The ASEAN Probiotic Supplements market is set to grow from an estimated USD 260.1 million in 2025 to USD 1,147.9 million by 2035, with a compound annual growth rate (CAGR) of 16% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 260.1 million |

| Projected ASEAN Value (2035F) | USD 1,147.9 million |

| Value-based CAGR (2025 to 2035) | 16% |

The ASEAN probiotic supplements market is on an exponential growth trajectory owing to soaring consumer awareness of the value of gut health and probiotics. With a rising number of people who are embracing the fact of how critical it is to keep a well-functioning gut microbiome, the need for probiotic supplements is soaring high across the region.

The case is this, especially with health-conscious individuals, such as the millennials and Gen Z members who have been putting stress on wellness and preventive healthcare.

The deteriorating lifestyle choices that lead to health conditions among people such as digestive issues, overweight, and stress, have also assisted the probiotics market in meeting demand. More consumers are now on the lookout for the natural and best methods to treat their existing problems and keep them from getting ill.

Besides this, the increased awareness and consumption of functional foods and beverages containing probiotics, which are perceived as proactive health alternatives, have been the main driving factors for the market growth as well.

Explore FMI!

Book a free demo

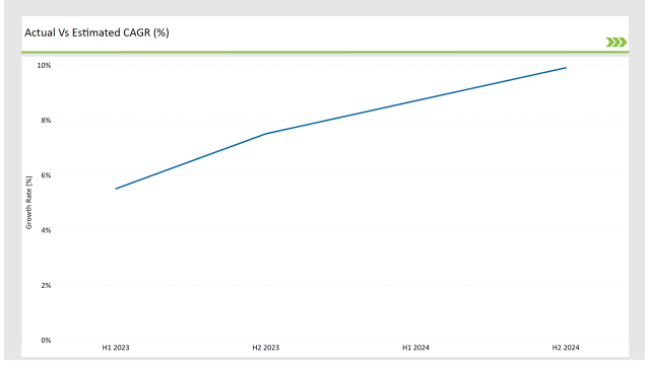

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Probiotic Supplements market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Probiotic Supplements market, the sector is predicted to grow at a CAGR of 5.5% during the first half of 2024, increasing to 7.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.7% in H1 but is expected to rise to 9.9% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Danone: Launched a new line of probiotic-infused yogurt aimed at enhancing gut health and immune support. |

| 2024 | Nestlé: Introduced a range of personalized probiotic supplements based on individual microbiome analysis. |

| 2025 | ProbioFerm: Expanded its product line to include a new probiotic powder designed for digestive health. |

| 2025 | Culturelle: Released a new formulation of probiotic capsules targeting immune health and overall wellness. |

Growing Demand for Personalized Probiotics

The skyrocketing demand for personalized probiotics has been propelled by the great strides made in microbiome research and the establishment of individual health needs. Probiotic consumers, notably, are more often in pursuit of customized supplements on issues like digestive health, immune support, and mental well-being than ever before. This tendency is particularly powerful among the health community of individuals who are looking out for the best specific solutions to improve their health.

The companies are manufacturing individualized probiotic formulas created from specific microbiome profiles. This technique not only makes personalized supplements available that tackle individual health issues but also can lead to better overall health.

Moreover, technological progression like DNA testing and microbiome studies have opened up a window for a user to witness the unique needs of their body that, in the end, persuade them to utilize personalized probiotics.

Increasing Popularity of Probiotics in Functional Foods

The functional food sector is quickly experiencing an increasing demand for probiotics consumption as people are looking for practical and delicious methods of including probiotics in their diet. Probiotic foods are not only limited to yogurt, kefir, and fermented drinks but also they are becoming mainstream as many brands are fortifying these products with probiotics to make them healthier.

A major factor for the expansion of this business is the rise in the number of people who realize the relevance of having a healthy gut and probiotic's role in supporting the good function of the digestive and immune systems. Shoppers are more and more interested now in food items that are both tasty and healthy, so probiotics become a very appealing ingredient in a wide range of food products.

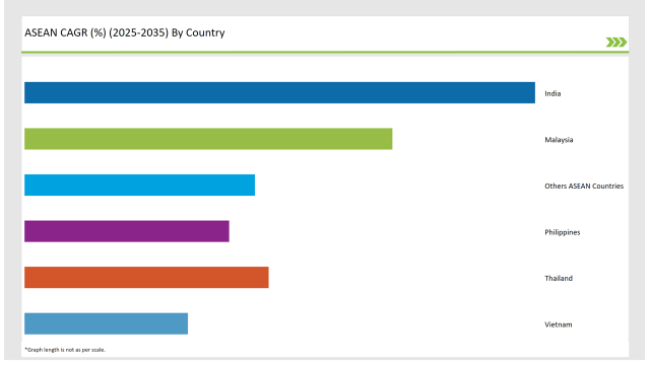

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Indian market for probiotic supplements is currently experiencing significant growth, thanks to the increasing momentum of regained health awareness and the active interest in preventive health care. The rising number of stomach disorders and other relayed health issues among people has made them quest for natural means of achieving their digestive health goals.

Probiotic supplements are now recognized as practical choices for improving digestion, feeling better overall, and many other reasons. The Indian government has been in favor of the health and wellness sector, pushing programs that endorse the body to be fit and food to be eaten healthy.

This has built a good atmosphere for the probiotic supplements industry to mature; with customers more and more often looking for items that would benefit their health. Moreover, the proliferation of online shopping sites has eased probiotic supplements to a wider customer segment, thus allowing people to buy products from the internet effortlessly.

The supplement market for probiotics in Malaysia is on the fast track to growth due to the population's increased emphasis on health and wellness. As a result of the soaring prevalence of lifestyle-related health problems like obesity and digestive disorders, people have been turning to the use of health supplements.

Probiotic supplements have emerged as a prominent choice for many people who want a natural method for improving gut health, and consequently, even their mental health and physical well-being. The Malaysian government has launched health promotion programs that have actively involved the population to have a healthier lifestyle.

In such an environment, turbocharged by the sale of probiotics, health-oriented and wellness-minded customers have made the products the preferred choice. The rise of social media and health influencers has also played a significant role in promoting probiotics, as individuals look for guidance and recommendations from trusted sources.

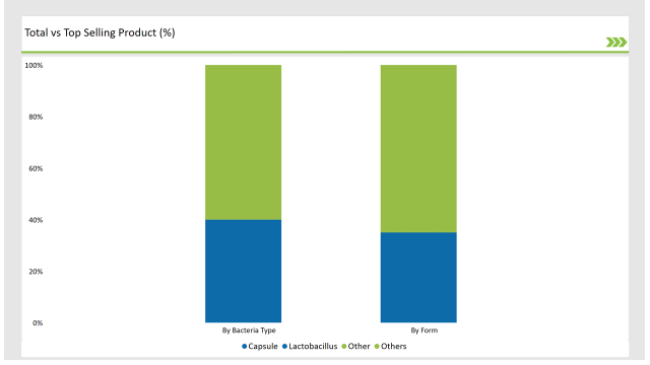

The dominance of capsules, which are expected to capture nearly 35% of the probiotic supplement market share by 2025, is predominant in this area. The reason for the preference for capsules is that these are very convenient to use, fast to apply, and can deliver the exact dose of probiotics.

Capsules are most commonly used by people who want an easy and effective way to add probiotics to their daily routine. Capsules in addition facilitate lifespan and stability as they add a protective layer between the probiotics and the environment, thus keeping the probiotics from exposure to the factors that can reduce their efficiency.

A renowned strain of lactobacillus is the one that could ferment lactose and produce lactic acid, mother lactic acid bacteria are a type of probiotic that can be found in various fermented products and foods, e.g., milk, yogurt, sauerkraut, etc. Lactobacillus bacterial cells play a key role in the process of lactic acid fermentation.

Thus, Lactobacillus is beneficial for digestion by preventing diarrhea, constipation, and irritable bowel syndrome (IBS). The popularity of probiotic supplements containing lactobacillus is expected to soar soon as the public embraces the idea of good gut health.

2025 Market Share of ASEAN Probiotic Supplements Manufacturers

Note: The above chart is indicative

The probiotic supplements market has a competitive landscape with many players fighting for market share. Some of the key companies in this sector include Danone, Nestlé, ProbioFerm, Culturelle, and Kefir Pro.

These companies are making use of their strong research and development capabilities to come up with innovations and launch new products that align with the changing needs of consumers.

The ASEAN Probiotic Supplements market is projected to grow at a CAGR of 16% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,147.9 million.

India are key Country with high consumption rates in the ASEAN Probiotic Supplements market.

Leading manufacturers include Herbalife, Optimum Nutrition (ON), MusclePharm, BSN (Bio-Engineered Supplements and Nutrition), Isopure, and GNC (General Nutrition Corporation) key players in the ASEAN market.

Capsules, Tablets, Powder, and Liquid

Lactobacillus, Bifidobacterium, Streptococcus, Others (Bacillus, Saccharomyces)

Retail Pharmacies/Drug Stores, Online Retail, Supermarkets/Hypermarkets, and Health Food Stores

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.