The ASEAN Oral Clinical Nutrition Supplement market is set to grow from an estimated USD 252.6 million in 2025 to USD 549.6 million by 2035, with a compound annual growth rate (CAGR) of 8.1% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 252.6 million |

| Projected ASEAN Value (2035F) | USD 549.6 million |

| Value-based CAGR (2025 to 2035) | 8.1% |

The ASEAN Oral Clinical Nutrition Supplement Market is currently touted as one of the fast-growing markets worldwide, owing to the rapidly rising chronic diseases, with the added factor of an aged population, and finally, a growing awareness of nutrition as a component in healthcare.

Oral clinical nutrition supplements (OCNS) are novelties specifically crafted to feed the body with the necessary elements when the person cannot obtain through ordinary food. Such nutrition aids have become an integral part in dealing with such troubles as malnutrition, kidney disorders, liver diseases, and nutritional deficiencies caused by cancer.

The market, on the one hand, is marked by product lines that bear various brands, including standard and specialized formulas that have been developed for individual health conditions.

The need for these nutritional products is primarily driven by the increasing number of hospitals and the expansion of the home healthcare sector in the region. Furthermore, the transition to preventive medicine and the availability of personalized nutrition have also become the two major factors for the market's growth.

Explore FMI!

Book a free demo

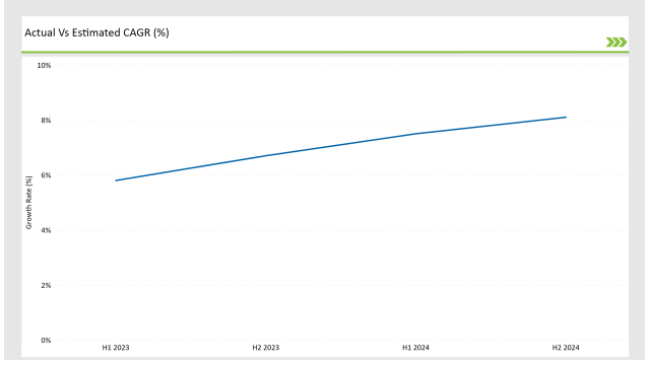

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the ASEAN Oral Clinical Nutrition Supplement market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Oral Clinical Nutrition Supplement market, the sector is predicted to grow at a CAGR of 5.8% during the first half of 2024, with an increase to 6.7% in the second half of the same year. In 2025, the growth rate is expected to decrease slightly to 7.5% in H1 but is expected to rise to 8.1% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2023 | Nestlé Health Science has brought in a supplementary range of oral clinical nutrition product specifically designed for use by patients suffering from renal disorders in Malaysia. The product range includes options that both feature reduced protein levels as well as enhanced flavor to make the food more palatable and to keep patient compliance at a higher level. |

| March 2023 | Abbott disclosed a new specialized formula for oncology patients in Thailand. The product contains extra vitamins and minerals to help with immune function and overall health during chemotherapy, therefore, meeting the special nutritional requirements of cancer patients. |

| July 2023 | Danone Nutricia introduced a brand new product line in India - a semi-solid oral clinical nutrition supplement for elderly people, which is specifically focused on the benefits of easy digestion and increased phosphorus absorption. |

| September 2023 | Baxter International has promoted the launch of a new liquid oral nutrition supplement in the Philippines, which is strictly designed for diabetes patients. This nutritional product is characterized by a low glycemic index, which aids in blood sugar management and provides essential nutrients at the same time. |

Rising Prevalence of Chronic Diseases

The factor that significantly governs the progress of the oral clinical nutrition supplement market is the increasing occurrence of chronic diseases such as diabetes, cancer, and kidney disorders.

The aging population and the increasing incidence of health issues caused by unhealthful lifestyle choices have necessitated the rise of specialized nutritional support. Oral clinical nutrition supplements play a crucial role in the management of disease-related malnutrition (DRM), a condition that a large proportion of chronic disease patients suffer from.

The involvement of healthcare professionals with nutrition in the fight against diseases has become more pronounced, hence, a broad focus on nutritional measures as components of treatment is becoming increasingly abundant with time.

This pattern is especially noticeable in the area of oncology, where patients typically undergo weight loss and deficits of nutrition due to the effects of cancer and its treatment. Therefore, the need for specialized formulas has been on an upward trend that particularly addresses the unique nutritional needs of these patients.

Increasing Awareness of Preventive Healthcare

The influence of the oral clinical nutrition supplement market by the increasing consciousness of preventive health care is observed genuinely. The trend of consumers practicing healthier lifestyles and turning to the means of the avoidance of diseases with the help of nutrition is more and more actual. This shift of perspective results in oral clinical nutrition supplements being the first that come to mind when a person seeks something to enhance his/her general health and life quality.

Providers of health care are not lagging behind the trend of learning about the importance of nutrition in the promotion of health. Doctors and nutritionists alike are recommending the addition of clinical nutrition supplements to the everyday diet of the patients. This regard is especially pertinent for those who are in the group of risk for chronic illness since these products can fill in the nutritional void and at the end results in healthier lives.

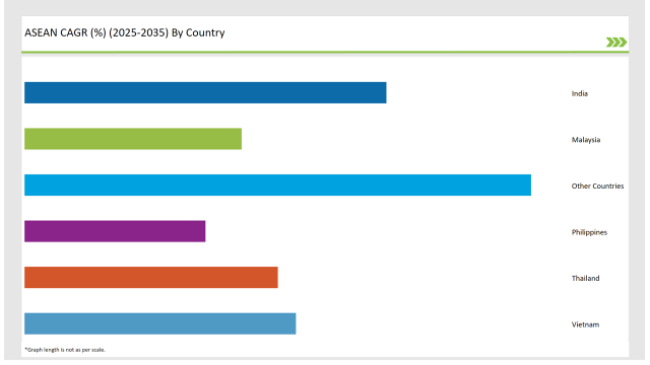

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The oral clinical nutrition supplement industry in India is experiencing impressive growth, primarily owing to the surging incidence of chronic illnesses and an increment in the elderly population.

