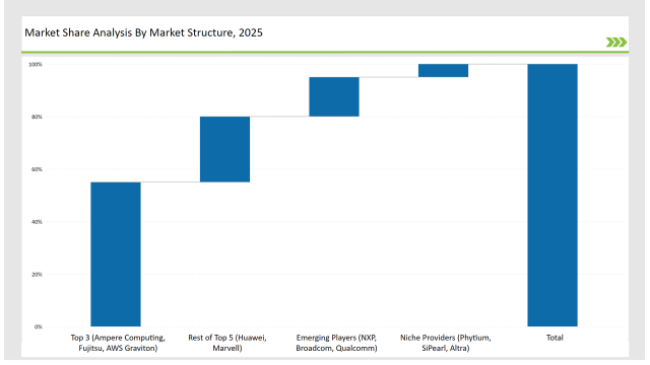

The ARM-Based Servers market is growing rapidly as enterprises prioritize high-efficiency, low-power server solutions for data centers, cloud computing, and edge computing applications. The long-standing market leaders Ampere Computing, Fujitsu, and AWS Graviton continue to establish their dominance with a combined 55% share of the overall market through the smooth integration of performance-focused ARM-based server processors with cloud services.

Huawei and Marvell, which focus on high-performance computing (HPC) and energy-efficient workloads, collectively secure 25% of the market. Emerging players NXP, Broadcom, and Qualcomm capture 15% by offering scalable ARM-based solutions tailored for edge computing and AI workloads. Niche vendors Phytium, SiPearl, and Altra hold 5%, addressing specialized regional markets and government applications.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (Ampere Computing, Fujitsu, AWS Graviton) | 55% |

| Rest of Top 5 (Huawei, Marvell) | 25% |

| Emerging Players (NXP, Broadcom, Qualcomm) | 15% |

| Niche Providers (Phytium, SiPearl, Altra) | 5% |

The ARM-Based Servers Market remains moderately concentrated, with leading firms holding 55-65% of the market. Pioneers such as Ampere Computing, AWS, and Fujitsu set industry performance standards, while high research and development costs create barriers for new entrants.

The segments are divided as ARM Cortex-A, ARM Cortex-M, ARM Cortex-R, and Others. The ARM Cortex-A makes up the majority of the cloud computing, AI workloads, and high-density data centers. Also, AWS Graviton, Fujitsu A64FX and Ampere Altra leverage Cortex-A cores for maximum power efficiency without sacrificing high-performance computing. ARM Cortex-M forms a sizeable portion of the market share providing support for embedded systems and edge computing applications needing real-time processing capability at low power consumption.

This is where NXP and Qualcomm come in. Please note that, ARM CORTEX-R is targeted towards industrial automation, telecommunications and aerospace applications, where deterministic performance and extremely high reliability is a key requirement. Other ARM based architectures would cater to specialized HPC and niche industries.

Operating systems split into 32bit and 64bit native. The broader 64-bit OS space leads here, in part because enterprise-sized memory footprint and compute efficiency are important to increased workloads for enterprise, cloud and AI processing. Some frequently used 64-bit ARM-compatible operating systems are Ubuntu Server, Red Hat Enterprise Linux (RHEL) for ARM and Windows Server on ARM. The 32-bit OS niche is still important for old applications, use embedded, and low-power use in clouds.

The ARM-Based Server market serves multiple industries with unique requirements. The telecommunications sector leads in adoption, leveraging ARM-based servers for 5G infrastructure and edge computing solutions, with Marvell and Huawei spearheading innovation. The consumer electronics industry also heavily utilizes ARM servers in gaming, media streaming, and IoT connectivity. Aerospace & defense sectors depend on ARM-based servers for secure, high-performance computing, with Phytium and SiPearl playing key roles.

In automotive, AI-driven workload optimization for autonomous vehicles and real-time computing gains traction, with Qualcomm and NXP driving adoption. Other industries, including energy & utilities, healthcare, and government, prioritize ARM-based servers for efficiency, security, and cost-effectiveness in mission-critical applications.

AI-Powered ARM Servers

As workloads increasingly demand efficiency and reduced power consumption, companies are introducing AI-based ARM servers to their cloud computing infrastructure. These servers perform heavy-duty AI tasks, such as training models to run at scale and inference processing. This is why they are great for businesses requiring energy-efficient AI computing since they have high performance per watt. With the rising usage of AI, there is a growing demand for solutions with AI functionality across different industries, making ARM-based servers an integral part in meeting these needs.

Cloud-Native ARM Adoption

Cloud providers such as AWS, Google Cloud and Microsoft Azure are making significant investments in ARM-based infrastructure to deliver improved performance and efficiency in cloud computing. Such investment has forced enterprises to move towards ARM-based cloud-based solutions because of reduced TCO, improved scalability, and reduced power consumption.

Allowing for more workspace per packing square, if taking an ARM-based cloud environment enables businesses to minimize their computing resources as well as their carbon footprint. With ARM processors gaining traction in mainstream cloud computing, enterprises increasingly benefit from them for high-performance and energy-efficient workloads.

HPC and Edge Computing

Telecom, automotive, and manufacturing industries are fast adopting ARM-based architectures for HPC and edge computing applications. These sectors require real-time processing capabilities at the edge to support latency-sensitive applications like autonomous driving, IoT, and network function virtualization. ARM-based systems provide flexibility, efficiency, and power optimization, hence being a very good fit for these workloads. Businesses are deploying ARM-powered HPC and edge computing solutions to accelerate high-speed data processing and improve overall computational efficiency.

Cybersecurity and Data Protection

Finance, healthcare, and government enterprises are strengthening ARM-based security features to meet compliance requirements and protect sensitive data. ARM's security architecture, including TrustZone and memory tagging extensions, MTE, helps businesses defend against cyber threats. These advanced security capabilities make the ARM-based processor a go-to choice for industries needing strong protection of data. With growing cybersecurity concerns, companies are adopting more ARM-based solutions to ensure regulatory compliance and strengthen the security of critical infrastructure.

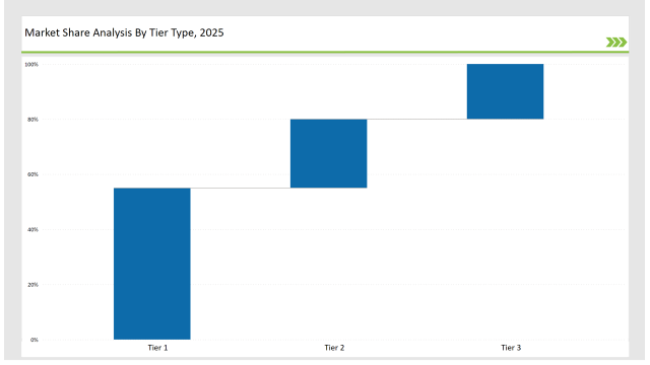

| Tier | Tier 1 |

|---|---|

| Vendors | Ampere Computing, AWS Graviton, Fujitsu |

| Consolidated Market Share (%) | 55% |

| Tier | Tier 2 |

|---|---|

| Vendors | Huawei, Marvell |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 2 |

|---|---|

| Vendors | NXP, Broadcom, Qualcomm, Phytium, SiPearl |

| Consolidated Market Share (%) | 20% |

| Vendor | Key Focus |

|---|---|

| Ampere Computing | Enhancing ARM multi-core efficiency for cloud workloads. |

| AWS Graviton | Driving cloud-native ARM adoption with optimized performance. |

| Fujitsu | Strengthening HPC solutions with high-efficiency ARM architecture. |

| Marvell | Expanding ARM-based networking and 5G applications. |

| Huawei | Developing AI-optimized ARM processors for enterprise adoption. |

Vendors must invest in AI-driven ARM processing, real-time analytics, and enhanced security measures to optimize server workloads. Blockchain-based ARM server authentication and energy-efficient automation will drive the next phase of ARM-based server evolution.

Ampere Computing, AWS Graviton, and Fujitsu dominate with a 55% share.

Cost efficiency, energy savings, AI workload optimization, and cloud-native infrastructure.

Telecommunications and consumer electronics lead in 5G, edge computing, and AI-driven applications.

ARM servers offer superior energy efficiency and scalability while maintaining competitive performance.

AI-driven processing, cloud-native ARM expansion, cybersecurity advancements, and HPC integration.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.