The ASEAN Plant Based Preservatives market is set to grow from an estimated USD 363.7 million in 2025 to USD 837.6 million by 2035, with a compound annual growth rate (CAGR) of 9.4% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 363.7 million |

| Projected ASEAN Value (2035F) | USD 837.6 million |

| Value-based CAGR (2025 to 2035) | 9.4% |

The food preservation sector within the ASEAN region is currently undergoing considerable changes with plant-based preservatives replacing the chemicals in preservatives and environmental and bio-based movements driving these changes. Typically, consumers are increasingly adopting clean-label products and therefore, plant-based preservatives become an obvious choice for them.

This change is mainly motivated by the improvement of healthy life and wellness, so that customers pay more attention to the products and its ingredients that throw many things into food.

The ASEAN market has experienced recently a significant boost of blue preservatives that derive from the natural sources of fruits, vegetables, and herbs. In addition to improving food shelf life, these preservatives both add nutritional value and enhance the flavor of food.

The region's abundant agricultural landscape is not only a source of raw materials but also provides a range of ingredients that are suitable for vegetarian food. In fact, it becomes an all-around market for the producers and traders of these preservatives.

On top of that, the sauna vegan and vegetarian movement as well as rigorous measures on food health and safety have had the effect of magnifying the wish for plant-based options. The consumers' greater focusing on the clarity of info on food contents and producers' contributions of proteins that are naturally placed on products having more effect describing what they should contain.

Based on manufacturers' expectations, the trend in the sector will go like this: plant-based preservatives in the ASEAN market will obtain the considerable growth in the upcoming years.

Explore FMI!

Book a free demo

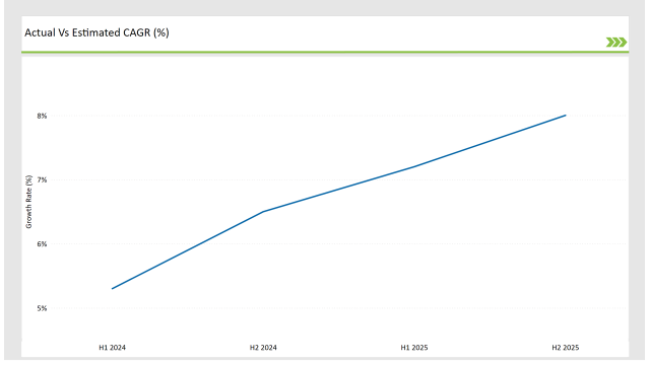

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Plant Based Preservatives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Plant Based Preservatives market, the sector is predicted to grow at a CAGR of 5.3% during the first half of 2024, increasing to 6.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 7.2% in H1 but is expected to rise to 8.0% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Naturex launched a new line of plant-based preservatives derived from indigenous herbs, including pandan and lemongrass, aimed at enhancing flavor and extending shelf life in Southeast Asian food products. |

| 2024 | DuPont introduced a novel hybrid preservation solution that combines rosemary extract with fermented ingredients, enhancing the antimicrobial properties while promoting gut health in ready-to-eat meals. |

| 2024 | BASF expanded its portfolio by developing a new range of plant-based preservatives that utilize essential oils from local plants, such as clove and cinnamon, to provide natural antimicrobial effects in baked goods. |

| 2024 | Kemin Industries developed a unique formulation that combines plant-based antioxidants with probiotics, targeting the growing demand for functional foods that offer both preservation and health benefits. |

Utilization of Indigenous Plant Species for Preservation

The most unusual development in the market of plant-derived food preservatives is the rising interest in the local plant species that are used in cooking and which are found to have preservative properties.

In the ASEAN region, countries like Thailand and Malaysia have the opportunity to take advantage of their rich biodiversity by adding local herbs and plants, with pandan leaves, lemongrass, and galangal being the most used, to the food preservation methods. These indigenous plants not only make good food preservation but also elevate the taste of food products, thus drawing the interest of both local and international consumers.

For instance, it has been scientifically proven that the extracts of pandan leaves themselves have the anti-microbial properties that can stop the growth of spoilage microorganisms in different foodstuffs. This trend is both the promotion of local resource utilization and the adoption of sustainable agricultural practices by urging farmers to grow these indigenous plants.

