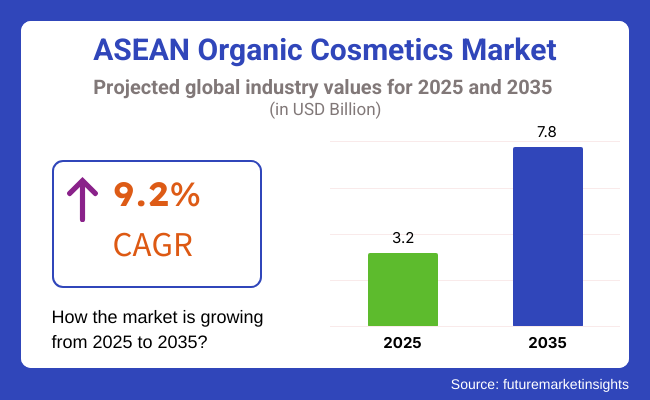

The ASEAN organic cosmetics market is expected to experience substantial growth from 2025 to 2035, driven by increasing consumer awareness of natural and chemical-free beauty products. The market is anticipated to grow from USD 3.2 billion in 2025 to USD 7.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 9.2% over the forecast period.

The growing demand for clean beauty, stringent regulations on harmful chemicals, and the rise in eco-conscious consumer behavior will fuel market expansion. Organic skincare, haircare, and makeup products will witness increased adoption as consumers shift toward sustainable and cruelty-free formulations. E-commerce channels, social media influence, and government initiatives supporting organic certifications will further accelerate market penetration across the ASEAN region.

The ASEAN organic cosmetics market will be shaped by strong demand in Thailand, Indonesia, and Malaysia, where beauty-conscious consumers increasingly prefer plant-based and non-toxic beauty solutions. Vietnam and the Philippines will also emerge as growing markets, supported by rising disposable incomes and expanding retail distribution networks.

Explore FMI!

Book a free demo

Thailand, Indonesia, and Malaysia will remain the dominant markets in ASEAN’s organic cosmetics industry. Increasing consumer awareness of skincare ingredients and a preference for herbal and plant-based formulations will drive demand. Local and international brands will invest in organic product lines, leveraging traditional herbal remedies and innovative clean beauty trends.

Thailand, a key beauty hub, will demand more organic sunscreens, serums, and herbal-based skincare. Indonesia’s booming beauty industry will witness a shift toward halal-certified organic cosmetics, aligning with consumer religious preferences and sustainability concerns. In Malaysia, regulatory policies promoting organic certifications will encourage the entry of both local and global organic cosmetic brands.

Vietnam and the Philippines will emerge as rapidly growing markets, fueled by increasing disposable incomes and consumer interest in chemical-free cosmetics. Organic makeup and skincare products, particularly those featuring coconut oil, aloe vera, and turmeric, will gain popularity due to local ingredient sourcing.

Vietnamese consumers, influenced by Korean and Japanese beauty trends, will demand organic alternatives to conventional beauty products. The rising influence of beauty influencers and online platforms in the Philippines will enhance organic beauty brand visibility. The rapid expansion of specialty organic stores and eco-conscious beauty retailers will strengthen the market in these regions.

High Production Costs And Limited Raw Material Availability

Despite strong market growth, the ASEAN organic cosmetics industry will face challenges related to the high cost of organic raw materials. The certification process for organic ingredients and sustainable packaging solutions will increase production expenses, making organic cosmetics relatively expensive compared to conventional products.

Additionally, the limited availability of certified organic raw materials within ASEAN will lead to reliance on imports, increasing production costs. Brands must invest in local organic farming initiatives and strategic partnerships to reduce dependency on imported ingredients.

Growth Of E-Commerce And Digital Influence

The rapid rise of e-commerce and digital beauty trends will provide significant opportunities for organic cosmetics brands. Online beauty marketplaces, direct-to-consumer (DTC) platforms, and social media-driven marketing will allow brands to connect with consumers directly.

Influencer partnerships, virtual skincare consultations, and AI-driven beauty recommendation platforms will enhance customer engagement. With ASEAN’s growing internet penetration and adoption of mobile commerce, organic beauty brands will capitalize on digital-first strategies to boost sales and brand awareness.

