The ASEAN Fish Protein market is set to grow from an estimated USD 102.8 million in 2025 to USD 205.9 million by 2035, with a compound annual growth rate (CAGR) of 7.8% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 102.8 million |

| Projected ASEAN Value (2035F) | USD 205.9 million |

| Value-based CAGR (2025 to 2035) | 7.8% |

Market expansion in the ASEAN fish protein sector happens in large part because more people are focused on fish-based health benefits while consumers have rising purchasing power and the ASEAN population continues to expand. Fish protein maintains high nutritional value that provides essential amino acids along with omega-3 fatty acids and various vitamins and minerals. Fish protein has become the top choice for nutrition-conscious people throughout the region because of its benefits.

Ten member countries comprising the ASEAN region maintain a traditional eating habit of fish consumption which serves as an essential dietary practice. Due to its large coastal areas and plentiful water resources the market receives additional growth potential from both wild catch fishery and aquaculture fish production. The market shows expanding growth because sustainable fishing methods and aquaculture operations multiply product demand from consumers who prefer responsible sourcing.

The health and wellness movement has changed consumer dietary choices because people now prefer proteins seen as healthy substitutes for red meat. New market trends especially dominate urban environments as people who lead active lives seek ready-to-eat healthy food products. Fish protein manufacturers benefit from new technologies which enable them to create fish protein hydrolysates and fortified fish products to reach multiple consumer markets.

Explore FMI!

Book a free demo

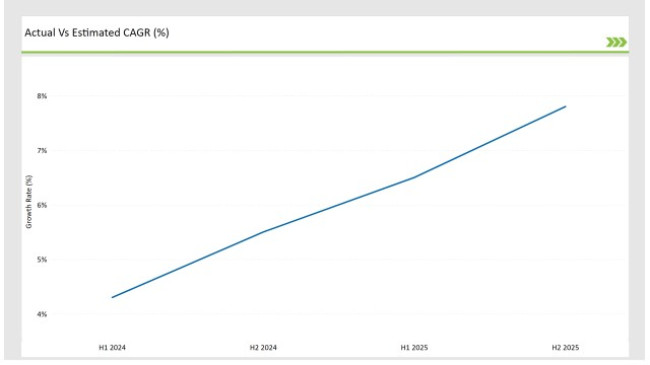

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Fish Protein market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Fish Protein market, the sector is predicted to grow at a CAGR of 4.3% during the first half of 2024, increasing to 5.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 6.5% in H1 but is expected to rise to 7.8% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Kerry Group introduced a new range of flavor -enhanced Fish Protein designed for the foodservice sector in May 2024. |

| 2024 | Cargill expanded its portfolio by introducing a range of natural sweeteners for bakery applications in April 2024. |

| 2024 | Archer Daniels Midland (ADM) announced a partnership with local farmers to source high-quality grains for its Fish Protein in May 2024. |

| 2024 | Baker Hughes introduced a new line of emulsifiers designed to improve the texture and shelf life of baked goods in June 2024. |

Rise of Urban Aquaponics

The practice of urban aquaponics grows in popularity across ASEAN cities since these areas have restricted spaces combined with intensive local requirements for fresh local food production. The new farming practice joins the production of fish through aquaculture and plant cultivation through hydroponics within self-regulating water cycles.

Singapore and Malaysia lead the way in urban aquaponics development due to their efforts of producing fish and vegetables in city centers. The strategy helps resolve food security problems while lowering the emissions caused by delivering food across rural to urban areas. Urban aquaponics systems have emerged because customers want sustainable locally-grown food along with urban residence groups showing more interest in food cultivation.

Development of Value-Added Fish Products

The ASEAN fish protein market undergoes transformation because consumers prefer added value fish products combined with convenience options. Customers choose processed fish products which include ready-to-eat meals and fish snacks and fillets because they want healthful convenient options. Thailand along with Vietnam seizes this market opportunity to create unique fish products which satisfy both domestic customers and international consumers. Value-derived fish product development increases fish producer profits and minimizes post-harvest waste that leads to sustainable fish supply chain management.

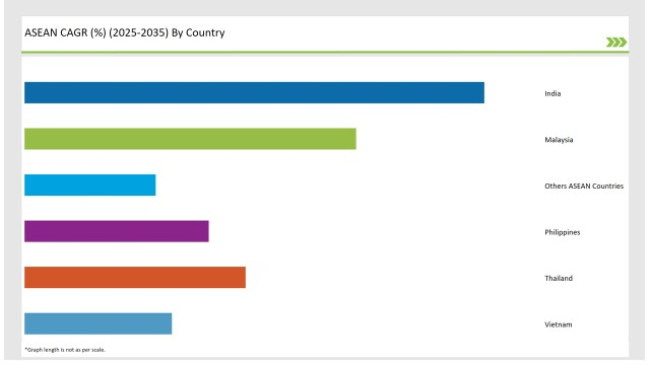

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The Indian fish protein market demonstrates continuous expansion because of multiple essential factors. India stands among the leading fish production countries because it possesses extensive coastal areas along with many watercourses. Increasing quantity of people alongside increasing incomes has resulted in growing demand for fish protein-rich foods.