Development of Hybrid Preservation Solutions

A novel paradigm is the creation of hybrid preservation solutions that integrate plant-based preservatives with other organic naturally occurring preservation methods like fermentation and essential oils.That is a way to develop the efficiency of the preservation process while keeping the environmentally friendly label sought by the consumers.

For instance, some manufacturers are utilizing the concept of combination of plant extracts like rosemary and green tea with fermented ingredients leading to the development of a synergistic effect which both improves the storage time and adds functional health effects.

This trend is becoming well-established in the ASEAN market as food manufacturers constantly follow their aim of finding out innovative methods of product differentiation in this case.

For example, the company in Malaysia has conceived a series of sauces that local Thai seasonings and fermented ingredients, where the first is a plant-based preservative that is used to add flavor, are included, and thus, the end product becomes probiotic rich and non-perishable ended up being.

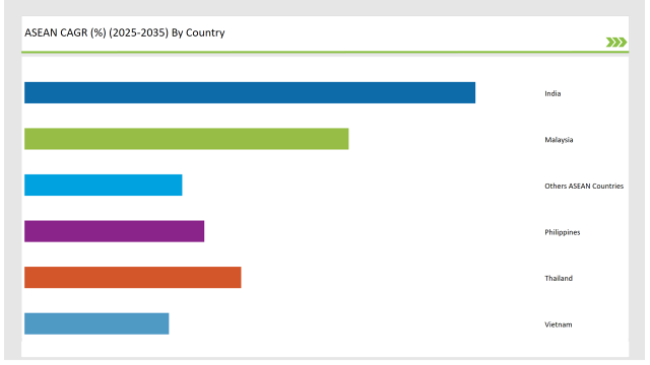

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

India's plant-based preservatives market is witnessing rapid growth and this is attributable to a number of factors. The major role is played by the rising consumer consciousness of health and wellness, which is the base of this movement.

Due to the fact that people are becoming increasingly aware of the substances used in their food, the need for natural and organic products is also increasing. This transition is encouraging food manufacturers to change the formula of their products according to the demand of the consumers adding plant-based preservatives that they prefer for clean-label products.

Increasing vegan and vegetarian section of the population in India is another factor that is driving the demand for plant-based solutions. As a considerable part of the population is vegetarian, there is of course a natural interest in plant-derived products, including preservatives. The Indian government's initiatives on organic farming and sustainable agriculture, which offer a strong supply chain for plant-based preservatives, also support this tendency.

The plant-based preservatives market in Thailand is flourishing, primarily as a result of health trends, eating habits, and the support of the government. The Thai society is quickly becoming more health-conscious and this is reflected in the rise of natural food products.

The consequent development of these products is making food producers switch to ethylene based preservatives less toxic than other preservatives and at the same time giving a nutritional value to the end product.

Thailand has one of the most fertile agricultural areas in the world and this is a significant factor for plant-based preservatives. Traditional Chili Paste, as the name, is traditionally made from two main ingredients: chili ("prik") and garlic ("krathiem").

These two ingredients are so important that the literal translation of this paste is "chili and garlic paste." There are several kinds of chili paste, but the most popular one is the sweet and sour kind (nam prik puang or nam prik wan). Variations of spicy levels exist, but mostly they are mild to mid spicy.

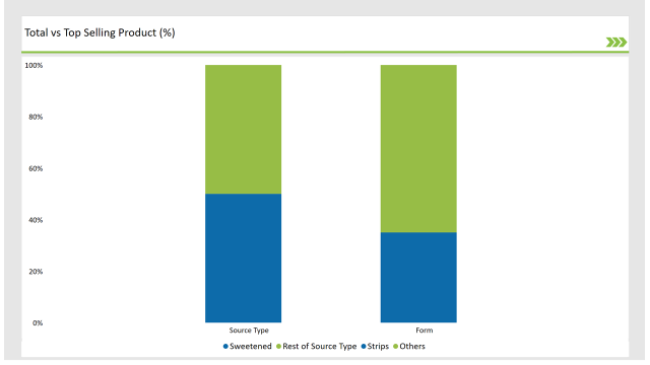

The sweetened segment Dominant of the plant-based preservatives market

The plant-based preservatives market is gaining especially the segment of sweetened preservatives, which is enhanced by the soaring preference of consumers for natural sweeteners and flavor enhancers. Health-conscious consumers are adding the use of artificial additives and preservatives to the list of things they want to get rid of, and the demand for such products is rising.

To achieve the desired quality attributes as well as the extension of the shelf life of sweetened products, manufacturers are applying plant-based preservatives, which are being derived from natural sources such as fruit extracts and herbal infusions.

Food industries are focusing on the usage of natural sweeteners like stevia and monk fruit while curtailing sugar content by adding plant-based preservatives to products. The most widespread indication for this trend can be seen in the snack and beverage industries, where consumers looking for options that exact with their health ambitions.

Trips segment of the plant-based preservatives market is a popular choice

The strips segment is consistently concentrating on innovating preservation methods specially designed for themselves. A prominent example is the employment of natural extracts derived from fruits and vegetables that not only serve as preservatives but also contribute to the flavor and texture of the strips.

For instance, extracts from apples and berries are being utilized for their natural sweetness and preservative qualities, allowing manufacturers to create healthy snack options without artificial additives.

The trending of snacking, especially among youth consumers, is a major factor in the demand for plant-based preserved strips. As consumers look for suitable fast foods that are in accordance with their health and wellness benefits, the strips segment is enlisted for the growth.

Corporations are making use of this trend by introducing flavored strips of various kinds that integrate plant-based preservatives, thus, accommodating a broad spectrum of flavor choices. As the market progress, the strips segment is estimated to be enhanced by technological advancements and the growing customer desire for superseded snack products.

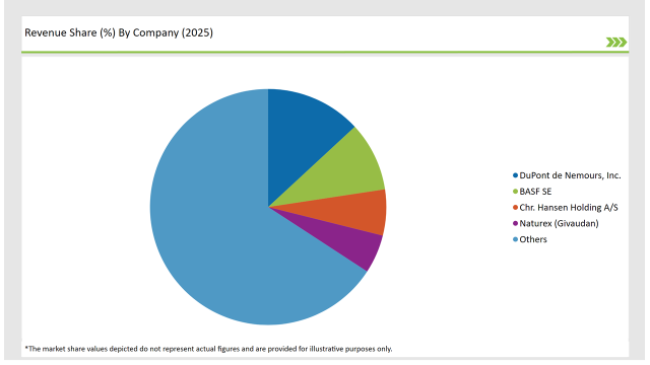

2025 Market Share of ASEAN Plant Based Preservatives Manufacturers

Note: The above chart is indicative

The plant-based preservatives market demonstrates the competitive contour as a large number of players are, in fact, the ones to contend for the market share. Innovation, product development, and alliances are the main areas through which the main market players work and invest to get the edge in this constantly changing market.

Numerous causes are involved in this fight among companies such as the higher rate of consumer interest in products that are made naturally and without labels, and the cultural shift towards eating more healthily, not to mention, the understanding people have grown to accept about the use of plant-based elements.

The ASEAN Plant Based Preservatives market is projected to grow at a CAGR of 9.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 837.6 million.

India are key Country with high consumption rates in the ASEAN Plant Based Preservatives market.

This Segment further Categorise into Herbs & Spices, Plant Extracts, Fruits & Vegetables, Essential Oils.

This Segment further Categorise into Liquid, Powder, and Others

Bakery & Confectionery, Dairy & Frozen Products, Snacks & Beverages, Meat & Poultry, Sauces & Dressings

Antimicrobial, Antioxidant, Anti-enzymatic, Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

Fish Waste Management Market Analysis by Source and End Use Industry Through 2035

Kelp Protein Market Analysis by Form and End Use Through 2035

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Fish Silage Market Analysis by Fish, Fish Type, Application and Form Through 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Edible Seaweed Market Analysis by Product Type, End Use Application, Extraction Method and Form Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.