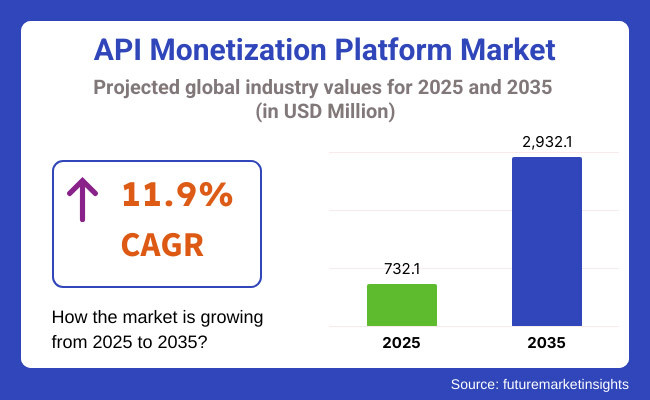

The global API Monetization Platform market is projected to grow significantly, from USD 732.1 million n in 2025 to USD 2,932.1 million by 2035 an it is reflecting a strong CAGR of 11.9%.

Companies deeply depend on third-party developers and outside partners to extend their digital ecosystems. API Monetization Platforms: managing, controlling, and generating revenue from API usage. Various industries such as BFSI, healthcare, and IT are embracing these solutions to simplify API accessibility, improve interoperability and generate revenue opportunities.

Stringent regulations like GDPR and CCPA are pushing strict API governance on organizations. Compliance provides measures for secure data exchange and unauthorized access prevention. As such, API monetization platforms enable enterprises to charge for existing and new API sets while ensuring compliance with regulatory frameworks through integrated, automated compliance tools.

With businesses evolving through digital transformation, they are using APIs as revenue-generating assets. They're monetizing these APIs as subscription services or pay-per-use. This raises the need for API security, analytics, and access control tools that enhance the efficiency of APIs while preventing their misuse.

As the cyber threats are increasing organizations risk API abuse, data breaches, fraud, and bot attacks. It offers continuous monitoring, real-time risk management, and threat detection mechanisms. These top features manage secure API transactions, protecting valuable data and mitigating financial loss.

North America holds the largest market share for API monetization platform owing to large-scale enterprise adoption, a robust digital economy, and stringent regulatory compliance. On top of that, businesses from countries like India and Australia are growing exponentially as companies hasten digital projects and seek out API based revenue streams.

| Company | Google LLC |

|---|---|

| Contract/Development Details | Partnered with a leading financial services firm to implement an API monetization platform, enabling the firm to securely expose and monetize its APIs to third-party developers, fostering innovation and new revenue streams. |

| Date | February 2024 |

| Contract Value (USD Million) | Approximately USD 50 |

| Renewal Period | 5 years |

| Company | IBM Corporation |

|---|---|

| Contract/Development Details | Secured a contract with a healthcare consortium to deploy an API management and monetization solution, aiming to facilitate secure data sharing among healthcare providers and enhance interoperability. |

| Date | August 2024 |

| Contract Value (USD Million) | Approximately USD 65 |

| Renewal Period | 6 years |

Rising adoption of API-driven business models for revenue generation

APIs are reshaping businesses earn revenue, with organizations in virtually every sector using APIs to deliver services, optimize operations, and create better consumer experiences. API monetization options have remained prevalent despite challenges in several sectors, leading to their adoption by BFSI firms as well as companies in healthcare, and IT to grow market reach and create new revenue streams.

Subscription-based API access, pay-per-use models and revenue-sharing agreements with third-party developers are becoming normal. “Businesses are starting to think of APIs as digital products instead of simply technical instruments, allowing them to actually monetize data and services,” he explains.

Regulators everywhere are also encouraging the adoption of APIs through open data initiatives and digital innovation. Such as, in 2023, a European government agency implemented an open API framework for banking institutions to promote competitiveness by enabling seamless sharing of financial data.

The push affected more than 5,000 financial institutions and led to a 30% increase in API transactions in the first year. These drive companies to build APIs with an integrated monetization process.

Integration of AI and analytics for API performance optimization

API Monetization with Artificial Intelligence (AI) and Analytics AI and analytics deliver value in API monetization by tracking performance, increasing security, and they optimize pricing models. Companies are using AI-powered analytics to monitor API usage trends, identify irregularities and estimate demand movements.

It allows organizations to implement dynamic pricing models determined by actual usage data, thus optimizing costs and enhancing the quality of customer engagement. AI-based API monitoring additionally helps in detecting the chances of failures and security weaknesses more than before they can annoy the inner business processes.

AI-powered APIs for public services are the trend among government agencies. The event occurred in 2024 when a national transportation authority implemented an AI-augmented API framework that monitored and acted upon real-time traffic conditions.

This system processed more than 10 million API requests daily and decreased delays related to congestion by 15%. The project showcased the potential for AI-powered APIs to improve efficiency in large scale operations and could persuade additional sectors to look to similar approaches to boost their API performance.

Adoption of API gateways for enhanced security and scalability

API gateways have become an essential component of API monetization, ensuring secure, scalable, and efficient API management. These gateways act as intermediaries between API providers and consumers, enforcing authentication, rate limiting, and traffic control.

With the growing adoption of APIs across industries, businesses are integrating API gateways to protect their digital assets from cyber threats while optimizing performance. API gateways also support multi-cloud and hybrid cloud environments, allowing seamless API management across different platforms.

Governments are implementing API gateway solutions to enhance cybersecurity in public sector digital services. In 2023, a government cybersecurity agency mandated API gateway adoption for all national e-governance portals.

This regulation affected over 1,000 public-facing APIs, reducing unauthorized access attempts by 40% within six months. Such initiatives highlight the critical role of API gateways in securing sensitive data and maintaining service continuity.

Increased API attacks and data breaches hinder adoption

As organizations continue to monetize their APIs, security weaknesses have emerged as a major impediment. APIs are gateways for data transfer between applications, which makes them key targets for cyberattacks. Weak authentication, misconfigurations, and exposed endpoints are exploited by threat actors to carry out attacks such as API scraping, injection attacks, and credential stuffing.

They result in unauthorized access to data, financial losses, and reputational damage for organizations. Industries that work with sensitive information, like BFSI companies and healthcare companies, have higher risks as cybercriminals are targeting APIs to extract critical user data.

API-based attacks are becoming more prevalent, which raises concerns for businesses that expose their digital assets to third parties. High-profile data breaches associated with API vulnerabilities have led to heavy financial penalties and scrutiny from regulators (e.g. Facebook, Equifax).

Organizations are worried that a single API hack could also expose not only their own infrastructure, but also that of their partners and customers. Consequently, some enterprises are cautious about fully committing to API monetization due to security concerns which, they fear, could counterbalance potential revenue advantages.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments enforced stricter API security and data protection policies. |

| Subscription & Usage-Based Models | Shift from one-time licensing to recurring revenue models. |

| AI & Machine Learning Integration | AI-assisted API analytics improved usage insights and performance optimization. |

| Cross-Industry API Adoption | Expansion beyond fintech into healthcare, retail, and IoT. |

| Market Growth Drivers | Growing digital transformation and open banking initiatives. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven compliance automation ensures secure API transactions and real-time monitoring. |

| Subscription & Usage-Based Models | AI-driven dynamic pricing adjusts API monetization based on real-time demand analytics. |

| AI & Machine Learning Integration | Predictive AI models enable autonomous API marketplace operations and self-adaptive monetization. |

| Cross-Industry API Adoption | AI-powered API ecosystems facilitate seamless interoperability across multiple industries. |

| Market Growth Drivers | AI-driven API aggregation platforms revolutionize service-based revenue generation. |

The section highlights the CAGRs of countries experiencing growth in the API Monetization Platform market, along with the latest advancements contributing to overall market development. Based on current estimates China, India and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 14.8% |

| China | 13.9% |

| Germany | 8.7% |

| Japan | 11.9% |

| United States | 10.4% |

Super apps like WeChat, Alipay and Meituan dominate China’s digital landscape, with a diverse range of services all within a single platform. Most of the apps combine with multiple APIs to offer seamless experiences for the users where they can access the financial service, social media, e-commerce, and transportation in a single application rather than switching from one application to another.

API monetization is a key factor for this ecosystem, as third-party developers pay to have their services integrated into these super apps, thus generating revenue for platform providers. A huge amount of business opportunities in China (API business models) with many daily transactions and involving users.

The Chinese government has also been keen on increasing digital infrastructure, which is naturally beneficial for API adoption. Recently, an effort is underway to do just that, to standardize API frameworks so as to support security and interoperability across industries.

More than 90% of mobile users in China access super apps every day in terms of official data; therefore, APIs play a vital role in user retention and connection. Superapp are growing ever more on China, with these apps driven by deep API, providing convenience and financial inclusion as China switches to a cashless society.

India has rapidly accelerated the growth of its e-commerce space backed by growing internet penetration, mobile-first consumer, and government-backed digital infrastructure. API-driven payment solutions are an integral part of this ecosystem, facilitating smooth transactions over different platforms.

One of India’s most successful API-driven payment systems is UPI (Unified Payments Interface), which has transformed the landscape of digital payments by enabling real-time money transfers between banks.

This monetization is facilitated for e-commerce behemoths such as Flipkart, Amazon India, and Reliance’s JioMart, which integrate payment gateways, automated fraud detection, real-time analytics, and more via APIs to improve customer experiences.

As the Indian government actively promotes API adoption with its initiatives like Digital India and India Stack, it has called upon businesses to build interoperable financial solutions. Recent data from official sources show that UPI transactions in India exceeded 12 billion in a single month, demonstrating the massive scale of API-driven payment innovations.

The US continues to be a leader in the cloud computing space, most popularly by major providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, that are innovating Software-as-a-Service (SaaS) solutions. API monetization lies at the heart of these solutions, empowering companies to efficiently build, integrate, and scale cloud applications.

APIs enable cross-communication between various SaaS products, allowing enterprises to tailor their software stacks with minimal coding. An API subscription model has emerged, providing cloud service companies with a way to make reoccurring revenue through premium integrations and more advanced analytics.

The USA government has been driving cloud adoption in various industries, with initiatives encouraging secure API usage in federal agencies and public sector organizations. A recent government report has disclosed that more than 65% of enterprises in the USA depend on cloud-based APIs to enable process automation and drive productivity. As such, new policies around API security and compliance standards are driving how businesses think about API monetization in the cloud.

The section contains information about the leading segments in the industry. By Component, the Services segment is estimated to grow quickly from the period 2025 to 2035. Additionally, by Enterprise Size, Large Enterprise segment hold dominant share in 2025.

| Component | CAGR (2025 to 2035) |

|---|---|

| Services | 13.9% |

With businesses across industries relying more and more on APIs, there has been a simultaneous rise in the demand for specialized API monetization services. Businesses are now not merely concentrating on APIs development but are looking out for expert services to secure APIs, manage APIs, and analyze them so as to enable revenue generation.

API monetization services help companies to maximize their API ecosystems and provide seamless integration, better performance, and compliance with industry regulations. With enterprises increasingly looking to accelerate their digital transformation efforts, they are turning to service providers offering solutions for API lifecycle management, subscription-based monetization models, as well as developer engagement strategies.

Another important player is shaping the API services area are the governments worldwide. The regulatory compliance update has left businesses with no alternative but to implement API protection services, as unauthorized access and data breaches are to be avoided at all cost. According to official reports, more than 70% of organizations that apply API monetization strategies also spend on professional services to improve both API performance and security.

| Enterprise Size | Value Share (2025) |

|---|---|

| Large Enterprise | 59.2% |

The value market is dominated by large enterprises owing to their large API consumption, global presence, as well as, high IT spending. These organizations use APIs to develop interconnected digital ecosystems, enabling communication across apps, partners, and customers seamlessly.

Monetizing APIs allows large enterprises to monetize their data and services and create new revenue streams through subscription, tiered pricing, and pay-per-use models. The BFSI, IT & telecom, and healthcare sectors are at the forefront of API adoption, utilizing APIs for secure transactions, cloud integrations, and customer engagement

Government policies are guiding API adoption for many big organizations. A new regulatory framework mandates that organizations that deal with personal sensitive data must implement API leveling auditing and compliance standards which would lead to increased API Governance investments. Over 80% of Fortune 500 companies have adopted API monetization strategies according to official statistics highlighting the importance of API driven business models.

The market for API monetization Platforms is expanding quickly due to businesses' growing awareness of the importance that APIs play in producing revenue, streamlining processes, and improving digital ecosystems.

Major industry players capitalize on AI-powered analytics, cloud-based scalability, and developer-centric solutions as leverage over their competition. API monetization is an integral part of businesses now - with enterprises adopting it to find new revenue streams, enhance data sharing, and have better customer experiences.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Google Cloud (Apigee) | 22-27% |

| Amazon Web Services (AWS) | 18-23% |

| Microsoft Azure (API Management) | 15-20% |

| IBM API Connect | 10-15% |

| MuleSoft (Salesforce) | 8-12% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Google Cloud (Apigee) | Offers a robust API management and monetization platform with AI-powered insights, security, and analytics for enterprises and developers. |

| Amazon Web Services (AWS) | Provides scalable API Gateway solutions with integrated billing, security, and advanced data analytics for API-driven businesses. |

| Microsoft Azure (API Management) | Delivers a cloud-native API platform focusing on security, hybrid cloud deployment, and seamless integration with enterprise systems. |

| IBM API Connect | Offers AI-enhanced API lifecycle management with strong security, compliance, and automation for enterprises handling complex integrations. |

| MuleSoft (Salesforce) | Specializes in API-led connectivity, helping enterprises streamline data flows and monetize APIs through a unified integration platform. |

Strategic Outlook

Google Cloud (Apigee) (22-27%)

Google Cloud’s Apigee, which is a force to be reckoned with in the API monetization sector, empowers enterprises with a fully-fledged API management platform that includes AI-driven insights. For businesses wanting to scale their API-driven models, its tight integration with Google Cloud services, developer support, and security protocols makes it a top choice. Continuing to invest in automation and analytics to simplify API monetization.

