The ASEAN Mezcal market is set to grow from an estimated USD 15.5 million in 2025 to USD 44.4 million by 2035, with a compound annual growth rate (CAGR) of 11.1% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 15.5 million |

| Projected ASEAN Value (2035F) | USD 44.4 million |

| Value-based CAGR (2025 to 2035) | 11.1% |

ASEAN mezcal represents a rising market portion within alcohol beverages because consumers are developing interest in traditional premium spirits such as mezcal. The Mexican beverage Mezcal continues to expand its reach in Southeast Asia because of its individual taste alongside its traditional cultural heritage. Premium and authentic spirits gain increased popularity among consumers who seek alternative options so mezcal emerges as their distinctive choice.

The combination of social media trends and the new dining experience culture drives the success of mezcal as a beverage. Modern-day consumers look for one-of-a-kind drinking experiences which cause mezcal tastings and cocktail events to spread throughout ASEAN metropolitan regions. The market outlook indicates a substantial expansion of mezcal sales while offering local producers along with international brands an opportunity to attract refined consumers.

Explore FMI!

Book a free demo

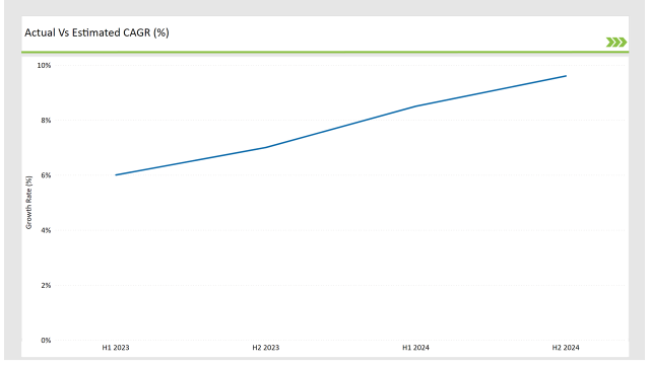

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Mezcal market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Mezcal market, the sector is predicted to grow at a CAGR of 6.0% during the first half of 2024, increasing to 7.0% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.5% in H1 but is expected to rise to 9.6% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Mezcal El Silencio launched a new line of organic mezcal, emphasizing sustainable farming practices. |

| 2024 | Del Maguey introduced a limited-edition mezcal sourced from a single village, highlighting traditional methods. |

| 2024 | Montelobos expanded distribution in Southeast Asia, targeting urban centers with a focus on cocktail culture. |

| 2024 | Ilegal Mezcal partnered with local bars to create signature mezcal cocktails, enhancing brand visibility. |

Rise of Craft and Artisanal Spirits

Artisanal and craft production methods within the mezcal market are driving a major market transformation. Modern consumers wish to understand product roots as they seek out traditional production combined with premium ingredients to create their beverages. The trade of handmade mezcal relies on sustainable steps because producers use traditional distillation methods and draw their agave supply from nearby farms.

Consumers seek products that match their values because they connect with the commitment to both quality and sustainability by producers. The craft mezcal market continues to grow through rising sales alongside the addition of new brands and enhanced product lines from established producers.

Growing Popularity of Mezcal Cocktails

Engaging cocktail mixologists find scrubbed party ingredients accessible due to mezcal's intricate and smoked notes. The mezcal beverage trend inspires mixology experts to both redesign traditional cocktails and build signature drinks that feature mezcal's characteristic taste profile. The switch in consumer behavior draws young drinkers interested in tasting fresh combinations and diverse tastes.

Social media has strongly contributed to advancing mezcal cocktails since its emergence. People discover mezcal cocktails through Instagram and similar digital platforms because these network channels showcase captivating visual presentations of drink creations that create higher demand for mezcal ingredients. The demand for mezcal will continue growing because bars and restaurants are starting to include mezcal cocktails on their menu selections thus establishing mezcal as a prominent alcoholic beverage.

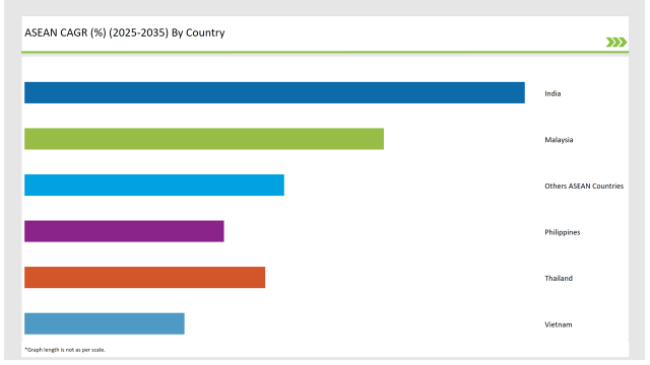

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Urban consumers leading the charge in India push the mezcal market forward because of their preference for upper-class alcoholic drinks. As mezcal becomes more prominent in cocktail bars many younger customers join these establishments.

The popularity of social media enables consumers to share their distinctive drinking flavors which fuels the market demand for mezcal. New-generation consumers follow their insistence for one-of-a-kind original experiences thus many mezcal tastings alongside events have found wider acceptance. Mezcal market experts anticipate substantial growth based on mounting mezcals visibility in the future.

