The ASEAN Allergen Free Food market is set to grow from an estimated USD1,381.8 million in 2025 to USD 4, 372.9 million by 2035, with a compound annual growth rate (CAGR) of 12.2% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 1,381.8 Million |

| Projected ASEAN Value (2035F) | USD 4,372.9 Million |

| Value-based CAGR (2025 to 2035) | 12.2% |

The ASEAN allergen-free food market is going through tremendous growth, largely due to the increasing consumer awareness of food allergies and intolerances. As the number of people knowing about the health risks posed by allergens is increasing, people are searching for allergen-free items that are available in the areas.

This is a tendency particularly visible among parents having kids with food allergies, who in turn seek safe and nutritious food for their families. The market in question includes an extensive variety of products, such as gluten-free, dairy-free, nut-free, and soy-free foods, so as to meet the demands of different diets.

The rising rates of food allergies and intolerances, combined with the larger and larger portion of health undertaker customers, are the main driving forces on the sales of such foods. On top of that, the arrival of health and wellness has been the driving force of the switch clean-label and driving the market even further.

Explore FMI!

Book a free demo

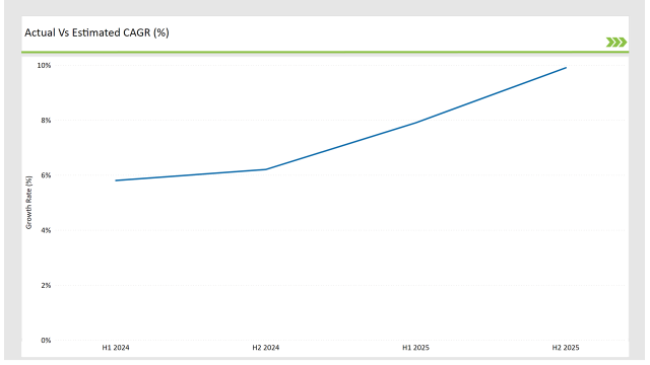

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Allergen Free Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Allergen Free Food market, the sector is predicted to grow at a CAGR of 4.8% during the first half of 2024, increasing to 5.7% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 6.8% in H1 but is expected to rise to 9.8% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Enjoy Life Foods launched a new line of allergen-free snacks made with natural ingredients to cater to health-conscious consumers. |

| 2024 | Free2b Foods introduced a new range of nut-free chocolate products, expanding their allergen-free offerings. |

| 2024 | Daiya Foods announced the launch of a new line of dairy-free cheese alternatives that are free from common allergens, targeting consumers with dietary restrictions |

| 2024 | Banza expanded its product line by introducing allergen-free pasta made from chickpeas, appealing to gluten-sensitive consumers. |

Increasing Awareness of Food Allergies and Intolerances

The steady increase in the number of people diagnosed with food allergies and the need for safe and nutritious food choices has undoubtedly made the allergen-free food market a vital trend. The demand for food allergy alternatives has notably become a priority, notably in the ASEAN region where the food allergies cases have been increasing, thus consumers are calling for taller and allergen-free products.

the rise in the media interest and information campaigns on food allergies has led to increased awareness among the public, thus prompting the consumers to be more careful in monitoring the ingredient labels and allergic information.

Demand for Clean Label and Natural Products

The pressing demand for clean label and natural products is yet another key trend shaping the allergen-free food market. Health-conscious consumers are seeking more and more products that are free from artificial additives, preservatives, and allergens.

This trend is especially noticeable in the ASEAN region which is the active consumers who laid greater emphasis on the transparency of food labeling and ingredient sourcing. Manufacturers react to this demand by reformulating the products to contain natural substances and to eliminate allergens. The clean label movement mainly explains that only simple, recognizable ingredients should be used in food products.

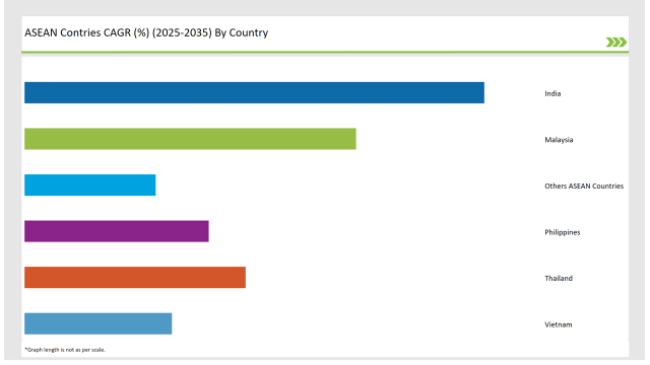

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

One of the fastest-growing sectors is the allergen-free food market in India, which is mainly fueled by consumers' growing knowledge of food allergies and intolerances and their purchasing power. As more people are being identified with food allergies, they are looking for safe and nutritious food alternatives, and this factor has been gradually becoming the trend.

The trend towards this is present primarily among parents of children with food allergies who want to ensure the health and safety of their families and are thus, seeking allergen-free products. The expansion of health care consciousness among the citizens of India is also aiding in the progress of the allergen-free food sector.

People are realizing the necessity of nutrition and are looking for the products that are in tune with their environmentally friendly practices and dietary restrictions. The result has been the marked increase in the number of allergen-free products available in supermarkets, health food stores, and even online platforms.

The food market for allergen-free products in Malaysia is on a growth trajectory and its success is driven by the steady increase in the number of consumers who are conscious of food allergies and intolerances. The rise in health consciousness in the Malaysian populace has resulted in the demand for allergen-free products, which are designed for people with specific dietary needs.

One major group of such customers is the parents of children who have food allergies and who are the ones the most actively concerned about their health. The Malaysian government is completely unfazed by food safety issues, has joined hands with the private sector through various marketing initiatives, and is fostering the development of allergen-free products to assure the health and safety of consumers.

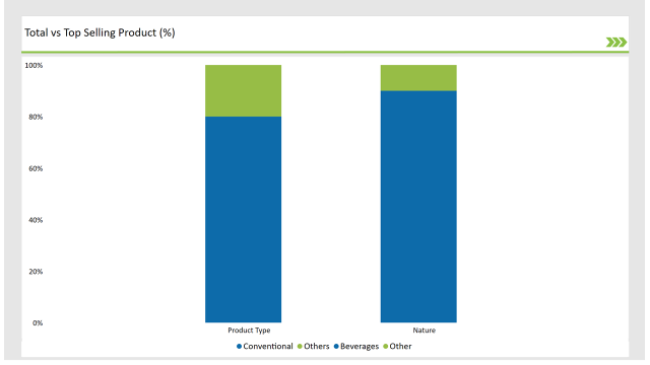

Mainstream allergen-free products are the principal players in the market as they comprise a noticeable portion of the total allergen-free food market. The key factor for this is the high availability and recognition of conventional products among the consumers. A considerable number of customers opt for the conventional allergen-free version as it is mostly regarded as a more practical and cheaper option than specialty products.

Conventional products that are free from certain allergens are especially sought after by families whose children have food allergies, with parents who wish to offer their children safe and healthy food options. Normally, allergen-free traditional products like gluten-free bread, dairy-free beverages, and nut-free snacking items are stocked in supermarkets and health food stores which are readily available for the consumers.

Beverages currently represent the main segment in the allergen-free food market as they hold a major percentage of total market volume. The rising customer demand for allergen-free drinks has made beverages take the lead in this market segment.

People now prefer plant-based milks as well as juices and functional beverages for their health benefits. Consumers who follow vegan diets and practice plant-based eating have increased the market demand for allergen-free beverages because they want alternative beverage options beyond traditional dairy together with other allergenic substances.

Consumers who suffer from lactose intolerance as well as nut allergies and gluten sensitivities specifically want allergen-free drinking products. Plants like almonds soybeans and oats now serve as healthful dairy milk substitutes that people widely buy for use in various homes. Consumers prefer functional beverages which provide hydration benefits together with nutrient additions because these provide both convenience and health benefits.

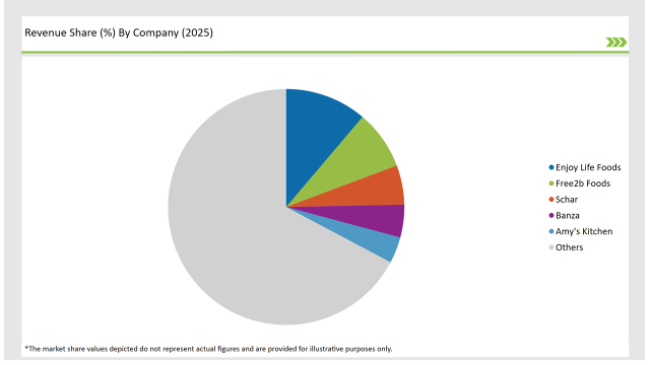

2025 Market Share of ASEAN Allergen Free Food Manufacturers

Note: The above chart is indicative

Multiple major companies operate in the allergen-free food market as the market shows strong competition for market share. Competitive market leadership comes from major companies such as Enjoy Life Foods alongside Free2b Foods, Daiya Foods, Banza and Simple Mills which use their combined experience together with inventive products and extensive distribution capabilities.

The ASEAN Allergen Free Food market is projected to grow at a CAGR of 12.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 4,372.9 million.

India are key Country with high consumption rates in the ASEAN Allergen Free Food market.

Leading manufacturers Gardenia Bakeries, Bread Talk, The Baker's Cottage, Allergen Free Food & Co. in the ASEAN market.

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Children’s Health Supplement Market Analysis by Product Type, Application and Age Group Through 2025 to 2035.

Hyaluronic Acid Supplement Market Product, Type, Application, Distribution Channel and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.