The ASEAN Starch Derivatives market is set to grow from an estimated USD 2,336.2 million in 2025 to USD 3,841.9 million by 2035, with a compound annual growth rate (CAGR) of 5.5% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 2,336.2 million |

| Projected ASEAN Value (2035F) | USD 3,841.9 million |

| Value-based CAGR (2025 to 2035) | 5.5% |

The area of ASEAN (Association of Southeast Asian Nations) flourishes with the starch derivatives market which is fuelled by the continuous demand from a wide variety of industries like food and beverage, pharmaceuticals, along with personal care.

The market is outlined by a great variety of starch derivatives opposite to each other, for instance, modified starch, native starch, and starch-based sweeteners which are applied due to their functional properties of thickening, gelling, and stabilizing.

The population pressure and the rise of the consumption power of the ASEAN countries are leading to the fact that the people eat more and more products that have to be processed through starches, which in turn creates the need for starch derivatives.

In addition, the region's agricultural landscape, with an abundance of raw ingredients such as corn, cassava, and potatoes, is ideal for starch production. In Thailand and Vietnam, cassava is a major product while in Malaysia and Indonesia, there exists corn, which makes sure that the processing plants have enough raw material for processing.

ASEAN Economic Community is envisioned to be the economic tool that will create more integration of the economy in the region. The idea will be to make the trade and investment issues of the starch derivatives division more easy.

The constantly growing perception of health and wellness is another force that also affects the market, as clients now prefer products that are relabelled as clean and use only natural substances, so manufacturers are forced to find ways to switch to healthier starch alternatives.

Explore FMI!

Book a free demo

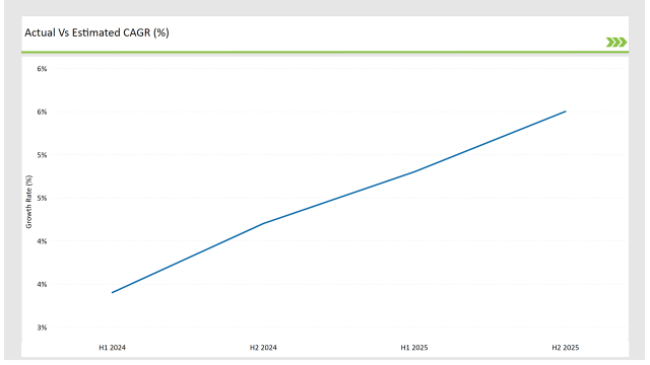

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Starch Derivatives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Starch Derivatives market, the sector is predicted to grow at a CAGR of 3.2% during the first half of 2024, increasing to 4.5% in the second half of the same year.

In 2024, the growth rate is expected to decrease slightly to 5.4% in H1 but is expected to rise to 5.5% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Ingredion Incorporated launched a new line of organic modified starches for clean label applications, catering to the rising consumer demand for transparency in food ingredients. |

| 2024 | Cargill invested in a state-of-the-art starch processing facility in Thailand to enhance production capacity and meet the growing demand for starch derivatives in the region. |

| 2024 | Tate & Lyle introduced a range of plant-based starches aimed at the growing vegan market, aligning with the trend towards healthier and more sustainable food options. |

| 2024 | Roquette Frères expanded its product portfolio with new functional starches specifically designed for the pharmaceutical industry, addressing the need for high-quality excipients. |

Rising Demand for Clean Label Products

Starch derivatives market is experiencing positive developments as clean-label products are encountering the same trends. People have become highly concerned about the quality of ingredients in food, thus preferring products made of natural things, less processed, and devoid of artificial chemicals.

The noticeable change can be seen in the food and beverage segment where producers are adjusting the formulation of products that take into account end-users' tastes for a healthier choice. Starch derivatives, like type of modified starches coming from natural sources, are employed in the food industry to improve texture and stability without breaching the clean label requirements.

On the flip side, firms are putting their money in research and development so that they will produce brilliant starch derivatives that really fit the clean label trend.

Among these include the manufacturing of organic and non-GMO starches for the benefit of people who take care of their health. The number of people who are choosing to eat plant-based foods and continue with the gluten-free diet equally urge the need for starches that can take their place as active ingredients in a variety of products.

Technological Advancements in Starch Processing

Starch derivatives market is undergoing a shift due to technological developments such as those in starch processing. The innovations in extraction, modification and processing techniques are allowing manufacturers to make starch derivatives with superior functional properties.

For example, the development in enzymatic modification has enabled the production of starches with certain desirable characteristics such as increased solubility, decreased viscosity, and better stability.

In addition, the deployment of digital and automation technologies in the processing of starch is optimizing the production processes, bringing costs down, and raising productivity levels.

This, in turn, not only improves the overall quality of starch derivatives but also provides better flexibility in adapting to the changes in consumer behavior. The manufacturers are using data analytics and machine learning for the optimization of production parameters and guaranteeing product consistency.

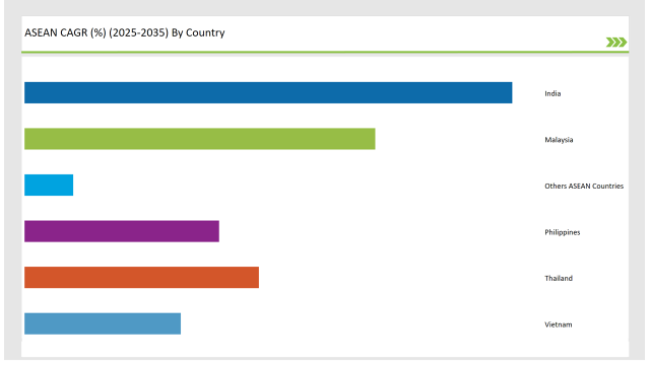

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The starch derivatives market in India has been growing very well, thanks to various reasons. The huge population of the country and the concomitant rise in disposable incomes are the foremost reasons for people to go for food items that are processed and convenience.

The urbanization factor continues its fast track course, and the customers now seem to double that interest in ready-to-eat meals and snacks that are made of pregelatinized starch for heat and stability.

The food and beverage sector in India is changing not only because of higher scrutiny but also by the introduction of health and wellness concepts. The stance that the clean label, especially starches, are used the most among other ingredients, adapting to consumer needs for the non-added preservatives against starch that are modified and meet the criteria will be the one change.

The rise of gluten-free and plant-based diets is another booster to the request for starch derivatives that can be used as a functional element in several functions.

The ascent of the starch derivatives market in Malaysia is a direct consequence of many contributing factors. This country as a location being the core of Southeast Asia and thus positioning itself as a main center for food processing and manufacturing, is drawing fully the interest of national and international investors.

Urbanization and the resulting shift in lifestyle habits, mainly towards the consumption of processed foods, are the two most critical factors that are driving the expansion of the market.

In the meantime, the Malaysian food and beverage industry are employees of health-oriented products achieved through a relative increase in the utilization of starch derivatives as functional ingredients. To fulfill the desires of consumers for clean labels and natural ingredients, Manufacturers have been reformulating their products which is the action driving the demand for modified starches.

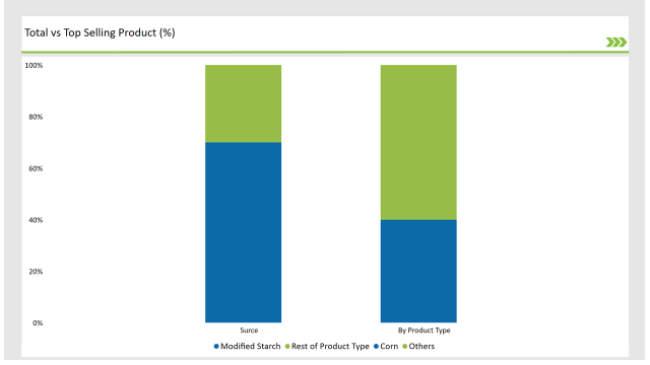

Modified starches represent a main segment of the starch derivatives market and are a good amount of their versatile applications to different sectors. These starches are modified by chemical or physical treatments to enhance their functional properties, which makes them suitable for a broad variety of uses, such as in food, pharmaceuticals, and cosmetics.

In the sector of food, modified starches act as thickening agents, stabilizers, and emulsifiers, which in turn have better texture and consistency to products such as sauces, dressings, and yogurt. The rise in their popularity of ready-to-eat meals and convenience foods creates a pressure to the industry for modified starches as the producers look for the possibilities of the increase of product shelf life and quality.

Corn is one of the most widely grown crops worldwide, especially in countries like the United States, Brazil, and China. This extensive cultivation guarantees a steady and plentiful quantity of corn, which, in turn, is a cheap source for starch production.

The large-scale corn farming and processing operations that benefit from economies of scale are the primary reason for decreased production costs. The latter is achieved through transferring the saving benefits to manufacturers and end-users.

Corn starch is quite adaptable and can be altered to friction fit a variety of uses in different sectors. For example, the food products are popularly used with corn starch as an ingredient of thickener, stabilizer, and emulsifier in sauces, soups, and baked goods. Its features such as gel formation and texture improvement make it the best choice for food manufacturers.

Corn starch is also noteworthy due to the fact that it is also used in other industries such as non-food, for pharmaceutical, textile, and paper products which increases their market potential.

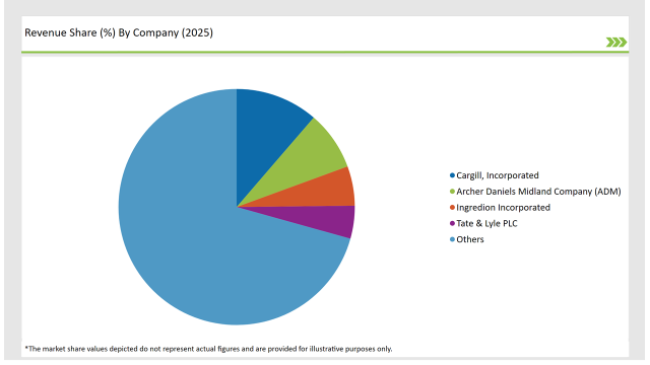

2025 Market Share of ASEAN Starch Derivatives Manufacturers

Note: The above chart is indicative

The starchy derivatives business is marked by a highly competitive environment with numerous main rivals battling for the market. The leading firms in the sector are Ingredion, Cargill, Tate & Lyle, Roquette Frères, and Archer Daniels Midland, plus many others. They are mainly using a mix of strategies like new product development, acquisitions, and ventures into curb markets to increase their shelf space.

The ASEAN Starch Derivatives market is projected to grow at a CAGR of 5.5% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 3,841.9 million.

India are key Country with high consumption rates in the ASEAN Starch Derivatives market.

This Segment further Categorise Modified Starch, Sweeteners, Native Starch, Cationic Starch

This Segment further Categorise into Corn, Potato, Wheat, Cassava

This Segment further Categorise into Food & Beverages, Paper & Paperboard, Feed Industry, Pharmaceuticals, Textiles

Dry, and Liquid

Thickening, Stabilizing, Binding, and Emulsifying

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.