The Thai mezcal market expands thanks to growing consumer interest in homemade distilled beverages alongside high-quality drinking choices. Precursor changes in the country's dining and nightlife activities have led consumers to become receptive toward trying mezcal as well as other distinctive alcoholic beverages. Expatriates together with international trends facilitate the growing consumer interest in mezcal.

Through its support for tourism and culinary celebrations the Thai government has opened pathways for mezcal tasting events to take place. Research indicates the market will continue to grow as mezcal gains wider consumer awareness regarding its origins together with production techniques. Asian ideals of cultural inquiry meet the rising interest in cocktail blending making Thailand a favorable environment for mezcal sales expansion.

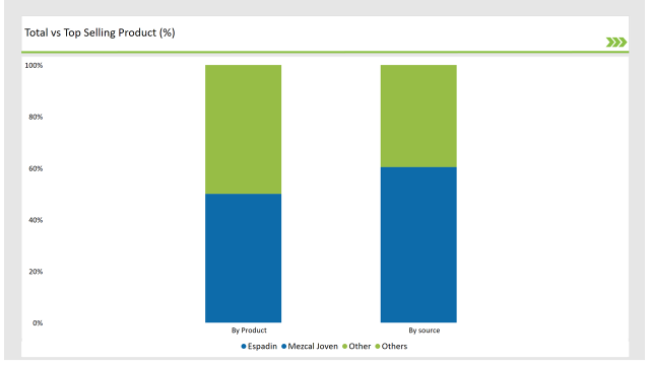

Mezcal Joven, or young mezcal, is the most popular segment in the mezcal market

Young mezcal positions as the lead category within the mezcal market securing its dominant position with high market shares. Once distilled mezcal immediately receives bottling for its unaged state which maintains the pure flavors of agave. The untainted freshness of mezcal joven works well in many mixed beverages since it can adapt easily to cocktail recipes.

Utiluspacing consumers who search for extraordinary beverage flavors continue to adopt mezcal joven while bars and restaurants observe its rising acceptance. Bartenders use different cocktail recipes to experiment with the distinct presentation of mezcal in order to show its particular qualities. According to predictions the rising popularity of craft cocktails will boost mezcal joven consumption and solidify its status as a central mezcal category.

Espadin is the most widely used agave species for mezcal production

The use of Espadin agave species represents the largest production segment within the mezcal market which remains dominant. Spadina stands out among agriffe varieties because it produces well-rounded flavors and also shows remarkable flexibility to various environments. The presence of Espadin mezcal serves as a standard reference point describing superior quality and taste characteristics for the entire mezcal sector.

The widespread demand for espadin mezcal exists because this category is easily accessible while distributors dedicate themselves to preserving environmentally friendly methods. luent awareness about sourcing responsibility alongside sustainabilityhas shifted consumer preferences toward espadin mezcal produced through traditional manufacturing approaches. Espadin mezcal maintains its status as a leading segment in mezcal market dynamics as market growth expands.

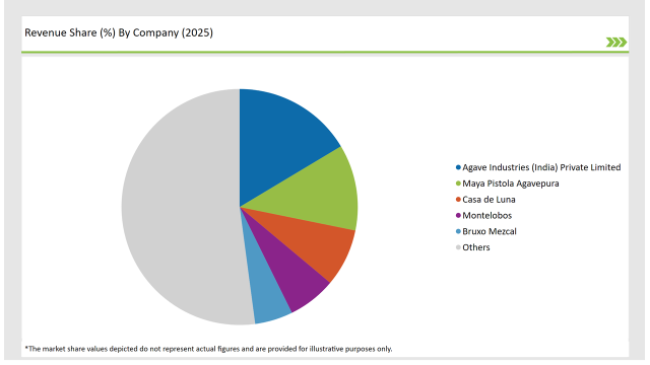

2025 Market Share of ASEAN Mezcal Manufacturers

Note: The above chart is indicative

The mezcal market is gaining deadly competition because many brands enter the spirit space because consumers increasingly want artisanal spirits. Both established producers and new industry participants use innovative approaches with distinct products and strategic marketing to take in more market share.

Market competition drives key producers to fund research projects that develop exquisite exclusive mezcal spirits which match consumers' current preferences. Entities within this market sector test multiple agave types through advanced aging procedures to distinguish themselves within an expanding market framework.

The ASEAN Mezcal market is projected to grow at a CAGR of 11.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 44.4 million.

India are key Country with high consumption rates in the ASEAN Mezcal market.

Leading manufacturers include Agave Industries (India) Private Limited, Maya Pistola, Agavepura, Casa de Luna, Montelobos, Bruxo Mezcal the key players in the ASEAN market.

Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Vidrio, and Others

Espadin, Tobala, Tobaziche, Tepeztate, Arroqueno, and Others.

Agave Mezcal, Blends

On-Trade Channel (55.4%), and Off-Trade Channel (44.6%)

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

Calcium Caseinate Market Analysis by End Use Application and Functionality Through 2025 to2035

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.