The ASEAN organic cosmetics market is poised for strong expansion, driven by increasing consumer demand for sustainable, chemical-free beauty solutions, favorable regulatory frameworks, and digital transformation in retail and marketing strategies.

| Country | Indonesia |

|---|---|

| Population (millions) | 278.6 |

| Estimated Per Capita Spending (USD) | 2.35 |

| Estimated Total Market Size (USD millions) | 654.71 |

| Country | Thailand |

|---|---|

| Population (millions) | 71.8 |

| Estimated Per Capita Spending (USD) | 2.35 |

| Estimated Total Market Size (USD millions) | 168.73 |

| Country | Philippines |

|---|---|

| Population (millions) | 117.3 |

| Estimated Per Capita Spending (USD) | 2.35 |

| Estimated Total Market Size (USD millions) | 275.66 |

| Country | Vietnam |

|---|---|

| Population (millions) | 99.5 |

| Estimated Per Capita Spending (USD) | 2.35 |

| Estimated Total Market Size (USD millions) | 233.82 |

| Country | Malaysia |

|---|---|

| Population (millions) | 34.3 |

| Estimated Per Capita Spending (USD) | 2.35 |

| Estimated Total Market Size (USD millions) | 80.61 |

Indonesia’s USD 654.71 Million organic cosmetics market is driven by a large, young population and rising disposable incomes. Increasing awareness of natural beauty products and sustainability is shaping consumer preferences. The influence of local and international brands and expanding e-commerce platforms is accelerating demand for organic skincare and personal care products.

Thailand’s USD 168.73 Million market benefits from a strong beauty and wellness culture, with demand for herbal and organic ingredients steadily increasing. The presence of luxury spas, tourism, and a premium skincare industry makes organic cosmetics a growing segment. Government regulations promoting natural beauty products further support sustainable cosmetic industry growth.

The Philippines' USD 275.66 Million organic cosmetics market is influenced by rising beauty consciousness and social media trends. Filipino consumers prefer natural, eco-friendly products, and international brands are entering the market through e-commerce and retail expansion. Additionally, local brands focusing on herbal and cruelty-free formulations are gaining popularity, driving market growth.

Vietnam’s USD 233.82 Million market is experiencing rapid growth due to increasing urbanization, young consumers, and a preference for herbal ingredients. Rising disposable income and demand for premium beauty products fuel interest in organic cosmetics. Korean and Japanese beauty influences, alongside local organic startups, contribute to a competitive market landscape.

High beauty standards, growing wellness trends, and demand for halal-certified organic products shape Malaysia’s USD 80.61 Million organic cosmetics market. Consumers prefer high-quality, chemical-free formulations, and premium international brands dominate sales. A well-developed retail and online presence and government initiatives promoting natural beauty drive steady market expansion.

The ASEAN organic cosmetics market is witnessing strong growth, driven by consumer preference for natural ingredients, ethical sourcing, and online retail expansion. A survey of 250 respondents across Thailand, Indonesia, Vietnam, Malaysia, Singapore, and the Philippines highlights key purchasing behaviors.

Organic and natural ingredients remain a top priority, with 65% of respondents preferring chemical-free and plant-based formulations. Brand loyalty varies, as 45% of consumers in Thailand and Vietnam actively seek cruelty-free brands, while 50% of Indonesian and 40% of Malaysian respondents prioritize halal-certified organic cosmetics. In Singapore and the Philippines, 50% of consumers favor multi-functional organic products, such as tinted moisturizers and all-in-one skincare solutions.

Consumer spending differs across markets. 55% of Singaporean and Malaysian respondents are willing to spend USD 30+ per product, while only 30% in Vietnam and Indonesia prefer higher-end options. Across ASEAN, 40% of respondents expect organic cosmetics to be priced within 10-20% of conventional beauty products, signaling a demand for affordable organic alternatives.

Online shopping is the dominant purchasing channel, with 60% of respondents in Thailand, Vietnam, and Indonesia preferring Shopee, Lazada, and brand websites. In contrast, 45% of Malaysian and Singaporean consumers still prefer brick-and-mortar retail, valuing the ability to test products before purchase. 35% of ASEAN consumers trust organic beauty recommendations from social media influencers, showing the impact of digital marketing.

Sustainability is increasingly important, with 50% of Malaysian and Singaporean respondents willing to pay more for eco-friendly packaging and refillable cosmetics. 40% of ASEAN consumers prefer local organic brands that support sustainable farming and lower carbon footprints. Animal cruelty concerns are strongest in Thailand and Vietnam, where 45% of respondents prioritize cruelty-free certification when selecting products.

