The ASEAN Herbs and Spices market is set to grow from an estimated USD 83,849.6 million in 2025 to USD 1,44,590.7 million by 2035, with a compound annual growth rate (CAGR) of 5.8% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025) | USD 83,849.6 Million |

| Projected ASEAN Value (2035) | USD 1,44,590.7 Million |

| Value-based CAGR (2025 to 2035) | 5.8% |

The ASEAN Herbs and Spices Market continues its notable expansion because consumers embrace changing tastes and seek organic ingredients while benefiting from the region's traditional cooking methods. Different types of basil, parsley, cilantro, cumin paprika, and turmeric compose the diverse market range that supports the food, beverage pharmaceutical, and personal care industries.

Environmentally vibrant ASEAN eating cultures depend on herbs and spices because they provide both culinary flavor quality and medical usefulness. The region demonstrates significance as a worldwide hub for herbs and spices because India together with Malaysia and Thailand serve as principal producers and consumers of these ingredients.

Increasing consumer interest in functional foods combined with natural remedies has led to an increased usage of herbs and spices in manufacturing value-added products that include flavored oils sauces and health supplements along with dressings.

The food service sector along with retail outlets maintains its market control of herb and spice sales throughout ASEAN countries because of urban development growth combined with rising incomes and prosperous tourism infrastructures.

The development of e-commerce systems allows consumers to discover many herb and spice options thus driving market expansion. The ASEAN Herbs and Spices Market will experience widespread growth thanks to recent advancements in packaging technology and processing techniques as well as updated flavor combinations.

Explore FMI!

Book a free demo

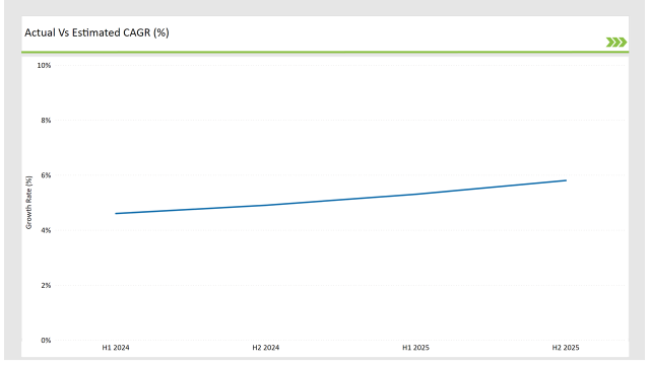

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Herbs and Spices market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Herbs and Spices market, the sector is predicted to grow at a CAGR of 4.6% during the first half of 2024, with an increase to 4.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 3.4% in H1 but is expected to rise to 5.3% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2023 to the first half of 2024, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2023 | India’s SpiceCo launched an organic cumin range targeting health-conscious consumers in ASEAN markets. |

| June 2023 | Thailand’s Herb Fusion Foods unveiled a new line of ready-to-use curry pastes for export to global markets. |

| September 2023 | Malaysia-based Natural Spices partnered with local farmers to expand organic turmeric cultivation. |

| November 2023 | Global spice leader McCormick introduced a premium spice blend collection tailored for ASEAN cuisines |

| March 2024 | Indonesian spice giant Indo Herbs expanded its e-commerce platform to offer direct-to-consumer organic herb products. |

Growing Demand for Organic and Natural Herbs and Spices

The ASEAN market demonstrates an active transition toward organic natural herbs and spices as consumers focus increasingly on health sustainability together with wellness elements. Members of the health-conscious population choose organic and clean-label products because these options contain minimally processed chemicals-free ingredients.

A high demand exists for cooking and medical applications since popular everyday seasoning herbs such as basil, rosemary, and parsley combined with beneficial spices including turmeric, cumin, and paprika are widely sought after in the market.

The growing clean-label movement promotes transparent ingredient sourcing methods as well as the use of natural products. Modern food items including functional foods as well as beverages and supplements now include herbs and spices specifically to deliver natural solutions for enhanced digestion while strengthening immunity and promoting total wellness.

Rising Popularity of Ready-to-Use Spice Blends and Flavored Products

ASEAN markets demonstrate heightened consumer interest in ready-made spice mixes which suit the convenience-driven preferences among their growing population of ready meal purchasers. Mid-crafted spice mixtures including curry powders plus barbecue rubs with garam masala serve as key kitchen staples throughout ASEAN homes by delivering genuine food flavors easily.

Consumer’s progressive preference for convenience in meal preparation drives this trend because dual-income families have become more common while people lead busier lifestyles. The food service industry integrates pre-blended spices as essential ingredients in its high-volume production processes to guarantee consistent flavors throughout all fast-food chain outlets as well as casual dining restaurants.

The manufacturing industry works to create new spice combinations that match global and regional eating preferences. Spice blends based on chili peppercorns hold influence over the Thai market alongside global adult-centric flavor profiles based on Indian spices.

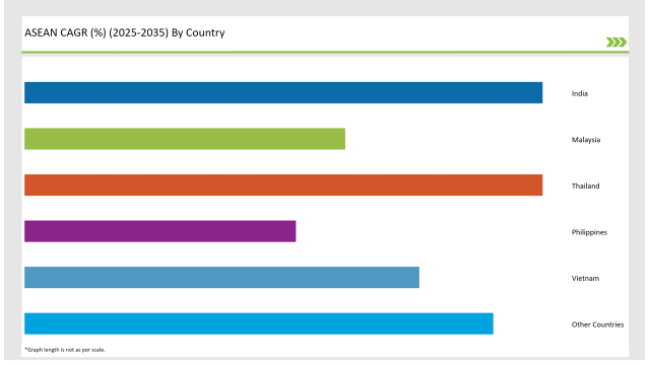

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The ASEAN Herbs and Spices Market receives substantial influence from India because this country leads the global spice production sector internationally. India's different climate zones combined with its traditional agricultural methods permit decades of expertise in spice cultivation which results in cumin, turmeric, and paprika production among many other varieties.

Indian food exports of spices show continuous growth owing to International demand for organic and sustainable sourced spices. The product ranges of Indian manufacturers now include organic spice blends functional powders and flavored oils as their product development focus. India's domestic market shows rapid expansion because of rising disposable incomes together with changing dietary preferences.

As a leading regional power in spices and herbs production, Thailand achieves this status through its strong culinary heritage coupled with its ancient medicinal traditions. Local agricultural expertise enables Thailand to produce premium herbaceutical items from lemongrass and basil to galangal as well as produce spices from chili to turmeric.

Thai cuisine's international recognition generates growing international interest in genuine Thai spices and herbs. Health-focused products like herbal teas functional beverages and dietary supplements now contain integrated native ingredients which strengthen the domestic market inside ASEAN.

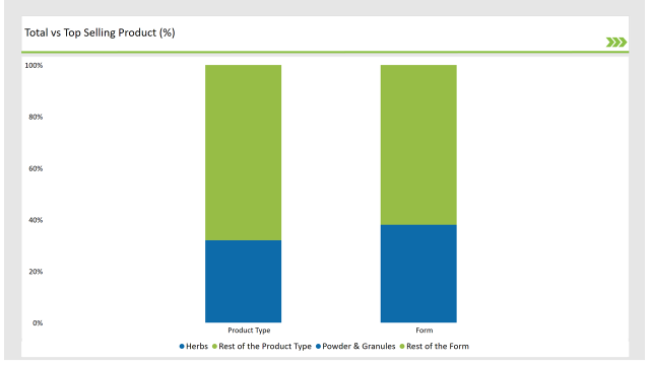

% share of Individual categories by Product Type and Form in 2025

The ASEAN market is ruled by natural herbs and spices including cumin and turmeric alongside basil and paprika because these ingredients have various uses in culinary preparation and medicine as well as functional foods. Favorable consumer demand for organic chemical-free minimally processed food products drives the preference for natural ingredients because they offer clean labels.

The demand for cumin as a spice continues to rise because of its tasty qualities combined with health advantages that support digestion and strengthen immunity function. People rate turmeric as one of the top products because it maintains anti-inflammatory functions and exhibits antioxidant behaviors which helps the food industry use it both in traditional cuisine and contemporary health supplements.

The hot pepper-derived spice paprika serves as an ingredient to elevate sensory appeal and visual appeal across various snack products and sauces while dominating processed food manufacturing.

Herbal and spicy products available as powders or granules hold the largest market share in ASEAN because they can be utilized in many ways and safely maintain freshness and they offer convenient application methods. Manufacturers and consumers who seek convenience use these forms extensively to flavor processed foods and prepared spice mixes along with bakery goods and snack seasonings.

Food processing industries mostly use three primary powdered spices which include cumin powder turmeric powder and chili powder. Restaurants depend on their fine texture structure to achieve uniform distribution of ingredients throughout recipes which generates reliable taste experiences throughout dishes. Derived into small granules garlic granules and onion granules offer manufacturers distinct advantages because they dissolve smoothly within sauces soups and marinades yet manage to stay free of clumps.

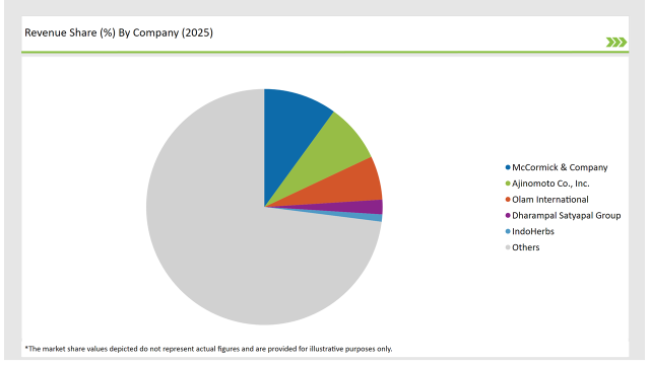

2025 Market Share of ASEAN Herbs and Spices Manufacturers

Note: The above chart is indicative

ASEAN herbs and spices market competition remains intense between McCormick's global prominence and the domestic power of Indo Herbs along with Spice Co. The market operates through two main strategies global companies develop advanced products to fit modern customer demands and local producers offer organic sustainable approaches for health-focused buyers.

This market competition depends on three main elements: strategic manufacturing alliances which expand distribution capabilities and product accessibility, product line diversification tailored to consumer preferences, and the development of electronic retail solutions enabling enhanced customer accessibility. The regional market environment of ASEAN herbs and spices undergoes sustained expansion due to its flexible structure.

The ASEAN Herbs and Spices market is projected to grow at a CAGR of 5.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,44,590.7 million.

India are key Country with high consumption rates in the ASEAN Herbs and Spices market.

Leading manufacturers include McCormick & Company, Ajinomoto Co., Inc., Olam International, Dharampal Satyapal Group and others are the key players in the ASEAN market.

As per Product Type, the industry has been categorized into Herbs, Spices, Paprika, Hot Pepper, and Cumin.

As per Form, the industry has been categorized into Powder & Granules, Flakes, Paste, Whole or Fresh.

As per By End Use, the industry has been categorized into Food, Beverage, Food Service, and Retail Sales.

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

USA Aqua Feed Additives Market Analysis from 2025 to 2035

Comprehensive Analysis of Europe Fish Meal Market by Product Type, Application, Source, and Country through 2035

Comprehensive Analysis of ASEAN Fish Meals Market by Product Type, by Application, Source, and Region through 2035

A Detailed Analysis of Brand Share Analysis for Fungal Protein Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.