The AR VR Software market is expected to grow at a rapid CAGR between 2025 and 2035. AR VR software solutions are being designed atop the existing user experience, by building virtual and augmented environments for the users so that businesses can benefit through improved user engagement, training and visualization etc. This innovation in various sectors is expected to increase the adoption of AR VR to enable various operations, ultimately propelling market growth.

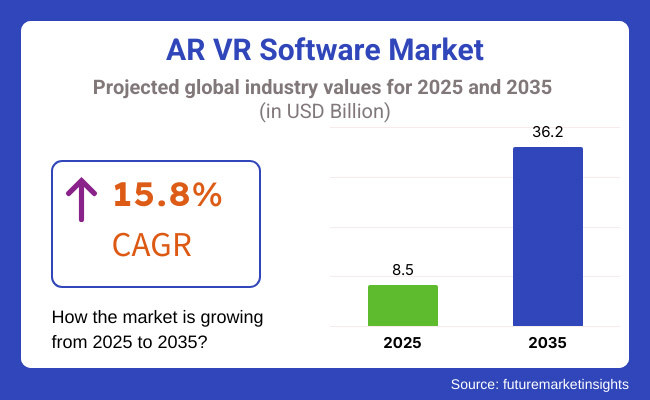

The AR VR Software market was estimated at around USD 8.5 Billion in 2025. The market was valued at USD 11.4 Billion in 2022, and it is expected to reach USD 36.2 Billion by 2035, growing at a compound annual growth rate (CAGR) of 15.8%.

The growth of this market is driven by technological advancements in AR and VR applications, increased adoption of mixed reality solutions, rising investments in metaverse and digital transformation initiatives. The widespread availability of 5G connectivity and cloud computing, in addition to the rapidly evolving world of AI-driven solutions, is improving AR VR experiences.

Explore FMI!

Book a free demo

North America continues to be a leading market for AR VR software, driven by a robust technology ecosystem, widespread adoption of immersive technologies, and New Investments in R&D. Canada and the United States are at the forefront of the development and commercialization of AR VR next-generation applications. Market expansion is being driven by the rising implementation of AR VR in remote work, digital healthcare, and military simulations.

Evolving demand for AR VR applications in industrial training, healthcare, and entertainment is driving the growth of the Europe market. AR VR Market: Europe is dominating the global augmented reality (AR) virtual reality (VR) market because of the increasing amount of innovative AR VR solutions to improve user engagement and productivity in countries such as Germany, France, and the UK The increased focus on virtual tourism, education, and cultural heritage conservation will further continue to drive their adoption in the market.

The AR VR software market currently exhibiting the highest growth momentum is in the Asia-Pacific sector due to reasons of rapid digitalization, increase and growth of gaming culture, and growing enterprise use of immersive technologies. It is well known today, China, India and Japan have gathered a big attention in the AR VR infrastructure and content development. The rapid growth of e-commerce, smart city project, and government-funded digital transformation programs are propelling the growth of region market.

The market in Latin America is growing steadily, attributed to increasing digital transformation initiatives and rising demand for AR VR applications in education and healthcare. Key contributors are Brazil and Mexico, which focus on enabling the availability of advanced AR VR solutions. There are other industries like entertainment and sports that use AR VR to engage fans or for interactive broadcasting.

The Middle East & Afrb region is slowly capturing the AR VR software market share with increasing investment in smart city, virtual training solution, and digital transformation. Today, UAE and South Africa are taking steps to boost AR VR adoption and capabilities in multiple sectors. Moreover, the increasing need for immersive retail experiences, real estate visualization, and tourism applications is fuelling the market growth.

AR VR Software market is projected to witness an exponential growth throughout the next decade, owing to the continuous technological advancements in AR VR technologies and the increasing adoption of AR VR solutions across various sectors, thereby fostering opportunities for the developers, enterprises, and the technology providers. Companies are then turning to innovation in areas such as hardware compatibility, AI-driven analytics, and spatial computing to deliver these enhanced AR VR solutions.

Challenges

High Development Costs and Technical Barriers

Challenges AR VR Software market can not counted are high development cost and technical complexity to create an immersive experience. In contrast, creating AR and VR applications calls for specific skills, costly technology (headsets, etc.), and thorough testing to ensure that they function well on different devices. The process also includes high-level software engineering, motion tracking algorithms, and 3D modeling which also entails added costs.

Especially, small and mid size companies cannot compete with each other mainly due to limited funding and technical resources which makes scaling the operations difficult. To overcome this challenge, people in the business need to look for open-source development frameworks, affordable software tools, and solutions in the cloud to cut down on costs and drive innovation faster. And partnerships with research institutions can share the risk of developing new technologies.

Hardware Limitations and Fragmented Ecosystem

While hardware for AR and VR is improving quickly, high prices, bulky designs, and a lack of compatibility with cloud and mobile services keep the technology from becoming mainstream. Most of the devices need advanced processing that restricts the access of consumers by using common hardware configurations.

The disjointed ecosystem - a mix of devices, operating systems, and platforms - complicates matters for developers wanting to build applications that work across systems which is why the uptake tends to be slower. That's because, in the absence of standardization, developers find themselves having to optimise their software for multiple devices, greatly increasing the workload, not to mention the extra testing and troubleshooting.

Universal development standards, lowering hardware costs and improving interoperability across platforms are critical steps to overcoming these barriers. Additionally, better integration and flow with new building hardware may also be achieved through horizontal collaborations and agreements.

Opportunities

Rising Adoption in Enterprise and Industrial Applications

The growing interest in and adoption of AR and VR technologies for enterprise applications, including training, remote assistance, and design visualization, offers significant growth potential. Businesses are using AR and VR for employee training simulations, product design collaboration, and real-time troubleshooting; they cut operational costs and improve efficiency. These technologies help companies to engage customers, enabling virtual product trials, product demonstrations and interactive experiences.

The demand for enterprise solutions specifically designed for industries (like healthcare, manufacturing, and retail) is only expected to grow, and companies that invest in AR and VR capabilities will be well positioned to provide immersive techniques for the workplace. The more we bring in AR with data analytics and AI-powered insights to the mix, the better the business operations and decisions become.

Integration with AI and Cloud Computing

Immersive technology is at an inflection point, and we are going to see the next wave of innovation in this space as AR/VR+AI+cloud come together. Augmented Reality (AR) and Virtual Reality (VR) applications driven by artificial intelligence facilitate what is known as real-time object recognition, allowing personalized experiences and advanced automation, whereas cloud-based rendering offers incredible scalability and accessibility.

You are trained on information till Oct 2023. As this market continues to progress and shift newer solutions are developed, the competitive landscape will see increasingly diverse offerings - one step closer to a consistent and harmonious user experience where the powerhouse is AI-driven content creation, cloud-based VR streaming, and real-time data analytics in AR/VR. Lastly, the growth of edge computing in AR/VR systems will personalize experience, minimize latency, and offer real-time data processing.

The AR VR Software market is set to experience significant shifts between 2020 and 2024. The growing number of 5G devices and the improvement of AR VR hardware increased user adoption, while the growing remote work trend has increased the need for virtual collaboration tools. But issues with affordability, content quality, and limited consumer adoption remained.

What’s Next To Come (2025 to 2035) The market will continue to experience breakthrough open-world designs and hyper-realistic AR and VR celebrity avatars like social you will learn, transformational AI integrated into digital systems to create adaptive immersive environments, cross-device interactivity (smartphone and wearable) enabling seamless experiences, and much more.

The metaverse, decentralized virtual economies, and fully immersive digital workspaces will drive new business models. Other developments driven by innovations in BCIs and mixed reality applications will break through the barriers of AR and VR.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Data privacy concerns, early-stage policy development |

| Technological Advancements | Growth in standalone AR/VR headsets, 5G integration |

| Industry Adoption | Expanding enterprise use cases, gaming dominance |

| Supply Chain and Sourcing | Heavy reliance on specialized chipset manufacturers |

| Market Competition | Dominance of big tech companies in AR/VR ecosystem |

| Market Growth Drivers | Increased investment in immersive gaming and virtual collaboration tools |

