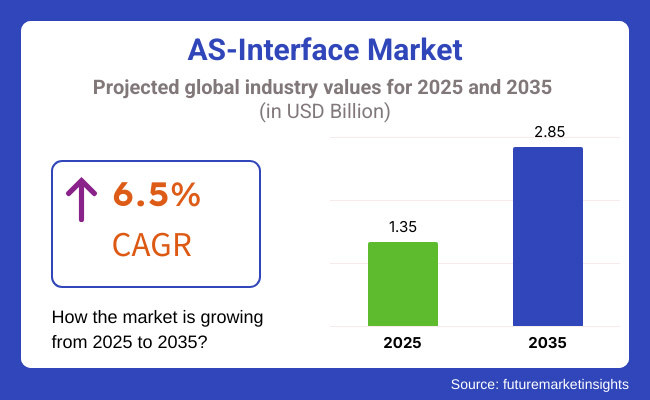

The AS-interface Market is expected to grow steadily from 2025 to 2035, with the growing adoption of industrial automation, smart manufacturing, and the need for efficient networking solutions across industries. The market is anticipated to grow from USD 1.35 billion in 2025 to USD 2.85 billion by 2035, with a compound annual growth rate (CAGR) of 6.5% during the forecast period.

The AS-interface (Actuator Sensor Interface) technology is frequently applied to low-cost, simple communication between sensors, actuators and control systems in a manufacturing context. The quest for Industry 4.0, smart factories and the ongoing progress in process automation have given an enormous upsurge to the adoption of AS-interface solutions.

They offer benefits like reduced wiring complexity, increased efficiency, safety improvements, and lower maintenance cost, which makes them very appealing in numerous sectors such as automotive, manufacturing, energy, and logistics.

Further expansion of the market is supported by regulatory initiatives governing industrial digitization, compliance with safety standards, and energy-efficient automation solutions. Moreover, the adoption of increasingly integrated edge computing, IoT, and real-time monitoring systems with AS-interface networks are increasing their adoption across different industrial applications.

Still, there are challenges that also pose need for strategic solutions, including compatibility and interoperability challenges with other communication protocols, potential security risks from cyber-attacks, and workforce development to handle bankruptcies and layoffs.

To overcome these challenges and maximize market opportunities, market players are engage in optimizing their existing AS-interface protocols through advanced upgrades, improving cybersecurity, and providing seamless integration with Industry 4.0 systems.

Explore FMI!

Book a free demo

North America dominates the AS-interface (AS-I) market share owing to the significant presence of industrial automation, smart manufacturing, and the rising adoption of Industry 4.0 technologies. The USA and Canada are leading the AS-I market in this region, with a major investment by key AS-I developers to make the solution efficient, simpler wiring, and plan optimization.

Market growth is driven by the increasing demand for industrial networking solutions across sectors like automotive, food & beverages, and pharmaceuticals. The focus towards Downtime reduction and Operational safety increase are also contributing to the AS-I adoption.

However, integration with existing legacy systems and cybersecurity concerns can present challenges. To overcome these challenges and ensure continuous growth in the market, North American industries are actively investing in advanced automation and interoperability solutions.

Countries such as Germany, France and Italy are well-known core markets of AS-interface technology, as they are characterized by an extensive level of industrial automation and a high degree of factory digitalization and are thus the favourite segments for AS-interface technology. This is attributable to the robust presence of major automation companies along with government initiatives promoting smart industries.

Demand for AS-I in manufacturing, logistics, and process industries continues to grow as strict safety regulations and energy-efficient automation solutions push it. Also, the EU's sustainability focus motivates the use of AS-I in green production settings.

Challenges of AS Integration in Industrial Automation as mentioned earlier, the integration of AS-I in various industrial communication protocols has complexities. To secure their global automation leadership, European manufacturers place their bets on pioneering technologies and system interoperability.

The Asia-Pacific region is leading the AS-interface market in terms of growth due to the rapid industrialization, growing manufacturing sectors, and rising investment deployments in automation for the countries, such as China, Japan, South Korea, and India. Demand for AS-I well is driven by the region's strong emphasis on smart factories and industrial IoT adoption.

Market growth is primarily attributed to the increasing demand for economical, high volume networking technologies from electronics, automotive, and consumer goods industries. AS-I adoption is supported by government initiatives as well, making the way for industrial automation and digital transformation.

Nevertheless, calamities due to lack of standardization, as well as the demand for skilled professional in automation technologies could impede market growth. The future growth of the AS-I market in the region will substantially be fuelled by initiatives to design more integrated AS-I solutions, and improve compatibility with various communication protocols.

Limited Data Transmission Speed and Network Complexity

First, AS-interface is limited to a data communication rate of 167 KBps, which limits its usefulness compared with more capable industrial communication protocols. AS-interface (AS-I) is a well-established protocol for low-speed, simple sensor-actuator applications but does not meet the needs of high-speed data-intensive processes, which explains its low adoption rates in complex industrial automation settings.

Furthermore, the integration of AS-interface with other industrial communication networks can lead to compatibility and network management challenges. By uniting AS-interface with higher level industrial Ethernet systems, able to does so by eliminating barriers within the broad spectrum by ultimately linking technology through constant protocol updates, extending compatibility and hybrid network solutions.

Rising Adoption of Industry 4.0 and Smart Manufacturing

There is a massive opportunity for AS-interface market due to the growing trend of Industry 4.0, and smart manufacturing. AS-interface is a cost-effective, yet efficient tool to move the industry closer to automated devices.

By implementing IoT smart sensors, diagnostics powered by AI, and predictive maintenance solutions, AS-interface overall has immense potential in industrial automation for the future. Focusing on these areas expanding AS-interface capabilities, improving data integration and meeting seamless compatibility with Industry 4.0 framework - will give them a competitive edge.

The AS-interface market is expected to grow at a rate between 2020 and 2024, as demand for simplified wiring, cost-effective automation solutions, and growing factory automation endeavours drive growth in this field. The market witnessed developments in safety networking, better power distribution and enhanced connectivity of devices. Yet, constraints like data speed limitations and challenges in integration with advanced communication protocols continued to hinder widespread adoption.

In 2025 to 2035, transforming AS-interface market is anticipated due to the uplifted functionalities through AI driven diagnostics, improved cybersecurity mechanism and hybrid industrial networking paradigm.

The demand for AS-interface solutions and the functionality will further increase due to the megatrends such as smart factories, digital twins and edge computing. Also, sustainable automation programs and energy-economical networking techniques enables the market know-how to broaden.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Growing focus on industrial safety compliance |

| Technological Advancements | Improvements in safety networking and device connectivity |

| Industry Adoption | Increased adoption in manufacturing and process industries |

| Supply Chain and Sourcing | Dependence on traditional wiring and hardware solutions |

| Market Competition | Dominated by established automation solution providers |

| Market Growth Drivers | Demand for cost-effective sensor-actuator communication |

| Sustainability and Energy Efficiency | Early-stage energy-efficient automation solutions |

| Integration of Smart Monitoring | Basic diagnostic and fault detection capabilities |

| Advancements in Industrial Networking | Limited integration with advanced communication protocols |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized global safety protocols and cybersecurity integration |

| Technological Advancements | AI-driven diagnostics, edge computing, and predictive analytics |

| Industry Adoption | Wider implementation in smart factories, logistics, and energy sectors |

| Supply Chain and Sourcing | Transition to wireless and hybrid networking solutions |

| Market Competition | Rise of innovative AS-interface applications in Industry 4.0 environments |

| Market Growth Drivers | Expansion in smart manufacturing, digital twins, and industrial IoT |

| Sustainability and Energy Efficiency | Full-scale adoption of sustainable networking and low-power automation systems |

| Integration of Smart Monitoring | AI-powered real-time monitoring, self-healing networks, and predictive maintenance |

| Advancements in Industrial Networking | Seamless connectivity with industrial Ethernet, IoT frameworks, and cloud-based automation |

Industrial automation and smart manufacturing are gaining traction leading to the growth of AS-interface in the US. Market growth is driven by the increasing requirement for cost-effective and efficient networking solutions across automotive, food & beverage, and pharmaceutical sectors.

Additionally, government initiatives promoting Industry 4.0 and smart factories have motivated manufacturers to adopt AS-interface systems into their systems. Demand for AS-interface solutions continues to grow steadily, thanks to the presence of key automation technology providers in the country as well as investments in ongoing digital transformations.

Additionally, increasing need for robust and easy wiring solutions in complex automation scenarios anticipated to drive the growth of the market over the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

The AS-interface market in the United Kingdom is steadily growing owing to the increasing focus on industrial automation, efficiency improvement, and cost reduction in manufacturing. AS-interface the demand for reliable, decentralized control solutions such as AS-interface is further accelerated by the widespread adoption of Industry 4.0 and the expansion of smart factory initiatives.

In the UK, automotive and aerospace sectors are utilizing AS-interface networks to facilitate communication pathways and assist operations. In addition, AS-interface technologies in this region are being driven by the focus on energy efficiency and sustainability in manufacturing processes, such as the gradual transition from decentralized to integrated and low-power automation solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.9% |

AS-interface Market Scope: Europe persist as the countries in AS-interface market owing to industrial automation in various portfolios and strict regulations regarding workplace safety & operational efficiency. Germany, France, and Italy are among the countries embracing AS-interface in their manufacturing, robotics, and material handling sectors.

Continuous advancements in AS-interface technology in the region have been propelled by the presence of a significant number of established automation & industrial communication solution providers in the EU.

In addition, the trend toward energy consumption reduction as well as the desire to reduce wiring complexity in industrial networks is driving the demand for AS-interface-enabled systems. The increasing focus on the development of smart cities, intelligent transport systems, and energy-efficient industrial solutions in the region will also aid market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.0% |

As industries are drawn to automation and digital manufacturing techniques, Japan’s AS-interface market is growing. AS-interface solutions allow for efficient, decentralized control and real-time data transfer, benefiting Japan’s long-established automotive, electronics, and semiconductor industries. Japan has embraced wide-ranging factory automation and advanced robotics, and as a result, AS-interface systems are increasingly integrated into many industrial applications.

Moreover, the need for compact and cost-effective networking solutions to boost production efficiency for a competitive advantage is expected to spur market growth. Smart automation technologies are also increasingly being adopted in order to reduce downtime and optimize maintenance processes, thereby driving further growth in demand for AS-interface in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

The AS-interface market in South Korea is growing rapidly, owing to the strong focus of the country on industrial automation, integration with IoT, and smart manufacturing. Growing demand from the semiconductor, electronics, and heavy machinery sectors is driving up demand for AS-interface technology. Rise in investments from the government side on digital transformation and smart factory initiatives are also supporting the acceptance of advanced industrial networking solution.

Moreover, as industrial automation processes become more complex, there is an increasing demand for simple, economical, and flexible communication between devices, which is where AS-interface comes in. As industrial connectivity and process automation in this country continues to develop at a rapid pace, the demand for AS-interface technology will steadily increase.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

AS-I Gateway/Master segment holds the major share of AS-interface (AS-I) Market owing to its importance in network management, data processing, and communication efficiency. It serves as a crucial link, managing the flow of information between AS-I slaves and more advanced automation systems, thus allowing for smooth data transfer and more effective real-time process management.

The growing adoption of Industry 4.0, smart manufacturing, and industrial automation has likewise created demand for AS-I master units as they offer more efficient field device integration, diagnostic capabilities, and centralized control in manufacturing plants.

This means that the companies are looking for, at the same time, advanced AS-I gateways with Ethernet compatibility, one and all with integrated PROFINET, Modbus, etc., a complete solution for interconnection with PLCs, SCADA, and other industrial control systems. The gateways respectively minimize wiring, promote energy efficiency as well as flexibility in the entire system, which makes them a prominent choice in industries like factory automation, robotics, material handling, and process sectors.

Further, AS-I gateway solutions provide enhanced cybersecurity to communication which is driving their adoption across different industries on the global front. Furthermore, these technologies are being adopted on a larger scale as industries globally are undergoing digitalization, predictive maintenance, and AI are playing their role in driving automation which is likely to boost the demand for AS-I Gateway/Master components, making them an integral segment contributing to the growth of AS-interface Market.

AS-interface Market segment by Application (Material Handling, Process Automation, and Factory Automation). The largest share of the AS-interface market by application in the AS-interface Market is attributed to the material handling segment which is primarily due to increase in automated logistics and warehouse operations as well as smart supply chain management.

The AIAS technology is also used in optimizing conveyor systems, sorting mechanisms, AGVS and robotic arms. With AS-I networks for direct communication and real-time operational management, industries like automotive, e-commerce, food and beverage and pharmaceuticals invest in intelligent, high-speed material handling automation solutions.

Especially when you think of automated warehouses and fulfilment centres in smart factories and industrial 4.0, the absolute precision, scalability, and interoperability of the entire system must be secured, so the use of AS-I technology is increasing. To tackle large-scale material handling systems AS-I networks offer inexpensive wiring, easy installation and improved diagnostic capabilities.

Also driving the market growth is the increased penetration of artificial intelligence (AI), Internet of Things (IoT) and cloud-based analytics in AS-I-enabled logistics solutions that help enable predictive maintenance, operational transparency and asset tracking.

The advent of automation, efficiency, and cost-effective supply chain management will continue to hold substantial supremacy in the Material Handling segment, emerging as a key driver of AS-interface market growth.

The AS-interface Market is exhibiting a strong growth spectrum having quick adoption of industrial automation, advancements of Industry 4.0, and increasing requirement of efficient networking of the manufacturing environment. AS-interface is designed to make communication in the industrial realm easier and less complex.

Increasing demand for the protocol in facilitating seamless communication between field devices, reducing wiring complexity, and improving the overall reliability of the system is expected to drive the market. In IoT Integration and Diagnostics: Innovations and Safety Measures in AS-interface

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Siemens AG | 20-24% |

| Pepperl+Fuchs | 16-20% |

| Bihl+Wiedemann | 12-16% |

| IFM Electronic | 10-14% |

| ABB Ltd. | 8-12% |

| Other Industry Players (Combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Siemens AG | Offers advanced AS-interface solutions with integrated safety and diagnostics for industrial automation. |

| Pepperl+Fuchs | Specializes in AS-interface networking solutions for hazardous environments and process industries. |

| Bihl+Wiedemann | Develops AS-interface gateways, safety monitors, and diagnostic tools for industrial connectivity. |

| IFM Electronic | Provides AS-interface-based sensor solutions and decentralized control systems for smart manufacturing. |

| ABB Ltd. | Focuses on integrating AS-interface with digital automation platforms, enhancing interoperability and efficiency. |

Key Company Insights

Siemens AG (20-24%)

Siemens AG leads the AS-interface market with cutting-edge industrial networking solutions, offering high-performance automation systems, integrated diagnostics, and enhanced safety features. The company’s emphasis on digital transformation strengthens its market position.

Pepperl+Fuchs (16-20%)

Pepperl+Fuchs specializes in AS-interface technology for hazardous areas and industrial safety applications, with a focus on robust and reliable networking solutions.

Bihl+Wiedemann (12-16%)

Bihl+Wiedemann is a key player in AS-interface innovation, developing high-performance gateways, safety modules, and communication tools to optimize industrial automation systems.

IFM Electronic (10-14%)

IFM Electronic focuses on sensor-based AS-interface solutions, offering decentralized control systems and real-time monitoring capabilities for smart factories.

ABB Ltd. (8-12%)

ABB Ltd. integrates AS-interface with digital automation platforms, enhancing system interoperability and energy efficiency for industrial applications.

Other Key Players (25-30% Combined)

The AS-interface market continues to grow with innovations in industrial automation, smart sensors, and IoT-enabled networking solutions. New entrants and innovators driving market growth include:

The overall market size for the AS-interface market was USD 1.35 billion in 2025.

The AS-interface market is expected to reach USD 2.85 billion in 2035.

The AS-interface market is expected to grow at a CAGR of 6.5% during the forecast period.

The demand for the AS-interface market will be driven by increasing industrial automation, rising adoption of smart manufacturing, growing demand for cost-effective and efficient networking solutions, advancements in sensor technology, and expanding applications in logistics and material handling.

The top five countries driving the development of the AS-interface market are the USA, Germany, China, Japan, and South Korea.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.