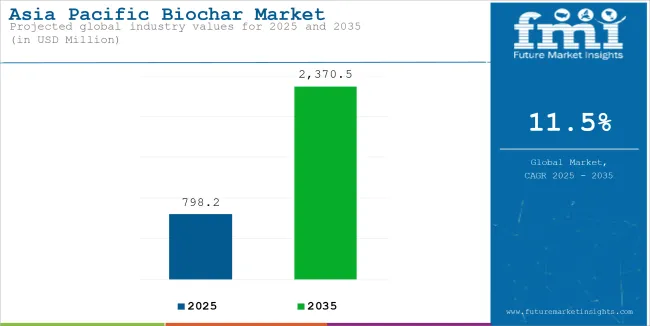

Asia Pacific sales of biochar stood at USD 715.8 million in 2024. The industry is further projected to exhibit a y-o-y growth of 10.5% in 2025 and reach USD 798.2 million in the same year and surging at a CAGR of 11.5% between 2025 and 2035, demand for the biochar is estimated to reach USD 2,370.5 million by 2035.

Biochar is a type of charcoal produced by pyrolysis of organic material, usually biomass, under a limited supply of oxygen. Rich in carbon, it has a very high surface area per unit mass, hence acting as an effective medium to help improve soil health and promote carbon sequestration. It can be obtained from any feedstock that contains carbon, such as wood, agricultural wastes, or even organic waste materials.

Agriculture currently constitutes the largest and also the fastest-growing application for biochar. It is used as a soil amendment to enhance soil fertility, improve water retention, and reduce the need for chemical fertilizers.

Biochar is also a key component in sustainable farming practices because of its ability to sequester carbon, which supports climate change mitigation efforts.

Besides, biochar is gaining popularity in industrial uses such as water treatment and carbon capture, and in animal farming for odor control and health benefits in livestock. These are the growing sectors where biochar demand is increasing with a focus on environmental sustainability.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 798.2 million |

| Market Value, 2035 | USD 2,370.5 million |

| Value CAGR (2025 to 2035) | 11.5% |

The biochar market in China is growing leaps and bounds, with its vast agricultural sector with increased focus on enhancement of soil quality. Agricultural productivity is cardinal in China, with biochar fast becoming a popular type of soil conditioner.

Its capacity to improve the fertility of the soil, retain soil moisture, and increase crop yield has made it especially attractive to farmers dealing with soil degradation and low nutrient content. As soil health is essential for maintaining food production, biochar presents an economically viable and sustainable solution.

Increased awareness among farmers and industrialists regarding the various environmental benefits offered by biochar, such as carbon sequestration and reduction in the usage of chemical fertilizers, has helped in the growth of the market.

The use of biochar in agriculture improves not only productivity but contributes toward more viable and sustainable farming, hence becoming a significant solution in China's agricultural market.

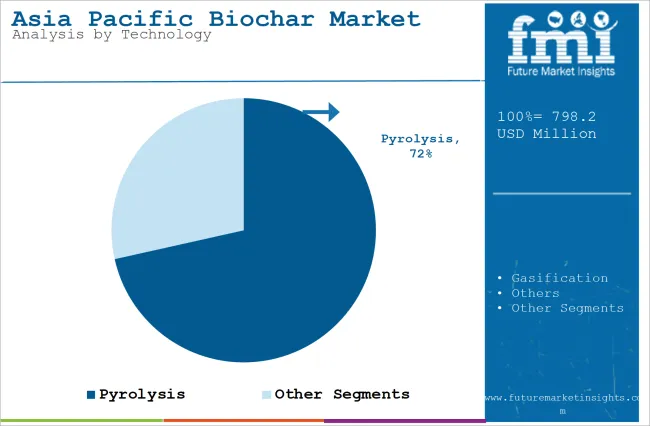

The section explains the market value of the leading segments in the industry. In terms of technology, the pyrolysis category will likely dominate and generate a share of around 71.5% in 2025.

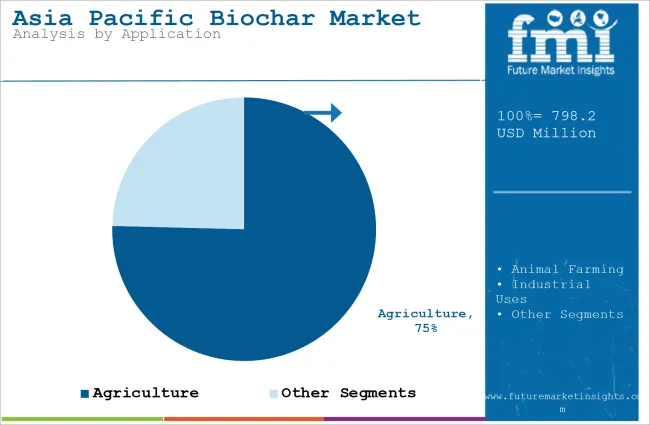

Based on application, the agriculture segment is projected to hold a share of 75.4% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Pyrolysis (Technology) |

|---|---|

| Value Share (2025) | 71.5% |

Pyrolysis dominates the market share of biochar with a share of 71.5% in contribution. The popularity of pyrolysis in producing biochar is justified by the way it effectively creates high-quality, high-carbon-content biochar.

The process provides controlled heat to the organic material without oxygen, allowing for its conversion to biochar and preserving properties that are beneficial. This gives way to biochars that significantly improve soil fertility, water retention, and nutrient availability, making it excellent for agricultural purposes. These advantages have placed it on top of the market.

Pyrolysis produces not only biochar but valuable by-products like syngas and bio-oil, adding economic value to the process. Such versatility makes the technology an attractive option for large-scale production because it can be integrated into existing systems that benefit from the production of renewable energy.

These added advantages help pyrolysis maintain its significant share of the market, given the environmental and economic benefits offered to producers by the process.

| Segment | Agriculture (Application) |

|---|---|

| Value Share (2025) | 75.4% |

Agriculture represents the highest market share, as biochar is highly efficient in maintaining soil health by its fertility and structure. It improves nutrient availability, moisture retention, and aeration, hence leading to better yields. This has made it an indispensable tool in modern agricultural practices, especially with the growing demand for sustainable farming methods.

Another dominant sector in the growth of the biochar market has been the growing contribution of sustainable agriculture. Biochar helps reduce the demand for chemical fertilizers with its eco-friendly approach.

Besides, it stores carbon dioxide for a long period, thus helping to reduce the effects of Asia Pacific warming. Presently, in agriculture, efforts are being directed toward carbon-neutral production, to which biochar has become an integral component of environment-conscious farming.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the Asia Pacific Biochar market.

This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 11.3%, followed by a slightly higher growth rate of 11.5% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 2024 | 11.3% (2024 to 2034) |

| H2 2024 | 11.5% (2024 to 2034) |

| H1 2025 | 11.4% (2025 to 2035) |

| H2 2025 | 11.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 11.4% in the first half and remain relatively moderate 11.6% in the second half. In the first half (H1) the market witnessed an increase of 10 BPS while in the second half (H2), the market witnessed slightly increase of 10 BPS.

Soil Health Improvement: Enhancing Fertility, Water Retention, and Nutrient Availability for Sustainable Agricultural Practices in APAC

Biochar improves soil structure, increases its ability to retain essential nutrients, and reduces nutrient leaching. In particular, this will be important for those areas where soils lack nutrient richness, a condition often found across much of APAC. Biochar helps farmers by enhancing soil fertility to reduce reliance on chemical fertilizers and promotes long-term sustainable agricultural practices.

Biochar enhances the water retention capacity of the soil, which becomes critical in most APAC countries that are either facing frequent droughts or very erratic rainfall. This water retention property will help in sustaining crop yields during dry periods, hence assuring a more consistent agricultural output. It reduces the need for frequent irrigation, conserving water resources.

Biochar supports better soil quality and, therefore, more resilient agricultural systems. This is of great importance for the APAC region, facing various challenges with regard to climate change, population growth, and the need for more sustainable farming practices.

Biochar application improves crop productivity with minimized environmental impacts, thus promoting a low-carbon and climate-resilient transformation of agriculture in the region.

Biochar as an Eco-friendly Solution to Boost Crop Yields and Combat Soil Degradation

Biochar is an effective soil amendment that helps boost crop yields by enhancing soil structure, nutrient availability, and water retention. Considering the problem of soil degradation in most APAC countries, biochar increases the potential of the soil for healthy plant growth. By providing a more fertile environment, it directly contributes to higher agricultural productivity and food security.

Most of the APAC regions are severely affected by soil erosion, nutrient depletion, and acidity due to high-intensity farming practices. Biochar helps improve these through soil organic carbon amendment, pH level improvement, and prevention of nutrient loss. That means the resilience in the soil condition will help toward long-term sustainability in agriculture with minimal chemical intervention.

With the rise in Asia Pacific concern for environmental sustainability, biochar presents a natural, environmentally friendly solution to improve agricultural practices. It enhances carbon sequestration and, consequently, reduces greenhouse gas emissions.

Besides, biochar helps decrease the application of synthetic fertilizers and chemical inputs, hence contributing to more environmentally friendly farming practices, which is in line with the increasing demand for sustainable agriculture within the APAC region.

Biochar's Role in Capturing Carbon and Contributing to Environmental Sustainability in Agriculture

Some of the benefits of using biochar include its capability for long carbon capture and storage in the soil. This forms the basis of carbon sequestration important in helping to mitigate climate change through reduction in the atmosphere of CO2.

Agriculture is among the high emitters into the atmosphere, and biochar provides a path in which the emissions can be off-set, hence increasing demand in markets which have focused on environmental sustainability.

Biochar is vital in enhancing soil quality and fertility; thus, it plays a very key role in ensuring sustainable farming. It limits the usage of chemical fertilizers, improves soil structure, and promotes healthy crops and ecosystems.

This helps to deliver long-term agricultural productivity with reduced environmental impacts from traditional farming practices, hence supporting the increasing emphasis on eco-friendly agriculture.

The increasing shift toward sustainability in agriculture across APAC is pushing farmers to adopt practices that reduce their carbon footprint. Biochar, therefore, will align with such goals and offer a natural, eco-friendly solution for enhancing soil health, increasing productivity, and reducing environmental degradation, thus driving the adoption of biochar in agricultural markets.

Expensive Biochar Production Processes, Including Pyrolysis and Gasification, Limiting Affordability for Farmers and Producers

Manufacturing biochar through such processes as pyrolysis and gasification requires highly specific equipment; therefore, it is very capital-intensive. Besides, these processes are energy-intensive and require complicated systems, further increasing the cost of production.

Because of this fact, the price of biochar is still correspondingly high, and its accessibility for small-scale farmers and producers, especially in developing APAC countries, is quite low due to the restricted agricultural budget. Due to the higher cost, the attractiveness of biochar as an economical soil amendment or agri-solution is lower.

Given the high cost of production, many farmers in APAC, especially those in rural or resource-constrained areas, may consider biochar beyond their budget. While biochar offers a number of agricultural and environmental benefits, its high production cost and lack of affordable alternatives prevent it from being widely used.

This would lead to the adoption of biochar only on a larger scale or at commercial levels, excluding the small farms and hence limited overall market growth and broader environmental impact in the region.

The Asia Pacific biochar industry recorded a CAGR of 8.9% during the historical period between 2020 and 2024. The growth of biochar industry was positive as it reached a value of USD 715.8 million in 2024 from USD 477.9 million in 2020.

Because of many reasons, particularly in agriculture, it has seen its demand grow very strongly. As the product helps improve the fertility of the soil, retains more water in the soil, and is increasing crop yield, farmers have liked it more. Besides that, it has been called a magic plant because of its role in capturing and storing carbon in the soil, adding to its appeal as a solution for mitigating climate change.

As environmental concerns rise, there is a growing preference for eco-friendly alternatives in agriculture and other industries, further driving demand. Due to all these factors combining, the market has witnessed continued growth during the historical period, with more sectors appreciating the long-term benefits accruing from this natural and highly sustainable solution.

Tier 1 companies include industry leaders with annual revenues exceeding USD 40 million. These companies are currently capturing a significant share of 55-60% Asia Pacificly. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. The firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include: Pacific Biochar, Airex Energy, Arsta Eco, Carbon Gold, Products, Inc.

Tier 2 companies encompass mid-sized participants with revenues ranging from USD 10-40 million, holding a presence in specific regions and exerting significant influence in local economies. These firms are distinguished by robust presence overseas and in-depth industry expertise.

They possess strong technology capabilities and adhere strictly to regulatory requirements. However, the firms may not wield cutting-edge technology or maintain an extensive Asia Pacific reach. Noteworthy entities in Tier 2 include Carbofex, Supreme, LLC, Bio Energy Earth Systems, and few others.

Tier 3 encompasses most of the small-scale enterprises operating within the regional sphere and catering to specialized needs with revenues below USD 10 million. These businesses are notably focused on meeting local demand and are hence categorized within the Tier 3 segment.

They are small-scale participants with limited geographical presence. In this context, Tier 3 is acknowledged as an informal sector, indicating a segment distinguished by a lack of extensive organization and formal structure in comparison to the structured one. Tier 3 includes Farm2energy, Biochar Products, Inc., and many more small and local players.

The section below highlights assessments of biochar market sale across key countries. China, India, Japan and South Korea are expected to showcase promising growth, with each exhibiting a strong CAGR around 8% through the forecast period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 9.5% |

| India | 8.7% |

| Japan | 7.9% |

| South Korea | 8.3% |

In China, the agricultural sector faces challenges such as soil degradation, erosion, and declining fertility. Using organic amendments has become a popular solution to restore soil health.

Organic products applied in soil amendment improve soil structure, increase nutrient availability, and have long-term advantages for soil fertility. It is for this reason that farmers seek sustainable alternatives that reduce reliance on chemical fertilizers, hence improving yields and productivity.

In China, where water is in short supply or rainfall is erratic, soil moisture retention is critical for successful crop production. Some amendments have been found to increase the water-holding capacity of the soil, enabling it to retain more water.

This is very important in arid regions where a consistent water supply is crucial. These improve the capacity of the soil to retain more water and avoid crop failure, thus making agriculture more efficient and sustainable, especially in water-scarce regions. This is the key driving demand of the market for water-efficient farming solutions.

In India, agriculture is heavily reliant on water, and many regions face chronic water shortages due to erratic monsoons and over-extraction of groundwater.

Organic amendments to the soil have actually proved beneficial in improving the water-holding capacity of the soil. This is achieved through the structure enrichment in the soil that avoids the rapid evaporation of water and helps the crops access the stored moisture for a longer duration.

This will further improve the efficiency of water use in agriculture, particularly in arid and semi-arid areas, making agriculture more resilient to drought conditions. There is, therefore, growing interest in adopting these solutions to mitigate the impacts of water scarcity.

With increasing pressure on land and water resources, sustainable agricultural practices are becoming more crucial in India. Organic amendments improve the fertility and water retention of the soil for higher and better crop yields; this reduces one's dependence on chemical fertilizers and pesticides, enhancing eco-friendly farming techniques.

Indeed, this development of sustainable agriculture will conserve water resources and give a better potential for long-run productivity. This, in turn, acts as a driver for the growing adoption of biochar solutions in India, especially in water-stressed regions.

Japan’s agricultural sector is increasingly aware of the need to minimize environmental impact. Traditional farming often relies heavily on chemical fertilizers and pesticides, which can degrade soil health and harm the environment. Biochar is an eco-friendly alternative that improves soil quality while reducing reliance on synthetic inputs.

Biochar improves soil fertility and nutrient retention, thus reducing the use of chemical fertilizers by farmers and their environmental footprint. Its carbon sequestration properties contribute to mitigating climate change and thus are one of the key solutions for sustainable agriculture in Japan.

Japan faces challenges in terms of soil degradation and the need for increased agricultural productivity. Biochar improves the soil structure, and it helps in better soil water retention, nutrient retention in the soil, and hence promotes better crop growth.

It ensures that higher yields and quality crops are realized, hence answering the call for more efficient and productive farming. Improvement of soil health helps address problems like soil erosion and nutrient leaching.

Biochar is increasingly becoming an important tool in enhancing agricultural productivity with environmental sustainability as Japan works toward sustainable food production.

The section provides comprehensive assessments and insights that highlight current opportunities and emerging trends for companies in developed and developing countries. It analyzes advancements in manufacturing and identifies the latest trends poised to drive new applications in the market.

A few key players in the biochar industry are actively enhancing capabilities and resources to cater to the growing demand for the compound across diverse applications. Leading companies also leverage partnership and joint venture strategies to co-develop innovative products and bolster resource base.

Significant players are further introducing new products to address the increasing need for cutting-edge solutions in various end-use sectors. Geographic expansion is another important strategy that is being embraced by reputed companies. Start-ups are likely to emerge in the sector through 2035, thereby making it more competitive.

Industry Updates

In terms of technology, the industry is divided Pyrolysis, Gasification, and Others

In terms of application, the industry is divided into Agriculture, Animal Farming, Industrial Uses, and Others

Key countries of India, China, Japan, South Korea, Australia, Indonesia, Thailand, Singapore, Malaysia, Vietnam, and Rest of Asia Pacific, have been covered in the report.

The Asia Pacific market was valued at USD 715.8 million in 2024.

The Biochar Market is expected to reach USD 798.2 million in 2025.

APAC demand is anticipated to rise at 11.5% CAGR.

The industry is projected to reach USD 2,370.5 million by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Functional Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Solid State Transformers Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Gasoline Injection Technologies Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Bentonite Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific In-Car Entertainment System Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Plastic Additives Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Analysis - Size, Share, and Forecast 2025 to 2035

Asia Pacific Wild Rice Market Report – Trends, Growth & Forecast 2025–2035

Asia Pacific Vinegar and Vinaigrette Market Insights – Growth, Demand & Forecast 2025–2035

Asia Pacific Whole Grain and High Fiber Foods Market Outlook – Size, Share & Forecast 2025–2035

Asia Pacific Wood Vinegar Market Analysis – Demand, Size & Forecast 2025–2035

Asia Pacific Tartrazine Market Analysis – Trends, Demand & Forecast 2025–2035

Asia Pacific Secondhand Goods Market Growth, Trends and Forecast from 2025 to 2035

Analysis and Growth Projections for Asia Pacific Essential Oil and Oleoresin Business

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA