The ASEAN Postbiotic Pet Food market is set to grow from an estimated USD 290.0 million in 2025 to USD 467.7 million by 2035, with a compound annual growth rate (CAGR) of 9.4% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 290.0 million |

| Projected ASEAN Value (2035F) | USD 467.7 million |

| Value-based CAGR (2025 to 2035) | 9.4% |

Southeast Asia's postbiotic pet food area is rapidly developing as an important subsector within the overall pet food segment, and this development is primarily driven by the growing awareness among consumers about the importance of pet health and wellness.

The fermentation of prebiotics produces postbiotics compounds which are bioactive substances and are becoming popular among pet owners interested in pets' digestion and general well-being. As more people in the ASEAN acquire pets, they desire to have access to quality, and thus, the demand for functional pet food products, which in some cases provide health benefits in addition to basic nutrition, is on the rise.

The continuing trend of anthropomorphism is reshaping the way consumers think, with pet owners actually treating their fur babies like family. This transformation is leading to the need for higher nutritional pet food standards which manufacturers have to meet, consequently prompting them to innovate and integrate postbiotics premix.

The inclusion of these substances that are prebiotic is a well-known way to add gut health benefits, raise immunity, and promote greater nutrient absorption which is why they are so in demand with health-oriented dog owners.

The introduction of e-commerce and the availability of online pet stores that sell postbiotic pet food products have made the consumer able to explore a greater variety of brands and choose the ones that they feel are the most effective with ingredient transparency being one of the biggest advantages.

All in all, the ASEAN postbiotic pet food market has the perfect platform to expand rapidly which is driven by the continuous and increasing availability of these functional pet food products that are beneficial for promoting health and well-being.

Explore FMI!

Book a free demo

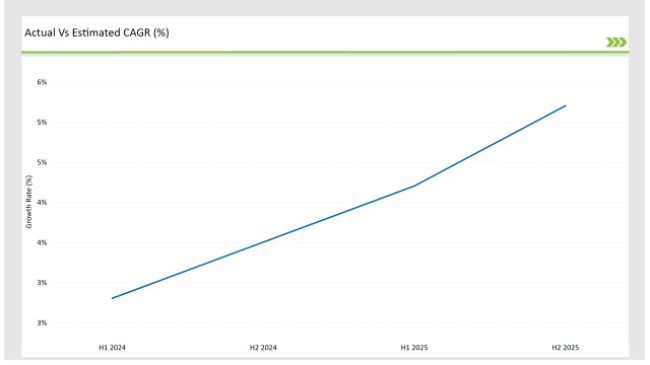

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Postbiotic Pet Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Postbiotic Pet Food market, the sector is predicted to grow at a CAGR of 3.2% during the first half of 2024, increasing to 4.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 5.4% in H1 but is expected to rise to 9.4% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | PetSmart launched a new line of postbiotic dog food formulated with natural ingredients in March 2024. |

| 2024 | Nestlé Purina introduced a range of organic pet treats enriched with postbiotics in April 2024. |

| 2024 | Hill's Pet Nutrition expanded its product line to include postbiotic cat food aimed at improving digestive health in May 2024. |

| 2024 | Blue Buffalo announced a partnership with a leading probiotic manufacturer to enhance its postbiotic formulations in June 2024. |

Growing Demand for Functional Pet Foods

Functional pet food products are in high demand in ASEAN because pet owners are looking for products that they can benefit from health-wise apart from just nutritional value. The trend has been expressed through the increase in postbiotic availability as pet’s probiotics, which support gut, immunity, and overall wellbeing among pets.

Owners of pets today are more informed about pets' gut conditions, resulting in their newly found interest in postbiotics content in products. These biologically active materials come from fermentation of probiotics and are arguably the trusted substances that normalize gut microbiota, therefore contributing to the good health of the host.

Rise of Natural and Organic Pet Food Products

In the ASEAN market, the inclination towards natural and organic pet food products is on the rise and due to pet owners who are more often looking for high-quality processing options for their pets. The transition is due to the growing realization that the artificial additives, preservatives, and low-quality ingredients in pet food bring health risks to the pets.

Natural and organic postbiotic pet food products stand out as especially being attractive to health-conscious consumers. These products not only have the advantages of postbiotics but also fit with the principles of sustainability and ethical sourcing that concerned pet owners want to endorse.

As a result, pet food manufacturers are taking action to meet these concerns by creating products that contain no artificial ingredients and are produced with the use of high-quality organic materials.

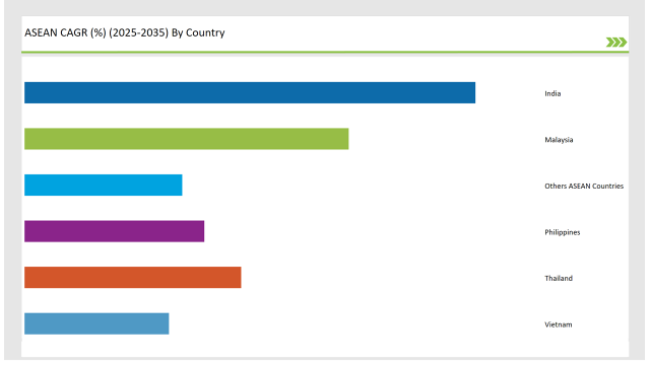

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Pet food packed with postbiotics is one of the fastest-growing categories in India, which is mainly due to the pet boom, Increase in disposable incomes, and going petcare positiveperatures. The trend of pet humanization is particularly strong in urban areas, where pet owners are increasingly treating their pets as family members and challenging high-quality, functional food products.

Increasing numbers of pet health issues such as obesity and digestive tract disorders respectively are grouped with pet owners looking for prevention initiatives like postbiotic pet diets that promote gut health as well as other health aspects.

Furthermore, the availability of such platforms as e-commerce, where customers buy products of their choice, is the main reason behind the increase in products of this kind, thereby allowing consumers to make choices based on the ingredients and efficiency of the products.

Backed by many factors, the post biotic pet food market in Thailand is showing high rates of expansion. The rise in the number of people owning pets, particularly in urban areas, has brought to the forefront the need for pet health and nutrition. Thai consumers have increasingly become choosier regarding the types of products their pets use, with a significant move towards premier and functional pet food options.

The substantial rise of e-commerce in Thailand has also been the main factor in the easy availability of post biotic pet food products. Online platforms are empowering pet owners with a wider assortment of choices, thus, it is more effortless to find products that focus on their pets' health needs. Correspondingly, the baby boomers and pet humanization trends are turning shopping into a more personal experience, and people tend to buy products that are organic and eco-friendly.

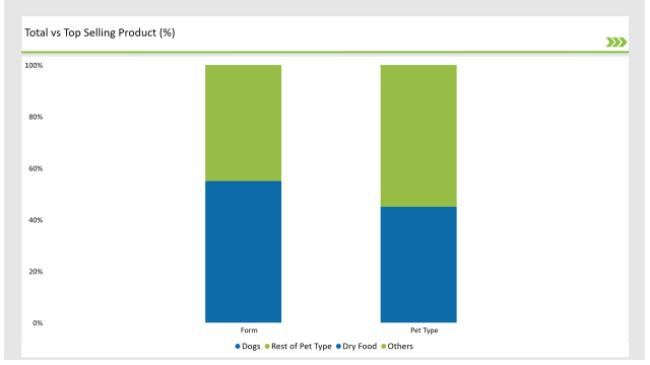

Dog food segment is projected to hold a significant market share

In the postbiotic pet food market, the dog food segment is anticipated to have a monumental market share of about 45% by 2025. This absolute rule is explained by the fact that the number of dog owners is on the rise and people are becoming more aware of the role nutrition plays in the health of their pets.

More and more, pet owners prefer products that not only provide their dogs with the necessary nutrients but also offer added health points such as better digestion and stronger immune systems.

The premiumization trend is most evident in the dog food segment, where consumers are ready to pay for high-quality products that are included with postbiotics. The items are formulated to sustain gut health, a function that is essential for the entire body to function well. As pet owners gain more knowledge of postbiotics benefits, the need for dog food incorporating these ingredients is projected to go up.

Dry food is anticipated to dominate the postbiotic pet food market

The postbiotic pet food market is expected to be mainly occupied by dry food, with an estimated 60.4% market share by 2025. The convenience of dry food that it is more shelf-stable and cost-effective compared to wet food varieties has made it widely accepted.

Dry food is a preferred choice of pet owners for the fact that it requires less space and time for feeding, and thus is a common option in many homes. The trend of adding postbiotics to formulations of dry food is rapidly gaining popularity among manufacturers who are responding to the needs of the market for health-focused products.

Dry food with added postbiotics provides various benefits like better digestion, improved nutrient uptake, and better gut health in pets. The actualization of the fact that gut microbiota are essential in the digestive process has been contributing to the increased demand for dry food that contains these health-promoting substances.

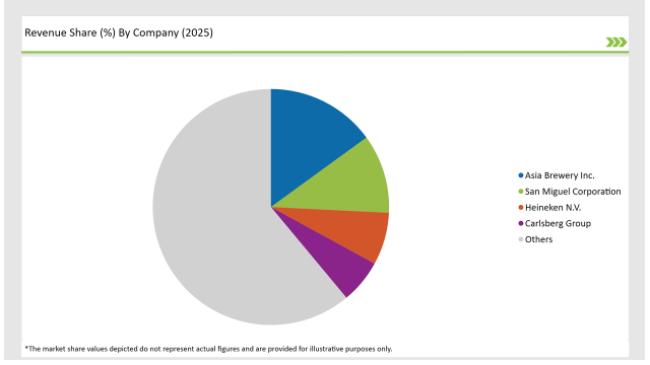

2025 Market Share of ASEAN Postbiotic Pet Food Manufacturers

Note: The above chart is indicative

As the sector continues to draw in numerous entry pointers, the postbiotic pet food market is getting significantly more competitive now. A good number of the pet food manufacturers that currently exist in the market have, to be effective in the midst of competitors, turned their product lines into multifunctional living materials that are partly based on kyoto postbiotics.

More specifically, the majority of the pet food makers, motivated by customer interest in healthful pet diets, are including postbiotic products in their offering. The following developments are, therefore, responsible for the boost in the number of projects, the companies that are financing inventiveness, and those that are employing the R&D in producing the products that have the postbiotics in the very first place.

The ASEAN Postbiotic Pet Food market is projected to grow at a CAGR of 9.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 467.7 million.

India are key Country with high consumption rates in the ASEAN Postbiotic Pet Food market.

This Segment further Categorise into Dogs, Cats, Other Pets

This Segment further Categorise into Dry Food, Wet Food, and Treats & Supplements

This Segment further Categorise Pet Specialty Stores, Online Retail, Veterinary Clinics, Supermarkets/Hypermarkets

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Kelp Protein Market Analysis by Form and End Use Through 2035

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Edible Seaweed Market Analysis by Product Type, End Use Application, Extraction Method and Form Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.