has compelled considerable monetary commitment in aseptic filling line infrastructure.

Dairy organizations, juice creators, and plant-based drink firms have headed adoption of aseptic filling technologies, making use of the expanded shelf life it allows for their products. Furthermore, pharmaceutical businesses have substantially expanded their application of isolator-based aseptic fillers for high-precision sterile pharmaceutical filling prerequisites.

As customers increasingly favour preservative-free packaged foods and the healthcare industry demands greater confirmation of drug sterility, experts anticipate the UK aseptic filling industry to continue developing progressively in the imminent years.

Continuous necessity for sterile solutions from these important industries will impel ongoing advancement in aseptic packaging systems. Meanwhile, companies small and large have invested heavily in innovative filling line overhauls utilizing modern robotics for elevated output.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

The aseptic filling industry in Europe has progressed tremendously over recent decades. For example, Germany established pioneering standards with novel technologies that champion the highest food safety regulations. Rigorous directives from the European Food Safety Authority and Good Manufacturing Practices persist in nurturing advanced aseptic packaging innovations. Citizens rightly anticipate protections for public health.

Meanwhile, the demands of consumers have helped fuel progressive material developments. The pursuit of recyclable goods has dovetailed with the filling sector's shift toward highly-efficient machinery. Automated lines with the capability for fast, precise work respond to expanding worldwide trade and industrial production. As nutritional and medical products process on an increasingly massive scale, aseptic technology streamlines operations to satisfy growing markets.

Without question, pharmaceutical and food manufacturers will digitize further to keep pace with globalization. Rising investments in cutting-edge robotic solutions signal confidence that European leadership in aseptic packaging will persist.

Nations across the continent illustrate a shared commitment to scientific advancement, environmental stewardship, and quality benchmarks that safeguard consumer welfare. These virtues will surely guide the filling industry toward continued improvements in the years ahead.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

The thriving Japanese aseptic filling industry caters diligently to escalating needs from food and drink companies and also the pharmaceutical sector seeking innovative packaging solutions. Japan is renowned for meticulous production and stringent quality demands driving advanced aseptic fillers equipped with robotic automation for improved productivity and minimal human intervention.

Healthful foods, nutritious drinks and many medical supplies rely on prolonged shelf life and rigorous cleanliness levels during packaging. Aseptic filling addresses these demands effortlessly. Furthermore, Japan actively invests in eco-friendlier materials like biodegradable PET bottles and paper-based cartons presenting unique demands for customized aseptic equipment accommodating non-traditional forms.

Steady technological progress in sterile packaging and integration of advanced automation in beverage and medicine indicate Japan's aseptic filling market is poised for steady evolution. Advancing technology will streamline processes while strict oversight satisfies industry quality needs for years ahead. Likewise, smaller aseptic fillers tailored for cosmetics and dietary supplements gain popularity expanding potential.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The South Korean aseptic fillers market has witnessed steady progression, propelled by escalating needs for aseptic packaging in the dairy, RTD beverages, and pharmaceutical sectors. South Korea’s rapid urbanization and burgeoning affinity for pre-packaged, preservative-free nourishments are driving demands for high-velocity aseptic fillers.

The administration’s concentration on pharmaceutical exports and biotechnological advancement is fueling capital expense in aseptic filling lines for vaccinations, biologics, and sterile injectable medicines. Additionally, development in useful and plant-established refreshments is boosting requirements for aseptic filling innovations. The expanding migrations to metropolitan zones have considerably added to the interest for bundling in uphold able and hygienic plans.

With consistently expanding speculation in food and drug robotization and strong authoritative help for aseptic bundling, experts anticipate that the South Korean aseptic fillers commercial center will develop consistently later on also. The public authority is chipping away at approaches to create fare of value included items to global business sectors and this is relied upon to upgrade the interest cycle.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The aseptic fillers market is dominated by an assortment of automated and semi-automated aseptic fillers, which are gaining widespread adoption in food and beverage, pharmaceutical and cosmetic industries owing to the increasing need for high-precision filling solutions to achieve sterility of products, extend product shelf life and enhance production efficiency.

This lead to microbiologically Inactivation of the liquid, minimizing human intervention along with high precise fill accuracy that makes these filling technologies a general necessity in the production of dairy, juice, ready-to-drink beverages, pharmaceutical drugs and personal care products.

Automated aseptic fillers are among the most modern and efficient filling technologies characterized by high-speed operation with real-time process monitoring and less manual involvement. Fully automated systems guarantee accurate fill levels, better product clean-up, and lower contamination risks in high-volume production facilities, eliminating the human factor present in semi-automated fillers.

Demand for high-speed automated aseptic fillers is on a rise across the beverage industry, with increasing consumption of RTD beverages and functional drinks prompting manufacturers to implement aseptic filling technologies to enhance sterility and boosting up production efficiency. Automated fillers have shown to enhance the production rates by more than 50%, thus providing a better output along with reduced costs for large-scale manufacturers as prescribed by the studies.

The use of automation in dairy processors has encouraged market growth for aseptic fillers, introducing completely enclosed, contamination- and bacteria-free filling stations for long-life milk and yogurt enabled packages. The adoption received a further boost with the integration of AI-powered real-time monitoring systems with automated defect detection and predictive maintenance to ensure improved product quality and longevity of the equipment.

Robotic-assisted aseptic fillers using multi-axis robotic arms to dispense accurate fills on filling machines have bolstered market growth since the robotic arms can achieve greater efficiency in the handling of complex packaging formats. The integration of smart filling lines, which includes IoT-connected machines for centralized control and data analytics, has been crucial in a higher synchronization along aseptic production lines, which has supported the market growth.

While offering advantages such as high output speed, low contamination risk, and improved process automation, automated aseptic fillers also have disadvantages such as high initial investment cost, complicated installation requirements, and increased maintenance requirements.

Nonetheless, developing solutions in AI-based process optimization, machine learning-assisted predictive maintenance, and self-cleaning aseptic filler systems have helped increase efficiency, cost-effectiveness, and operational flexibility, which continue to drive growth in the market for automated aseptic fillers.

In fact, semi-automatic aseptic fillers have seen good market acceptance over the years, thanks to growing investments by manufacturing companies in flexible, economic and hybrid filling solutions for medium-scale beverage, dairy and pharmaceutical production. Semi-automated systems provide more flexible production capabilities compared to fully automated fillers, allowing manufacturers to customize fill settings and packaging formats when necessary.

The growing requirements for semi-automated aseptic fillers from artisanal beverage producers, especially custom batch processing for organic drink and artisanal juices has propelled the penetration of flexible aseptic filling equipment due to the increasing preference for flexible aseptic filling systems from small and mid-sized beverage manufacturers. Research shows that semi-automated fillers lower contamination risks by more than 30%, which ensures more compliance with food safety regulations.

As a case in point, the advent of semi-automated aseptic filling machines in the pharmaceutical drug packaging industry has further bolstered market demand with the ability to provide manual oversight of dose filling that favours precision during dose filling, thus enabling wider application in sterile injectable and biologics manufacturing.

AI-driven process guides and fill level monitors have also increased adoption, improving accuracy and reducing product waste. Compact semi-automated fillers with space-efficient designs for low output production lines have optimized market growth with enhanced usable range in emerging and regional markets.

The introduction of hybrid aseptic fillers with semi-automated operation and parts for full automation as optional upgrades has tightened gain in the market, which is anticipated to help manufacturers making the shift to high-volume production achieve better scalability.

While semi-automated aseptic fillers provide increased cost efficiency, versatility, and lower maintenance requirements than fully automated systems, they bring challenges such as slower throughput, greater reliance on operator skill, and lower scalability for larger runs.

Nevertheless, recent developments in AI-assisted manual control, hybrid automation models, and smart aseptic fill validation technologies increase usability, affordability, and process precision, promising growth prospects for semi-automated aseptic fillers.

Single-head and multi-head aseptic fillers are two major market drivers as manufacturers are deploying customized filling solutions in order not only to optimize production capacity but to achieve consistency of the product and reduce the risk of contamination.

One of the most versatile and economical solutions is with a single-head aseptic filler with fill heads that can provide accuracy and repeatability into the low millilitre range for small-scale production and specialty product packaging. Single-head fillers also enable custom batch processing, making it easier to maintain control over fill volumes and packaging types compared to multi-head fillers.

Increasing trend of single-head aseptic fillers in organic juice and functional beverage production with adjustable fills for custom niche health drinks has catalysed the adoption of flexible small batch aseptic fillers, as premium beverage brands emphasize product integrity and customized packaging. According to research, single-head fillers decrease production errors by over 40%, allowing for improved consistency in specialty product lines.

Increasing use of single-head fillers in pharmaceutical applications with accurate dose-filling for injections and vaccines has been further supporting market demand ensuring higher uptake during sterile drug compound at small-scale. Advanced capabilities like AI-based fill-level calibration with automatic volume adjustment and adaptive viscosity control have further increased adoption by ensuring consistent product quality across various packaging formats.

Aseptic monobloc fillers refer to compact single-head aseptic fillers, with portable and modular design for small-scale production units. Market expansion has been further reinforced by the adoption of sensor driven contamination detection with real time microbial monitoring in the filling chamber to better align with global aseptic packaging regulations.

Single-head aseptic fillers, for instance, have clear merits in precision, customization, and cost-efficiency, but lower throughput than multi-head systems, higher labour costs on a per-unit basis, and limited scalability for high volume production.

Nonetheless, the advent of innovative solutions like AI-driven process automation, modular head expansion systems, and hybrid batch-to-continuous filling technologies focused on enhancing usability, adaptability, and cost-effectiveness are set to ensure robust growth for single-head aseptic fillers in the market.

In the healthcare and biopharma segments, multi-head aseptic fillers have established high market adoption rates in high-output beverage, dairy, and pharmaceutical production, with factories increasingly investing in large and continuous sterile filling systems. Multi-head fillers are capable of much higher speeds than single-head systems providing greater productivity in high-speed production lines.

The growing demand for multi-head fillers in ultra-high-temperature (UHT) dairy packaging, which offers simultaneous filling of multi-containers, has resulted in the wider adoption of the high-throughput aseptic fillers, which improve efficiency and lower costs for dairy manufacturers.

Growing use of vial filling solutions in condom manufacturing, with multi-head and multi-dose packaging configurations in pharmaceutical biologics manufacturing have enhanced market demand, favouring higher market penetration into vaccine and liquid drug production. The adoption has been further propelled by the implementation of robotic-assisted multi-head aseptic fillers, with automated capping, sealing, and label application, enabling better end-to-end production.

While multi-head aseptic fillers excel in generating higher output speeds, greater cost efficiency, and adaptability to large-scale mass production, potential drawbacks of multi-head aseptic technology include high initial setup costs, greater requirement for space, and complex maintenance processes.

But new advances such as intelligent filling adjustments based on algorithms, automated real-time contamination detection systems, and next-generation modular multi-head expansion systems are increasing efficiency, flexibility, and the overall capacity for long-term operational flexibility, supporting continued gains for multi-head aseptic fillers.

The growing need for shelf-life packaging, aseptic filling, and other automation processes in the food & beverage, pharmaceuticals, and dairy industries have led to the growth of the aseptic fillers market. The key technological trends are adoption of high-speed aseptic filling machines, AI usage in production monitoring, and development of greener packaging technologies.

Flexible packaging and automation solutions to extend shelf life are global packaging machineries manufacturers as well as specialized aseptic technology companies, which is an important factor driving growth in the aseptic processing market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Tetra Pak International S.A. | 15-20% |

| Krones AG | 12-16% |

| GEA Group AG | 10-14% |

| SIG Combibloc Group | 8-12% |

| Serac Group | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Tetra Pak International S.A. | Develops high-speed aseptic carton filling machines, AI-driven process control, and sustainable aseptic packaging solutions. |

| Krones AG | Specializes in ultra-clean and aseptic PET bottling solutions, integrating automation for dairy, beverage, and pharmaceutical applications. |

| GEA Group AG | Manufactures aseptic filling machines with advanced sterilization, ensuring contamination-free liquid packaging. |

| SIG Combibloc Group | Provides compact aseptic filling systems for dairy, juice, and plant-based beverages, integrating real-time monitoring. |

| Serac Group | Offers aseptic filling lines with high flexibility for food, dairy, and personal care products. |

Key Company Insights

Tetra Pak International S.A. (15-20%)

The aseptic fillers market, including Tetra Pak, which provides AI-integrated aseptic carton filling solutions, automation-driven sterility control, and eco-friendly packaging innovations.

Krones AG (12-16%)

Krones is well known for aseptic PET and glass bottling systems, enabling high-speed production of beverages without contamination.

GEA Group AG (10-14%)

Offer high-fidelity aseptic filling lines, ensuring we optimize for hygiene processing and sterilization efficiency.

SIG Combibloc Group (8-12%)

SIG Combibloc provides sustainable and space-efficient aseptic fillers that create cost-efficient, flexible solutions for liquid packaging.

Serac Group (5-9%)

Reputed for advanced sterility control, their aseptic filling systems include unique modular system designs for the dairy and food processing applications.

Other Key Players (40-50% Combined)

Several packaging technology firms and automation solution providers contribute to next-generation aseptic filling innovations, AI-driven process optimization, and sustainable sterile packaging. These include:

The overall market size for Aseptic Fillers Market was USD 54.0 Billion in 2025.

The Aseptic Fillers Market is expected to reach USD 79.5 Billion in 2035.

The demand for the aseptic fillers market will grow due to increasing demand for extended shelf-life packaging, rising adoption in the food and beverage industry, advancements in aseptic processing technology, and stringent regulations on food safety, driving the need for sterile and efficient filling solutions.

The top 5 countries which drives the development of Aseptic Fillers Market are USA, UK, Europe Union, Japan and South Korea.

Automated and Semi-Automated Technologies Drive Market to command significant share over the assessment period.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.