The artificial intelligence in military market is expected to witness substantial growth between 2025 and 2035, fueled by rising defense budgets in countries like the United States, China, India, Russia, and Israel. The increasing adoption of AI-enabled autonomous systems and growing demand for AI-driven cybersecurity and intelligence solutions are further accelerating this expansion. From autonomous drones and robotic combat systems to predictive analytics and AI-powered command platforms, artificial intelligence is reshaping the future of military operations.

Countries such as the U.S. are investing heavily in AI for battlefield decision-making and drone warfare, while China is advancing in AI-enabled surveillance and electronic warfare capabilities. Meanwhile, India and Israel are focusing on AI for border security and counter-terrorism, and Russia continues to develop AI-driven electronic defense and unmanned combat systems.

This global race for military AI supremacy reflects a new era of digital arms competition-one that evokes the surveillance intensity of the Cold War, but powered by cutting-edge algorithms, data, and real-time autonomy.

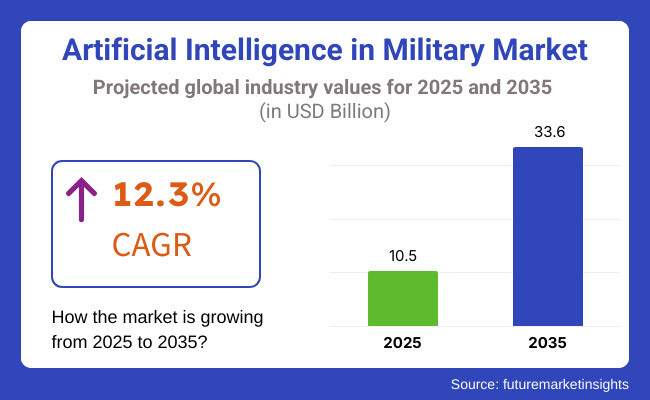

The market is expected to reach USD 10.5 Billion in 2025 and USD 33.6 Billion in 2035, at a phenomeanal CAGR of 12.3% during the forecast period. Predictive algorithms (machine learning (ML), computer vision, natural language processing (NLP), and various AI-driven cybersecurity solutions) set to redefine future military operations. Moreover, increasing partnerships between defense agencies and AI technology providers are speeding up the incorporation of AI-driven military tactics, drone conflicts, and driverless combat systems.

Based on regions, the Artificial Intelligence in Military Market is segmented into North America, Europe, Asia Pacific, Middle East North Africa, and South America, of which, North America is projected to dominate in terms of market share, due to high defense spending along with strong AI research capabilities and the presence of advanced military technology-driven sector.

North America leads the region in AI-powered military applications, including autonomous weapons, surveillance systems, and cyber defense, due to major investments in recent years by the United States and Canada.

The DoD is spearheading the effort to bring AI-enabled forces to the USA military - through initiatives like the Joint Artificial Intelligence Center (JAIC) and Project Maven, which applied AI technology to intelligence analysis, automated threat detection and battlefield decisionmaking. Major defense contractors such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies are also prioritizing AI-aligned combat systems, hypersonic missile guidance systems, and UAVs.

Furthermore, adoption of AI in a range of applications including Cybersecurity, Electronic Warfare, Autonomous Reconnaissance Missions, and others is also expected to boost the regional market growth over the projected time period. North American Military Strategies Transformed with AI Armed Logistics, Troop Deployment, and Threat Assessment

Europe has become a key player in the Artificial Intelligence in Military Market. Countries such as Germany, the UK, France, and Italy are all leaders in military AI research, investment in cybersecurity, and collaborative defense efforts. New models, technologies, and not algorithms will increase the adaptation of AI warfare: The European Defence Fund (EDF) and NATO’s AI Strategy.

UK’s Ministry of Defence (MoD) And France AI Defence Programs UK’s Ministry of Defence MoD and AI defence programmes in France are exploring AI-powered drones, autonomous reconnaissance vehicles and next-gen AI-driven battlefield management systems. Germany is also investing in AI "fused" cyber defence and electronic warfare systems to combat cyber threats while simultaneously utilizing tactics of hybrid warfare.

The European Union's strong emphasis on AI ethics and regulation of autonomous weapons is shaping the development of military AI applications that align with international norms of ethical warfare. This regulatory approach ensures that innovation in defense technology remains balanced with humanitarian considerations. At the same time, growing demand for AI-enabled threat intelligence, automated logistics, and unmanned combat vehicles is accelerating the adoption of AI across the region’s defense sector.

Asia Pacific is anticipated to hold the highest CAGR in artificial intelligence in military market owing to the increasing geopolitical tension, growth of defense budget and investments in AI authenticated military technologies. Countries as diverse as China, India, Japan, and South Korea are advancing toward autonomous combat systems, AI-enhanced surveillance, and cyber warfare capabilities at an astonishing pace.

With its AI Military-Civil Fusion Strategy, China is heavily investing in autonomous drones, AI missile systems, and AI surveillance networks. The People’s Liberation Army (PL A) Strategic Support Force is embedding AI into cyber operations, electronic warfare, and autonomous battlefield decision-making. AI applications in defense are also expanding through China’s AI-powered border security and facial recognition surveillance systems.

These needs caught the attention of Indian defence decision makers and have resulted in AI driven defence modernisation spearheaded by the Defence Research Design and Development Organisation (DRDO), which is working on AI powered combat drones, unmanned ground vehicles (UGVs) and AI driven predictive threat analytics. Japan and South Korea are similarly at the forefront on AI-powered missile defense systems, robotic combat support, and AI-enhanced cybersecurity platforms.

Long-term market growth is driven by the growing focus of the Asia-Pacific region on AI-based battlefield automation systems, autonomous naval systems, and new-generation AI military networks.

Challenges

Ethical Concerns and AI Warfare Regulations

One of the biggest challenges AI in Military Market faces is the ethical and legal implications associated with the use of AI-enabled autonomous weapons and automation of warfare. The international military AI law is very limited due to the fact that there are currently no concepts behind LAWS (lethal autonomous weapon systems).

The global security risks also include AI systems bias, cybersecurity issues and misuse of military-related AI technologies. Potential dangers posed by adversarial AIs, deepfake-fuelled misinformation, and AI-powered cyber people-wars make utilizing AI on the battlefield a no less complex issue.

Opportunities

AI-Powered Cybersecurity and Autonomous Defense Systems

There are certain challenges observed in the Artificial Intelligence in Military Market, though it is likely to show tempting growth in the forecast timeline. AI-driven threat detection, automated cyber defense response, and predictive risk assessment are part of the growing defense capabilities against cyberattacks in military networks across the world.

These advancements include the use of AI-powered robotic combat systems, AI-driven decision support systems, and AI-enhanced battlefield logistics. In addition, improvements in missile guidance systems that use machine learning, AI space monitoring, and military encryption using quantum AI are all factors that are likely to continue to drive market growth.

AI-fueled multi-domain operations (MDO), AI-savvy war gaming simulations, and real-time AI-based tactical assessment all contribute to the preparedness of a military force. New opportunities are emerging in the way of next-gen AI-powered drones, AI-enhanced electronic warfare and AI-enabled autonomous naval vessels as governments and defense contractors make big investments.

The AI market for military applications grew rapidly between 2020 and 2024, as predicated by growing defense budgets, the ever-growing autonomous weapons system, cybersecurity and AI-based intelligence analysis. AI also fueled unmanned aerial vehicles (UAVs), autonomous ground combat systems, AI-enabled surveillance and real-time threat detection for governments and defense agencies all over the world.

AI-assisted decision-support systems from predictive analytics for battlefield strategy, to AI-facilitated logistics automation and autonomous reconnaissance drones were integral to, as well as valuable assets of, modern military operations.

Revolutionary technologies will transform the AI in the military market between 2025 and 2035, with quantum AI, neuromorphic computing, and AI-enabled swarm intelligence driving the future of military operations. AI-driven hypersonics missile targeting, lethal autonomous combat drones, and AI-enabled electronic warfare (EW) capabilities are already revolutionizing warfare.

