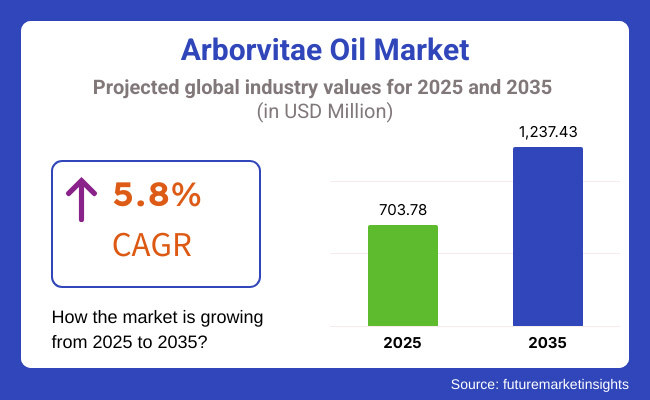

The global arborvitae oil market is set to grow from USD 703.78 million in 2025 to USD 1,237.43 million in 2035, expanding at 5.80% CAGR during the forecast period.

Used commonly for its natural preservation and pungent-smelling qualities, arborvitae oil is pale yellow-green, moderately thick, and possesses a very deep earthy aroma that is highly sought in industries. Natural antibacterial substance in the oil prevents wood decay, so it is the first choice for the better protection of wood.

This oil is a very famous choice among manufacturers due to its antibacterial, antifungal as well as insect-repelling properties. Eco-friendly cleaning products and aromatherapy sector use this oil most significantly.

Increased demand for clean-label products is also altering the consumption attitude, whereby consumers increasingly demand transparency in their ingredients and inherently unprocessed oil with no extra synthetics. Companies such as Young Living have brought the purity and chemical-free quality of their oils to the forefront, appealing to the customers who opt for natural wellness products.

With continuous innovations and an increasing number of customers shifting toward natural wellness products, it is poised that the industry will continue to prosper. The tendency to produce plant-based products, the ecological way of production, and the digital consumer engagement will be the drivers of the demand for the product and thus, it will remain a key player in the essential oil business.

Explore FMI!

Book a free demo

The governing principle of the study was to identify the differences and similarities between these three stakeholder groups present in the arborvitae oil market and thus resulted in the use of this table for comparison of the differential factors.

For aromatherapy and cosmetic manufacturers, oil purity and concentration, and scent profile and aromatic quality is paramount since these directly impact product performance and consumer appeal. They also need natural origin and organic certification to maintain brand integrity while achieving premium market acquisition.

Natural health supplement companies make purity and certification a priority along with oil types, but fragrance is of low-to-low-moderate priority, the focus being on health benefits rather than scent profile. In comparison, household products manufacturers find oil purity moderately important, whilst saying that scent quality is of relatively low priority, as, for them, cost efficiency is rated high.

With the supplement segment being a big driver of demand, companies in the sector aren't as concerned about supply chain consistency or environmental sustainability compared to household needs.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consumers began exploring the product for skincare, wellness, and insect-repellent uses, mainly in niche markets. | The product will be widely used in personal care, home products, and holistic health. |

| Some brands promoted eco-friendly sourcing, but sustainability wasn’t a major purchasing factor. | Ethical harvesting, carbon-free manufacturing, and eco-friendly packaging will be key. |

| Exclusively marketed through specialty outlets and online health websites with moderate consumer awareness. | On offer in prominent retail chains, pharmacies, and online giants as demand increases. |

| Mostly used by essential oil enthusiasts for relaxation and immune support. | Found in skincare, haircare, household cleaners, and supplements. |

| Social media influencers promoted the product, but market penetration remained limited. | AI-powered recommendations and engaging shopping experiences will drive consumer interaction. |

| Purity standards for essential oils were in the process of emerging but were region-specific. | Organic certification and purity standards will become compulsory for industry viability. |

Between 2020 and 2024, the industry saw consistent growth, mainly based on the growth in demand for organic and natural essential oils within the wellness, cosmetic, and pharmaceutical sectors. Growing consumer trend toward aromatherapy and organic medicinal treatments fuelled the industry's growth.

Moreover, the cosmetics industry experienced increased use of the product because of its anti-aging and antimicrobial properties, which made it a sought-after ingredient in personal care and skincare products. Supply chain disruptions amid the COVID-19 pandemic in 2020 and 2021, though, posed short-term difficulties in raw material sourcing and global trade. Through 2023 and 2024, the industry picked up momentum with better farm practices, organic harvesting methods, and more investment in organic essential oil production.

Looking forward between 2025 and 2035, the industry is likely to experience a transition toward sustainability, regulation, and multipurpose applications. As concerns regarding the environment rise, green extraction methods and sustainable sourcing practices will be a necessary part of the production process. Regulatory agencies can put in place tighter regulations on wild harvesting and deforestation, compelling manufacturers to switch to sustainable forestry management for raw material procurement.

The wellness industry will continue to propel demand, but there will also be new uses in pharmaceuticals, antimicrobial coatings, and alternative medicine. Furthermore, biotechnology advances and chemical extraction methods will facilitate increased yields and improved product quality, making the product more viable for mass industrial uses.

Arborvitae oil comes from the wood from the Thuja plicata tree and, unlike some other wood oils, is a by-product of forestry rather than active logging - meaning that the supply is highly contingent on the availability of the sustainable resource. Tighter environmental regulations and changes to forestry practices could limit raw material availability. And now climate factors like wildfires and infestations can also affect availability, causing supply shortages.

The arborvitae oil market is niche and very much operating at a story level, led by aromatherapy, natural insect repellents and wood preservation end usages. Demand is often volatile and subject to trends or multi-level marketing pushes. Arborvitae oil is competing with other oils, like Cedarwood and sandalwood, that could serve as substitutes if prices become too high, or supply isn’t steady. A shift in a single buyer's purchasing strategy may impact all providers in a given segment.

Arborvitae oil contains bioactive compounds such as Thoric acid and Tropolones, which may be regulated for safety. It may lead to restrictions on concentrations or usage of these compounds in cosmetics, therefore limiting the applications. Also, marketing claims covering either antimicrobial or therapeutic properties could be examined for regulatory scrutiny. Any action to classify the wood the source tree produces as endangered could impose new trade restrictions that would have even wider implications for global supply chains.

Retail pricing for arborvitae oil is elevated due to its rarity and expected benefits. Direct sales brands market it as a high-end essential oil with a price tag of between USD 4.80- USD 6.40 per mL - far above bulk market prices. The mark-up in small retail bottles is justified by consumer trust, purity assurances and therapeutic positioning.

Wholesale suppliers use a tiered pricing system, where bulk buyers get major discounts. Small-scale buyers pay a premium on a per-unit basis because of handling and distribution costs, while larger orders, such as 25 kgs, reduce your cost per kg. This tiered model allows an artisan to be accessible to the local market while participating in an industrial buyer’s market.

Pricing based on substitute products such as Cedarwood oil, which provides similar features at lower prices. It is essential for suppliers to keep arborvitae oil in a competitive range, or risk losing buyers to alternative products. If a leading producer ramps up supply, oversupply could bring prices down, and the opposite for shortages.

Brands attempt to avert price variability by bundling arborvitae oil along with other essential oils in kits or in proprietary blends, thus spreading the cost across multiple products. Long-term supplier contracts create price stability and ensure supply, while sustainable sourcing agreements ensure social and environmental characteristics of a product.

The product is a wonderful natural cleansing agent owing to its incredibly strong antibacterial, antifungal, and antimicrobial effects. Its germ eliminating and detoxifier ability is the reason why it is now growing popular in eco-friendly household cleaners, cosmetics and personal care products.

As the global green cleaning products industry grows, the demand for plant-based alternatives, such as the product, is surging. The smell of the oil is woody and earthy, which is why it is a popular ingredient in luxury and organic cleaning products, adding to the sensory appeal of natural formulations.

The organic arborvitae oil segment is growing due to the increased consumer demand for pesticide-free essential oils from sustainable sources. Organic cultivation yields a higher potency and purity, making it suitable for therapeutic, aromatherapy, and cosmetic use.

Front-running wellness and skincare brands, such as Neal’s Yard Remedies and doTERRA, highlight organic ingredients to suit toxin-free and ethical consumers. While organic oil comes at a premium, it is well worth the price for its quality and sustainable farming methods, consistent with the growing trend for organic essential oils.

The product is extensively applied in the pharmaceutical industry because of its strong antimicrobial, anti-inflammatory, and antioxidant activities. It is obtained from the Thuja plant and has bioactive compounds like thujone, tropolone, and terpenes, which have strong medicinal activities.

These activities render it very effective in the treatment of skin infections, respiratory diseases, and inflammatory disorders, making it a useful component in pharmaceutical products. Its capacity to fight bacterial and fungal infections has resulted in its incorporation into topical ointments, antiseptic creams, and treatments for wound healing.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

| Germany | 3.3% |

| UK | 3.8% |

| India | 5% |

| Japan | 5.9% |

Demand for the product in the USA is driven by growing consumer demand for natural, plant-based essential oils for uses in aromatherapy, personal care, and home care. Growing awareness of the therapeutic benefits of the product, such as its antimicrobial and insect-repelling properties, has also boosted demand.

