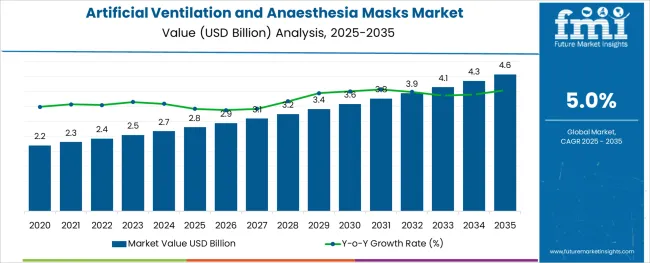

The Artificial Ventilation and Anaesthesia Masks Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The artificial ventilation and anaesthesia masks market is experiencing consistent growth due to the increasing demand for precision-driven respiratory support and the rising volume of surgical interventions across both developed and emerging healthcare systems. Advancements in mask ergonomics, material safety, and airtight sealing technologies have improved patient comfort and clinical outcomes.

The growing prevalence of respiratory conditions, particularly among aging populations, along with the expansion of intensive care units and surgical departments, has reinforced the need for reliable anaesthesia delivery solutions. Regulatory emphasis on patient safety and infection control is prompting hospitals to adopt single-patient-use masks and sterilizable components.

As surgical care becomes more specialized and perioperative risks become more actively managed, the market is projected to expand steadily, driven by demand for customizable and procedure-specific respiratory interfaces.

The market is segmented by Application and Risk of Procedure and region. By Application, the market is divided into Operation Room, Intensive Care, Emergency Room, Dental, and Home Care. In terms of Risk of Procedure, the market is classified into High-Risk Patients, Moderate-Risk Patients, and Standard Patients. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

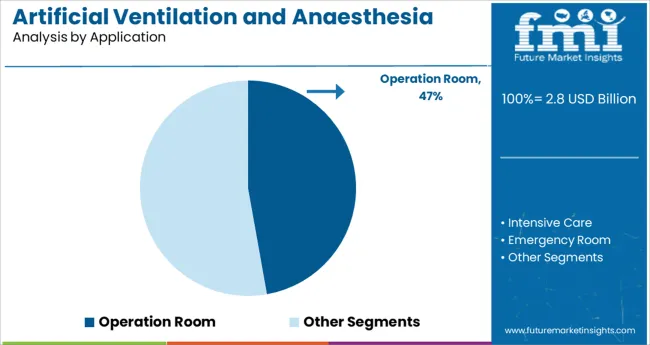

The operation room segment is expected to contribute 47.20% of the total market revenue by 2025 within the application category, making it the leading segment. This growth is being supported by the increasing number of surgical procedures requiring controlled ventilation and precise anaesthetic delivery.

Operation rooms demand high performance respiratory interfaces to ensure uninterrupted oxygenation and anaesthetic administration throughout the procedure. Healthcare facilities are prioritizing masks that offer enhanced sealing, minimal leakage, and compatibility with advanced ventilators and monitoring systems.

The critical nature of maintaining airway security during surgery has led to the standardization of high quality anaesthesia masks in operative settings. As surgical complexity and volume continue to rise, the operation room segment remains the central focus for innovation and investment in this market.

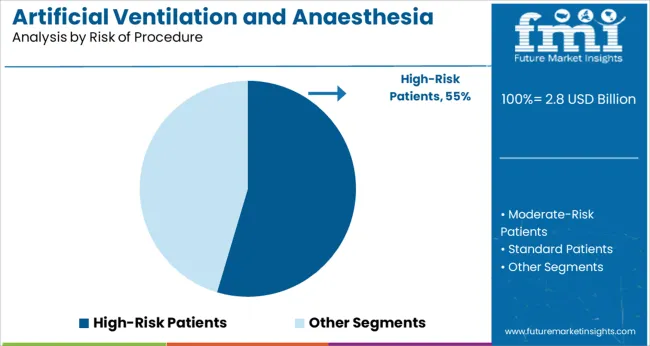

The high risk patients segment is projected to hold 54.60% of the total market revenue by 2025 under the risk of procedure category, positioning it as the dominant segment. This is driven by the growing clinical need to manage respiratory challenges in patients with compromised health conditions, including cardiovascular disease, obesity, pulmonary disorders, and geriatric vulnerabilities.

High risk cases demand specialized anaesthesia and ventilation solutions that reduce the likelihood of perioperative complications. Healthcare providers are increasingly investing in patient specific mask designs that offer optimal fit and minimal dead space, enabling accurate gas exchange and reducing the risk of aspiration.

The presence of comorbidities and the need for closely monitored anaesthetic administration reinforce the adoption of advanced mask technologies in high risk surgical and critical care scenarios. As the burden of chronic illness increases globally, the high risk patients segment is expected to sustain its lead within the artificial ventilation and anaesthesia masks market.

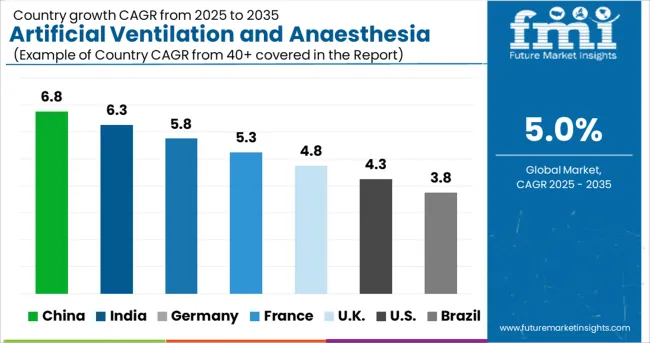

North America holds the largest market for Artificial Ventilation and Anaesthesia Masks. From 2020 to 2024, the North American Artificial Ventilation and Anaesthesia Masks market experienced a CAGR of 5.3% and is projected to see a CAGR of 4.7% in the next ten years.

According to a study an American is expected to get seven operations done on average in his or her entire lifetime and the number of the USA patients who get any kind of complication from surgery is around 1.5 million thus, increasing the demand for Artificial Ventilation and Anaesthesia Masks.

Another key driving factor in the North American Artificial Ventilation and Anaesthesia Masks Market is the increasing rates of chronic diseases and surgeries in Canada. Approximately 31 out of 100,000 Canadians die from chronic respiratory diseases, as per 2024 reports. And around 2 million surgeries are performed in Canada every year. All these factors are driving the Artificial Ventilation and Anaesthesia Masks Market in North America.

The United States has the largest market for Artificial Ventilation and Anaesthesia Masks, which is projected to reach a valuation of USD 4.6 billion by 2035. From 2020 to 2024, the market in the United States grew at a CAGR of 4.8%. Between 2025 and 2035, the United States is expected to be a market with a USD 509.3 million absolute dollar opportunity.

In the United States, every year 5 million people are admitted to ICUs. The number of Americans that were affected by chronic sleep disorders as per a report published by the National Sleep Foundation in 2012. This is expected to increase the demand for Ventilation Equipment and Anaesthesia Masks in the next ten years as these patients are more likely to visit the emergency department and intensive care unit.

Another reason which is helping in boosting the United States Artificial Ventilation and Anaesthesia masks Market is the introduction of The Affordable Care Act by The United States as more patients are now encouraged to opt for surgical treatments.

China’s market is still in the budding stage. China’s Market is projected to reach a valuation of USD 280.4 million by 2035. From 2020 to 2024, the market in China grew at a CAGR of 4.3%. Between 2025 and 2035, China is expected to be a market with a USD 2.7 million absolute dollar opportunity. In 2024, critical care artificial ventilators and anaesthesia masks made up more than 70% of the overall artificial ventilators and anaesthesia masks market in China.

A key reason for the growth of the Artificial Ventilation and Anaesthesia Masks Market in China is the growing older population in the country. The older population in China is expected to reach 2.8 million by the year 2025, as per the United States Census Bureau. This provides ample opportunities for players in the Artificial Ventilation and Anaesthesia Masks Market. China also exported the most number of Artificial Ventilators and Anaesthesia Masks worldwide, during the pandemic. China exported 16,000 artificial ventilators and anaesthesia masks in just one month during the pandemic.

In 2024, the leading players in China’s Artificial Ventilation and Anaesthesia Masks were Getinge AB, Dragerwerk AG & Co KGaA, Nihon Kohden Corp and Hamilton Medical AG.

The Market for Artificial Ventilation and Anaesthesia Market in Japan is expected to experience a CAGR of 3.4% in the next ten years with an absolute dollar opportunity of USD 64.8 million. By 2035, the Japanese market for Artificial Ventilation and Anaesthesia Market is expected to be worth USD 226.1 million.

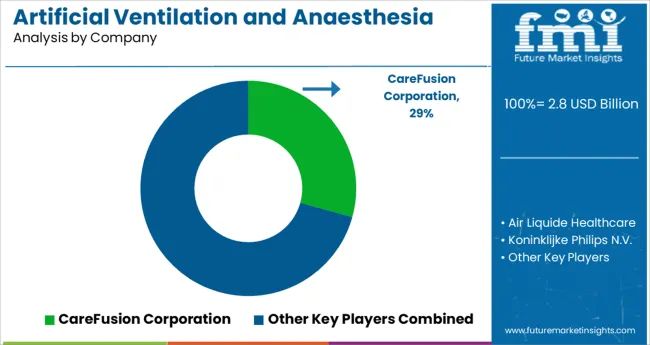

Artificial Ventilation and Anaesthesia Masks market is moderately competitive and has numerous players. Many key companies are now focusing on collaborating on new research and development activities.

The key companies operating in the Artificial Ventilation and Anaesthesia Masks Market are CareFusion Corporation, Air Liquide Healthcare, Koninklijke Philips N.V., Fisher and Paykel Healthcare, ResMed, Ambu A/S, Acutronic Medical Systems, GaleMed, HOFFRICHTER GmbH and Dragerwerk SA.

Some of the recent developments by the key providers of Artificial Ventilation and Anaesthesia Masks are as follows:

The global artificial ventilation and anaesthesia masks market is estimated to be valued at USD 2.8 billion in 2025.

It is projected to reach USD 4.6 billion by 2035.

The market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types are operation room, intensive care, emergency room, dental and home care.

high-risk patients segment is expected to dominate with a 54.6% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Artificial Ear Simulator Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Retail Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (AI) in Automotive Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Healthcare Market Size, Growth, and Forecast for 2025 to 2035

Artificial Intelligence In Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Artificial Pancreas Device Market Size and Share Forecast Outlook 2025 to 2035

Artificial Flower Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Artificial Preservative Market Outlook by Product, Type, Form, End Use Application and Others Through 2035

Artificial Hair Integration Market Growth - Trends & Forecast 2025 to 2035

Artificial Intelligence in Military Market Analysis - Size & Forecast 2025 to 2035

Analysis and Growth Projections for Artificial Sweetener Business

Ventilation Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA