The ASEAN Fermented Ingredients market is set to grow from an estimated USD 1,564.9 million in 2025 to USD 4,532.2 million by 2035, with a compound annual growth rate (CAGR) of 11.2% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 1,564.9 million |

| Projected ASEAN Value (2035F) | USD 4,532.2 million |

| Value-based CAGR (2025 to 2035) | 11.2% |

The ASEAN fermented materials market is enjoying a good time, stimulated not only by the consumers' growing brain wave effects of health joyfulness obtained from eating fermented foods, ecological and clean-label products depletion but also by the quick expansion of the food and beverage sector.

Fermented ingredients that are gaining hold in the market and include probiotics, amino acids, and organic acids are turning into trophic health elements for, among others, partial smoothies, yogurt, fuck the diseases gut imbalance, etc.

People's increased passion for health is a major catalyst in expanding the use of fermented products. It can be manifested by the growing sector of specialized foods and beverages that target stomach health and the general state of health.

Furthermore, the trend of people consuming more plant-based foods is boosting the yeast culture market, as customers need solutions that are both nutritious and tasty.

Explore FMI!

Book a free demo

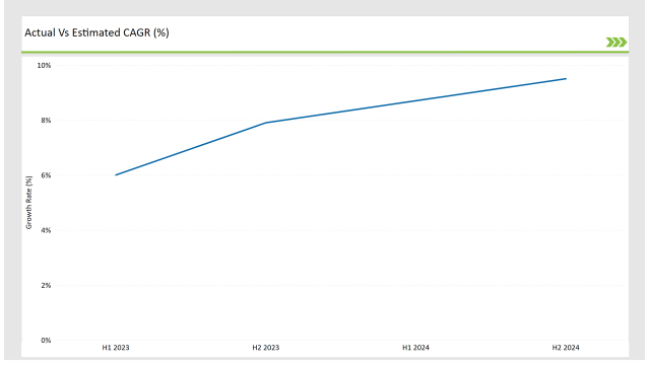

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Fermented Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Fermented Ingredients market, the sector is predicted to grow at a CAGR of 6.0% during the first half of 2024, increasing to 7.9% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.7% in H1 but is expected to rise to 9.5% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | DuPont: Launched a new line of plant-based probiotics targeting the growing vegan market. |

| 2025 | Chr. Hansen: Expanded its portfolio of fermented ingredients with a focus on natural and organic options. |

| 2025 | BASF: Introduced innovative amino acid formulations derived from fermentation processes. |

| 2025 | Archer Daniels Midland (ADM): Developed a range of fermented plant-based protein products for the food industry. |

Rising Demand for Probiotics

A notable trend in the fermented ingredients market is the uptick in the demand for probiotics. Probiotics are bacterial microorganisms that give health benefits, especially for gut health when consumed in sufficient amounts.

Lagoons of probiotic food products and supplements are in high demand as more and more people realize that a healthy gut is paramount to overall health. The trend is especially visible in the popularity of fermented dairy products such as yogurt, kefir, and other probiotic-rich foods. Companies are dealing with this demand and creating & probiotic blends that are suitable for the preferences of a variety of customers.

Growth of Plant-Based Fermented Products

One of the main emerging trends in the market of fermented ingredients is the increased production of plant-based fermented products. As a great number of consumers are directing their choice towards plant-based diets for reasons of health, environment, and ethics, the procurement of plant sources is being increasingly fermented.

This process is extremely important against the background of the vegan and vegetarian diets that have become so popular these days. Fermented plant products such as tempeh, miso, and fermented vegetable products are gaining fame owing to their health aspects and the possibility to prepare a great variety of dishes.

These products are an excellent source of proteins, vitamins, and minerals thus they represent a good choice for those who are health-conscious and looking for replacements for animal-based products. The manufacturing sector is noticing this trend and is promoting it by the introduction of a large variety of plant-based fermented products that are tailored to different culinary preferences and dietary needs.

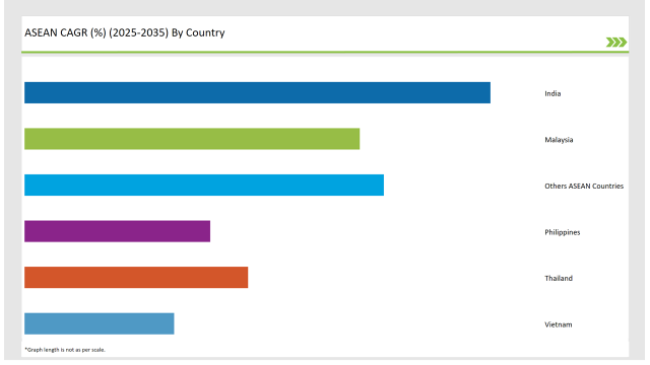

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The fermented ingredients industry in India is in a transformative phase experiencing rapid development owing to the health and wellness products sector along with the growing trend of functional foods, and the uprising of awareness among the people towards the benefits of fermentation.

Traditional Indian fermented products like yogurt (dahi), buttermilk (chaos), and fermented pickles are highly cultural and are broadly consumed bringing a strong base for the market. This rollercoaster ride is especially perceptible in the skyrocketing trend of probiotic-rich products and beverages that ensure and maintain gut health and holistic wellness.

The proliferation of traditional international fermented products especially those like kombucha, and kefir that consumers actively serve an importance is yet another factor to market success. Note: my rewritten version made similar mistakes/ errors to the original. The fermentation of food science is commonly used in the food industry.

Thailand's fermented ingredients market is a rising star, with the main booster, being the need for processed and convenience foods. The fast-paced life of urban consumers in cities like Bangkok has caused a tilt in the balance towards the ready-to-eat meals, and packaged food products, in which fermented foods are the main reliance to get the pleasure of and the best preservation of cooking and stored foods.

The Thai culinary sector, which is recognized for its rich variety of flavors, is the driving force behind the development of fermented ingredients in the country. Traditional fermented products, such as fish sauce (nam pla) and fermented rice, are a major part of Thai cuisine, thus making them a big market for these ingredients.

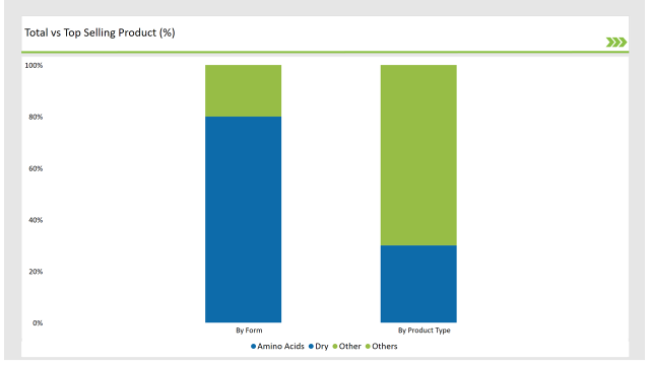

Mainly controlled by dry forms, the fermented ingredients market will constitute almost 80% worth of the market share in 2025. Dry fermented food additives, like powdered probiotics, dried yeast, and fermented powders, are the dominant products due to their practical nature, shelf life, and a sample of use in different food products.

Producers are putting the focus on the production of top-quality dry fermented products retaining their beneficial properties during processing and storage. The multifunctional nature of dry types makes it possible to add them easily to FYR, snacks, and diet supplement products.

Based on the product category, amino acids are the top type of the fermented ingredients market, owning a market share of approximately 60.4% in 2025. Amino acids, the main substances that makeup proteins, are crucial for many bodily functions such as muscle growth, immune resistance, and hormone production.

The increasing realization of the significance of amino acids to health and well-being is the factor that is fueling their usage in the food and beverage sector. Manufacturers are now adding fermented amino acids to various products like protein powders, energy bars, and functional beverages as a response to the health-minded consumer base that is expanding.

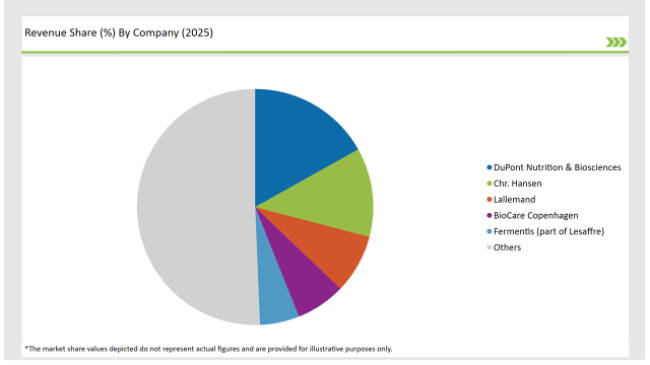

2025 Market Share of ASEAN Fermented Ingredients Manufacturers

Note: The above chart is indicative

Fermented products in the market are marked by fierce competition, with many participants fighting for market division in different sections. The main actors in the field such as DuPont, Chr. Hansen, BASF, Archer Daniels Midland (ADM), and Kerry Group control the market by using their powerful brand identity and far-reaching distribution networks to sell products to customers effectively.

The ASEAN Fermented Ingredients market is projected to grow at a CAGR of 11.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 4,532.2 million.

India are key Country with high consumption rates in the ASEAN Fermented Ingredients market.

Leading manufacturers include DuPont Nutrition & Biosciences, Chr. Hansen, Lallemand, BioCare Copenhagenthe key players in the ASEAN market.

Liquid, and Dry.

Amino Acids, Organic Acids, Biogas, Polymer, Vitamins, Antibiotics, and Industrial Enzymes

Food & Beverages, Pharmaceuticals, Paper, Feed, Others

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.