The global ASEAN Lactase market is projected to be valued at USD 189.61 million in 2025 and is expected to reach USD 317.79 million by 2035, expanding at a CAGR of 5.7% over the forecast period.

Concentration is understood as the new term for the shares of manufacturer on the market. The key manufacturers are focusing on increasing their concentration and market share by producing more, forming strategic partnerships, and creating new products.

Lactase enzyme demand is increasing, which consequently requires a ramp-up of production facilities in the key ASEAN countries. This development is the result of a growing number of people with lactose intolerance and the enlargement of the dairy alternatives market.

One of the InvestR&D aims is to create better formulations with increased lactase activity, hence, FEC. The problem is that firms are utilizing cost-effective methods for enzyme production to stay competitive and, at the same time, ensure the high quality of products.

| Attributes | Description |

|---|---|

| Estimated ASEAN Lactase Business Size (2025E) | USD 189.61 million |

| Projected ASEAN Lactase Business Value (2035F) | USD 317.79 million |

| Value-based CAGR (2025 to 2035) | 5.7 % |

The trend of health awareness among consumers is bringing a paradigm shift in the ASEAN lactase market. Consumers have the desire for dairy products with no additives, thus, the producers resorted to using lactase enzymes from natural fermentation processes.

On the other hand, businesses are using e-commerce channels and digital marketing to promote their products and reach out to consumers who are conscious of their health. Thus, by aligning their business strategies with the changes in dietary patterns, they are making direct competition more intense, which, in turn, centralizes the market.

Explore FMI!

Book a free demo

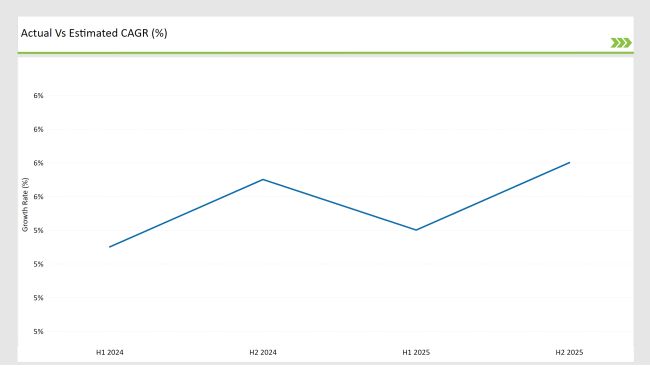

A detailed comparison regarding the changes of the yearly compound growth rate (CAGR) indicator for six months in the base year (2024) and the current year (2025) is demonstrated in the table below regarding the ASEAN Lactase market, specifically.

This semi-annual analysis shows the main shifts in market dynamics and suggests the patterns of revenue realization and, hence, gives the stakeholders a little more exact information about the growth trajectory in the year. H1, or the first half of the year, includes January to June, while H2, the second half, includes July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The market prediction for the ASEAN Lactase sector is a rise of 5.3% in the CAGR during the first half of 2024 to 2034, while the second half of the year will show a 3.8% increase. A further rise of 5.4% in the H1 of the year 2025 to 2035 would be expected, followed by a peak of 5.9% in H2.

The main factors that will result in this upsurge are the higher investments in enzyme production, the consumers' increasing demand for lactose-free dairy products, and the recognition of lactase-based formulations in the sector of food and beverages.

Lactose-Free Dairy Consumption and Application in ASEAN Expanding

High lactose-free dairy product consumption is the driver behind the rapid development of the lactose-free dairy sector in the ASEAN region. Increased consumer awareness of lactose intolerance and the need for healthier diets are the causes at the root of this phenomenon.

The dairy industry is introducing lactose-free milk and yogurt, as well as ice cream, as new products in their line. Urbanization and the availability of more disposable incomes are also playing their part in the transition to the premium brand dairy sector, which employs lactase enzymes to promote digestibility.

Companies producing lactase enzymes are showing great potential in the Indonesian, Thai, and Vietnamese markets, where they are local players. The lactase enzymes technology application is also seen in the local factories as they try to optimize the use of the product in meeting consumers' requirements.

The entrance of grocery delivery platforms and the popularization of health stores are the secondary drivers promising more penetration, thereby speeding up the application rate of lactase-treated dairy in the region.

Enzyme Technology in Production and Formulation

ASEAN is the area where lactase enzyme production is experiencing an innovation revolution, and what is more, producers are now found allocating resources to permit enzyme extraction and fermentation technology upgrade.

Newer versions of public and private industries have begun to use this efficient microbial fermentation achieved through enhanced enzyme technology to make lactose hydrolysis in dairy products better. Another popular topic is encapsulation technology, which acquires more and more traction as it boosts enzyme stability for longer shelf life and better performance under abnormal pH and temperature conditions.

In the regional production of local enzymes, producers are also launching new lines based on the cost-effectiveness of enzyme immobilization, which promotes both reusability and diminishes the cost of production overall. The high level of competitiveness motivates firms to look for research-backed solutions that result in the creation of new-generation lactase enzymes that can be used in a wider variety of food and drink processes. Consequently, the regional market is better supplied with innovative enzymes.

Market Growth and Regulatory Challenges

The lactase market landscape is determined by the regulatory developments taking place across the ASEAN countries. Several countries, most notably Malaysia and Singapore, have modernized their food safety regulations, which has opened the way for new milk and non-milk formulations of the lactase enzyme.

The government is also disbursing innovation funds through research grants partnered with industry, thus nurturing local enzyme production. The harmonization of food additive regulations that fracture under the ASEAN trade agreement is becoming one more facilitator of cross-border trade and empowers manufacturers to sell lactase virtually in all member states.

Nevertheless, adherence to enzyme purity and labeling standards remains a serious obstacle for this business, wherefore the players invest in regulatory and quality assurance staff for a better position in the market. The mentioned regulatory amendments include changes that will reshuffle the panorama of the lactase market in ASEAN.

| Date | Development |

|---|---|

| March 2024 | ASEAN released the "Mechanism to Establish, Review, and Update Food Safety Standards," streamlining the harmonization of food safety regulations. |

| June 2024 | The ASEAN Business Council hosted a workshop in Jakarta to identify sustainable paths for ASEAN agriculture. |

| September 2024 | ASEAN published the "Enhancing and Integrating Regional Food Safety" report, emphasizing integrated food safety measures across member states. |

| December 2024 | ASEAN updated the "ASEAN Food Safety Policy," reinforcing core principles for food safety measures throughout the food chain. |

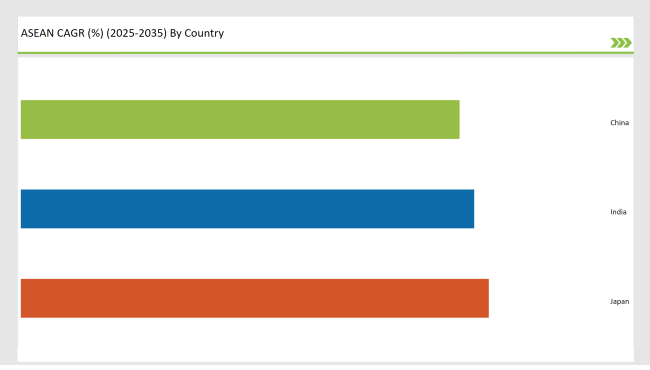

The lactase sector in India is anticipated to show a CAGR of 6.2% during the forecast period of 2024 to 2034. The major force behind this is the increasing cases of lactose intolerance in the Indian population, which leads to the growing demand for lactose-free dairy products.

The population of the middle class, which is also increasing and has more disposable income, is also a big factor in the consumption of lactase enzymes along with other specialized food items. The food and beverage sector's innovative approach, which is mainly the introduction of lactose-free dairy products, is also a key factor in market growth.

In addition, the increasing focus on health and an inclination towards preventive healthcare are the reasons that consumers are looking for products that help in the digestion of food better; thereby, the lactase market in India is increasing.

According to CAGR, the lactase market in China is expected to be increasing at a rate of 6.0% within the years of 2025 to 2035. This rise is based on the high number of lactose intolerant people among the Chinese population, which has caused a greater demand for lactose-free dairy products.

The quick progress in urbanization and the fact that the population has more money to spend are reasons why people are choosing healthy diets that include lactose-free options. The dairy industry is making changes to keep up with the demand and address it with the expansion of lactose-free products, which in turn leads to the need for lactase enzymes.

Also, enzyme technology is moving forward, and with lactase being included in different food and beverage applications, it is beneficial for the market. The government's support of the dairy industry and the introduction of initiatives that are meant to better public health nutrition are also factors that play a big part in the rise of the lactase market in China.

The lactase market in Japan is anticipated to grow at a CAGR of 6.4% from 2025 to 2035. The rise in lactose intolerance awareness and the health benefits linked to lactase-free items are the main factors that affect the development of this growth.

It is known that the Japanese are very conscious about their health and this has resulted in more acceptance of functional foods, including those that have lactase enzymes. The dairy industry in Japan is going for innovation to meet this demand with the introduction of various lactose-free dairy products.

Another aspect is that the elderly population in Japan is looking for foods that are easier to digest, which as a result increases the consumption of lactose-free foods. The integration of lactase in dietary supplements and the popularity of fermented dairy foods are some other factors that contribute to the growth of this market. All in all, the mixture of health fads and product innovation drives the lactase market in Japan.

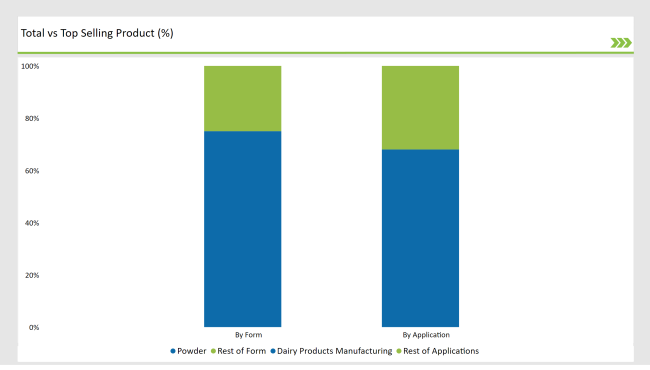

The powder form is the main segment of the ASEAN lactase market, maintaining a 75% value share. The reason behind this is the long shelf life, easy storage, and effective application in dairy processing, which is the preference for powdered lactase. Food manufacturers like powdered lactase because its stability is high, and it does not change at different temperatures, thus not affecting the outcome of the processing.

The demand for powdered lactase, which is widely used in making lactose-free dairy products such as milk, cheese, and yogurt, has grown due to this. The food processing sector in the ASEAN region is going fast with the adoption of enzyme technology for better product consistency, which is why the use of powdered lactase is promoted.

The bulk availability of powdered lactase packaging in the market also benefits the manufacturers as it is cost-effective, and thus, it is more and more adopted in massive dairy production.

Dairy product manufacturing is the biggest application segment for lactase in the ASEAN market, accounting for 68% of the market value. The consumer trend toward lactose-free dairy products has risen dramatically, while the number of lactose-intolerant people has grown, which is why lactase enzymes are desired in dairy processing.

Dairy companies have been the ones who are adding lactase to milk, yogurt, and cheese to reach this new group of consumers. The upsurge of internet marketing and supermarkets has also been efficient money-wise with the rising number of lactose-free dairy products, which in turn improved the market.

In addition, the enzyme technology improvements that have been done have provided chances for the dairy producers to manufacture lactose-free foods, which are better in taste and do not affect the texture or nutritional contents.

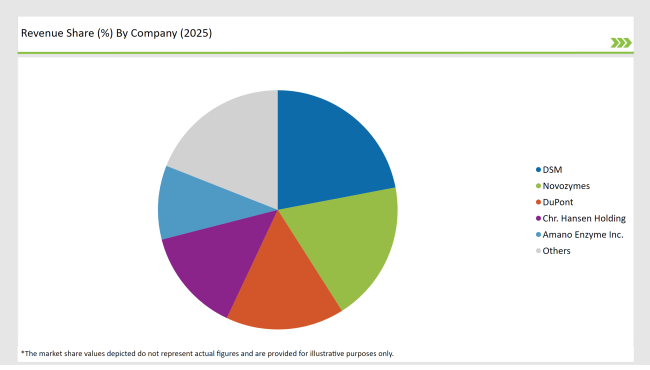

2025 Market share of Latin America Lactase manufacturers

Note: The above chart is indicative in nature

The ASEAN lactase market is characterized by a mix of global giants and regional specialists. Prominent multinational corporations like DSM, Novozymes, DuPont, and Chr. Hansen Holding dominates the scene with a significant market share. These companies utilize their financial strength, product variety, and distribution network as their competitive advantage.

For example, DSM and Novozymes have both been involved in research and development in the area of enzyme technology, including lact, to accommodate the growth of the lactose-intolerant population. Local companies such as Amano Enzyme Inc. and Advanced Enzyme Technologies Lt. also contribute greatly to the market with their tailored solutions that are based on the local consumer preferences and their eating habits.

Apart from this, Antozyme Biotech and Bioven Lactase emphasize their strategy on cost-efficient production methods to make lactase enzymes affordable for smaller dairy producers, too. Moreover, the likes of Sabinsa Corporation and Kerry Group are now also embedding lactase enzymes in their wider nutritional and functional food portfolios, which is a mark of the growing health and wellness trend.

The competitive environment in the market is further increased with the constant developments in enzyme technology and the growing number of lactose-free products, which both drive innovation and foster strategic partnerships among the major players.

The ASEAN lactase market is projected to grow at a CAGR of 5.7% during the forecast period from 2025 to 2035.

The market is estimated to reach approximately USD 317.79 million by 2035, up from USD 189.61 million in 2025.

The food and beverages segment is expected to witness significant growth due to the increasing demand for lactose-free dairy products among health-conscious consumers.

Key growth drivers include the rising prevalence of lactose intolerance, increasing health consciousness among consumers, and the expansion of e-commerce platforms facilitating easier access to lactose-free products.

While specific companies operating exclusively in the ASEAN lactase market are not detailed in the available sources, prominent global players in the lactase market include DuPont, DSM, and Novozymes.

The market is segmented into powder and liquid lactase enzymes.

The market is categorized into fungi, yeast, and bacteria-based lactase enzymes.

The market is divided into dairy products manufacturing, infant formula production, and beverage processing.

The market includes food-grade and feed-grade lactase enzymes.

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.