The Aramid Fiber Market is estimated at USD 4.45 billion in 2025 and is expected to reach USD 7.60 billion by 2035 with a CAGR of 5.5%. Technological breakthroughs in protective textiles, aerospace, and automotive sectors will drive significant advancements in the aramid fiber industry in 2024. The demand for high-strength, lightweight materials kept progressing steadily as industries focused on performance improvement and sustainability.

The defense sector was the main propellant of industry expansion in 2024 due to the increased procurement of ballistic protection equipment by military forces worldwide. Rising geopolitical tensions fueled the demand for protective clothing and body armor, leading to increased investment in advanced materials for enhanced durability and safety. Similar to aerospace applications, the incorporation of high-performance composites reinforced aircraft structural components while maintaining high strength-to-weight ratios.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.45 billion |

| Industry Value (2035F) | USD 7.60 billion |

| CAGR (2025 to 2035) | 5.5% |

In 2024, the automobile industry also saw greater adoption of advanced fiber-based materials, particularly in EVs. Battery manufacturers have integrated heat-resistant fibers into electric vehicle battery insulation materials to improve thermal protection and fire safety. This trend strengthened the role of lightweight, durable materials in automotive design.

Looking ahead to 2025 and beyond, innovation in sustainable and recyclable fiber-based solutions will shape industry dynamics. Estimated at a 5.5% CAGR, key sectors such as defense, automotive, and aerospace will continue driving demand, with the Asia-Pacific region emerging as a dominant player due to rapid industrialization and technological advancements.

Explore FMI!

Book a free demo

We also expect sizeable growth in the aramid fiber industry in 2025, driven by technological breakthroughs in the protective textiles, aerospace, and automotive sectors. The pursuit of strong, lightweight materials was ever-present, with industries looking at performance efficiencies and approaches to sustainability.

In 2024, industry growth was primarily led by the defense sector, driven by increased procurement of ballistic protection equipment by military forces worldwide. The automotive industry also adopted high-performance fibers with greater enthusiasm, particularly in EVs. These fibers were incorporated into insulating materials for electric vehicle batteries to enhance thermal insulation and fire safety properties. The upward trend is expected to accelerate in 2025 as regulatory agencies implement stricter safety standards.

For the forecast period of 2025 and beyond, the sector will be fueled by a higher investment in research and development, primarily in the area of green and recyclable aramid products. With the Asia-Pacific region being rapidly industrialized and spearheading other major industries such as defense, automotive, and aerospace, the global landscape is estimated to grow at a 5.5% CAGR, also leading to cross-vertical opportunities.

| Country | Key Regulations & Policies |

|---|---|

| United States | Strict National Institute of Justice (NIJ) ballistic protection standards regulate defense and law enforcement equipment. The Environmental Protection Agency (EPA) has also established guidelines for the chemical processing of high-performance fibers to ensure environmental safety. |

| United Kingdom | High-performance protective gear is required by the defense and security export policy. The REACH chemical safety guidelines for fiber production must be adhered to. |

| France | Military applications under defense procurement law necessitate high-strength materials sourced locally. Yes, it includes strict fire resistance standards for aerospace textiles. |

| Germany | In automotive and aerospace applications, DIN standards set specific requirements for material performance and durability. Additionally, the EU Green Deal emphasizes sustainability, pushing manufacturers to adopt eco-friendly and recyclable fiber-based solutions. |

| Italy | High-performance vehicles must use high-temperature-resistant materials in compliance with automotive safety standards. Lightweight ARIMAD composites are a high priority for the defense sector. |

| South Korea | The Korean Industrial Standards (KS) prescribe the use of high-performance fibers for military and firefighting applications in Korea. Strengthened regulations on EV battery safety have led to increased investment in advanced insulating materials. |

| Japan | In the field of protective textiles, stringent new requirements are being developed, such as Japanese Industrial Standards (JIS), which set such requirements as durability and flame resistance. Industrial Quality Control for Aerospace Composites. |

