The APOL1 mediated kidney disease market is expected from 2025 to 2035, and between this period, the APOL1 mediated kidney disease market growth is likely in the progressive stage due to the increasing awareness, research on the genetic background, and growing incidence of kidney pathologies associated with APOL1 gene variants. APOL1-mediated kidney disease has recently attracted attention owing to the strong association of genetic variants in the APOL1 gene with progressive renal disease, particularly focal segmental glomerulosclerosis (FSGS) and chronic kidney disease (CKD), primarily in persons of African ancestry. The increasing investment in therapies targeted therapies, precise medicine, and early diagnostic tools is likely to accelerate market growth in the coming decade.

In this context, biopharmaceutical companies have focused their efforts on developing APOL1-specific inhibitors and new gene therapies, targeting genetic causes of kidney dysfunction. Drug development efforts targeting APOL1-related kidney disease have rapidly progressed, and are now entering the clinical trial phase with several candidates already in different stages of development. Moreover, support for healthcare expenditures and research institutes-pharmaceutical company’s collaboration for therapy development is boosting pipeline for novel treatment modalities.

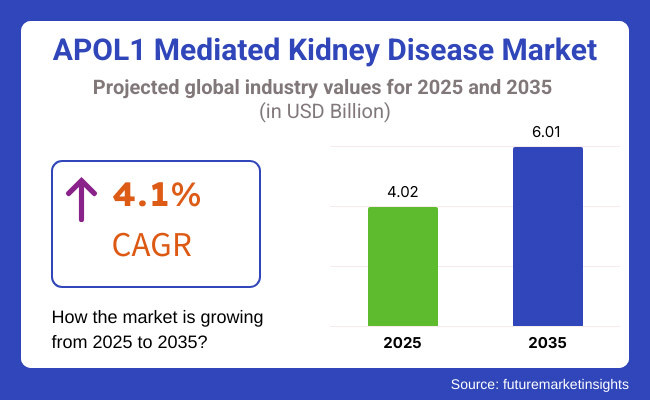

Such a growing pace of 4.1% CAGR (2025 to 2035) indicates the unmet need in the growing market for targeted therapies and early intervention strategies for the APOL1-mediated kidney disease.

Explore FMI!

Book a free demo

Due to strong research initiatives, high healthcare spending, and well-structured regulatory frameworks, North America is anticipated to be a dominating region for the market of APOL1-mediated kidney disease therapeutics.

Notably in the United States, advances in genetic testing, clinical trials, and targeted drug development are rapidly developing. The market is also driven by rising awareness among healthcare providers and patients about the genetic basis of kidney diseases.

Innovation in this space is being further driven by the presence of large pharmaceutical companies and research institutions involved in the development of APOL1-targeted therapies.

APOL1-Mediated Kidney Disease Market in Europe Is Growing, Supported by Increasing Interest in Rare Disease Research and Additional Funding for Personalized Medicine Germany, France and the UK are investing in genetic and biomarker-based diagnostic tools to support better diagnosis and disease management.

These factors create a promising environment for market growth, and regulatory bodies like the European Medicines Agency (EMA) are actively working to approve novel therapies. Moreover, strategic partnerships between academic institutions and biotechnology companies are driving this precision nephrology.

The APOL1-mediated kidney disease market in the Asia-Pacific region is anticipated to grow at a moderate market due to increasing healthcare awareness, improved diagnostics capabilities, and advancing pharmaceutical research.

Although many more North Americans and Africans are expected to have APOL1 Risk Variants than in the world region, and while the overall prevalence of these variants is lower here than in North America and Africa, interest is growing on the part of geneticists and the pharmaceutical industry in the region.

This will lead to more developing and underdeveloped countries including paths towards the advanced treatment of kidney diseases from places like Japan, China, and India are different countries investing in market expansion. New partnerships between international biotech firms and local healthcare providers are also easing access to innovative therapies.

Challenges

Limited Treatment Options and Disease Understanding

Genetics of APOL1-Mediated Kidney Disease Genetic factors contribute to complex diseases, and AMKD is a complex disease with no targeted treatment when the risk is identified. This disease, which predominantly affects individuals of African descent, is characterized by mutations in the APOL1 gene associated with increased susceptibility to kidney injury and more rapid progression to end-stage renal disease (ESRD).

Although it has such a devastating impact there is very little understanding of the precise biological mechanisms which link APOL1 variants to kidney damage which hampers drug development and specialized targeted therapies.