Additionally, environmentally friendly brands are incorporating the product into their green products, boosting sales. The growth in wellness and organic retail channels, with high momentum, also supports industry growth. The USA arborvitae oil industry is expected to expand at a 4.2% CAGR during the forecast period, according to FMI.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Natural & Plant-Based Preferences | Increased consumer demand for natural ingredients used in personal care, well-being, and home care. |

| Sustainability Focus | Growing usage of arborvitae oil in green products and sustainable lines by firms. |

Natural cosmetics and aromatherapy industries in Germany are robust drivers of the product demand. With growing interest in utilizing plant-based ingredients in well-being products such as hair and skin care, the industry for essential oils in Germany is growing.

Demand for essential oils due to their therapeutic benefits such as stress relief is a major driver. Regulatory policies of Germany toward the employment of organic and sustainably cultivated ingredients also propel industry growth. The German industry will expand at a 3.3% CAGR during the study period, according to FMI.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Natural Cosmetics & Aromatherapy | Promoting demand for plant-based ingredients in natural cosmetics and wellness products like skincare. |

| Sustainability Regulations | Growing employment of organic and sustainably cultivated ingredients due to encouraging regulatory policies. |

The UK arborvitae oil market is expanding with organic and natural products gaining more popularity from consumers, particularly in the category of beauty and wellness. The antimicrobial and soothing nature of arborvitae oil makes it a great product to be added in premium skincare solutions.

Growth in home fragrances and arborvitae oil diffusers, driven by rising wellness and self-care culture, is also expanding the industry. Adding momentum to the industry, manufacturers' adoption of sustainable sourcing practices will further support the industry. The UK industry will grow at a 3.8% CAGR during the forecast period, according to FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Beauty & Wellness Demand | Growth in use of the product in premium skincare products, home fragrance, and self-care. |

| Sustainability in Sourcing | Greater emphasis on sustainable sourcing and environmental-friendly processes within the essential oils industry. |

India's rich heritage in Ayurveda and herbal medicine is at the core of growing demand for the product. Growing application of essential oils in Ayurvedic medicine, natural skin care, and home care is driving demand for the product.

Growing disposable income and surging demand for chemical-free personal care products are fueling the industry to expand. Local players also want to adopt green production methods to cater to growing worldwide demand for high-quality, Indian-origin oils. The Indian industry is expected to expand at 5.0% CAGR during the forecast period, according to FMI.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Ayurvedic & Herbal Application | Traditional cultural belief of essential oil use in Ayurvedic treatments and herbal cosmetics. |

| Green Production Processes | Adoption of green production methods to fulfill global demand for high-quality Indian origin oils. |

The product demand in Japan is increasing steadily with the increasing popularity of natural health remedies such as aromatherapy and herbal medicine among consumers. Organic care products, functional fragrance, and essential oil-based air fresheners are popular.

Japanese path-finding R&D in plant-based products has opened up new areas of applications of the product in skincare, air freshener, and overall health products. Japan's focus on high-quality, eco-friendly essential oils is also a contributing factor towards growth in the industry. FMI anticipates Japan's industry to grow at a 5.9% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Organic & Holistic Health | Increasing industry demand for the product in organic consumer products, active fragrances, and air purifiers. |

| Shifting Application & Sustainability | Connect high-tech R&D with innovative application of the product for skin care and top priority for sustainability. |

The global industry has high concentration and is dominated by a handful of multinational essential oil manufacturers with superior extraction technology and large-scale purchasing power. The companies have controlling stakes in key production stages from raw material acquisition to distillation, guaranteeing consistent product quality and supply to aromatherapy, personal care, and home use.

Strategic purchase and supply contracts helps setting up in the industry. Top companies forge sole-source arrangements with sustainable timber operations to ensure raw material availability. Vertical integration with sustainable forestry operations alleviates reliance on volatile wood markets, improves operational efficiency, and prevents scope for larger players to increase output efficiently.

Distributors with a broad reach and network increase the competition among key players. They have strong connections with wellness brands that are established, cosmetic producers, and direct-to-consumer essential oil vendors. Their developed logistics setup ensures extensive availability of products, bolstering their clout and preventing new entrants from developing strong industry hold.

Product innovation and sustainable sourcing efforts make industry leaders stronger. They invest in environmentally friendly harvesting practices, organic certifications, and high-tech distillation processes to increase purity and therapeutic potency. This focus on sustainability and quality enhances brand loyalty, solidifying their competitive edge while setting industry standards.

Regulatory knowledge further focuses the industry on best-of-breed firms. Complying with complicated global safety and environmental regulations demands significant resources. Top players are best at acquiring compliance certifications, ensuring easy access to international markets and reinforcing their leadership in regulated segments, such as personal care and therapeutic uses.

There is an increased demand for natural wellness products, because of which, the top companies stay dominant. With the capacity to increase production, practice ethical sourcing, and adjust according to changing industry standards, dominant firms maintain their dominance. Enabled by strategic partnerships and research, dominant firms catalyze sustained industry concentration, raising industry thresholds in terms of quality, sustainability, and product innovation.

Major players like doTERRA, New Directions Aromatics Inc., and AVI Naturals use their vast distribution network along with research-driven product development to maintain their competitive edge. The pharmaceutical sector continues to be the top consumer of the product used as antiseptic and immune-supporting.

The personal care and cosmetics sector utilizes it for clean beauty-aligned formulations in the skincare and haircare arena, with strong branding, regulatory compliance, as well as ethical sourcing setting them apart from each other. Within these industry regulations are sustainability challenges, and businesses that have invested in transparent supply chains with earth-friendly extraction methods will earn consumer trust and attain long-term stability in the industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| doTERRA International LLC | 20-25% |

| New Directions Aromatics Inc. | 15-20% |

| AVI Naturals | 10-15% |

| Venkatramna Industries | 8-12% |

| Lala Group of India | 5-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| doTERRA International LLC | Delivering high-quality, sustainable arborvitae essential oil widely used in personal care, home care, and wellness products. |

| New Directions Aromatics Inc. | Supply bulk and wholesale essential oils, including the product, to cater to the cosmetic and fragrance industries. |

| AVI Naturals | The focus is mainly on organic and therapeutic-grade oil; this will be complemented with the expansion into Ayurvedic and holistic healing markets. |

| Venkatramna Industries | Natural essential oils and plant extracts dominate the activity with strong emphasis on traditional medicine formulations. |

| Lala Group of India | Manufactures and offers a spectrum of aromatic oils, including arborvitae, covering applications in personal care and fragrance sectors. |

Key Company Insights

doTERRA International LLC (20-25%)

A market leader in essential oils, doTERRA offers high-purity products with applications in aromatherapy, wellness, as well as skincare.

New Directions Aromatics Inc. (15-20%)

A global supplier of essential oils, providing high-quality arborvitae oil to businesses in the cosmetics, perfumery, and health industries.

AVI Naturals (10-15%)

A leading manufacturer of organic and therapeutic essential oils, AVI Naturals integrates arborvitae oil into Ayurvedic and natural healing products.

Venkatramna Industries (8-12%)

A trusted name in the essential oils industry, supplying pure and natural oils for use in traditional medicine as well as personal care.

Lala Group of India (5-10%)

A well-known producer of essential oils, specializing in aromatic and therapeutic oils for cosmetics, fragrances, and wellness.

The sales of arborvitae oil are anticipated to be worth USD 703.78 million in 2025.

The market is predicted to reach a size of USD 1, 237.43 million by 2035.

Organic oil is widely purchased.

Key companies include doTERRA International LLC, New Directions Aromatics Inc., AVI Naturals, Venkatramna Industries, Lala Group of India, Verma Fragrance Industries, India Aroma Oils and Company, S. International, AyurVikalp, Paras Perfumers, Indian Aroma Exports, Pure Path Essential Oils, Moksha Lifestyle Products, Katyani Exports, Ahimsa Oils, Piping Rock, and Arborvitae Australia Health and Wellbeing Pty.

Japan, slated to grow at 5.9% CAGR during the study period, is expected to witness fastest growth.

By function, the segmentation is as cleansing agent, purifying agent, and flavoring agent.

By nature, the segmentation is organic and conventional.

By end use, the segmentation is as pharmaceutical, wood preservation, insect repellent, perfumeries, aromatherapy, homecare cleaning products, spa and relaxation, and healthcare.

By region, the segmentation is as North America, Latin America, Europe, the Middle East & Africa, and Asia Pacific.

Dairy-Free Cream Market Insights – Plant-Based Dairy Alternatives 2025 to 2035

Dairy Flavors Market Trends – Growth & Industry Forecast 2025 to 2035

Egg Protein Market Insights – High-Protein Nutrition & Market Growth 2025 to 2035

Dried Eggs Market Insights – Shelf-Stable Nutrition & Industry Growth 2025 to 2035

Egg Substitute Market Insights – Plant-Based Alternatives & Industry Growth 2025 to 2035

Egg-Free Dressing Market Trends – Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.