Premium organic cosmetics (USD 30+) have strong demand in Singapore and Malaysia, while affordable options (USD 10-USD 20) dominate in Vietnam, Indonesia, and the Philippines. E-commerce is accelerating, requiring brands to enhance digital marketing strategies.

Local organic brands have strong appeal, and global brands must highlight ethical sourcing and sustainability to compete. The ASEAN organic cosmetics market is growing rapidly, and brands focusing on affordable, sustainable, and digitally accessible products will gain a competitive edge.

| Market Shift | 2020 to 2024 |

|---|---|

| Ingredient Innovation | Brands prioritized plant-based and organic ingredients such as turmeric, moringa, and coconut oil to align with traditional Southeast Asian herbal remedies. They incorporated probiotic and adaptogenic ingredients to support skin health. |

| Sustainability & Packaging | Companies transitioned to glass, aluminum, and biodegradable packaging, reducing single-use plastics. They introduced refill stations and FSC-certified materials. |

| Technological Advancements | ASEAN brands began integrating AR try-ons, AI-driven skin assessments, and digital consultations. They adopted microencapsulation to enhance product absorption. |

| Global Expansion & Market Penetration | ASEAN organic cosmetics brands expanded into China, Japan, and Australia, emphasizing their heritage ingredients. They leveraged e-commerce platforms like Shopee and Lazada to drive growth. |

| Customization & Personalization | Brands introduced bespoke skincare sets catering to different skin concerns. They used online quizzes and AI-based recommendations to enhance customer engagement. |

| Influencer & Social Media Marketing | Brands collaborated with beauty influencers and regional celebrities to enhance credibility. TikTok and Instagram Reels drove viral marketing. |

| Product Trends & Consumer Behavior | The demand for clean beauty and minimalist skincare rose, with consumers favoring multi-purpose organic products. Herbal-infused beauty and Ayurveda-inspired skincare gained momentum. |

| Market Shift | 2025 to 2035 |

|---|---|

| Ingredient Innovation | Companies leverage AI-driven ingredient customization, enabling consumers to personalize skincare based on their microbiome and environmental exposure. Biotech innovations such as lab-grown botanicals and algae-derived actives gain traction. |

| Sustainability & Packaging | Brands fully embrace circular economy models with compostable packaging and refillable solid formulations. Blockchain technology ensures end-to-end ingredient traceability. |

| Technological Advancements | Companies integrate IoT-enabled skincare devices providing real-time diagnostics and adaptive formulations. Nano-encapsulation improves ingredient stability and penetration. |

| Global Expansion & Market Penetration | Companies establish localized production hubs in key markets, reducing carbon footprints. AI-driven localization customizes product offerings for different skin tones and climates. |

| Customization & Personalization | Hyper-personalized skincare becomes mainstream with real-time skin condition tracking. DIY skincare kits with freshly activated organic ingredients gain popularity. |

| Influencer & Social Media Marketing | Companies implement AI-generated virtual influencers and metaverse beauty consultations. NFT-linked product exclusives enhance digital engagement and brand loyalty. |

| Product Trends & Consumer Behavior | Biohacking-inspired beauty trends emerge, with consumers embracing DNA-based skincare diagnostics. Hybrid skincare cosmetics such as tinted serums and probiotic foundations become mainstream. |

Singapore’s organic cosmetics market is witnessing steady growth, driven by rising consumer preference for natural, chemical-free beauty products. With a well-developed retail infrastructure and strong e-commerce penetration, organic cosmetic brands have found a solid foothold in the country.

Consumers in Singapore prioritize high-quality, dermatologically tested skincare solutions that align with sustainability and ethical beauty trends. Major retailers such as Sephora, Watsons, and Guardian offer an extensive range of organic beauty products, while online platforms like Lazada and Shopee further enhance accessibility.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Singapore | 5.7% |

Malaysia’s organic cosmetics market is expanding as consumers become more conscious of ingredient transparency and product safety. The demand for halal-certified organic beauty products has significantly risen, catering to the country’s Muslim-majority population. E-commerce giants such as Shopee Malaysia and Lazada, alongside physical stores like sasa and Guardian, dominate the distribution landscape, ensuring organic cosmetics are accessible nationwide.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Malaysia | 6.5% |

Thailand is emerging as a key player in the ASEAN organic cosmetics market, fueled by a strong wellness and beauty culture. Thai consumers favor herbal, plant-based formulations that align with traditional skincare practices. Popular retail outlets like Eveandboy and Boots and e-commerce platforms such as Shopee and Lazada provide widespread access to organic beauty products.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Thailand | 7.1% |

Indonesia’s organic cosmetics market is growing rapidly due to increasing consumer awareness of sustainable and ethical beauty trends. With a young, beauty-conscious demographic and a strong digital landscape, the country has become a key market for organic beauty brands.

The government’s push towards eco-friendly policies and local ingredient sourcing further supports industry growth. Leading retailers like Sociolla and Watsons, along with e-commerce platforms such as Tokopedia and Shopee, dominate sales channels.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Indonesia | 8.0% |

Vietnam’s organic cosmetics market is gaining traction, fueled by a growing middle class, increased disposable income, and rising beauty consciousness. Vietnamese consumers favor skincare solutions that protect against pollution and sun damage, making organic, antioxidant-rich cosmetics highly popular. Both local brands and international organic beauty companies are expanding their presence in the Vietnamese market through retail stores like Guardian and online marketplaces such as Tiki and Shopee.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Vietnam | 7.6% |

The skin care segment dominates the ASEAN organic cosmetics market as consumers increasingly prioritize natural and chemical-free beauty solutions. Rising awareness of synthetic chemicals' potential harm has accelerated the demand for organic moisturizers, serums, and sunscreens. Consumers in urban centers across Thailand, Indonesia, and Malaysia seek products with hydration, anti-aging, and brightening benefits, driving the popularity of plant-based and cruelty-free skincare.

Organic beauty brands innovate by incorporating botanical extracts like aloe vera, turmeric, and green tea, catering to the growing preference for clean beauty. Moisturizers and serums lead the segment as consumers opt for fast-absorbing, lightweight formulations that support skin hydration and barrier protection. Sunscreens infused with antioxidants and SPF protection also witness strong demand as ASEAN consumers prioritize sun care.

Leading brands such as Sensatia Botanicals, The Body Shop, and Human Nature continue to expand their organic skincare lines with dermatologically tested, vegan, and eco-friendly formulations. The increasing interest in sustainability further encourages brands to develop zero-waste packaging and ethical sourcing initiatives.

The hair care segment in the ASEAN organic cosmetics market is expanding as consumers turn to chemical-free and plant-based hair solutions. Concerns over scalp health, hair thinning, and environmental damage have driven demand for organic shampoos, conditioners, and hair oils made from coconut oil, argan oil, and hibiscus extracts.

Ayurvedic and herbal formulations are particularly popular in countries like Indonesia and Malaysia, where traditional remedies influence beauty routines. Consumers seek sulfate-free and paraben-free hair care products that strengthen hair while reducing scalp irritation. Dry shampoos and leave-in treatments enriched with botanical nutrients also gain traction, especially among urban professionals seeking convenient hair care solutions.

Brands such as Love Beauty and Planet, Avalon Organics, and Naturals by Watsons continue introducing cruelty-free and vegan hair care lines, reinforcing the trend toward holistic hair wellness.

The organic makeup segment is experiencing steady growth as ASEAN consumers shift towards toxin-free and skin-friendly cosmetics. Consumers increasingly prefer makeup infused with skincare benefits, such as foundations with botanical extracts, lipsticks with shea butter, and mineral-based blushes.

Demand for multi-functional, lightweight formulations is particularly strong, with organic BB creams, tinted moisturizers, and natural lip tints gaining popularity. In markets like Thailand and Vietnam, the demand for organic color cosmetics is rising among younger consumers who prioritize ethical and eco-conscious beauty choices.

Key players, including Ilia Beauty, Kjaer Weis, and Alima Pure, are expanding their regional presence, offering refillable and biodegradable packaging to align with sustainability Trends.

The organic fragrance segment is gaining momentum as consumers move from synthetic perfumes to plant-based, alcohol-free, and essential oil-infused alternatives. Botanical fragrances derived from jasmine, lavender, and sandalwood resonate with ASEAN consumers looking for natural, skin-safe scents.

Organic roll-on and solid perfumes are becoming increasingly popular due to their long-lasting effects and travel-friendly packaging. Additionally, consumers seek products free from phthalates and artificial stabilizers, driving innovation in clean fragrance formulations.

Brands such as Lush, Aesop, and Grown Alchemist are introducing organic perfume oils and aromatherapy-based scents to meet the demand for eco-friendly, non-toxic fragrances.

E-commerce has become the fastest-growing distribution channel for organic cosmetics in the ASEAN market, with consumers preferring the convenience, variety, and accessibility of online platforms. Marketplaces such as Shopee, Lazada, and Sephora Online enable consumers to access various organic beauty brands at competitive prices.

Direct-to-consumer (DTC) platforms are gaining traction as brands strengthen their digital presence through personalized skincare serum, AI-powered product recommendations, and subscription-based organic beauty boxes. Social media campaigns, influencer partnerships, and live-stream shopping events further boost online sales, making e-commerce the primary driver of market expansion.

Subscription-based models offering curated organic skincare and beauty kits are also rising in popularity, enhancing consumer engagement and loyalty. Brands that leverage digital strategies and transparent marketing are well-positioned to capture ASEAN’s growing demand for organic cosmetics.

The ASEAN organic cosmetics market is experiencing significant growth, driven by increasing consumer awareness of natural and sustainable beauty products. Brands in this region emphasize eco-friendly formulations, ethical sourcing, and transparency to differentiate themselves from conventional cosmetics.

Companies are investing in sustainable packaging, clean beauty initiatives, and digital marketing strategies to attract environmentally conscious consumers. The rise of social media influencers and a growing focus on health and wellness further propel market expansion. Leading players strengthen their competitive advantage through diverse product lines, innovative formulations, and regional expansion.

Market Share Analysis By Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Innisfree | 12-16% |

| The Body Shop | 10-14% |

| Burt's Bees | 8-12% |

| Human Nature | 6-10% |

| Hada Labo | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Innisfree | Focuses on natural ingredients sourced from Jeju Island. Offers eco-friendly products and promotes sustainability through recycling programs. |

| The Body Shop | Emphasizes ethically sourced ingredients and cruelty-free products. Engages in community trade programs and environmental activism. |

| Burt's Bees | Specializes in natural personal care products with a focus on sustainability. Utilizes recyclable packaging and supports bee conservation efforts. |

| Human Nature | Offers affordable organic personal care products using locally sourced ingredients. Committed to fair trade practices and community development in the Philippines. |

| Hada Labo | Provides simple and effective skincare products with a focus on hydration. Formulates products free from unnecessary additives, appealing to health-conscious consumers. |

Strategic Outlook Of Key Companies

Innisfree (12-16%)

Innisfree leads the ASEAN organic cosmetics market with its natural ingredient-focused products. The brand invests in sustainable sourcing and eco-friendly packaging. Innisfree expands its regional presence through stand-alone stores and e-commerce platforms. The company engages consumers with loyalty programs and educational campaigns on environmental conservation.

The Body Shop (10-14%)

The Body Shop maintains a strong market position with its commitment to ethical beauty. The company collaborates with local communities for ingredient sourcing and supports various social and environmental causes. The Body Shop enhances its product range with vegan options and limited-edition collections to attract diverse consumer segments.

Burt's Bees (8-12%)

Burt's Bees gains market share by focusing on natural formulations and sustainability. The brand invests in research to develop innovative products that meet consumer demand for clean beauty. Burt's Bees strengthens its distribution network in ASEAN countries through partnerships with retailers and online platforms.

Human Nature (6-10%)

Human Nature offers affordable organic products tailored to the ASEAN market. The company emphasizes community development and fair trade, resonating with socially conscious consumers. Human Nature expands its reach through direct selling, retail outlets, and online channels.

Hada Labo (5-9%)

Hada Labo appeals to consumers seeking minimalist and effective skincare solutions. The brand focuses on hydration and formulation products without unnecessary additives. Hada Labo increases its market presence through collaborations with influencers and educational content on skincare routines.

Other Key Players (45-55% Combined)

Several emerging and niche organic cosmetics brands contribute to the market's growth. These companies focus on clean beauty, sustainability, and innovative formulations. Notable brands include:

The ASEAN Organic Cosmetics industry is projected to witness a CAGR of 9.2% between 2025 and 2035.

The ASEAN Organic Cosmetics industry stood at USD 2,750 million in 2024.

The ASEAN Organic Cosmetics industry is anticipated to reach USD 7.8 billion by 2035 end.

Indonesia is set to record the highest CAGR of 10.5% in the assessment period.

The key players operating in the ASEAN Organic Cosmetics industry include L’Oréal, Estée Lauder, Weleda, The Body Shop, Inika Organic, and others.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.