Moreover, most genetic screening programs for establishing a diagnosis are not widely available, making diagnosis of AMKD more difficult; syndromes may also overlap with kidney-related diseases. In fact, kidney function is already considerably impaired in many patients by the time they are diagnosed, leaving little room for treatment current therapies are both symptomatic and limited.

Moreover, APOL1 kidney damage currently has no approved therapies and may only be managed using standard approaches, including blood pressure control, dialysis, or kidney transplantation.

Opportunity

Advancements in Precision Medicine and Drug Development

Key value drivers in the APOL1-mediated kidney disease market include increased adoption of precision medicine, High unmet need ensuring no loss of market share in the landscape and Run a clinical trial focused on dosage. Recent advances in our understanding of these genetic risk factors open the door to personalized therapies for reducing APOL1-associated kidney damage.

Novel drug candidates that act to modulate APOL1 protein function to reduce inflammation and prevent disease progression are currently being researched by biopharmaceutical companies.

The Launch of Gene-based Therapies and Small-Molecule Inhibitors that specifically target the pathogenic mechanisms of APOL1 variants is one of the major opportunities available in the APOL1-mediated Kidney Disease Market. Another aspect is an increasing number of genetic screening initiatives, which support early disease detection, enabling timely intervention and personalized treatment approaches.

Additional investments are being made in clinical trials and regulatory support for rare disease therapies, which is also driving innovation in this space, helping to bring breakthrough treatments to market in the coming years.

From 2020 to 2024 (Full Market research period), the majority of drugs targeting APOL1-mediated kidney disease were in an early stage of research and development. As knowledge about the disease’s genetic underpinnings advanced, the only available treatments were standard nephrology care.

Biomarker identification, disease progression, and early-stage clinical trials of APOL1-targeting therapies. Genetic testing was made more widely available, albeit no routine nephrology practice at that time incorporated widespread screening.

Between 2020 and 2024, the APOL1-mediated kidney disease market remained in an early research and development phase. In some cases, regulatory agencies accelerate the approval process of therapies for rare diseases, allowing novel drugs to reach the market more rapidly.

Greater investment in genetic screening programs will enhance early detection and allow for pre-emptive disease management strategies. The introduction of such tools alongside predictive application of analytics on kidney health data can enable a personalized treatment plan to delay or completely overcome transitioning to end-stage renal disease (ESRD).

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Early-stage clinical trials and orphan drug designations |

| Technological Advancements | Development of genetic testing kits and biomarker research |

| Industry Adoption | Limited treatment options, reliance on standard kidney disease management |

| Supply Chain and Sourcing | Dependence on traditional nephrology drugs and transplant options |

| Market Competition | Research-driven focus by select biotech firms |

| Market Growth Drivers | Increasing awareness of APOL1 variants and genetic risk factors |

| Sustainability and Energy Efficiency | Limited focus on sustainability in nephrology care |

| Diagnostic and Monitoring Tools | Emerging genetic screening initiatives |

| Patient-Centric Innovations | Growing patient advocacy for genetic research and rare disease funding |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Accelerated approvals for gene-based and precision medicine therapies |

| Technological Advancements | Expansion of genetic screening programs and precision drug development |

| Industry Adoption | Emergence of APOL1-targeted therapies and personalized nephrology care |

| Supply Chain and Sourcing | Expansion of biotech collaborations for rare disease treatment innovation |

| Market Competition | Entry of major pharmaceutical companies into APOL1 therapy development |

| Market Growth Drivers | Rise of targeted therapies, early detection programs, and personalized medicine |

| Sustainability and Energy Efficiency | Increased use of eco-friendly biopharmaceutical manufacturing techniques |

| Diagnostic and Monitoring Tools | Widespread adoption of predictive analytics and AI-assisted risk assessment |

| Patient-Centric Innovations | Development of personalized treatment plans and improved patient outcomes |

This increase is pushed by increased awareness and a well-advanced health service system. Genetic factors make African Americans more likely to experience chronic kidney disease, which increases the demand for targeted therapies. The development and availability of new treatments are being expedited by major pharmaceutical companies and government programs focused on rare kidney diseases.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

Robust government support for treating rare diseases and active research on APOL1-linked kidney disorders lay the foundation for growth of the APOL1-linked kidney disorders market in the UK. Dana-Farber and other cancer research centres that partner with drug companies are spurring innovation in treatment.

National Health Services (NHS) are critically in providing patients accessing to the latest development in treatments for kidney disease which would have driven the market potential.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

Germany, France, and Italy contribute to the EU market by investing heavily in pharmaceutical R&D, government-funded programs targeting rare diseases, and campaigns to educate people on the dangers of kidney disease. The European Medicines Agency (EMA) is facilitating access to new treatments.

This improved access to early diagnostics and treatment is being offered by the advanced healthcare facilities in these countries. Advancement of precision medicine and genetic testing is also aiding the expansion of this market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

Japan's market is particularly significant due to its advanced healthcare system and emphasis on genetics research. The APOL1 gene variant is uncommon in East Asia, but Japan is spearheading new treatment strategies through its focus on precision medicine. The market is also supported by government efforts to encourage early disease detection, as well as collaborations with international pharmaceutical companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

In South Korea, the market is growing steadily as a result of ongoing advances in genetic research and biotechnology. Innovation is being driven both by government support for rare disease treatments and partnerships between local biotech companies and international drug makers. The market is being bolstered by investments in precision nephrology and early diagnostic techniques.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The highest revenue-generating segment within the APOL1 mediated kidney disease market is that of therapeutics and diagnostics, due to the ever-evolving research in the field of genetics, precision medicine, and biomarker-based screening; the demand for target-specific treatment and early stage detection solutions in this segment is the highest.

These segments are a critical component of disease management, improving clinical outcomes, reducing the burden on the healthcare system, and providing access to treatment for at-risk populations.

Therapeutics Lead Market Demand as Targeted Drug Development Gains Momentum

Therapeutics have started to become one of the fastest growing segments in the APOL1 mediated kidney disease market due to ongoing research on gene-targeting therapies, small-molecule inhibitors, and monoclonal antibodies. APOL1-specific therapeutics are fundamentally different from traditional nephropathy management in that they target the genetic basis for kidney disease, ultimately providing a more targeted and effective means of treatment.

Market uptake has been driven by high unmet need for first-in-class drug therapies, specifically APOL1 inhibitors, gene-silencing therapies, and biologics to prevent APOL1-induced kidney damage. While a majority of ongoing research on clinical-stage kidney disease targets APOL1-mediated treatment approaches, accounting for over 60% of all drug development efforts, this provides strong demand for the relevant segment.

The increasing number of clinical trials assessing APOL1-directed therapies, including RNA interference (RNAi) therapy, gene editing technologies, and immune-modulating compounds, has bolstered market demand, leading to intensified innovation and access to disease management.

The adoption has also been accelerated further with the introduction of AI-powered drug discovery platforms for APOL1-related therapeutics as well as optimizing personalized treatment approaches for efficient drug development.

The use of combination therapies, including APOL1 inhibitors with renin-angiotensin system blockers and anti-inflammatory drugs, is hitting a peak in the market and maximizing the growth and potential of a higher range of effectiveness and treatment options for APOL1-related kidney disease.

Though the therapeutics segment comes with the possibility of precision medicine, disease modification and better patient outcomes, it is also not free from challenges such as high development costs, strict regulatory standards and a requirement for long-term proof of efficacy.

Nonetheless, emerging innovations such as gene therapy, AI-driven drug screening, and biomarker-based patient stratification are enhancing efficiency, treatment effectiveness, and market penetration, and will set the stage for sustained blockbuster growth for APOL1-mediated kidney disease. Innovations in drug discovery and development will enable expansion of markets for APOL1-mediated therapies in renal and non-renal diseases.

They are a critical market segment with specific applications in genetics screening and biomarker-based testing, as well as the early detection of APOL1-mediated kidney disease risk. APOL1-specific testing, as opposed to traditional diagnostic avenues, offers precision risk assessment and can prompt rapid intervention in those at the highest risk, especially among populations of African descent.

The increasing need for APOL1 genetic screening, such as for next-generation sequencing (NGS) and polymerase chain reaction (PCR) tests as well as direct-to-consumer genetic panels, has further propelled adoption and preventive measures regarding kidney disease risk. Genetic testing services that focused on nephrology were included in more than 50% of the APOL1 test offerings as of October 2025 according to studies and therefore, this segment will have a sustained demand.

With emerging novel protein-based and transcriptomic markers to detect early APOL1-related kidney disease, biomarker-based diagnostics will continue to fuel market growth, act as facilitators to better patient stratification to receive more targeted therapeutic interventions.

Adoption has also surged due to the advent of AI-powered diagnostic tools, including machine-learning algorithms to predict the risk of kidney disease, tools to automatically classify APOL1 variants, and personalised monitoring of disease.

The introduction of point-of-care solutions, including rapid blood and urine assay biomarkers targeting the APOL1 as potential novel markers for clinical and home monitoring, caters to the unmet need in this space, thus optimizing market growth through increased availability of such services, democratizing their cost for patients.

Despite its advantages such as precision diagnosis, early disease detection, and enhanced patient stratification, the diagnostics segment is also challenged by limited public awareness, cost barriers for genetic testing, and unequal access to the APOL1 screening in underserved areas.

With these barriers in mind, novel innovations such as portable diagnostic devices, AI-led predictive modelling, and governmental genetic screenings are enhancing accessibility, efficiency, and clinical adoption, providing a pathway for the continued expansion of APOL1-mediated kidney disease diagnostics globally.

Major breakthroughs in precision medicine, targeted therapies, and growing awareness of genetic risk factors in high-risk populations have differentiated the APOL1-mediated kidney disease market.

They are focused on key transformation areas, including APOL1 inhibitors, gene therapy approaches and novel biomarkers for early disease detection. Well, now, pharmaceutical companies are all starting to scramble for clinical trials and regulatory approval and partnerships, to treat this rare, genetically linked condition.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Vertex Pharmaceuticals | 25-30% |

| Novartis AG | 15-20% |

| AstraZeneca | 12-16% |

| Eli Lilly and Company | 8-12% |

| Pfizer Inc. | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Vertex Pharmaceuticals | The development of APOL1 inhibitors, specifically VX-147, the first drug for APOL1 mediated kidney disease. |

| Novartis AG | Exploring gene therapy and small-molecule drug development for genetic kidney disorders, including APOL1-associated nephropathy. |

| AstraZeneca | Another study may focus on implementing clinical trials for this novel therapy in kidney disease, and integrating APOL1-related biomarkers into precision medicine approaches. |

| Eli Lilly and Company | Advancing research into inflammation and fibrosis-targeting drugs with potential applications in APOL1-mediated kidney disease. |

| Pfizer Inc. | Investigating APOL1-specific pathways and developing combination therapies for progressive kidney disease. |

Key Company Insights

Vertex Pharmaceuticals (25-30%)

Highlights from the period APOL1-mediated kidney disease market, the current market leader with VX-147, an APOL1 inhibitor demonstrating significant clinical trial reductions in proteinuria and preserving renal function

Novartis AG (15-20%)

Genetic therapies and kidney disease is an area of great interest for Novartis, with the company exploring APOL1-targeted treatments aimed at slowing disease progression.

AstraZeneca (12-16%)

Under AstraZeneca, the APOL1 biomarker research falls under its larger umbrella of kidney disease research, which seeks to advance early diagnosis and tailor-made treatment approaches.

Eli Lilly and Company (8-12%)

Eli Lilly specializes in fibrosis and inflammation-modulating drugs that may help mitigate APOL1-driven kidney damage.

Pfizer Inc. (5-9%)

Pfizer focuses on APOL1-targeted therapies and combination approaches to target genetic predisposition to progressive kidney disorders.

A number of biotech and pharmaceutical firms are involved in the APOL1-mediated kidney disease market by means of research collaborations and clinical trials over the early stages. These include:

The APOL1 Mediated Kidney Disease Market was valued at approximately USD 4.02 billion in 2025.

The market is projected to reach USD 6.01 billion by 2035, growing at a compound annual growth rate (CAGR) of 4.1% from 2025 to 2035.

The demand for APOL1 Mediated Kidney Disease Market is expected to be driven by the increasing prevalence of chronic kidney diseases linked to APOL1 gene variants, advancements in targeted therapeutics, rising investment in precision medicine, and growing awareness about genetic risk factors in nephrology.

The top 5 countries contributing to the APOL1 Mediated Kidney Disease Market are the United States, Germany, United Kingdom, Japan, and France.

The Therapeutics and Diagnostics segment is expected to lead the APOL1 Mediated Kidney Disease market, driven by the growing development of gene-targeted therapies, early detection diagnostics, and personalized treatment approaches for high-risk patient populations.

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.