The ASEAN Dehydrated Onions market is set to grow from an estimated USD 106.3 million in 2025 to USD 197.5 million by 2035, with a compound annual growth rate (CAGR) of 7.1% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 106.3 million |

| Projected ASEAN Value (2035F) | USD 197.5 million |

| Value-based CAGR (2025 to 2035) | 7.1% |

The ASEAN dehydrated onions market continues on an upward trajectory since consumers now demand convenience foods while interest in ready-to-eat meals grows together with a home cooking trend.

The region has adopted dehydrated onions as essential food components for their extended stability and focused flavor which now play vital roles in numerous culinary processes. The market operates with diverse product lines which include onion flakes alongside powder and granules that serve industrial as well as retail customers.

The dehydrated onions market operates within an exclusive region across ten ASEAN nations. The dehydrated onion market gets sustained by three key ASEAN countries which include India, Malaysia and Thailand.

Market growth in dehydrated onions has been accelerated by the establishment of food processing enterprises and increasing opportunities for exports. E-commerce platforms enable consumers to easily purchase dehydrated onion products and this improves the market's penetration rate.

Health-conscious consumers support dehydrated onions due to their alternative status as healthier than fresh onions while providing convenience together with authentic taste. Organic dehydrated onions have increased in the marketplace because consumers prefer natural products thus expanding their market reach.

Technological advancements in processing methods together with novel packaging approaches will essential for forming how the ASEAN dehydrated onion market develops in the future.

Explore FMI!

Book a free demo

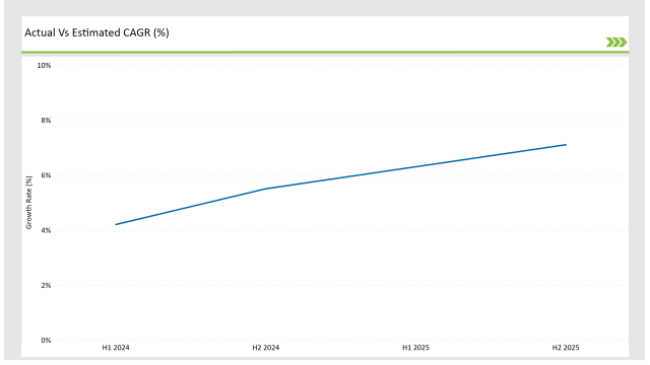

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Dehydrated Onions market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Dehydrated Onions market, the sector is predicted to grow at a CAGR of 4.2% during the first half of 2024, increasing to 5.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 6.3% in H1 but is expected to rise to 7.1% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | ABC Dehydration Co. expanded its production facility in Thailand to increase output of dehydrated onion products by 25%. |

| 2024 | Fresh Flavors Inc. partnered with local farmers in Vietnam to enhance the quality and sustainability of onion sourcing. |

| 2024 | Gourmet Ingredients introduced a new range of dehydrated onion blends tailored for traditional Indonesian dishes. |

| 2024 | Spice World implemented innovative packaging solutions in the Philippines to improve the shelf life of dehydrated onion products. |

Growing Demand for Convenience Foods

The market for convenient foods expanded substantially in recent times because people lead hectic lives and their dietary choices now favor quick solutions. Dehydrated onions are widely chosen by consumers because they offer extended shelf stability and effortless preparation capabilities in culinary preparations.

The dehydrated onions market experiences rising demand because of increasing ready-to-eat meals and instant food product adoption. Manufacturers select dehydrated onions as an ingredient to upgrade food taste since their usage requires no detailed preparation.

The urban population drives this market expansion because they prefer short and convenient food preparation options. The dehydrated onions market has an optimistic outlook since manufacturers will develop new products to respond to changing consumer desires.

Increasing Health Consciousness among Consumers

Consumers show increasing awareness about food nutrition because health consciousness has grown at an accelerated rate. Dehydrated onions give consumers both high nutritional content and ease of use so people view them as healthier compared to fresh onions.

The rising consumer demand for natural ingredients coupled with the clean eating movement has caused organic dehydrated onions to gain greater popularity in the market. Manufacturers are influenced by consumer health-oriented buying preferences to create products that match health-oriented objectives.

The demand for dehydrated onions continues to increase because of their usage in health-oriented recipes alongside wellness meal plans. The dehydrated onions market shows promising prospects because of the ongoing health and wellness trend while manufacturers prioritize openness and high-quality standards and nutritional advantages.

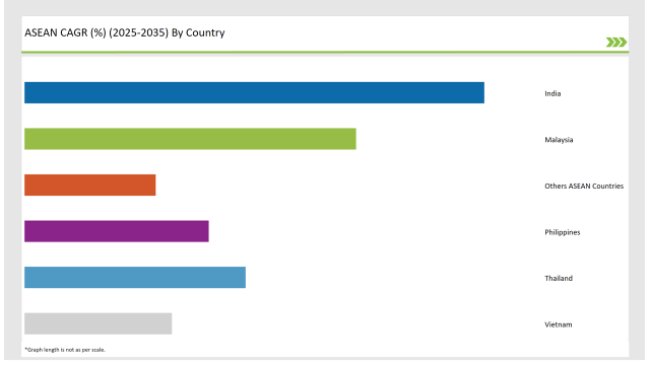

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

As a major onion producer worldwide India observes increasing demand in its dehydrated onions marketplace because of several reasons. The processed food and convenience market's increasing popularity has resulted in strong market growth for dried onion products because of the food processing industry development.

Indian dehydrated onions continue to expand their export potential abroad thus driving the market growth onward. Manufacturers can satisfy different consumer choices because red white and yellow onions are available to them.E-commerce platforms helped dehydrated onion products gain wider distribution thus bringing them closer to consumers.

The rise of health-oriented eating patterns motivates consumers to seek clean-label natural or organic dehydrated onions because it matches their dietary demands.

The dehydrated onions market in Malaysia has been expanding because Western food popularity is rising and consumers are increasingly adopting convenience foods. Consumers today live busy lives because of urbanization trends making them search for time-saving meal options.

The features of long storage shelf life and easy usage have established dehydrated onions as a preferred food item among consumers. The Malaysian food processing industry continues to develop while adding dehydrated onions to sauces along with soups and ready-to-eat meal products.

As Malaysian customers become more health-conscious they increasingly prefer food products which are natural and organic. The market demand for organic dehydrated onions grows because consumers wish to find healthier alternatives. Malaysia’s government benefits dehydrated onions through agricultural sector support and local produce promotion which enhances the market’s potential.

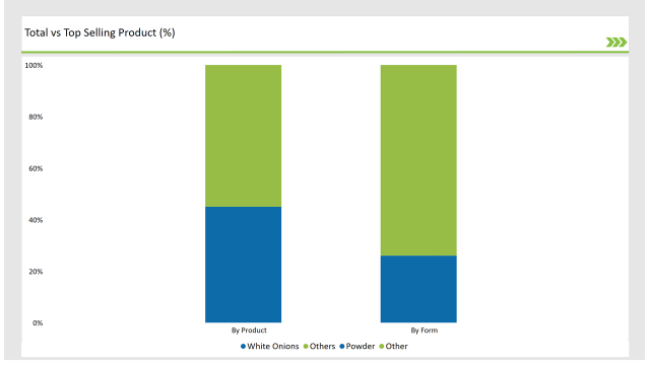

Natural dehydrated onions will prevail in the market due to their broad usability across different culinary preparations. People prefer these products because they maintain both flavor profile and valuable nutrients in addition to providing effortless usage. The modern market value of natural products continues to increase because health-conscious consumers actively seek clean-label products.

The market for dehydrated onions sees manufacturers dedicate their efforts to securing premium quality produce alongside making improvements to dehydration processes that result in superior products. The combination of home cooking popularity and ethnic cuisine trends creates expanding demand for natural dehydrated onions.

The dehydrated onion flake market has been increasing recently because consumers value the textured appearance of this product. Food manufacturers use dehydrated onion flakes as an ingredient for enhancing soup and stew and casserole dishes while eliminating the requirement for fresh-cut onions.

The rise of ready-to-eat meal products alongside meal delivery kits boosts the demand for onion flakes because they provide users with effective flavor additions without requiring fresh ingredients. Manufacturers dedicate their efforts to creating high-quality flakes that hold onion essentials such as aroma and flavor for mixing concurrence with the tastes of professional chefs and regular kitchen enthusiasts.

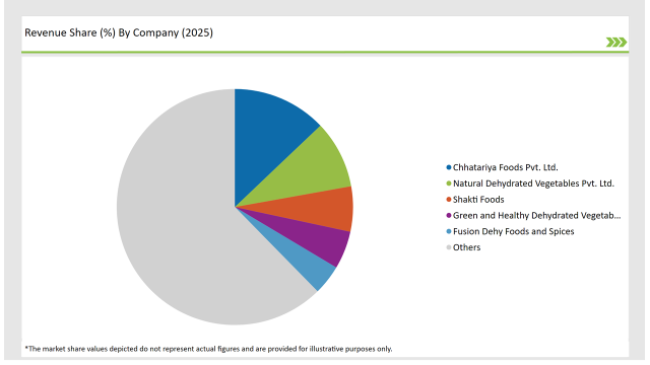

2025 Market Share of ASEAN Dehydrated Onions Manufacturers

Note: The above chart is indicative

Multiple important entities dominate the competitive environment of the dehydrated onions market in this region. Major organizations prioritize product improvements alongside quality elevation as well as sustainability strategies to establish better market positions.

The market now experiences rising competition due to both traditional companies who entered alongside fresh market participants which enables consumer’s access to various products.

The ASEAN Dehydrated Onions market is projected to grow at a CAGR of 7.1% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 197.5 million.

India are key Country with high consumption rates in the ASEAN Dehydrated Onions market.

Leading manufacturers Chhatariya Foods Pvt. Ltd., Natural Dehydrated Vegetables Pvt. Ltd., Shakti Foods, Green and Healthy Dehydrated Vegetables Food Co, Ltd in the ASEAN market.

White Onions, Red Onions, Pink Onions, Hybrid Onions

Chopped, Minced, Granules, Powder, Flakes, Others

Air Drying, Freeze Drying, Microwave Drying, Others

B2B (Direct), Food Service, Retail (B2C)

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

UK Sports Nutrition Market Report – Growth, Demand & Innovations 2025-2035

USA Sports Nutrition Market Trends – Demand, Size & Forecast 2025-2035

Australia Sports Nutrition Market Outlook – Trends, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.