The country is grappling with a substantial malnutrition problem, particularly among the older people and individuals with chronic health issues. In light of this, healthcare providers are coming to the realization that nutrition significantly aids in the management of these conditions, hence, there is an increase in the consumption of oral clinical nutrition supplements.

The segment of the oral clinical nutrition supplement market in Thailand is witnessing rapid growth, owing this predominately to the trend towards preventive healthcare and the treatment of chronic diseases.

The Thai citizens are becoming more aware of health issues and, consequently, the interest in dietary supplements that are beneficial for the general health has surged. the market shows a new dimension due to the product innovativeness that addresses the specific dietary requirements of the patients and consequently sustains the growth process.

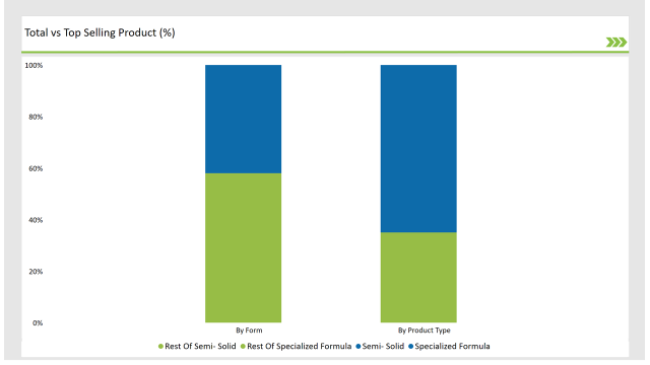

Specialized Formula for off-label use are the major players in the Oral Clinical Nutrition Supplement.

Pre-made formulas for off-label use are the major players in the Oral Clinical Nutrition Supplement industry and make up around 65% of the total market volume. These items are specially developed to cater to the individual dietary requirements of people suffering from a variety of ailments like the ailments of the digestive system, the urinary system, and the side effects of cancer treatment.

The rise in the number of people living with long-term conditions as well as the increasing acknowledgment of the role of individualized dietary intake in the management of these problems is the main cause of the growth in the specialized formulas market.

More and more medical practitioners are recommending the use of specially developed oral nutrition supplements for the purpose of supporting the patients receiving treatments for specific diseases. For example, cancer nutrition supplements are designed to increase the amount of calories and protein in the body which can help patients keep their weight and strength during the cancer therapy.

Semi-solid oral clinical nutrition supplements are gaining popularity in the market

The market trend shows that semi-solid oral clinical nutrition supplements are becoming a crucial category of product by controlling 42% approximately of the total share. These products are specifically used by individuals, who may have trouble swallowing or digesting traditional liquid or powder formulations, as a handy and tasty means.

The semi-solid format presents a unique texture that may prove to be more attractive for some patients, especially the elderly and individuals with dysphagia. The major reason that individuals choose semi-solid supplements is that they have a higher rate of swallowing problems. In particular, the elderly often face these specific issues.

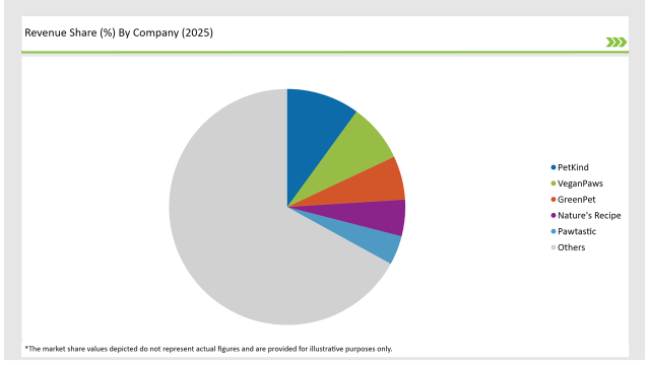

2025 Market Share of ASEAN Oral Clinical Nutrition Supplement Manufacturers

Note: The above chart is indicative

The prominent participants of the Oral Clinical Nutrition Supplement market are Alltech, Cargill, Nutreco, De Heus, Lallemand Animal Nutrition, etc. These companies take the advantage of their animal nutrition knowledge to create premium CMRs for the particular demand of the calves. They are also diversifying their products to include both medicated and non-medicated options as well as natural ingredients and probiotics formulations.

The ASEAN Oral Clinical Nutrition Supplement market is projected to grow at a CAGR of 8.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 549.6 million.

India are key Country with high consumption rates in the ASEAN Oral Clinical Nutrition Supplement market.

Leading manufacturers include Alltech, Cargill, De Heus, Nutreco are the key players in the ASEAN market.

As per Product Type, the industry has been categorized into Standard Formula, Specialized Formula

As per Distribution Channel, the industry has been categorized into Disease-Related Malnutrition (DRM), Renal Disorders, Hepatic Disorders (10%), Oncology Nutrition, and Diabetes Others

As per Form, the industry has been Liquid, Semi-solid, and Powder

As per Sales Chanel, the industry has been into Prescription-based and Over-the-Counter

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

A detailed analysis of the Australian Vitamin Premix industry and growth outlook covering vitamin type, form, and end user segment

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.