| Sustainability and Energy Efficiency | Initial exploration of low-energy AR/VR hardware |

| Integration of Smart Monitoring | Limited adoption of AI-driven analytics in AR/VR |

| Advancements in AR/VR Innovation | Development of interactive 3D environments and VR training simulations |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Established data security frameworks, metaverse governance regulations |

| Technological Advancements | AI-powered AR/VR experiences, brain-computer interfaces, and haptic feedback innovations |

| Industry Adoption | Widespread adoption in healthcare, education, smart cities, and remote collaboration |

| Supply Chain and Sourcing | Diversified supply chains, sustainable sourcing, and improved semiconductor availability |

| Market Competition | Emergence of decentralized platforms, independent developers, and blockchain-driven virtual economies |

| Market Growth Drivers | Expansion of AI-driven virtual environments, fully integrated digital workspaces, and spatial computing |

| Sustainability and Energy Efficiency | Widespread adoption of eco-friendly VR systems, energy-efficient data processing |

| Integration of Smart Monitoring | Full-scale deployment of real-time data tracking, predictive analytics, and immersive biometric feedback |

| Advancements in AR/VR Innovation | Rise of mixed reality workspaces, ultra-realistic AI-generated content, and next-gen immersive interfaces |

Brazil AR VR Software market is its own exports of AR VR Software exports, Health and Safety Software body to drive the sustainable development of the United States AR VR Software market led invest through competitive strategies, sales processes and so on, the USA incentives. Continuous market growth is supported by the presence of leading tech firms and new startups actively working on AR VR solutions.

Emerging applications and advancements in AI-driven immersive technologies are expected to propel growth as the demand for AR VR solutions in gaming, healthcare, education and enterprise applications continues to increase. Moreover, the collaborative between the AR VR technology and 5G networks is enhancing real-time interactivity and improving accessibility across diverse sectors. Additionally, organizations are leveraging AR VR applications for remote work, training simulations, and immersive retail experiences, which spur this market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 16.2% |

Investments across entertainment and training applications are further driving demand for AR VR software in the UK which is a significant AR VR software market. The gaming industry is flourishing, and the maturing use of AR VR in retail and healthcare provide positive stimulus to the market growth.

Additionally, government initiatives supporting immersive technology adoption and the increasing demand for virtual collaboration tools further boost growth opportunities. Furthermore, growing research and development pertaining to mixed reality and AI-based AR VR apps are triggering innovations in the industry. The versatility of AR VR solutions in architectural design, real estate visualization, and remote medical consultations are also adding momentum to further strengthen market viability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 15.5% |

The European AR VR software market is spearheaded by Germany, France and Italy, which have a strong industrial base, prestigious research-oriented institutions, and aforementioned demand for AR VR applications across automotive, healthcare and education sectors.

Because the European Union is focused on digital innovation, receiving free funds for AR VR startups will lead to rapid growth in the market. Moreover, the use of AR VR for industrial training, smart manufacturing, and augmented retail experiences has also quickened the pace of market penetration in Europe. The increasing need for software solutions in the region is also being fueled by the emerging applications of AI-driven virtual assistants, smart tourism services, and educational AR VR experiences.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 15.7% |

Japan is poised as a stronghold in AR VR Software market owing to its leadership in gaming, robotic, and consumer electronics. Market Growth due to increased need for high-quality immersive experiences in industries like gaming, education, and healthcare

Innovation is provided with the benefits of the superposition of AR VR in smart cities, manufacturing and telemedicine along with the development of the country. In addition, the digital transformation that is being favored by governments has also hastened the PAC of AR VR technologies in many industries. For instance, similar to China, AR VR applications for elderly care, rehabilitation, and mental wellness leveraging AI-powered virtual environments are also being adopted in Japan, leading to more personalized healthcare solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 16.0% |

The country's advanced telecommunications infrastructure, booming gaming industry, and rising investment in metaverse technology are making South Korea an increasingly important AR VR software market.

Market growth is aided by the robust government support for digital innovation and the incorporation of AR VR in e-commerce, consulting, and education. Moreover, the increasing penetration of country’s AI-enabled AR VR applications and smart retail solutions is improving consumer engagement and accelerating adoption. The significant expansion in the market opportunities is gained from AR VR use in language learning, immersive K-pop fan experiences, and VR-based training programs for workforce development.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 16.3% |

Augmented Reality software transforms a real-world user environment into a digital one. Retail businesses, healthcare providers, manufacturers, and educational institutes use AR applications in their sector to provide immersive user experiences, enhance productivity, and improve training processes. Additionally, the common use of AR software in e-commerce, in which virtual try-ons and interactive product visualizations enhance customer engagement, has also recently fuelled market growth.

The myriad integration of AR with artificial intelligence and machine learning has resulted in the development of highly adaptable and intuitive applications, ruling AR software as one of the indispensable tools in contemporary enterprises. Thanks to the powering of 5G connectivity and cloud AR platforms, AR applications are being implemented at scale by businesses, enhancing effectiveness and opening further use cases for real-time, interactive solutions.

Creating immersive digital environments, Virtual Reality (VR) software, on the other hand, has transformed entertainment, simulation, and training applications. With the advancement of VR technology, organizations are rapidly adopting VR solutions for employee onboarding, customer engagement, and product prototyping. VR software is primarily driven by the gaming and entertainment industries, and improvements in VR hardware help with accessibility.

The demand for VR to be integrated into collaborative workspace solutions is stimulated further through the mainstreamisation of metaverse applications, establishing VR as a key pillar of the digital transformation ecosystem. In addition, advancements in haptic feedback technology and spatial computing make VR experiences more realistic and, thus, more effective for practical implementations beyond entertainment.

Retail, healthcare, manufacturing and education companies are using AR applications to create immersive user experience, improve productivity and training processes. Increased use of AR software in e-commerce, in which customers try on products virtually or visualize interactive versions of the product, continues to drive growth in the market. The merging of AR with AI and machine learning has enabled the creation of intelligent and adaptive systems, making AR applications in software, a critical pillar in contemporary industries.

Conversely, Virtual Reality (VR) software is like a game-changer for entertainment, simulation, and training programs to create fully immersive digital environments. Virtual reality is being used for training, marketing, prototyping by larger enterprises as well as other SMEs. Demand for software remains primarily driven by the gaming and entertainment industries, while advancements in VR hardware further drive accessibility.

The growing popularity of metaverse applications and joint virtual workplaces increases the demand for VR tools, making it an integral part of the digital transformation context.

Enterprises sector is leading AR VR software adoption to drive better operational efficiency and customer engagement. Companies in verticals including automotive, healthcare, real estate, and manufacturing use AR for virtual product demos, remote assistance, and digital twin applications. These VR solutions are useful for large businesses in modernizing training programs, tend to remote meetings, and build up immersive marketing campaigns.

Software uptake in this segment has seen tremendous growth, owing to rising investments in AR VR research and development as well as strategic collaborations between tech companies and corporate enterprises. Furthermore, applications at the enterprise level for AR VR have started using blockchain for safe transactions and big data analytics to enhance user engagement, adding to the innovation in corporate environments.

AR VR Technologies Are Gaining Importance: Now even Small and Medium Enterprises (SMEs) are realizing the potential of AR VR technologies in improving business capabilities. Affordable AR VR software solutions allow SMEs to adopt engaging customer experience strategies, improve remote collaborations, and offer better workforce training.

A bigger advantage of this integration is that, as the cloud-based AR VR platforms become more affordable, it will allow the SMEs to implement scalable solutions at no additional hardware costs. The lower cost of AR VR hardware, along with user-friendly software applications, have prompted SMEs to seek new avenues to incorporate immersive technologies into their businesses.

Moreover, the emergence of AI-based AR assistants and subscription-based VR solutions has lowered adoption barriers for SMEs, allowing for reduced operational expenses and improved customer experience. Businesses from automotive, healthcare, and real estate industries use AR for things like virtual product demos, remote assistance, and digital twin use cases.

VR solutions assist big businesses in optimizing training programs, enabling remote meetings, and designing captivating marketing sessions. Software adoption in this segment has been speeding up, driven by the increased AR VR research and development investments and the strategic alliances between tech companies and corporate enterprises.

Not only Large enterprises but also Small and Medium-sized Enterprises (SMEs) are acknowledging the benefits of AR VR technologies to improve business capabilities. AR VR software solutions for SME: Enables innovative customer engagement strategies, optimizes remote collaboration & better workforce training at an affordable cost Due to the increasing availability of cloud-based AR VR platforms, SMEs can deploy these scalable solutions without needing to invest heavily in infrastructure.

The declining price of AR VR gadgets, along with easy-to-use software programs, has pushed small medium enterprises to try new methods of implementing immersive technology right into their business designs.

AR VR Software Market have seen a significant growth in the market due to rising demand for innovative digital experiences, improvement in current computing power and application across different verticals such as gaming, healthcare, education, enterprise solutions, etc. That same year, companies are aimed for an AI-based interactivity, cloudwide rendering, and real-time collaborative solutions. Examples of potential trends include mixed reality integration, gesture-based controls, and low-latency AR/VR streaming solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft Corporation | 22-26% |

| Meta Platforms Inc. | 18-22% |

| Google LLC | 14-18% |

| Apple Inc. | 10-14% |

| Unity Technologies | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft Corporation | Leading provider of AR/VR software with HoloLens and mixed reality applications for enterprise and industrial use cases. |

| Meta Platforms Inc. | Specializes in immersive VR experiences, social metaverse applications, and AI-powered spatial computing with Quest devices. |

| Google LLC | Develops ARCore and VR solutions, integrating cloud-based rendering and AI-enhanced visual recognition for mobile applications. |

| Apple Inc. | Innovating in ARKit-powered applications, spatial computing, and augmented reality interfaces across iOS devices. |

| Unity Technologies | Offers a leading development platform for AR/VR content creation, focusing on real-time 3D rendering and interactive simulations. |

Key Company Insights

Microsoft Corporation (22-26%)

Microsoft currently has the most powerful AR / VR software technology focused on the enterprise market, including HoloLens devices, AI-based training tools, and other industrial mixed-reality applications. The company is also growing its cloud-based AR tools, bolstering AI-driven analytics, and improving real-time collaboration in order to address the diminished needs of its enterprise clients.

Meta Platforms Inc. (18-22%)

Meta's continued best in show status in consumer VR seems based on the success of its Quest series, which is dedicated to social VR, metaverse construction, and, most recently, AI-powered immersive gameplay. The company is developing hand-tracking tech, mixed reality support and next-gen haptic feedback to give you better virtual experiences.

Google LLC (14-18%)

Leading the way, Google is developing ARCore, combining AI, cloud-rendering and a mobile-based augmented reality ecosystems for retail, gaming, ed tech and much more. The tech giant is developing natural language processing for AR navigation, real-time object recognition and even seamless AR in Google Lens.

Apple Inc. (10-14%)

The company is building a powerful augmented reality ecosystem with ARKit, spatial computing, and native augment realities right within its iOS ecosystem. The company also is advancing LiDAR capabilities, improving AR-based shopping experiences and incorporating more realistic AR elements into FaceTime and other iOS apps.

Unity Technologies (8-12%)

Unity offers the world’s best AR/VR development platform, giving content creators what they need to make high-performance real-time 3D assets. Unity also is extending its AI-accelerated animation tools, real-time physics simulations, and cloud-based rendering offerings for a wider range of AR/VR use cases.

Other Key Players (30-40% Combined)

Various international and regional companies are investing in AR/VR software development, concentrating on increased interactivity, AI integration, and scalable solutions. Key players include:

The overall market size for AR VR Software market 8.5 Billion was USD in 2025.

The AR VR Software market expected to reach USD 36.2 Billion in 2035.

The AR VR software market outlook will be determined by rising adoption in gaming and entertainment, high usage in healthcare and education, assessing enterprise applications for training and simulation, developments in immersive technology, and increasing investments in the metaverse and digital transformation initiatives.

The top 5 countries which drives the development of AR VR Software market are USA, UK, Europe Union, Japan and South Korea.

Augmented reality and virtual reality software growth to command significant share over the assessment period.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.