Through different governmental schemes and initiatives the Indian government actively supports aquaculture development to boost fish production. Programs such as the Pradhan Mantri Matsya Sampada Yojana (PMMSY) focus on sustainable fishing practices and the development of infrastructure for fish farming. Modern aquaculture techniques have experienced an increase in investment which resulted in enhanced fish production quantity and improved fish quality.

The ASEAN region notes Thailand as a top fish and seafood exporter and it maintains a fully developed aquaculture sector. The fish protein market in the country advances by using advanced farming methods together with a strong export-focused strategy as well as numerous fish species choices.

The Thai government remains dedicated to promoting sustainable fishing approaches while establishing laws to secure the durability of fish populations. Sustainability remains essential because it protects Thailand's excellent reputation as a stable fish product exporter to worldwide markets.

The rising worldwide fish consumption in European and North American markets motivated businesses to build new aquaculture and processing centers. Thailand's fishing companies are improving through developing fish products containing added value which target evolving consumer demand for prepared food and frozen fish items.

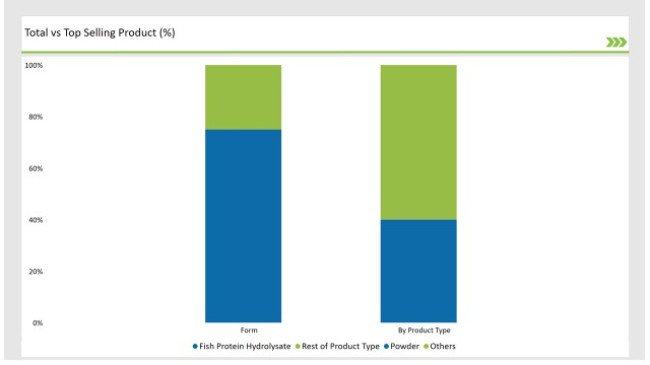

Fish protein hydrolysate grows in popularity throughout the ASEAN fish protein market since it provides both nutritional value and functional benefits. Fish protein hydrolysate exists as a product formed through enzymatic fish protein breakdown while keeping its peptides and amino acids abundant. The markets for food, pharmaceuticals and animal feed sectors drive their demand of fish protein hydrolysate.

The food industry utilizes fish protein hydrolysate as a flavor enhancer together with its application as a functional food protein source. Manufacturers see Fish protein hydrolysate as an important food ingredient because it enhances product taste quality while delivering nutritional benefits. The market demand for protein-rich products is rising due to health and wellness trends which drives the growth of fish protein hydrolysate markets.

Presently the powdered version of fish protein gains popularity throughout the ASEAN fish protein market especially because of its versatile nature and easy handling. The fish protein powder market finds extensive utilization in supplement diets for human consumption as well as functional foods together with performance-based sports products. Fish protein powder demand is rising among health-conscious consumers because they recognize both its high omega-3 fatty acid content and essential amino acids together with its health benefits from fish consumption.

Customers in the dietary supplement industry purchase fish protein powder because it provides premium protein nutrition alongside muscle recovery benefits and health advantages. Fitness enthusiasts together with athletes adopt fish protein powder because they seek to boost protein consumption for higher performance results. The upsurge of plant-based eating patterns has generated increased interest in alternative protein options thus pushing manufacturers to create novel combinations between fish protein and plant ingredients.

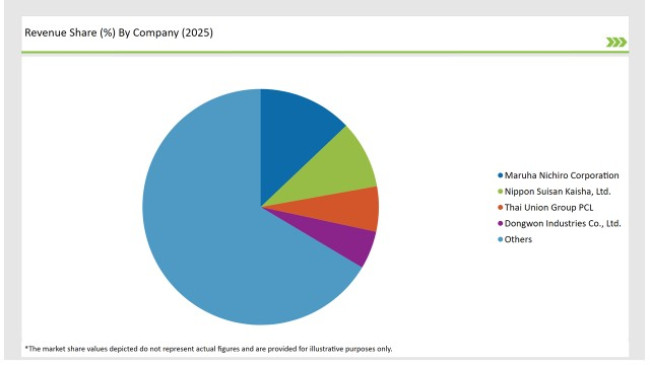

2025 Market Share of ASEAN Fish Protein Manufacturers

Note: The above chart is indicative

The ASEAN fish protein market exhibits strong competition between many businesses that attempt to control market share. Different established seafood producers partner with rising competitors who focus on developing innovative seafood products as well as sustainable business practices. Multiple market drivers influence direct competition in this industry because both product excellence and pricing structure together with distribution systems and customer confidence in the brand matter to competitors.

Sustainability stands out as a principal business tactic that leads organizations toward competitive market domination. The growing number of environmentally conscious consumers chooses businesses which put emphasis on environmentally friendly production and sourcing practices.

The ASEAN Fish Protein market is projected to grow at a CAGR of 7.8% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 205.9 million.

India are key Country with high consumption rates in the ASEAN Fish Protein market.

This Segment further Categorise into Fish Protein Hydrolysate, Fish Protein Isolate, Fish Protein Concentrate,

This Segment further Categorise into Powder, and Liquid

This Segment further Categorise Food & Beverage, Dietary Supplements, Dietary Supplements, Pharmaceuticals, Others,

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.