Military encrypted communication networks will become unbreakable, and the reach of counterintelligence and cyber resilience will be significantly increased with the help of quantum-enhanced AI algorithms.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Global discussions on AI ethics in warfare, autonomous weapon regulations, and military AI governance. |

| Technological Advancements | AI-driven unmanned systems, automated cybersecurity defenses, and predictive battlefield analytics. |

| Industry Applications | Used in surveillance, autonomous weapons, AI-powered logistics, and cybersecurity. |

| Adoption of Smart Equipment | AI-powered threat detection, autonomous UAVs, and real-time reconnaissance. |

| Sustainability & Cost Efficiency | High costs limited the adoption of AI-based defense technologies in developing nations. |

| Data Analytics & Predictive Modeling | AI-assisted threat prediction, anomaly detection in defense networks, and real-time risk assessment. |

| Production & Supply Chain Dynamics | Growth affected by chip shortages, cybersecurity vulnerabilities, and autonomous weapon regulations. |

| Market Growth Drivers | Growth fueled by defense modernization, rising geopolitical tensions, and AI-driven security enhancement. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI arms control treaties, quantum AI cybersecurity compliance, and blockchain-based military data governance. |

| Technological Advancements | Quantum AI military applications, AI-powered drone swarms, and neuromorphic AI-driven combat strategy optimization. |

| Industry Applications | Expanded into AI-enhanced electronic warfare, autonomous robotic soldiers, and AI-driven cyber-physical defense ecosystems. |

| Adoption of Smart Equipment | Autonomous AI combat teams, AI-driven augmented battlefield intelligence, and smart AI-assisted military command systems. |

| Sustainability & Cost Efficiency | Energy-efficient AI-driven military operations, AI-optimized war simulations, and quantum computing for cost-effective defense analytics. |

| Data Analytics & Predictive Modeling | Quantum AI-powered battlefield simulations, predictive military logistics, and AI-driven strategic deterrence modeling. |

| Production & Supply Chain Dynamics | AI-driven decentralized military manufacturing, blockchain-secured defense supply chains, and quantum AI-based military logistics automation. |

| Market Growth Drivers | Future expansion driven by quantum-enhanced military AI, fully autonomous combat systems, and AI-powered hybrid cyber-physical warfare. |

The United States Artificial Intelligence in Military Market is growing rapidly as an increasing demand for AI in military operations and the advancements in AI technology are expected to drive market growth. The air-defense systems and smart munitions being developed by DOD are increasingly powered by AI surveillance and drivers of autonomous weapons and IOT in Cyber attacks.

Initiatives like the Joint Artificial Intelligence Center (JAIC) and Project Maven are hastening the uptake of AI at the military decision-making, intelligence analysis, and battle automation stages. ML and AI also includes serval more fields like AI-enabled drones, advanced predictive maintenance systems powered by AI, and AI-driven cyber security is improving military efficiency and operational effectiveness.

The Army, Navy and Air Force are working with defense contractors including Lockheed Martin, Northrop Grumman and Raytheon on next-generation AI combat and reconnaissance technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.8% |

Implementations for the Artificial Intelligence in Military Market in the United Kingdom are rising on account of escalating investments in AI defense applications, government-backed artificial intelligence innovation programs, & increasing adoption of AI-based cybersecurity and surveillance systems across the nation.

Government missions such as the Defence Artificial Intelligence Strategy of the UK Ministry of Defence (MoD) has started focusing on AI-enabled autonomous combat vehicles, AI-driven intelligence gathering and unmanned aerial systems (UAS).

At the same time, use of and access to the use of these systems is proliferating, as nations like the UK tighten the screws on its cyber defense infrastructure and leverage AI to detect threats and be used in cyber warfare and counterterrorism applications. The adoption of AI in battlefield intelligence and decision support systems is also being advanced through cooperation between government and AI research institutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.0% |

The Artificial Intelligence in Military Market in the European Union is growing significantly due to collaborative defense initiatives, AI integration in unmanned combat systems, and increased military spending across member states. The European Defence Fund (EDF) is actively investing in AI-driven military research and development projects.

Germany, France, and Italy are leading the adoption of AI-powered surveillance, autonomous tanks, and next-generation warfare technologies. Additionally, the NATO AI Strategy is promoting the use of AI in military intelligence, cybersecurity, and AI-enabled battlefield analytics.

The EU’s focus on AI ethics and responsible military AI development is shaping regulatory frameworks to ensure human oversight in autonomous military operations.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.3% |

The growth of the Japanese Artificial Intelligence in Military Market is attributed to growing geopolitical tensions, surge in investment in autonomous defense technologies and government-backed AI initiatives for military modernization.

Japanese Ministry of Defense (MoD) to incorporate AI surveillance, robotic combat systems, and AI-based cyber defense solutions into its military infrastructure. Japan also focuses on developing AI-enhanced missile defense systems to enhance the national security.

Japanese defense firms like Mitsubishi Heavy Industries and NEC Corporation are all focusing closely on AI threat analysis, battlefield automation, and next-gen unmanned defense vehicles.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.5% |

Web-based AI military systems are emerging as the dominant segment in South Korea's defense technology market, particularly in terms of revenue, despite the sector still being in its early stages. The South Korean government, led by the Ministry of National Defense (MND), is committed to integrating AI across its military ecosystem. This includes applications in autonomous drones, advanced surveillance systems, and AI-enhanced weaponry.

In response to escalating digital threats and cyber espionage, South Korea is also prioritizing investments in AI-based cybersecurity and supercomputing infrastructure to support national defense objectives. Key defense players such as Hanwha Defense and LIG Nex1 are spearheading innovation in AI-powered combat vehicles, next-generation missile systems, and military robotics-solidifying the country's position as a regional leader in smart defense technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.6% |

The Artificial Intelligence (AI) in Military Market is experiencing rapid expansion, driven by advancements in autonomous systems, real-time data analysis, and AI-powered decision-making. Among the key offerings, software and hardware are the dominant segments, as modern defense organizations rely on AI-driven solutions to enhance combat effectiveness, threat detection, and strategic operations.

Software Leads Market Demand with AI-Powered Analytics and Autonomous Decision-Making

Military Modernization and AI-Powered Software Solutions: AI in Military Modernization AI is being implemented to accelerate targeted software solutions to drive military modernization, from autonomous decision-making to predictive analytics and real-time threat assessment. We focus on the applications of machine learning (ML), deep learning, and natural language processing (NLP) in defense agencies, such as improving intelligence gathering, cybersecurity, and battlefield automation.

UK, Chinese and USA military forces have been pouring money into AI-enhanced surveillance systems, autonomous combat vehicles, and cyber defense platforms, where the software is integral to the data processing, predictive modeling, and automated target recognition. Also AI software is embedded into command and control (C2) systems, allowing for more rapid situation awareness, mission planning, and execution of decisions.

Military AI is increasingly valuable, with strategic advantages, but must still contend with software vulnerabilities, adversarial AI threats, and data security concerns. But developments in AI-powered encryption, the interpretability of AI (XAI), and cyber-resilient algorithms are enabling defense authorities to enhance both system security and operational reliability.

Hardware Expands as AI-Driven Combat Systems and Edge Computing Gain Traction

AI-integrated hardware is transforming the battlefield, and including the autonomous drones, AI power weaponry as well as advanced computing chips has led to massive investments. The abilities of real-time accurate target recognition, battlefield analytics, and autonomous operations are enabled by AI-facilitated sensor fusion, edge computing, and high-performance processing units.

AI-driven combat drones, unmanned ground vehicles (UGVs), and combat robots have been increasingly deployed, enabling military forces to carry out risky missions with less and less human involvement. Moreover, such as neuromorphic computing and AI-equipped radar components enhancing obstacle tracking, adversary identification, and real-time maneuvering in ever-changing warzones.

Yet these capabilities come with challenges such as high costs, energy consumption, and integration complexities that constrain large-scale adoption. The next wave of military AI hardware technologies, ranging from lighter AI processors to quantum simulation and AI chips ready to launch, is expected to be catalyzed by investment opportunities.

The integration of AI-driven military solutions is primarily driven by warfare platforms and cyber security, as these applications enhance combat efficiency, intelligence operations, and national defense strategies.

Warfare Platforms Dominate Market as AI-Driven Combat Systems Enhance Military Capabilities

Military applications will leverage AI heavily, with autonomous combat vehicles, enhanced AI fighter jets, and precision-guided weapons belonging to the warfare platform segment that will be the largest adopter in this sector. From AI-piloted Drones to robot infantry, from AI-aided missile defense - they are changing the face of the modern battlefield, creating a tactical dimension of real-time support and threat assessment, including adding synchronized coherence and speed to combat efficiency.

Major military tech firms like Lockheed Martin, Northrop Grumman and BAE Systems are embedding AI avionic navigation, automated targeting, and self-learning combat strategies into next-gen fighter aircraft, naval vessels, and armored vehicles. This mutates into many drones attacking the enemy in conjunction with an AI swarm drone that can actually kill; reconnaissance; air support with little human supervision.

Yet, legal and ethical obstacles are the challenges facing this growing trend, and the risks of fully autonomous warfare under AI control pose strict regulatory limits. Yet, the responsible use of AI for defense and battlefield situations is being ensured through evolved Human-AI collaboration, ethical constraints on AI, and real-time decision-support systems.

Cyber Security Expands as AI Strengthens Digital Defense and Threat Intelligence

As cyber threats and digital warfare continue to grow, AI-based cyber security has established itself as an essential aspect of the modern military strategies. For example, the application of AI in threat detection, automated cyber defense, and AI countermeasures against adversarial AI will provide stronger national security against cyberattacks, espionage, and electronic warfare threats.

In order to protect the military systems against hacking attempts, data breaches, and malware infiltration, real-time network monitoring, anomaly detection and AI-powered encryption is being utilized with the help of AI. Moreover, AI-powered cyber deception tools and digital forensics solutions are assisting defense entities in detecting, understanding and neutralizing cyber threats before they result in large-scale disruptions.

Nonetheless, concerns exist around threat activities like AI-enabled cyberattacks, adversarial AI exploitation, and shortfalls in defense capabilities. AI-powered cyber defense capabilities are expected to be further augmented by investments in areas such as AI-augmented security frameworks, quantum cryptography, and deep-learning-based threat intelligence.

The global Military Artificial Intelligence (AI) market is expanding rapidly as users adopt AI-powered defense mechanisms, autonomous configurations, and real-time battlefield analytics. Military and defense agencies are utilizing AI-enabled surveillance, unmanned combat capabilities, cybersecurity applications, and autonomous sustainable battle decision-making systems to improve their efficiency and to bolster their defense strategy.

The market covers top defense manufacturers, artificial intelligence software companies, and military tech companies, all of which contribute to breakthroughs in artificial intelligence drone warfare, predictive maintenance, and driverless battle machines.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Lockheed Martin Corporation | 15-20% |

| Northrop Grumman Corporation | 12-16% |

| BAE Systems plc | 10-14% |

| Raytheon Technologies Corporation | 8-12% |

| General Dynamics Corporation | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lockheed Martin Corporation | Develops AI-driven autonomous fighter jets, AI-powered missile defense systems, and machine learning-enhanced battlefield analytics. |

| Northrop Grumman Corporation | Specializes in AI-based cyber warfare, unmanned combat aerial vehicles (UCAVs), and AI-enhanced sensor fusion technologies. |

| BAE Systems plc | Manufactures AI-powered decision support systems, robotic combat vehicles, and next-gen AI-driven electronic warfare solutions. |

| Raytheon Technologies Corporation | Focuses on AI-driven missile guidance systems, automated surveillance, and predictive threat detection. |

| General Dynamics Corporation | Provides AI-powered autonomous ground combat vehicles, military-grade AI communication systems, and smart warfare analytics. |

Key Company Insights

Lockheed Martin Corporation (15-20%)

Lockheed Martin leads the AI-driven military technology sector, offering autonomous fighter aircraft, AI-assisted missile defense, and AI-enhanced military logistics solutions.

Northrop Grumman Corporation (12-16%)

Northrop Grumman specializes in AI-based cyber warfare systems, autonomous drones, and AI-enhanced electronic warfare technologies for modern battlefields.

BAE Systems plc (10-14%)

BAE Systems develops AI-powered military decision-making systems, robotic warfare technologies, and AI-assisted sensor fusion systems for tactical defense operations.

Raytheon Technologies Corporation (8-12%)

Raytheon focuses on AI-integrated missile defense, AI-powered battlefield intelligence, and real-time autonomous surveillance systems.

General Dynamics Corporation (6-10%)

General Dynamics provides AI-driven autonomous military vehicles, smart warfare communication systems, and predictive maintenance for defense fleets.

Other Key Players (35-45% Combined)

Several defense contractors, AI firms, and government-backed research organizations contribute to advancements in AI-powered military systems, unmanned combat technologies, and predictive warfare analytics. These include:

The overall market size for the Artificial Intelligence in Military Market was USD 10.5 Billion in 2025.

The Artificial Intelligence in Military Market is expected to reach USD 33.6 Billion in 2035.

Increasing defense budgets, rising adoption of AI-driven autonomous systems, and advancements in cybersecurity and threat detection will drive market growth.

The USA, China, Russia, Israel, and India are key contributors.

Software and Hardware in type is expected to lead in the Artificial Intelligence in Military Market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 24: Europe Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 27: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: South Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 29: South Asia Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 30: South Asia Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 36: East Asia Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Oceania Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 42: Oceania Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: MEA Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Platform, 2018 to 2033

Table 48: MEA Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Platform, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Installation, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 25: Global Market Attractiveness by Component, 2023 to 2033

Figure 26: Global Market Attractiveness by Application, 2023 to 2033

Figure 27: Global Market Attractiveness by Technology, 2023 to 2033

Figure 28: Global Market Attractiveness by Platform, 2023 to 2033

Figure 29: Global Market Attractiveness by Installation, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Installation, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 55: North America Market Attractiveness by Component, 2023 to 2033

Figure 56: North America Market Attractiveness by Application, 2023 to 2033

Figure 57: North America Market Attractiveness by Technology, 2023 to 2033

Figure 58: North America Market Attractiveness by Platform, 2023 to 2033

Figure 59: North America Market Attractiveness by Installation, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Platform, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Installation, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Platform, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Installation, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Platform, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Installation, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 101: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 102: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 103: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 104: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 107: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 108: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 113: Europe Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 114: Europe Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 115: Europe Market Attractiveness by Component, 2023 to 2033

Figure 116: Europe Market Attractiveness by Application, 2023 to 2033

Figure 117: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 118: Europe Market Attractiveness by Platform, 2023 to 2033

Figure 119: Europe Market Attractiveness by Installation, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Platform, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) by Installation, 2023 to 2033

Figure 126: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 135: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 136: South Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 137: South Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 138: South Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 139: South Asia Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 140: South Asia Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 142: South Asia Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 143: South Asia Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 144: South Asia Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 145: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 146: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 147: South Asia Market Attractiveness by Technology, 2023 to 2033

Figure 148: South Asia Market Attractiveness by Platform, 2023 to 2033

Figure 149: South Asia Market Attractiveness by Installation, 2023 to 2033

Figure 150: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 152: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 154: East Asia Market Value (US$ Million) by Platform, 2023 to 2033

Figure 155: East Asia Market Value (US$ Million) by Installation, 2023 to 2033

Figure 156: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 163: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 164: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 165: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 166: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 167: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 168: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 169: East Asia Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 170: East Asia Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 171: East Asia Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 172: East Asia Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 175: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 176: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 177: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 178: East Asia Market Attractiveness by Platform, 2023 to 2033

Figure 179: East Asia Market Attractiveness by Installation, 2023 to 2033

Figure 180: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Technology, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Platform, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Installation, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 191: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 192: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 193: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 194: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 195: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 196: Oceania Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 197: Oceania Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 198: Oceania Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 199: Oceania Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 203: Oceania Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 204: Oceania Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 205: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Technology, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Platform, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Installation, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 212: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: MEA Market Value (US$ Million) by Technology, 2023 to 2033

Figure 214: MEA Market Value (US$ Million) by Platform, 2023 to 2033

Figure 215: MEA Market Value (US$ Million) by Installation, 2023 to 2033

Figure 216: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 221: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 222: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 223: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 224: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 225: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 226: MEA Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 227: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 228: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 229: MEA Market Value (US$ Million) Analysis by Platform, 2018 to 2033

Figure 230: MEA Market Value Share (%) and BPS Analysis by Platform, 2023 to 2033

Figure 231: MEA Market Y-o-Y Growth (%) Projections by Platform, 2023 to 2033

Figure 232: MEA Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 233: MEA Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 234: MEA Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 235: MEA Market Attractiveness by Component, 2023 to 2033

Figure 236: MEA Market Attractiveness by Application, 2023 to 2033

Figure 237: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 238: MEA Market Attractiveness by Platform, 2023 to 2033

Figure 239: MEA Market Attractiveness by Installation, 2023 to 2033

Figure 240: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Artificial Ventilation and Anaesthesia Masks Market Size and Share Forecast Outlook 2025 to 2035

Artificial Pancreas Device Market Size and Share Forecast Outlook 2025 to 2035

Artificial Flower Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Artificial Preservative Market Outlook by Product, Type, Form, End Use Application and Others Through 2035

Analysis and Growth Projections for Artificial Sweetener Business

Artificial Turf Market Growth & Trends 2024-2034

Artificial Plants Market

Artificial Wood Beams Market

Artificial Airway Holders Market

Artificial Cartilage Implant Market

Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Artificial Bowling Surface Market

Artificial Hair Integration Market Growth - Trends & Forecast 2025 to 2035

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA