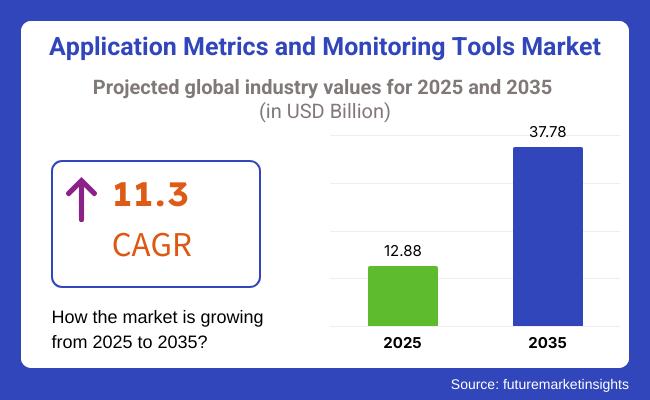

The application metrics and monitoring tools market is poised to observe significant growth between 2025 and 2035 due to the growing adoption of cloud-native applications, AI-based observability solutions, and the rising demand for real-time application performance monitoring. The industry will be worth USD 12.88 billion in 2025 and reach USD 37.78 billion by 2035, with a projected compound annual growth rate (CAGR) of 11.3% during the forecast period.

As more businesses are adopting microservices, DevOps, and hybrid cloud deployments, the demand for advanced monitoring solutions to offer application uptime, security, and optimization of performance is building pace.

The convergence of predictive analytics, automated incident response, and AI-powered anomaly detection is also elevating the monitoring solutions. Furthermore, rising IT environment complexity combined with the IoT usage explosion and edge computing growth is compelling businesses to invest in full-stack observability platforms.

In addition, organizations in different industries, such as finance, manufacturing, and government services, are focusing on pre-event monitoring solutions to reduce downtime and improve user experience. The adoption of server-less computing and containerized applications is also boosting the requirement for scalable, real-time monitoring solutions.

Explore FMI!

Book a free demo

As businesses emphasize observability, performance optimization, and security, the industry for application metrics and monitoring tools sees steep growth. Organizations prefer full-stack monitoring solutions that are AI-driven and multi-cloud enabled to attain operational efficiency.

Cloud providers' main concerns are service scalability, API-based integration, and automated incident resolution for seamless service delivery. IT teams and developers highlight infrastructure like DevOps-capable tools, auto-scaling capabilities, and code-level analytics to enable rapid development cycles.

Security and compliance are of prime importance; as more and more AI-based anomaly detection is adopted, offering an additional layer of protection, yet further, requirements for real-time threat intelligence are growing. The industry is gradually going the path of AIOps, edge computing analytics, and server less monitoring that will allow the organizations proactively detect and solve issues.

Models of the pricing are either subscription basis or flexible pay-as-you-go options based on the preferences of different businesses. The evolution of this industry is in the direction of automation, AI-enabled monitoring, and predictive analytics that will allow the organizations to have high-performing applications available with less time downtime.

| Company | Contract Value (USD Million) |

|---|---|

| Datadog | Approximately USD 60 - USD 70 |

| New Relic | Approximately USD 50 - USD 60 |

| Splunk | Approximately USD 70 - USD 80 |

| Dynatrace | Approximately USD 65 - USD 75 |

| AppDynamics | Approximately USD 55 - USD 65 |

In 2024 and early 2025, the industry witnessed significant momentum driven by the rising demand for real-time insights and enhanced application performance. Leading companies such as Datadog, New Relic, Splunk, Dynatrace, and AppDynamics have secured pivotal contracts and strategic partnerships, underscoring the industry's focus on proactive incident management, data-driven decision-making, and digital transformation. These developments highlight the industry's commitment to delivering robust, scalable monitoring solutions that cater to increasingly complex IT environments.

Between 2020 and 2024, the industry expanded rapidly, driven by cloud adoption, digital transformation, and real-time performance optimization. Businesses migrating to hybrid and multi-cloud environments prioritized AI-powered observability, real-time anomaly detection, and automated root cause analysis.

Legacy APM tools matured into end-to-end observability platforms that harmonized metrics, logs, and traces. Accelerated adoption of DevOps and SRE speeded up predictive analytics. In response to an uptick in cybersecurity threats, this resulted in zero-trust security models, and logging began to be encrypted. Data ingestion was expensive, which was a challenge.

Between 2025 and 2035, self-healing infrastructure, and decentralized monitoring will define the industry. Machine learning will automate issue detection. With growing edge computing and IoT, monitoring tools will facilitate low-latency, distributed observability.

Quantum-ready frameworks will appear for secure workload tracing, and block chain-backed observability will provide better data integrity. Future solutions with seamless application performance will focus on proactive, autonomous monitoring.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased regulations (GDPR, CCPA, HIPAA) needed application monitoring tools to guarantee secure data harvesting, encryption, and compliance auditing. | Blockchain-secured AI-based monitoring platforms guarantee real-time compliance automation, decentralized logging, and privacy-preserving app analytics. |

| AI-based monitoring tools enhanced anomaly detection, predictive analytics, and auto root cause analysis for app performance. | AI-born monitoring platforms identify application bottlenecks automatically, self-tune workload allocation, and forecast system failures ahead of time. |

| Companies embraced cloud monitoring tools to oversee performance in hybrid and multi-cloud environments. | AI-powered, self-learning monitoring platforms facilitate real-time workload balancing, cross-cloud observability, and predictive application scaling for seamless performance. |

| From conventional monitoring, companies moved to observability frameworks, combining logs, metrics, and traces for greater insights. | AI-powered, autonomous observability platforms utilize real-time contextual analysis, predictive debugging, and dynamic dependency mapping for self-healing applications. |

| IT operations teams utilized AI-powered operations (AIOps) to automate incident detection, response, and resolution in real-time. | AI-powered, intent-based AIOps platforms offer predictive incident resolution, self-configuring monitoring dashboards, and automated anomaly remediation across IT ecosystems. |

| The advent of edge computing necessitated application monitoring tools to monitor distributed workloads and real-time data processing. | AI-optimized edge-native monitoring solutions facilitate autonomous performance tuning, low-latency problem fixing, and adaptive workload prioritization for IoT and smart applications. |

| Growing cyber-attacks resulted in real-time security monitoring, anomaly detection, and automated risk assessment functionality in monitoring solutions. | AI-based, zero-trust observability platforms automatically identify security vulnerabilities, counter insider attacks, and apply real-time adaptive security policies. |

| Fast 5G connectivity enhanced real-time monitoring for low-latency apps such as games, AR/VR, and autonomous systems. | AI-supported, 6G-based monitoring platforms utilize ultra-low latency observation and anticipatory performance optimization. |

| Businesses ensured that the application monitoring solutions are power-efficient. This was mainly to reduce power utilization and environmental impact. | Carbon-conscious, AI-powered monitoring platforms dynamically optimize resource consumption, optimize power-efficient application performance, and allow net-zero computing initiatives. |

| Businesses tested blockchain-based monitoring for transparency, data integrity, and secure audit trails. | Decentralized monitoring systems with AI integration provide tamper-proof performance logs, real-time anomaly consensus verification, and immutable traceability for enterprise use cases. |

The industry is currently exposed to a number of risks, particularly data security, integration challenges, scalability issues, regulatory compliance, and industry competition. Data security risks are the most serious concern, as monitoring tools tend to gather real-time data like application performance, user behavior, and system logs.

If any breaches occur, the arrival of such sensitive data without authorization can also lead to compliance violations and destruction of the company's reputation. The emphasis is on the protection of data by full-DT end-to-end encryption, secure APIs, and strict access controls. Integration challenges stem from the fact that the IT ecosystems in many businesses are very heterogeneous, and most have old legacy systems.

The majority of firms face the challenge of integrating contemporary monitoring tools with cloud-native applications and on-premises infrastructures as well as with systems and services from vendors such as Amazon and Microsoft. To be able to deal with this barrier, vendors are required to provide not only the integration of API but the integration of hybrid monitoring tools and a range of deployment options as well.

Scalability issues can be a potent force in defeating performance monitoring of big applications. As companies expand, they need instruments capable of managing their high traffic networks, barriers to multi-tier architectures, and adaptation to the micro services approach. The products must be capable of scaling automatically, have AI for anomaly detection, and should also do predictive analytics

The competitive landscape is heating up with major companies like Datadog, New Relic, Dynatrace, and Splunk on the front end offering their innovatively advanced monitoring instruments. The key to staying in competition is the to pivot the focus of the company toward the factors that are different with respect to their AI-infused insights, personalized dashboards, and the fixing of the issues before they even arise through proactive assessment.

| Countries/Region | CAGR (2025 to 2035) |

|---|---|

| USA | 11.4% |

| UK | 11.1% |

| European Union | 11.3% |

| Japan | 11.0% |

| South Korea | 11.5% |

The USA industry is growing as organizations focus on the real-time monitoring of application performance, AI-infused analytics, and the monitoring of cloud-native infrastructure. Organizations focus on problem-solving in real-time, automated performance monitoring, and real-time visualizations of data to make operations more effective.

Federal Trade Commission (FTC) and top technology companies are investing in cloud-seamless monitoring solutions, predictive analytics, and AI-powered anomaly detection to enable frictionless digital experiences. Increased adoption of hybrid and multi-cloud has compelled demand for end-to-end performance monitoring and automated observability platforms. FMI believes that the USA industry is slated to grow at 11.4% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| AI-Based Monitoring | Companies use AI-driven analytics for predictive maintenance and real-time monitoring of the cloud. |

| Cloud and Hybrid Penetration | Cloud-native and hybrid infrastructure expansion fuels demands for self-servicing observability solutions. |

| Regulatory and Security Investments | Public and private investment in AI-driven security and compliance solutions. |

| Digital Transformation | Businesses maximize digital business performance with smart performance monitoring. |

The industry in the UK is increasing as more organizations are embracing cloud-based technologies, enhancing cybersecurity solutions, and using AI-driven application monitoring. Organizations are employing real-time performance monitoring, smart log analysis, and application diagnosis for automatic optimization of efficiency.

The National Cyber Security Centre (NCSC) is promoting AI-based root cause analysis, cloud-secure monitoring, and end-to-end system awareness. Organizations are placing greater emphasis on self-healing applications, dynamic workload optimization, and predictive IT operations. Innovative players like IBM, SolarWinds, and AppDynamics lead the way with AI-powered security monitoring in conjunction with automated performance optimization.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| AI and Automation | Businesses adopt AI-based diagnostics and automated monitoring solutions. |

| Cloud Growth | Cloud growth increases demand for secure monitoring solutions. |

| Cybersecurity Enhancement | Government and enterprise requirements drive expenditure in AI-powered security analytics. |

| Operational Efficiency | Businesses emphasize predictive maintenance and self-healing solutions. |

The European Union industry is growing due to digital transformation plans, IT security needs, and AI-powered APM solutions in high demand. EU policies on cloud governance, cybersecurity, and data protection generate demand for sophisticated monitoring platforms. Germany, France, and the Netherlands are driving the growth of AI-driven cloud observability, future problem identification, and real-time performance monitoring.

Edge computing, containerized applications, and real-time workload balancing are transforming the industry. Siemens, SAP, and Nagios are some of the leading technology players that invest in intelligent performance analytics, AI-driven IT automation, and cloud-native monitoring. FMI is of the opinion that the European Union industry is slated to grow at 11.3% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| Regulatory Compliance | EU data protection and cybersecurity regulations trigger demand for trusted monitoring solutions. |

| AI and Cloud Innovations | Firms spend on AI and cloud observability application monitoring. |

| Edge and Container Technologies | Firms use edge computing and container applications for scalability. |

| Digital Transformation | Firms use real-time workload balancing for peak performance. |

Japan's industry is growing as AI innovation projects, investments in cloud-based IT infrastructure, and digital observability solutions increase in importance. The Ministry of Economy, Trade, and Industry (METI) encourages AI-based IT operations, predictive workload analysis, and self-healing application insights in business renewal.

Mission-critical app monitoring in real-time and preventive security analysis is the new standard. Japanese tech pioneers like Fujitsu, Hitachi, and NEC lead AI-based performance management, cloud-security analytics, and autonomous IT operations.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI Innovation | Government policies enable AI-based IT operations and predictive analysis. |

| Cloud-Based IT Infrastructure | Cloud-native infrastructure funding heightens the demand for monitoring solutions. |

| Security and Compliance | Companies appreciate instant security analysis and compliance with industry regulations. |

| Digital Observability | Companies adopt advanced monitoring platforms to ensure smooth functioning. |

South Korea's industry is growing as country-wide 5G rollouts, AI-driven IT management, and cloud monitoring technology drive business technology landscapes. The Ministry of Science and ICT (MSIT) is spearheading AI-based diagnostic, predictive IT operations, and real-time cloud security analytics projects.

The demand for containerized app monitoring, Kubernetes observability, and multi-cloud AI analytics is increasing in the industry. South Korean companies like Samsung SDS, LG CNS, and SK Telecom are investing in AI-based app monitoring, cloud-based automated IT operations, and intelligent security analytics to maximize digital infrastructure efficiency. FMI is of the opinion that the South Korean industry is slated to grow at 11.5% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| 5G and Connectivity | Country-wide 5G launches fuel demand for real-time observability solutions. |

| AI-Driven IT Operations | Businesses leverage AI-based diagnostics and predictive analytics for optimal performance. |

| Multi-Cloud Adoption | Businesses maximize infrastructure efficiency using containerized apps and Kubernetes observability. |

| Security and Compliance | Businesses concentrate on AI-based security analytics and compliance monitoring. |

The monitoring of deployment models enables the evaluation of how well resources, deployment, and application performance are utilized both on-premises, on-cloud, and in hybrid environments. Continuous observability, in the context of cloud computing that is rapidly evolving with every passing day and the development of DevOps Automation as well as hybrid IT strategies, provides the businesses to monitor the health of their infrastructure, give due attention in case of a performance bottleneck, and ensure seamless scalability.

Equipped with this power, giants such as DataDog, NewRelic, and Splunk are building AI-enabled observability tools capable of predictive analytics, automated root cause analysis and cross-cloud visibility. These technologies help the IT staff to optimize workloads and make sure that the service is available at all times, before the fact detect performance issues.

As organizations move to cloud-native architectures and Kubernetes-based deployments, the need for intelligent deployment monitoring solutions will grow. The Application Runtime Architecture Discovery and Modeling part is gaining traction as enterprises move to microservices, containerized surroundings, and serverless computing.

In the features of distributed applications and ephemeral workloads dominant in today’s IT landscapes, businesses need real-time visibility to discover inefficiencies, drive error resolution, establish robust monitoring capabilities, and optimize overall system architectures to maximize business impact with a limited per-transaction resource pipeline.

The tech leaders in this field include Cisco AppDynamics, Dynatrace, and Broadcom (CA Technologies), who offer deep code monitoring, real-time anomaly detection, and automated root cause analysis (RCA) with their unique AI-powered runtime observability solutions. These tools help DevOps and SRE (Site Reliability Engineering) teams decrease downtime, increase application efficiency, and expedite the troubleshooting process.

With ever-growing businesses adopting microservices-based applications and API-driven architectures, intelligent runtime monitoring solutions will continue to be a key investment to improve operational resilience and software reliability.

Due to the growing adoption of standalone and cloud-based monitoring platforms, the Software Mode segment dominates the industry share. Companies of every size are relying on AI-powered analysis, log monitoring in real-time, and automated alerting to improve application stability and find better experiences for users.

Splunk, IBM Instana, and Elastic (ELK Stack), to name a few, are offering the complete monitoring suite across the board, providing not only AIOps (Artificial Intelligence for IT Operations) and full-stack observability but also an automatic correlation of events. These platforms enable organizations to monitor KPIs, identify anomalies, and drive operational efficiencies across complex IT ecosystems.

As enterprises adopt cloud-native development, DevOps automation, and digital transformation, scalable and AI-driven monitoring solutions will become a necessity. This segment is anticipated to undergo rapid innovation in application as a result of machine learning-based anomaly detection and predictive analytical developments.

The industry is expected to increase significantly in the Service Mode segment as businesses seek managed services, professional consulting, and tailored integration for monitoring tools. It is recommended for enterprises to leverage Observability-as-a-Service (OaaS) and managed APM (Application Performance Monitoring) solutions to address application performance and cybersecurity issues as they lack in-house knowledge.

Big industry players like Accenture, Deloitte, AWS, and Microsoft Azure Professional Services are expanding their service portfolios and empowering businesses to set up personalized monitoring plans to boost cloud governance compliance and strengthen their security posture. These services include AI-based anomaly resolution, performance optimization seminars, and end-to-end observability consultancy.

The industry is on a steep growth trajectory as enterprises emphasize real-time performance tracking, cloud infrastructure management, and AI-based observability solutions. The increasing complexity of software calls for automated monitoring, predictive analytics, and cloud-native observability platforms to assist businesses in maximizing efficiency and minimizing downtime.

Datadog, New Relic, Dynatrace, Splunk, and AppDynamics (Cisco) provide industry-leading application performance monitoring solutions, AI-based diagnostics, and end-to-end observability tools, whereas start-ups and niche solution providers focus on API monitoring, open-source observability, and security-integrated monitoring solutions, driving competition.

The evolution of the industry now revolves around the paradigm of server less computing along with the advent of containerized applications and observability at the edge. The vendors are thus compelled to adopt machine-learning-based anomaly detection and automatic root cause analysis. Companies are, in addition, extending cloud monitoring solutions to cover hybrid and multi-cloud infrastructure.

Investment-wise, log management, real-time analytics, and the integration of DevSecOps are all altering the competitive landscape. Technology vendors now seek to differentiate themselves by strengthening user-centric insights, AI-based automation, and advanced security features, all as businesses turn towards digital experience monitoring with proactive issue mitigation.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Datadog, Inc. | 20-25% |

| New Relic, Inc. | 15-20% |

| Dynatrace, Inc. | 12-16% |

| Splunk Inc. | 10-14% |

| AppDynamics (Cisco) | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Datadog, Inc. | Specializes in cloud-based observability, AI-powered monitoring, and security analytics. |

| New Relic, Inc. | Focuses on full-stack observability, AI-driven diagnostics, and real-time anomaly detection. |

| Dynatrace, Inc. | Innovates in AI-powered application performance management and cloud-native monitoring. |

| Splunk Inc. | Provides log management, SIEM security analytics, and IT infrastructure monitoring. |

| AppDynamics (Cisco) | Develops end-to-end application monitoring with deep business insights and AI-driven performance optimization. |

Key Company Insights

Datadog, Inc. (20-25%)

Datadog shines in the industry with its cloud-native observability platform, which introduces AI-assisted insights, security monitoring, and real-time analytics to improve the performance of complex IT environments.

New Relic, Inc. (15-20%)

New Relic boasts whole-stack observability by offering customers AI-powered diagnostics, real-time anomaly detection, and cloud monitoring built right into its protocols.

Dynatrace, Inc. (12-16%)

Dynatrace is committed to monitoring powered by AI capabilities with intelligent automation, analytics, and cloud-native monitoring powered for super-efficient IT operations.

Splunk Inc. (10-14%)

With exceptional skills in log management, SIEM security, and IT infrastructure monitoring, Splunk performs deep application performance and security threats.

AppDynamics (Cisco) (6-10%)

AppDynamics enhances businesses' performance with AI, which facilitates full visibility and insight into their applications. It also offers performance analytics that leverage the alignment of business outcomes.

Other Key Players (20-30% Combined)

The industry is projected to reach USD 12.88 billion in 2025.

The industry is expected to grow significantly, reaching USD 37.78 billion by 2035.

South Korea is poised for the fastest growth, with a CAGR of 11.5% from 2025 to 2035.

International Business Machines (IBM) Corporation, Microsoft, Hewlett-Packard, New Relic, CA Technologies, Compuware Corporation, Dell Inc., AppDynamics Inc., and Riverbed Technology Inc. are the key players in the industry.

The software mode is widely used, offering comprehensive application monitoring, analytics, and performance optimization solutions.

By component, the industry is segmented into deployment model monitoring, application runtime architecture discovery and modeling, user-defined transaction, application component monitoring, and reporting & application data analytics.

By mode, the industry is segmented into software, service, integration service, deployment service, training & education, and maintenance & support.

By deployment mode, the industry is segmented into on-premises, cloud, and hybrid.

By verticals, the industry is segmented into finance, manufacturing & resources, distribution services, services, public sector, and infrastructure.

By region, the industry is segmented into North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.