Amazon Web Services (AWS) (18-23%)

AWS API GatewayAWS offers a well-devised API Gateway, through which enterprises can implement, deploy, as well as monetize APIs at a huge scale. AWS combines API management with cloud infrastructure, including automated billing, access control, and analytics. The company is focused on strengthening its market position by enhancing its API security, cost management, and AI-powered analytics.

Microsoft Azure (API Management) (15-20%)

Microsoft Azure offers a robust API monetization platform with API management, integration with enterprise IT systems, security compliance, and hybrid cloud capabilities. By applying AI and machine learning to APIs, Microsoft delivers real-time insights, enabling organizations to optimize both the pricing and performance of their APIs. The company's broker mutual purchases momentum is a driver of market share expansion with enterprises, SaaS providers.

IBM API Connect (10-15%)

IBM API Connect's focus on security-first API management makes it particularly attractive for enterprises in regulated industries like finance and healthcare. AI-powered automation plays a core role within the platform to help govern APIs with security and compliance. IBM is growing its cloud-native approach, particularly for hybrid cloud API deployments.

MuleSoft (Salesforce) (8-12%)

MuleSoft, a Salesforce acquisition, specializes in API-led connectivity and enterprise integration. The platform enables businesses to unify and connect applications, data, and devices, as well as monetize APIs in a single ecosystem. MuleSoft’s claim to fame is leveraging APIs to integrate Salesforce CRM and other enterprise software tools, enabling better access to customer data and greater monetization opportunities.

Other Key Players (20-30% Combined)

Lesser known players such as Kong Inc., WSO2, Axway, 3scale (Red Hat), and Tyk are also experiencing growth by offering niche tools for API monetization. These businesses provide targeted API management and developer tools such as open-source and cost-effective API gateways. They offer innovations to the startup and enterprise wanting flexibility over how the API is deployed and how they will monetize.

In terms of component, the segment is segregated into API Monetization Platform and Services.

In terms of Enterprise Size, the segment is segregated into Small & Medium Enterprise and Large Enterprise.

In terms of Industry, it is distributed into BFSI, IT & Telecom, Manufacturing, Travel & Hospitality, Healthcare, Energy & Utilities and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

The Global API Monetization Platform industry is projected to witness CAGR of 11.9% between 2025 and 2035.

The Global API Monetization Platform industry stood at USD 732.1 million in 2025.

The Global API Monetization Platform industry is anticipated to reach USD 2,932.1 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 13.7% in the assessment period.

The key players operating in the Global API Monetization Platform Industry Google Cloud (Apigee), Amazon Web Services (AWS), Microsoft Azure (API Management), IBM API Connect, MuleSoft (Salesforce), Kong Inc., WSO2, Axway, 3scale (Red Hat), Tyk.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Telecom API Platform Market Growth – Trends & Forecast 2023-2033

Data Monetization Platform Market Size and Share Forecast Outlook 2025 to 2035

Cloud API And Management Platforms And Middleware Market Size and Share Forecast Outlook 2025 to 2035

Apigenin Market Size and Share Forecast Outlook 2025 to 2035

Platform Lifts Market Size and Share Forecast Outlook 2025 to 2035

Platform Architecture Market Size and Share Forecast Outlook 2025 to 2035

Platform Boots Market Trends - Growth & Industry Outlook to 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Platform Trolley Market Growth – Trends & Forecast 2025 to 2035

Rapid U-drills Market Size and Share Forecast Outlook 2025 to 2035

Rapid Microbiology Testing Market Forecast Outlook 2025 to 2035

Rapid Test Cards Market Size and Share Forecast Outlook 2025 to 2035

Rapid Prototyping Materials Market Size and Share Forecast Outlook 2025 to 2035

Rapid Test Readers Market Size and Share Forecast Outlook 2025 to 2035

Papillary Thyroid Cancer Market Size and Share Forecast Outlook 2025 to 2035

Tapioca Pearls Market Analysis - Size, Share, and Forecast 2025 to 2035

Rapid Strength Concrete Market Size and Share Forecast Outlook 2025 to 2035

Rapid Self-Healing Gel Market Size and Share Forecast Outlook 2025 to 2035

Tapioca Maltodextrin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rapid Infuser Market Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA