The ASEAN Bakery Ingredient market is set to grow from an estimated USD 9,042.9 million In 2025 to USD 20,258.2 million by 2035, with a compound annual growth rate (CAGR) of 8.4% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 9,042.9 Million |

| Projected ASEAN Value (2035F) | USD 20,258.2 Million |

| Value-based CAGR (2025 to 2035) | 8.4% |

ASEAN (Association of Southeast Asian Nations) bakery ingredients market has been the fastest-growing market because of changing consumer preferences, urbanization, and the growing of the foodservice industry; they are all the driving forces of it.

With an increasing population of the region's urbanized people, the demand for fast, and ready-to-eat baked goods will be fulfilled by the bakery products. This situation is aggravated by the home baking trend, which has been of significance in the pandemic period, when people have been looking for good quality materials for cooking.

With this development, the foodservice operators are being forced to use premium bakery ingredients and to increase the quality and range of what they offer. Consequently, this has led to the uprising in the need for particular ingredients like flour, sweetener, emulsifier, and flavorings to the region's customers who are used to trying different foods.

The improvement of health and wellness knowledge is also impacting the behavior of consumers, which is resulting in the demand for healthier bakery products. Thus, the manufacturers are pushed to create innovative products such as organic, gluten-free, and low sugar ingredients, which are in demand and are purchased by health-conscious customers. Also, technological progress that makes it possible for producers to obtain high-quality raw materials is the reason of both home bakers and professional chefs evolving their needs.

Explore FMI!

Book a free demo

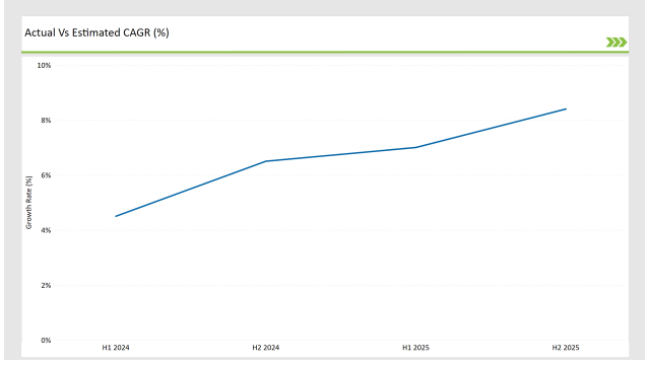

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Bakery Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Bakery Ingredients market, the sector is predicted to grow at a CAGR of 4.5% during the first half of 2024, increasing to 6.5% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 7.0% in H1 but is expected to rise to 8.4% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | General Mills launched a new line of organic flours aimed at health-conscious consumers in March 2024. |

| 2024 | Cargill expanded its portfolio by introducing a range of natural sweeteners for bakery applications in April 2024. |

| 2024 | Archer Daniels Midland (ADM) announced a partnership with local farmers to source high-quality grains for its bakery ingredients in May 2024. |

| 2024 | Baker Hughes introduced a new line of emulsifiers designed to improve the texture and shelf life of baked goods in June 2024. |

Growing demand for natural sweeteners

The bakery ingredients market is undergoing a substantial transformation due to the health and wellness trend that is reshaping while consumers are now highly leaning towards healthier products in their diets. ASEAN region is the most conspicuous area of observation to this transformation where increasing health consciousness is the main driver of demand for healthier diet constituents.

Consumers are looking for bakery products that are not only tasty but also pack health benefits which is why whole grain flours, natural sweeteners, and functional ingredients have become a mainstay in this field.

For example, there is a particular interest in natural sweeteners like stevia and monk fruit, which can provide sweetness without the calories that are related to the regular sugars. What is more, the choice of whole grain and high-dark type flours alongside this trend is increasing, as consumers learn more about the vital role that dietary fiber has in gut health.

Rise of home baking has emerged as a significant trend in the bakery ingredients market

Home baking has appeared as a remarkable trend in the bakery ingredients market. With the majority of people being at home, many found their way to home baking as a method of expression and also a tool to bond with the family.

The increased level of home banking activities that we are seeing nowadays has resulted in the need for more superior materials that are used in making bakery products through self-consumption. The trend has been absorbed by producers by adding their line of products aimed at home bakers.

The number of items on the market, including such niche products as specialty flours, baking mixes, and cake decorations, has increased remarkably. Businesses are also putting their money into marketing activities that are aimed at the consumer segment of home bakers by providing them with recipes, tips, and general inspiration that they can use to bake at home.

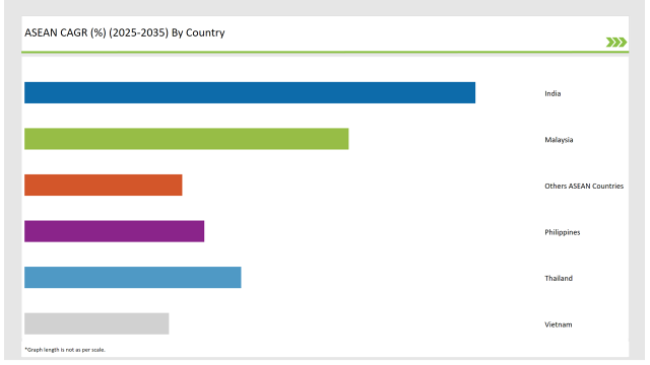

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The India market for bakery ingredients is ballooning at a fast pace, benefitting from a myriad of factors. The rising urban population and per capita income push the consumers to switch from traditional foods to the ready-made conglomerates that also include packed baked foods. Thus, more people want to buy only those products that are fully prepared for use.

Consequently, those consumers who demand high-quality bakery ingredients are increasing in numbers. On top of this factor is the fast-growing tendency of eating healthily among the Indians, which indeed affects the choice of their purchases.

There is a noticeable increase in the consumption of bakery products which are made healthier, and the manufacturers are therefore taking the lead by providing more and more of the ingredients that are organic, whole grain, and low in sugar. The change is clear, for instance, the increasing use of whole wheat flour and natural sweeteners, as the people are now more conscious of the health advantages of these foods.

As the lifestyle changes and preferences of consumers are directed the growth of the bakery ingredients market in Malaysia, this sector is primarily on the way of achieving huge success. The rising middle class, which demands more convenience foods, is the main reason for the increase in the consumption of baked goods.

People want to prepare meals easier and faster, so they look for quality bakery ingredients thus their demand goes up. The food market has seen new brands of bakery raw materials that align with the eating habits of locals, thus, further driving the market.

The health and wellness movement is also one factor contributing to the changes in the tastes of consumers in Malaysia. A larger number of people are becoming more aware of their health so the demand for bakery items produced with no additives and organic ingredients has risen. Consequently, this has driven the manufacturers to create and offer products that have low gluten, less added sugars, and extra health benefits.

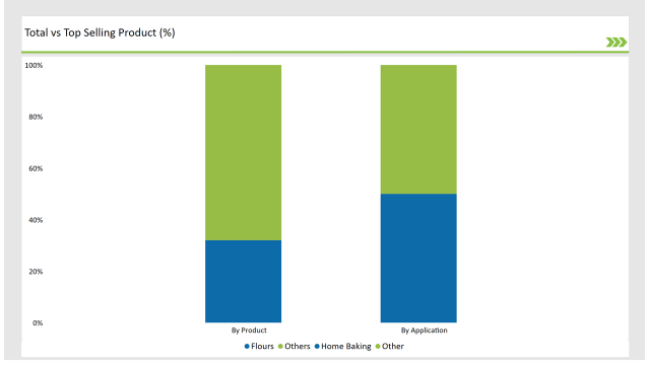

The bakery ingredients market sees flours as the leading members, making up a significant part of the whole market. They are the starting point for nearly all kinds of baked goods, for instance, bread, pastries, cakes, and cookies.

Nowadays, as consumers are looking for varied options for their baking, the demand for different types of flour such as all-purpose flour, whole wheat flour, and specialty flours (almond and coconut flour for example) is growing rapidly. The demand for whole grain and specialty flours is primarily driven by the growing health concerns of the consumers.

Whole wheat flour, for instance, is becoming more popular because of its nutritional value being high as compared to the refined flours. People are now recognizing the significance of dietary fiber and are intentionally looking for the foods that enhance their health. This phenomenon is especially present in markets such as India and Malaysia, where baking customs are altered by people to make them more wholesome.

The presence of ready-to-drink (RTD) Bakery Ingredients has seen an upsurge due to their convenience and availability in the market. With the increasing number of people leading busy lifestyles, the consumers are now more on the lookout for beverages that do not require any preparations and which they can have on the go. RTD malt beverages are the most suitable answer for that, as they provide a straightforward and rapid option for people wanting to enjoy the refreshing drinks without the need for mixing or preparation.

Nothing can beat the popularity of RTD malt beverages in cities where people are always on the run and look for the easiest of solutions. Manufacturers who recently noticed this trend are introducing new flavors and marketing of RTD malt beverages in cans and bottles. Thus consumers can have it their way by the selection of products they desire.

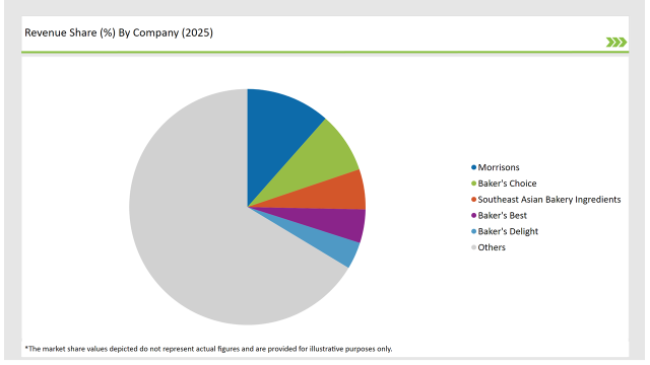

2025 Market Share of ASEAN Bakery Ingredients Manufacturers

Note: The above chart is indicative

The home baking segment is developing very rapidly in the bakery ingredients market, as a result of the growing consumer interest in baking at home. The pandemic has been a crucial factor in this trend since many people used baking as both a creative outlet and a medium to bond with their families.

This aspect of home baking has resulted in the demand for quality bakery ingredients to a large extent, as people wish to create the same flavors and textures that they are accustomed to in professional baked goods in their own kitchen.

The ASEAN Bakery Ingredients market is projected to grow at a CAGR of 8.4% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 20,258.2 million.

India are key Country with high consumption rates in the ASEAN Bakery Ingredients market.

Leading manufacturers Asia Morrisons, Baker's Choice, Southeast Asian Bakery Ingredients in the ASEAN market.

Flours, Sweeteners, Leavening Agents, Fats and Oils, and Others

Commercial Baking, Home Baking, and Industrial Baking

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

USA Aqua Feed Additives Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.