The ASEAN Hydrolyzed Vegetable Protein market is set to grow from an estimated USD 32.4 million in 2025 to USD 99.6 million by 2035, with a compound annual growth rate (CAGR) of 11.9% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 32.4 million |

| Projected ASEAN Value (2035F) | USD 99.6 million |

| Value-based CAGR (2025 to 2035) | 11.9% |

The ASEAN Hydrolyzed Vegetable Protein (HVP) market shows robust upward potential due to expanding consumer interests in dietary well-being and the rising market for plant-based protein choices. This market expansion exists because of growing consumer preference for meatless diets and heightened incidences of lactose intolerance and gluten sensitivity.

Health-conscious consumers together with athletes choose chickpeas as their HVP source because they provide essential protein alongside multiple nutritional advantages. The food and beverage processing sector leads HVP usage by incorporating it throughout their snapping products and prepared meat dishes as well as sports nutrition protein bars. Modern HVP isolates market development and focuses on creating high-end products that support consumers' changing preferences.

Explore FMI!

Book a free demo

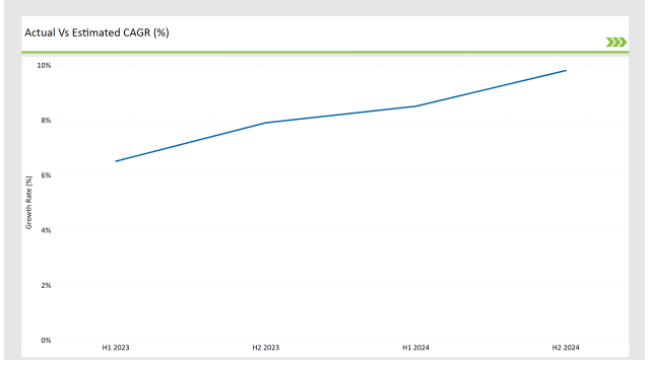

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Hydrolyzed Vegetable Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Hydrolyzed Vegetable Protein market, the sector is predicted to grow at a CAGR of 6.5% during the first half of 2024, with an increase to 7.9% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.5% in H1 but is expected to rise to 9.8% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Launch of a new line of Hydrolyzed Vegetable Protein-based protein bars by a leading snack manufacturer, targeting health-conscious consumers. |

| 2024 | The partnership between a Hydrolyzed Vegetable Protein supplier and a major beverage brand to create a new line of protein-enriched drinks. |

| 2024 | Introduction of Hydrolyzed Vegetable Protein-based meat alternatives by a prominent food company, catering to the growing demand for plant-based options. |

| 2024 | Expansion of a Hydrolyzed Vegetable Protein production facility in Thailand to increase capacity and meet rising demand in the region. |

Rise of Plant-Based Diets

Activators process legume-based Hydrolyzed Vegetable Protein which provides substantial amounts of protein yet remains both fat-free and cholesterol-free. Hydrolyzed vegetable protein serves as an alternative for meat reducers who want protein in their diet without dietary changes.

HVP offers manufacturers a versatile platform that allows them to use it across numerous food products including snacks and meat alternatives Therefore opening tremendous opportunities for all food production segments. Early indications show that the HVP market will grow strongly due to rising consumer interest in plant-based proteins combined with advancement in product development.

Increased Focus on Health and Nutrition

The increasing concern about nutrition and health functions is a major developmental driver for the Hydrolyzed Vegetable Protein (HVP) market. Diet-knowledgeable consumers now seek protein-rich food products that deliver supplementary health benefits because of their better dietary understanding of protein value.

The hydrolyzed vegetable protein (HVP) has earned its reputation through multiple health advantages including ample protein quantity and enhanced digestive health and weight control benefits. Manufacturers within the food industry now create novel products that focus on HVP's nutritional aspects because of growing consumer interest in heart promotion and digestive well-being. Consumer interest in healthy dietary choices positions the HVP market advantageously to grow through multiple segments including sports nutrition and functional foods.

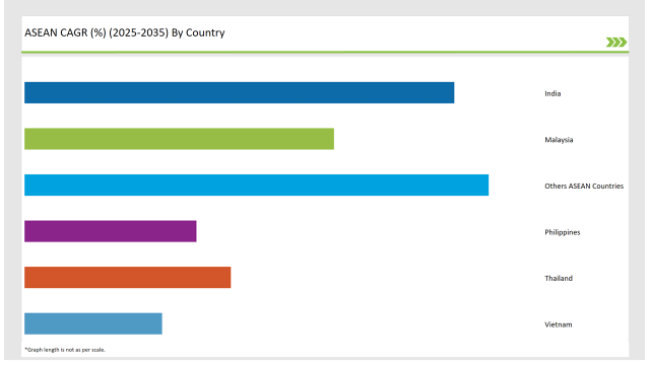

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The hydrolyzed vegetable proteins market in India demonstrates rapid expansion because of sociocultural influences and dining trends alongside economic developments. Indian society embraces plant-based proteins because traditional chickpea dishes form a core element of its extensive culinary tradition.

The shifting understanding of nutrition by consumers in urban locations combined with their increasing health-conscious behaviors has fueled market demand for plant-based proteins. Hydrolyzed Vegetable Protein market growth continues to increase because of cultural and religious perspectives driving the popularity of vegetarianism and veganism.

The government of India supports pulse farming particularly chickpeas because it enhances food security and nutrition during its active promotion of these agricultural activities. The government's backing facilities lead to increased Hydrolyzed Vegetable Protein output which makes the product more affordable for the consumer base.

Hydrolyzed Vegetable Protein demonstrates substantial market advancement throughout Malaysia because consumers increasingly focus on wellness nutrition needs. Due to increasing lifestyle diseases, consumers are turning toward nutritious food products to support their wellness needs. The alteration in consumer habits has created a greater need for plant-based proteins among which Hydrolyzed Vegetable Protein stands prominent.

The Malaysian government initiated several dietary program campaigns that reinforce legume consumption thus leading to increased traditional cuisine acceptance of Hydrolyzed Vegetable Protein. Traditional Malaysian cooking now regularly includes chickpeas and legumes because of which Hydrolyzed Vegetable Protein has become a familiar component for Malaysian consumers.

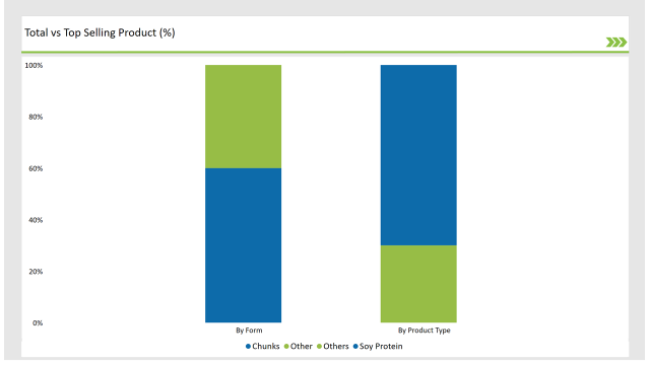

Soy protein controls forty percent of the ASEAN Hydrolyzed Vegetable Protein market sector. The dominance of soy protein results from its combination of superior protein composition together with flexible use and extensive food industry presence. The versatility of soy protein drives its usage throughout meat alternative and beverage production and protein bar creation which brings manufacturers to this premium ingredient for plant-based protein delivery.

Health-conscious consumers find soy protein beneficial because it contains essential amino acids alongside its nutritional makeup. People are choosing soy products because of their proven health advantages for the heart together with their weight management properties while consumer understanding of these benefits continues to rise. The Hydrolyzed Vegetable Protein market will benefit from rising plant-based diet adoption because soy protein maintains its position as a primary product category.

From the standpoint of the variety of forms, chunks are the most sought-after and widespread type of Hydrolyzed Vegetable Protein in the market, with a surging 38% in market share. Fragments of protein are sizable and easy products that can be used in food technologies for example liquids, soups, or salads.

Their partial implementation in these dishes by housewives, restaurants, and their manufacturers as well as the positive perception of the products as 'meat substitutes' make them particularly appealing. It is worth mentioning that the use of chunks improves the overall nutritional status of meals alongside texture and taste improvement.

The flexitarian diet also contributes to this form of Hydrolyzed Vegetable Protein's growth being eaten by customers who decrease the intake of meat products but like to have food that tastes and feels the same. Thoughts about adding new solutions to their food have stimulated customers to want more products to choose from; that is to say, chunks are easy to integrate into various dishes, which results in novel food.

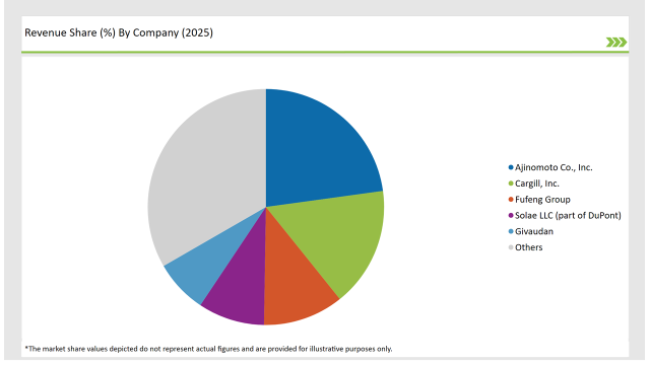

2025 Market Share of ASEAN Hydrolyzed Vegetable Protein Manufacturers

Note: The above chart is indicative

The ASEAN Hydrolyzed Vegetable Protein market is marked by a competitive scenario in which a large number of participants are competing for their share of the market. The blooming interest in the plant-protein sector has not only drawn the attention of veteran food manufacturers but has also welcomed the entry of a host of new players into the market, consequently producing a lively and fast-developing atmosphere.

The ASEAN Hydrolyzed Vegetable Protein market is projected to grow at a CAGR of 11.9% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 99.6 million.

India are key Country with high consumption rates in the ASEAN Hydrolyzed Vegetable Protein Market.

Leading manufacturers include Ajinomoto Co., Inc., Cargill, Inc., Fufeng Group, and Solae LLC (part of DuPont) Others are the key players in the ASEAN market.

As per Form, the industry has been categorized into Chunks, Slice, Flakes granules

As per Product Type, the industry has been categorized into Soy Protein, Wheat Protein, Pea Protein, Rice Protein, and Chia Protein, Flax Protein, and Corn protein

As per End Use, the industry has been categorized into Household, Commercial, Food Industry, and Animal Feed

As per Distribution Channel, the industry has been categorized into Direct and Indirect

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

A detailed analysis of the Australia Licorice Root industry and growth outlook covering form, and application segment

UK Licorice Root Industry Analysis from 2025 to 2035

USA Licorice Root Industry Analysis from 2025 to 2035

A detailed analysis of the Australia Mezcal industry and growth outlook covering product, source, concentration, and distribution channel segment

Comprehensive Analysis of Europe Mezcal Market by Product, Source, Concentration, Distribution Channel and Country through 2035

Comprehensive Analysis of ASEAN Mezcal Market by Product, By Source, By concentration, By sales Channel and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.