The global market for aqua feed additives is quite dispersed, and the five largest companies-Alltech, Cargill, DSM Animal Nutrition, Kemin Industries, and Evonik Industries-control 54% of the overall market. They dominate because they are equipped with the latest technological tools for formulating feeds, have good relationships with aquaculture farms, and invest in green technologies. But 46% of the market is controlled by mid-range and emerging players, which indicates fragmentation in specialty feed additives, functional proteins, and regional aquafeed solutions. Leading them first with 18% is Alltech, which rides on its technical expertise in amino acid-based feed solutions and gut health-promoting additives that enhance digestibility and retention of nutrients in farmed fish. Second comes Cargill at 16%, emphasizing high-performance fish feed blends, such as omega-3-supplemented additives to boost growth rates and immune response. The remaining 46% of the market share is held by mid-tier and upcoming players like Novus International, ADM (Archer Daniels Midland), Nutreco, Biomin, and Ridley Corporation, which are involved in functional feed additives, probiotics, and green aquafeed solutions.

Explore FMI!

Book a free demo

| Market Structure | Top 5 Leading Brands |

|---|---|

| Industry Share (%) | 54% |

| Key Companies | Alltech, Cargill, DSM Animal Nutrition, Kemin Industries, Evonik Industries |

| Market Structure | Mid-Tier & Growth Players |

|---|---|

| Industry Share (%) | 30% |

| Key Companies | Novus International, ADM, Nutreco |

| Market Structure | Specialty & Emerging Brands |

|---|---|

| Industry Share (%) | 16% |

| Key Companies | Biomin, Ridley Corporation, other niche players |

The aqua feed additives market is moderately fragmented, with the top five companies controlling 54%, while 46% is held by mid-tier, regional, and niche brands. Private labels remain absent, as feed formulation requires high regulatory compliance and consistency in aquaculture nutrition.

The amino acid segment leads with 26% market share, as methionine and lysine-based formulations improve fish growth rates and feed efficiency. Evonik Industries and Alltech are leaders in this area, providing maximized protein synthesis and sustainable feed conversion rates. Vitamins comprise 22%, with the likes of DSM Animal Nutrition and ADM contributing immune-boosting products that promote fish metabolism and resistance to disease. Minerals take up 18%, and their importance cannot be overstated in bone formation and enzyme activity in aquaculture. Nutreco and Cargill are among the significant contributors, creating balanced trace mineral mixtures for high-value fish species. Antibiotics add 12%, but their use is in the process of being reviewed because of regulatory issues. Firms such as Novus International and Kemin Industries are developing antibiotic alternatives such as probiotics and acidifiers.

Salmonids lead the market with 32% with salmon and trout aquaculture demanding high-protein, omega-3 enriched feed additives. Alltech and Cargill are the front runners in the development of amino acid and vitamin mixes for salmonids. Tilapia (24%) is a rapidly growing fish in Latin America and Asia, with the advantage of low-cost feed additives that enhance digestion and the feed conversion ratio. DSM Animal Nutrition and ADM have good market presence in tilapia feed products. Catfish (15%) and crustaceans (12%) need immune-boosting minerals and antibiotics to lower disease threats on aquaculture farms. Novus International and Nutreco specialize in functional feed additives specific to these species. Carp (8%), molluscs (5%), and mullet (4%) are smaller but consistent market sectors, with new feed formulations enhancing nutrient retention and stress resistance in these aquatic animals.

The aqua feed additives business in 2024 experienced significant developments in antibiotic-free products, functional gut health additives, and sustainable feed materials, as businesses responded to evolving regulatory environments and industry need for increased feed efficiency.

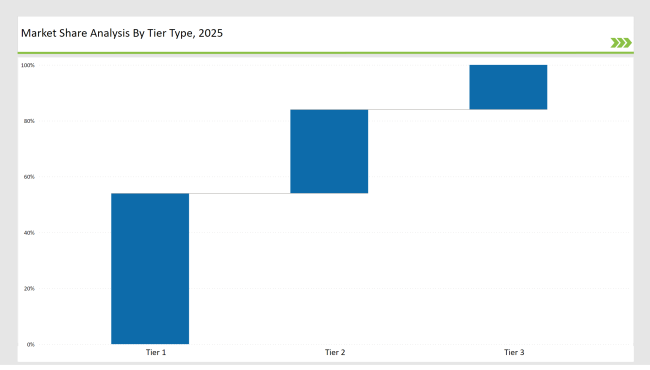

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 54% |

| Example of Key Players | Alltech, Cargill, DSM Animal Nutrition, Kemin Industries, Evonik Industries |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Novus International, ADM, Nutreco |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 16% |

| Example of Key Players | Biomin, Ridley Corporation, other specialty brands |

| Brand | Key Focus |

|---|---|

| Alltech | Launched next-gen methionine-based feed additive, improving protein utilization in salmon farming. |

| Cargill | Expanded omega-3-enriched aquafeed line for higher DHA and EPA content in farmed fish. |

| DSM Animal Nutrition | Introduced probiotic-based feed additives for antibiotic-free fish farming. |

| Kemin Industries | Developed organic acid-based gut health enhancers for disease prevention in tilapia and catfish. |

| Evonik Industries | Strengthened lysine and methionine-based protein optimization solutions for efficient feed conversion ratios. |

| Novus International | Invested in fermentation-based protein alternatives, reducing dependency on traditional fishmeal. |

| ADM | Expanded soy-based protein additives, improving digestibility in shrimp and crustaceans. |

As more global restrictions are imposed on the use of antibiotics, there will be increased demand for gut health promoters, probiotics, and acidifiers. DSM Animal Nutrition and Kemin Industries and other firms will create their functional feed solutions, including disease prevention and immune system support for aquaculture species.

Dependence on fishmeal and soy-derived proteins will diminish as the market moves toward fermentation-based proteins, algae meal, and insect-based proteins. ADM and Nutreco are already spearheading the change with investments in low-carbon alternative protein feed products.

With consumer demand for nutritious farmed fish rising, producers of aqua feeds will step up EPA/DHA fortification of fish feeds, providing enhanced nutrition in farmed seafood. Cargill and Alltech are spearheading developments in aquafeed rich in omega-3.

Aquafeed businesses will adopt AI-driven formulation platforms to maximize feed conversion ratios (FCR), minimize nutrient loss, and enhance fish growth performance. Nutreco and Alltech are already at the forefront of intelligent aquaculture nutrition solutions.

Mid-tier brands like Novus International, ADM, and Nutreco focus on alternative protein sources, disease-resistant feed additives, and species-specific formulations. Specialty brands like Biomin and Ridley Corporation cater to niche markets, including organic feed solutions and regional aquaculture species.

Aquaculture expansion into new fish species like crustaceans, mollusks, and regional tilapia varieties is driving demand for customized feed solutions. Ridley Corporation and Nutreco are developing species-specific additives tailored to regional farming conditions.

With increasing disease outbreaks in aquaculture, companies like Kemin Industries and Novus International are creating probiotic and immune-boosting feed additives to enhance disease resistance and gut health in farmed fish.

AI-powered tools are being used to optimize feeding schedules, improve feed conversion efficiency, and reduce waste. Companies like Alltech and Nutreco are investing in digital precision nutrition platforms to enhance sustainable feed practices.

New companies struggle with high R&D costs, regulatory compliance, and competition from established players. However, brands that focus on functional feed additives, sustainable ingredients, and customized formulations can gain market share in niche segments.

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Buttermilk Powder Market Analysis by Product Type, Sale Channel, and Region Through 2035

Oat-based Beverage Market Analysis by Source, Product Type, Speciality and Distribution channel Through 2035

Multivitamin Melt Market Analysis by Ingredient Type, Claim, Sales Channel and Flavours Through 2035

Mineral Yeast Market Analysis by Calcium Yeast, Selenium Yeast, Zinc Yeast, and Other Fortified Yeast Types Through 2035

Nuts Market Analysis by Nut Type, Product Type, Distribution channels, End-use Industry, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.