The ASEAN Potato Flakes market is set to grow from an estimated USD 755.9 million in 2025 to USD 1,543.5 million by 2035, with a compound annual growth rate (CAGR) of 7.4% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 755.9 million |

| Projected ASEAN Value (2035F) | USD 1,543.5 million |

| Value-based CAGR (2025 to 2035) | 7.4% |

The ASEAN Potato Flake Market is experiencing strong expansion because consumers increasingly seek food ingredients that are convenient and versatile. Food and drink manufacturers make potato flakes by drying cooked mashed potatoes into a stable product that maintains long-term storage capabilities and works well in numerous food and beverage applications in addition to non-food processes.

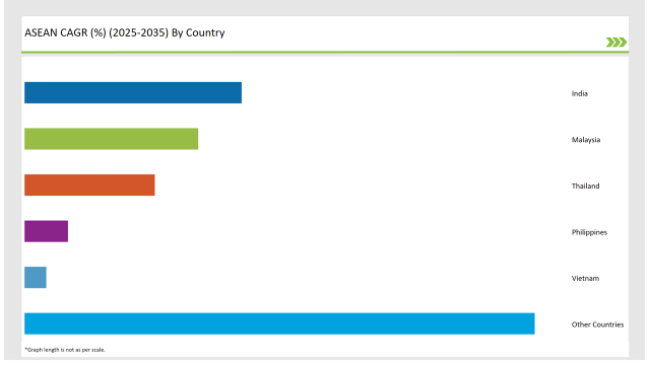

Potato flakes find vital application in American economic nations because consumers choose ready-to-eat food products because of urbanization while diverse food demands increase due to modern life patterns. The market absorbs its share from India together with Malaysia and Thailand while these nations operate concurrently in production and consumption roles.

India drives its processed potato market through its solid agricultural foundation while Malaysia raises demand through its growing food service industry and Thailand supports expansion through its substantial snack and processed food sector.

Potato flakes serve as a key component across various industries from the snack sector to the soup industry bakery production and baby food manufacturing. Since health-conscious consumers have emerged potato flakes with organic and clean-label certifications have gained increased market demand. The market trend toward ingredient transparency and sustainability finds alignment with these particular products.

Explore FMI!

Book a free demo

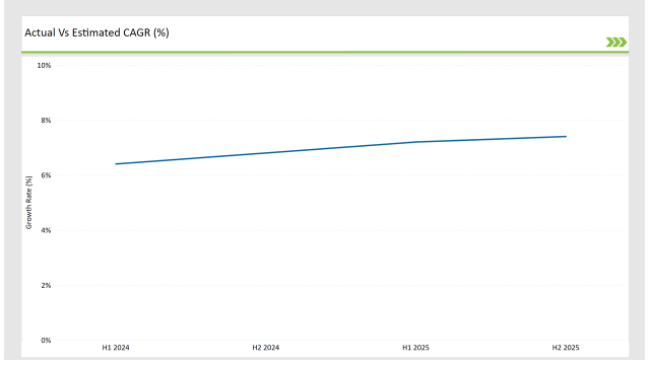

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Potato Flake market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Potato Flake market, the sector is predicted to grow at a CAGR of 6.4% during the first half of 2024, with an increase to 6.8% in the second half of the same year. In 2025, the growth rate is anticipated to decrease to 7.2% in H1 slightly but is expected to rise to 7.4% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2024 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April 2023 | AgroFlakes India launched a new organic potato flake line targeted at premium ASEAN markets. |

| July 2023 | Thailand-based FlakeTech introduced instant mashed potato premixes using locally sourced potato flakes for HoReCa customers. |

| September 2023 | Malaysia’s PotatoPro Foods partnered with local farmers to promote sustainable production practices for potato flakes. |

| November 2023 | Global brand FlakeMasters launched fortified potato flakes for baby food applications in ASEA.N |

| February 2024 | IndoFlake expanded its production capacity in Indonesia to meet the rising demand for clean-label potato flakes. |

Rising Demand for Convenience Foods and Ready-to-Eat Products

The ASEAN Potato Flake Market has expanded due to escalating consumer interest in convenient food products. The rising pace of urban living has pushed people toward using ready-to-eat food and processed products alongside snacks. Potato flakes serve as an excellent raw material in many food categories because they provide lightweight functionality with shelf-life stability and easy application.

Consumer demand for instant mashed potatoes derived from potato flakes continues to grow with strong acceptance from both the consumer sector and food industry operators (HoReCa). Badami potato flakes have become preferred by hotels restaurants and catering services because they reduce workload during meal preparation and maintain consistency in large serving portions. Instant mashed potatoes serve as restaurant side dishes and baking toppings after simple rehydration procedures.

Potato flakes continue to gain popularity as one factor behind this product trend growth. The food industry depends heavily on potato flakes since these ingredients help create chips extruded snacks and puffed snacks by offering structural support and better texture quality. Apart from Thailand and Malaysia the growing snack industry of both countries positions them as major markets for these applications.

Expanding Applications in Food Processing and Non-food Industries

The versatility of potato flakes has enabled their adoption across diverse applications, from food processing to non-food industries. In the food sector, potato flakes are a key ingredient in soups, sauces, snacks, and bakery products. Their ability to thicken, bind, and enhance texture makes them indispensable in processed food manufacturing.

In the snacks industry, potato flakes are used to create a variety of products, including chips, puffed snacks, and extruded items. Their lightweight and dehydrated nature ensures ease of transportation and storage, making them a preferred choice for snack manufacturers in ASEAN countries like Malaysia and Thailand.

In baby food production, potato flakes are valued for their nutritional benefits and easy digestibility. Fortified potato flakes, enriched with vitamins and minerals, cater to health-conscious parents seeking premium baby food products.

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The ASEAN Potato Flake Market benefits significantly from India being the world's largest potato manufacturing nation. Indian potato farming at large scales combined with favorable climate conditions results in a continuous raw material supply for potato flake manufacturing.

Processed food demand is growing in India because of urban population expansion and shifting eating patterns combined with the growing number of dual-earning families. Potato flakes have gained popularity for their usage in both snacks and soups as well as various bakery items according to consumer needs for prepackaged meals. Indian potato flake manufacturers use growth in e-commerce platforms to distribute their products to ASEAN countries.

The expanding food service industry of Malaysia serves as the main catalyst behind the potato flake market. Restaurants and cafés along with quick-service outlets depend heavily on potato flakes to take advantage of their convenience features and adaptable characteristics.

The food service operations across the country depend heavily on potato flakes because they serve as essential components for both instant mashed potatoes and snack coatings.

The rising customer demand for environmentally friendly sustainable organic products contributes significantly to the growth of potato flake markets in Malaysia. Local producers received encouragement from sustainable farming practice support by the government and growing clean-label product preference to implement organic certification.

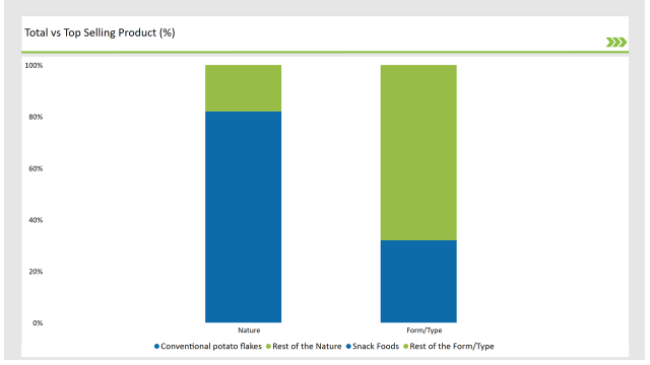

Conventional potato flakes dominate the ASEAN Potato Flake Market.

The ASEAN potato flake market heavily favors conventional products because they provide affordable price advantages and broad industrial product applicability. Organic potato flakes focus on premium markets but conventional flakes are more affordable making them the preferred choice for snack and soup producers along with makers of ready-to-eat meals.

Processed food industries use conventional potato flakes commonly because standard agricultural techniques guarantee dependable availability and minimize production expenses. The functional properties of thickening and binding alongside texture improvement make these flakes essential for large-scale food manufacturers to produce essential functional benefits to food systems.

The low price point enables manufacturers to keep product costs competitive while operating in the cost-sensitive ASEAN markets which include Indonesia Vietnam and the Philippines.

Dehydrated potato flakes are the most popular form in the ASEAN Potato Flake Market.

The ASEAN Potato Flake Market shows dehydrated potato flakes as its primary form because of their lightweight structure alongside long shelf life and application versatility. Drying mashed potatoes into sheets produces potato flakes when the sheet breaks into chunks. Processing through dehydration conserves both taste and structure together with nutritional value to produce ideal processed food components.

Food processors use extensively dehydrated potato flakes to create soups and premixes and instant mashed potatoes and ready-to-eat meals. Quick rehydratable properties offer manufacturers and consumers ease of use.

A signature element in instant soup mixes relies on dehydrated flakes because they offer texture creation and improve flavor quality. Different food snack products such as potato-based chips and crisps achieve their puffed and extruded state through the utilization of these flaked potato ingredients.

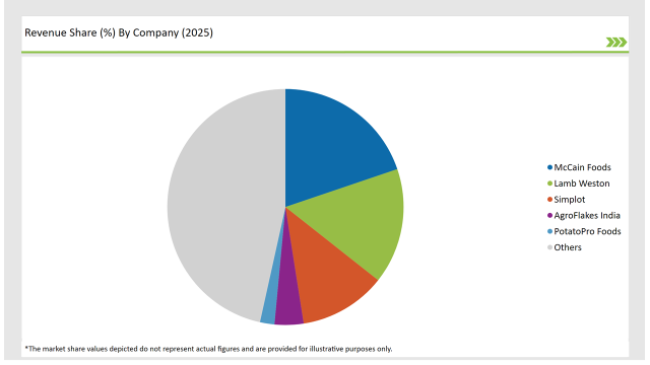

2025 Market share of potato flakes Manufacturers

Note: The above chart is indicative

The potato flakes market functions with moderate concentration because major international companies coexist alongside regional businesses. Global food giants McCain Foods together with Lamb Weston and Simplot control the market using their multiple production plants in addition to strong distribution channels and recognizable brands. The growing market benefits from these companies using innovation and product quality with operational efficiency to uphold competitive advantages.

The ASEAN Potato Flake market is projected to grow at a CAGR of 7.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,543.5 million.

India are key Country with high consumption rates in the ASEAN Potato Flake market.

Leading manufacturers include McCain Foods, Lamb Weston, Simplot, AgroFlakes India and others are the key players in the ASEAN market.

As per Form/Type, the industry has been categorized into Standard Flakes, Mashed Potato Pellets, Powder/Granules, and Specialty Flakes

As per Grade, the industry has been categorized into Food Grade and Feed Grade

As per nature, the industry has been categorized into Conventional and Organic

As per By End Use, the industry has been categorized into Food & Beverages, Animal Feed, Cosmetics & Personal Care, Pharmaceuticals, Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Kelp Protein Market Analysis by Form and End Use Through 2035

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Edible Seaweed Market Analysis by Product Type, End Use Application, Extraction Method and Form Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.