| China | The implementation of the Made in China 2025 policy aims to promote local production of cutting-edge materials, supporting technological self-sufficiency. Additionally, enhanced safety regulations are driving innovation in firefighting gear to improve durability and heat resistance. |

| Australia & New Zealand | Industrial applications of heat-resistant textiles and protective garments: AS/NZS standards about military zeniths, strengthening military-grade material certifications. |

| India | Ballistic-resistant fabrics are increasingly being produced domestically under India's manufacturing initiatives. Defense Production Policy Fire Safety Aramid Fiber Standard by Bureau of Indian Standards (BIS) |

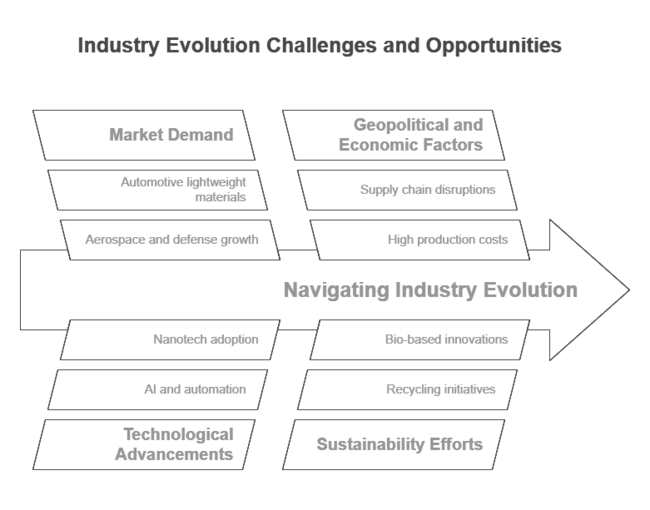

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Heavy demand in the aerospace, defense, and industrial sectors translates to continued growth. | Growth is driven by EVs. Battery insulation, renewable energy, and advanced composites. |

| Supply chain disruptions related to COVID-19 and geopolitical tensions. | More investment should be made in domestic production and raw material security. |

| There has been significant progress in ballistic protection and flame-resistant clothing. | The new high-performance fibers provide additional heat resistance and durability. |

| The company specializes in high-performance materials for both military and aerospace applications. | Growing demand for features and properties of lightweight and high-strength materials is projected to boost the automotive and infrastructure sectors. |

| This marks the beginning of sustainability and recycling efforts. | There are emerging circular economy models and bio-based high-performance fiber innovations. |

| Innovation and production were heavily concentrated in North America and Europe. | Asia-Pacific is emerging as a manufacturing and consumption leader. |

| Cost-sensitive markets prevented widespread adoption due to high production costs. | Broader accessibility is driven by cost optimizations and economies of scale. |

| Conventional manufacturing processes are reliant. | AI, automation, and nanotech adoption to enhance fiber performance. |

Based on product type, the meta-aramid market industry is expected to continue leading the industry with a CAGR of 5% from 2025 to 2035, which accounted for 75% of global fiber industry revenue in 2024. Due to its tensile strength, heat resistance, and resistance to deterioration, para-aramid leads the industry as a critical component of security and protection, such as body armor, helmets, and military equipment.

As both the EV and renewable energy markets continue to grow, their applicability in high-voltage systems is growing as well. It is also widely used in flame-retardant textiles, from firefighter coats to industrial protective gear. Increasing workplace safety regulations and fire prevention standards are also propelling its demand across industries.

Security and protection are expected to emerge as a prominent segment by application, with a CAGR of 4.8% projected from 2025 to 2035. The security and protection application segment is dominant, accounting for more than 40% of global sales. This segment remains the largest, driven by rising defense spending and strict safety regulations. Highly ballistic and heat-resistant, advanced fibers are widely used in bulletproof vests, helmets, riot protection, and industrial protective clothing.

Fuel efficiency and the development of lightweight materials are accelerating demand. The fastest-growing sector includes electrical insulation, high-voltage insulation, printed circuit boards, and cables, driven by growth in renewable energy, grid modernization, and the expansion of electric vehicles. As industries increasingly emphasize efficiency and sustainability, high-performance fibers are gaining prominence to enhance electrical and industrial performance.

High-performance fibers are widely used in industries such as aerospace, automotive, and defense, especially in the United States, which is one of the largest consuming nations. The USA Department of Defense (DoD) funding for ballistic protective materials has vigorously sustained the adoption of these fibers in body armor, helmets, and reinforced military-grade vehicles.

The aerospace industry, driven by companies like Boeing and Lockheed Martin, uses advanced composites in aircraft structures to save weight and add durability. Sustainable development is also at the forefront of the country’s shift toward bio-based and recyclable fiber materials, placing the USA at the top of next-generation fiber technologies. Having a CAGR of 5.4%, the industry in the USA is expected to reach USD 1 billion by 2035.

The consistently growing defense and aerospace sectors in the UK contribute to driving demand. The UK Ministry of Defense purchases large volumes of fiber-reinforced bulletproof vests, helmets, and flame-resistant clothing to protect its soldiers. Furthermore, the country’s strong aviation sector, supported by major players like Rolls-Royce and BAE Systems, is driving regional industry growth.

The production of high-quality technical fibers in the UK is facilitated by stringent safety guidelines from the UK Health and Safety Executive (HSE) and adherence to EU REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) policies. Demand for heat-resistant fibers is expected to increase in high-temperature insulation and battery safety applications due to the UK's growing focus on electric vehicles (EV) and renewable energy solutions.

The defense, aerospace, and automotive industries in France continue to shape the demand landscape. The French military and police forces are placing greater emphasis on high-performance protective equipment, driving significant demand for fiber-based ballistic body armor, tactical apparel, and riot gear.

Moreover, local players such as Renault and Peugeot in the automobile industry are integrating durable fiber materials in high-performance tires and friction materials to enhance vehicle safety and longevity. France's commitment to sustainability and EU green regulations has further fueled innovation in eco-friendly alternatives, establishing the country as a leader in sustainable fiber technology.

Germany accounts for a significant share of the overall consumption, primarily due to its strong automotive, industrial, and defense sectors. Germany's large automotive manufacturers, including BMW, Mercedes-Benz, and Volkswagen, create a strong need for reinforced fiber in tires, friction materials, and lightweight composites to enhance fuel efficiency and vehicle performance. Protective fiber materials are also widely used in the German military for advanced body armor, protective clothing, and vehicle armor.

The aerospace sector (including Airbus and others) also makes heavy use of aramid-based composites to increase aircraft lifetimes and reduce fuel consumption. Germany's strong industrial base also supports the demand for high-temperature insulation, as well as optical fibers and fire-resistant textiles.

The Italian counterpart of the landscape is gaining traction in industries such as defense, automotive, and fashion. Security forces and law enforcement agencies in Italy use bulletproof vests, helmets, and tactical uniforms made of high-strength materials. Italy’s world-class automotive sector, including Ferrari, Lamborghini, and Fiat, integrates reinforced composites in high-performance tires, brake systems, and lightweight vehicle components.

The demand for heat-resistant fabrics used in fire-retardant and protective clothing, especially for industrial workers and firefighters, has also been propelled by Italy’s strong presence in the fields of fashion and textiles. While the aerospace sector is smaller than that of other European countries, the demand for aircraft reinforcement materials still adds to the overall trend.

The industry in South Korea is growing rapidly, with a CAGR of 4.1%, and is forecasted to reach USD 0.57 billion by 2035, driven by its advanced automotive, defense, and electronics sectors. The country’s heavy emphasis on military modernization increases the requirement for ballistic armor, tactical gear, and lightweight military vehicles. Hyundai and Kia are at the forefront of the automotive sector, where high-performance fibers are used in tires, friction materials, and insulation for EV batteries.

Moreover, reinforced optical fibers are vital for high-speed data transmission due to South Korea's development of consumer electronics and 5G infrastructure, contributing to increased sales. In addition, the government is also investing in renewable energy and electric vehicle (EV) infrastructure development, which is driving demand for electrical insulation and power grid applications.

Japan is well-developed, particularly in defense, automotive, and electronics. The country is home to leading high-performance fiber manufacturers, including Teijin and Toray, which export advanced materials for both domestic and international applications. Toyota, Honda, and Nissan dominate Japan's motor industry, integrating specialized fibers into high-tech tires, braking systems, and lightweight car components. Fiber-based protective gear, including bulletproof jackets and fireproof textiles, remains critical for the defense industry. Growing network systems focused on technological innovation and miniaturization are expected to boost demand for specialty fibers in optical cables and electronic components.

Japan's extensive safety legislation and environmental awareness are driving R&D efforts for next-generation sustainable fibers with enhanced recyclability and eco-friendly properties. The industry is anticipated to reach USD 0.67 billion, growing steadily at a 4.5% CAGR by 2035.

We expect China's rapidly expanding automotive, defense, and industrial bases to fuel its rise as the dominant force in high-performance fiber applications. The industry will reach USD 0.94 billion with a CAGR of 5.2% by 2035. The government is also encouraging the local production of advanced materials to reduce reliance on imports as part of its Made in China 2025 program.

The country's massive defense industry is driving enormous demand for ballistic protection and military-grade vehicle reinforcements. China's fast-growing electric vehicle (EV) market, led by companies like BYD and NIO, is driving rapid demand for battery insulation, high-performance tires, and lightweight composites.

Australia and New Zealand’s industry is small but growing steadily, mostly due to defense, firefighting, and industrial applications. Demand for firefighter suits, industrial gloves, and heat-resistant uniforms is rising due to strict safety standards for protective clothing in both countries. As they invest in advanced body armor and tactical gear for military personnel, adoption of high-strength protective materials is increasing in the defense sector.

In addition, the region's emphasis on renewable energy is also driving demand for electrical insulation and high-voltage power transmission solutions. Local production of reinforced composites in Australia and New Zealand is expected to grow as both countries enhance their manufacturing capabilities.

High-performance materials are the preferred choice in India's defense and automotive industries. The government's Make in India program promotes domestic manufacturing of ballistic armor, tactical gear, and other protective apparel for military and law enforcement forces. Companies such as Tata Motors and Mahindra have been integrating advanced composites into high-performance tires and friction materials for the automotive sector.

In addition, the growing power sector is propelling demand for electrical insulation materials. The increasing focus on workplace safety and fire prevention in India is driving the adoption of protective apparel within industrial settings.

The industry is group-oriented, and a few key players control the global market. Here’s a breakdown of the share in 2024 for the top companies:

The leading company is DuPont de Nemours, Inc. (35%)

DuPont is the world leader in aramid fiber, mainly because of its flagship product, Kevlar. It has solutions for many industries, including defense, automotive, and industrial.

Teijin Limited (25%)

Teijin, a Japanese chemical company, is a significant aramid fiber player that manufactures the Twaron and Technora brands. The firm operates in Asia, Europe, and North America.

Yantai Tayho Advanced Materials Co., Ltd. (15%)

Yantai Tayho Advanced Materials Co., Ltd. has been growing its presence in international scenario.

Kolon Industries, Inc. (10%)

Kolon Industries entered a business alliance with a leading automaker to develop lightweight electric vehicle (EV) aramid fiber composites, aiming to foster innovation and strengthen its position.

Hyosung Corporation (8%)

Kordsa, a global leader in reinforcement technologies, specializes in high-performance materials, including aramid fiber applications for tire reinforcement, composites, and industrial uses.

DuPont is expanding its production

DuPont is expanding its aramid fiber production capacity in the United States. This acquisition will help align its business with its growing portfolio of high-performance materials essential for defense and aerospace applications.

Teijin Starts Production of Eco-Friendly Aramid Fibers

Teijin announces a new line of eco-friendly options. Teijin has constructed its all-new line of eco-conscious aramid products using recycled materials. This innovation caters to the increasing demand for high-performance materials that are environmentally friendly and complement global sustainability objectives.

Kolon Industries: A Long-term Strategic Partnership

Kolon Industries entered into a business alliance with a leading automaker to develop lightweight electric vehicle (EV) aramid composites. By working together, they aim to foster innovation and strengthen Kolon industries’ position.

The sector falls under the specialty chemicals and advanced materials sector, which is closely linked with the defense, aerospace, automotive, electronics, and industrial safety industries. As a high-performance synthetic fiber, Aramid is subject to the macroeconomic demand drivers of the industrial economy, such as industrial expansion, growth in technology, defense spending, and environmental policy.

The global economy, particularly in developing countries like China, India, and Southeast Asia, is driving demand for protective equipment, car reinforcements, and infrastructure materials. Further growth is driven by the rising adoption of electric vehicles (EVs) and renewable energy projects, in which these fibers are used for battery insulation, lightweight composites, and electrical insulation.

Strong growth driven by government spending on defense and security remains, with many countries increasing investments in ballistic protection and tactical warfare. Strict fire safety and workplace regulations mandated in developed economies are driving the consumption of high-performance protective clothing and industrial safety solutions.

Recycling schemes, sustainable production processes, and technological innovation will create new opportunities amid challenges from inflation, supply chain disruption, and volatile prices for raw materials. Growth in the aramid fiber sector will remain relatively stable, with the compound annual growth rate (CAGR) standing at just over 5%-although steady growth in energy-efficient/high-tech applications should support demand through the next decade.

Industries such as defense, aerospace, automotive, and renewable energy that generate employment have huge growth potential in the aramid fibers market. The demand for these lightweight, high-strength, and heat-resistant materials is increasing across various industries, creating new growth opportunities for the landscape.

One of the biggest growth areas is the electric vehicle landscape, where high-performance fibers are being used increasingly in battery insulation, lightweight components, and high-end tires. Producers that invest in bio-based and recyclable advanced fibers will gain a competitive advantage as governments worldwide push toward sustainability and fuel efficiency. In addition to that, the establishment of 5G networks and the installation of fiber optics will create new opportunities for the fiber-reinforced optical cable industry.

Rising military budgets and global tensions are driving demand for new ballistic protection materials in the defense industry. Access is something that we're seeing companies win lucrative long-term government deals around, whether it's next-generation lightweight armor solutions or tailored defense applications. Similarly, industrial safety standards are raising the demand for aramid-based fire-retardant clothing and protective equipment, generating new revenue opportunities.

To leverage such opportunities, companies must constantly diversify their product offerings by investing in R&D, target ing strategic acquisitions of renewable energy companies, automakers, and defense departments, targeting regional expansion to Asia-Pacific and Middle Eastern high-growth sectors, and investing in innovation initiatives to produce differentiated products.

Tough yet lightweight, aramid fibers are ideal for body armor, helmets, vehicle reinforcement, and so much more, thanks to their incredible balance of ballistic resistance, heat resistance, and durability.

They help provide thermal stability and insulation for EV batteries, which minimizes the chances of fire and enhances the overall performance.

Their low weights but high tensile strength improve aircraft fuel efficiency, structural integrity, and impact resistance, among other things.

While relying on existing ethylene terephthalic acid, research is ongoing for bio-based aramid fibers and improved recycling methods to lower environmental impact.

Manufacturing processes and material formulations are driven by safety, environmental, and chemical compliance laws.

The industry is bifurcated into para-aramid and meta-aramid.

It is fragmented into security & protection, frictional materials, rubber reinforcement, optical fibers, tire reinforcement, electrical insulation, aerospace, and others.

Is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, the Middle East, and Africa.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.