The global antiviral drug packaging market and is projected to a steady CAGR during the period of 2025 to 2035, due to the rapid expansion of the antiviral drug markets worldwide in terms of the demand for antiviral medicines for the treatment of infectious diseases.

The high prevalence of chronic viral infections including hepatitis, HIV and influenza has driven a booming market for packaging that is safe, efficient and compliant. Companies focus on broadening merchant use squeezes that keep drug security to improve usability names and ensure drug is free from foreign body or micro-organisms.

Various stricter regulatory requirements in the market of pharmaceutical packaging have contributed to the rising demand for high-barrier materials, child-resistant and/or child-proof, and tamper evident designs.

Additionally, growing global healthcare infrastructure and increasing availability of antivirals in developing markets is further fuelling demand for advanced drug packaging intermediary. A push toward sustainability in packaging is also shaping industry development, as companies look into reusable and recyclable materials.

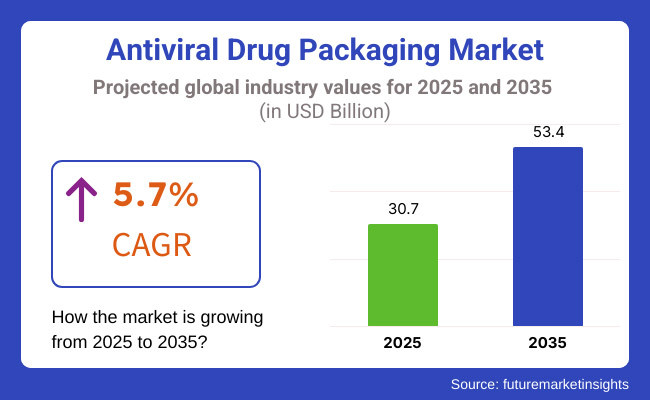

The ongoing need for specialized pharmaceutical packaging solutions to meet evolving market demands is projected to grow at a CAGR of 5.7% during the forecast period between 2025 to 2035.

Explore FMI!

Book a free demo

North America is among the prominent markets for antiviral drug packaging, due to strong pharmaceutical manufacturing capabilities and stringent regulatory guidelines by organizations such as the FDA.

In October 2023, packaging solutions open the door to a world of benefits, including higher product integrity and better patient safety, posing challenges across all market segments, the data focuses on the demand for innovative packaging that can meet health regulations, driven by the United States as a global centre for drug development.

Moreover, rising demand for voluminous sustainable packaging and growing prevalence of blister packs, pre-filled syringes and smart packaging technologies are inducing the market growth.

The packaging of antiviral drugs in Europe is anticipated to be fuelled by stringent pharmaceutical safety regulations and the increasing demand for premium quality solutions for drug packaging. With 19% of consumers claiming to avoid all waste packaging, what can sustainable design do? Countries including Germany, France and the UK are leading the way in the adoption of sustainable, patient-centric packaging designs.

EU regulations on pharmaceutical packaging have driven a surge in child-resistant and tamper-proof adoption. The growth of pharmaceutical cold-chain logistics and a booming biosimilar market are also fuelling market growth.

Antiviral drug packaging market is witnessing the fastest growth in Asia-Pacific owing to increasing pharmaceutical production in countries such as China, India, and Japan. The increasing number of infectious diseases, as well as government initiatives to improve the accessibility of healthcare, is predicted to promote the demand for antiviral medications, which in turn will promote innovation in the packaging.

Market growth is also attributed to the increasing presence of contract manufacturing organizations (CMOs) in the region. In addition, eco-friendly and cost-effective packaging solutions are gaining appreciative momentum owing to regulatory and environmental concerns.

Challenges

Stringent Regulatory Compliance and Material Selection

The antiviral drug Balsa market is also undergoing challenges due to stringent regulatory requirements and demand for top quality, contamination free medication packaging components. The choice of proper packaging materials is vital, as antiviral drugs need an exact protection against environmental elements like moisture, oxygen, and light.

Packing guidelines are very stringent, imposed by regulatory agencies including FDA and EMA, given that the carton or plastic material should not compromise the active pharmaceutical ingredient or drug's efficacy and safety. Manufacturers now face additional complexity and expense in complying with these ever-changing regulations.

Packaging materials when it comes to sterility and durability is another challenge paired with liquid formulations, injectable, and biologics. As such, for the manufacturer, this means investing in advanced material research, sustainable alternatives, and production practices focused on the stringent compliance requirements associated with pharmaceutical packaging.

Opportunity

Growth in Sustainable and Tamper-Proof Packaging Solutions

Growing global demand for anti-viral medication presents opportunities for innovators offering intelligent, sustainable and tamper-proof packaging solutions. Additionally, the pharmaceutical industry is also pivoting towards more sustainable packaging solutions such as biodegradable blister packs and recyclable plastics due to its ever-affecting environmental impact on medication, maintaining drug integrity.

In addition, the antiviral drug packaging market is witnessing an increased demand for tamper-evident packaging, ensuring product security and preventing counterfeiting. Track-and-trace mechanisms, serialization, and other smart labelling solutions are being established for greater transparency across supply chains.

Investing companies can reinforce brand trust while complying with regulatory mandates aimed at sustainability and patient safety.

The market for antiviral drug packaging experienced robust growth from 2020 to 2024. Rapid innovations in sterile and single-use packaging formats occurred in the market due to the emphasis on patient safety coupled with regulatory compliance. The use of child-resistant packaging and tamper-proof seals became more common as this was targeted to prevent any misuse of the medication.

Furthermore, drug companies wanted cheaper packaging options that did not interfere with the stability of the drug.

In the years 2025 to 2035, the market is likely to see advancements in sustainable pharmaceutical packaging, superior barrier protection technologies and smart Sustainable packaging solutions like biodegradable and recyclable materials will gain momentum as the focus on environment-friendly packaging rises.

They are expected to improve shelf life for drugs through innovations in barrier films and multi-layer packaging, and offer better protection against counterfeiting with enhanced security features. The need for personalized packaging solutions that cater to certain formulations of antiviral medication will also increase.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter guidelines on drug safety and child-resistant packaging |

| Material Innovation | Increased use of high-barrier plastics and glass packaging |

| Industry Adoption | Widespread implementation of tamper-evident and single-use packaging |

| Supply Chain and Sourcing | Emphasis on cost-effective, locally sourced materials |

| Market Competition | Dominance of large pharmaceutical packaging firms |

| Market Growth Drivers | Demand for antiviral medications and sterile packaging solutions |

| Sustainability and Energy Efficiency | Introduction of recyclable plastics and waste-reduction initiatives |

| Security and Anti-Counterfeiting | Implementation of tamper-proof and child-resistant designs |

| Customization and Patient-Centric Design | Focus on ease-of-use packaging formats for patient adherence |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of global compliance standards and sustainability-focused regulations |

| Material Innovation | Growth in biodegradable, recyclable, and plant-based pharmaceutical packaging |

| Industry Adoption | Expansion of eco-friendly and smart-labelling solutions |

| Supply Chain and Sourcing | Adoption of global sustainable sourcing and circular economy principles |

| Market Competition | Growth of specialty packaging providers offering customized drug packaging |

| Market Growth Drivers | Rise of eco-conscious pharmaceutical packaging and advanced drug protection |

| Sustainability and Energy Efficiency | Large-scale adoption of carbon-neutral packaging solutions and energy-efficient manufacturing |

| Security and Anti-Counterfeiting | Growth in serialization, track-and-trace mechanisms, and authentication features |

| Customization and Patient-Centric Design | Development of personalized packaging solutions for different antiviral formulations |

Increasing infectious diseases like influenza, HIV & hepatitis across the globe the demand for antiviral drugs are also detected in the USA which leads to market growth of antiviral drugs in packaging. The growth of the market is encouraged by the pharmaceutical industry interests in innovative drug delivery systems and the need for tamper-evident, moisture-resistant and child-proof packaging solutions.

In addition, the stringent guidelines being introduced by the USA FDA structuring pharmaceutical packaging is forcing the organizations to put into practice quality rich, sustainable and intelligent packaging technologies

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

The growth of the United Kingdom antiviral drug packaging market is being fuelled by greater investment in pharmaceutical research and development (R&D) and upcoming government legislation to limit drug abuse. In addition, the sustainable pharmaceutical packaging materials like recyclable and biodegradable materials are one more factor affecting the market trends in the country.

Moreover, increasing prevalence of viral infections coupled with growing demand for long term antiviral therapy in geriatric population will further accelerate the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.6% |

Germany, France and Italy make up the lion’s share of the EU’s outputs of antiviral drugs, spurred on by a general pharmaceuticals manufacturing ethos, as well as the tough regulatory regimes dictated by the European Medicines Agency (EMA).

Today, patient safety is a key area of focus for European governments are adopting stricter regulations on the manufacturing process for packaging products and hence boosting demand for sterilized and contamination-free packaging products.

By the same token, manufacturers make effort toward creating sustainable packaging solution with a variety of recyclable packaging materials as well as be responsive of plastic waste and increase awareness about eco-friendly packaging solutions. The growing demand for antiviral therapeutics, being COVID-19, Influenza, and HIV therapeutics, is also propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.8% |

The market for antiviral drug packaging in Japan is expanding owing to its aging population, along with increasing demand for antiviral drugs to combat chronic diseases such as hepatitis and influenza. Its sophisticated pharmaceutical industry is now prioritizing high-barrier, tamper-proof smart packaging to ensure medicine safety and shelf life preservation.

The growing implementation of personalized medicine and biotech medication also contribute to the demand for innovative format packages, like pre-filled syringes and blister packs to bring.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

The South Korean market for antiviral drug packaging is growing steadily, thanks to the country's presence in the pharmaceutical and biotech sectors. Government efforts to promote domestic drug production and increased demand for antiviral therapies especially seasonal flu and viral outbreaks are driving market growth.

Smart packaging technologies such as RFID tracking and temperature sensitive packaging are also being adopted.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

Antiviral Drug Packaging Market, by packaging type - The antiviral drug packaging market is segmented into primary and secondary packaging based on the packaging type; the primary and secondary packaging segments are expected to hold the largest share in the global antiviral drug packaging market owing to the growing demand for safe, tamper-proof, and contamination-free pharmaceutical packaging. Request for such information is essential at further mentioned segments to maintain drug effectiveness, conform regulatory action, and prepare patients to be medicine compliant thereby becoming a part of pharma manufacturers, healthcare protector and supply chain members.

Primary Packaging Leads Market Demand as Advanced Drug Containment Solutions Gain Traction

The rise in demand for advanced drug containment solutions is primarily driven by the rise in primary packaging, the input segment into the market.

Thus, the primary packaging segment currently controls with a direct contact containment solution, including stability and sterility to antiviral drugs along with controlled release of medication. Unlike breakthrough packaging, primary packaging solutions must be able to meet strict regulatory requirements while providing a barrier against external attack to the drugs.

Moreover, rising importance of patient safety and product integrity by pharmaceutical companies is fostering the adoption of specialized primary packaging formats such as blister packs, prefilled syringes, vials, ampoules, and pouches, thereby propelling market growth.

Studies show that well over 65% of antiviral drugs are packaged using high barrier materials that provide the best protection from moisture, light, and oxygen.

The growing adoption of new technologies of primary packaging, including, but not limited to, child-resistant closures, unit-dose packaging, and tamper-evident seals has fuelled the market demand, providing more security and convenience to end users.

Increased implementation of smart packaging technologies, such as NFC-enabled authentication (near-field communication), RFID tracking (radio-frequency identification), and real-time thermal monitoring to support drug traceability and patient compliance, has further boosted penetration of the solutions.

Some of the key factors contributing to market growth are the development of sustainable and eco-friendly primary packaging solutions (such as biodegradable blister films, recyclable glass vials, and the usage of plant-based polymers) in line with global environmental sustainability goals.

Despite the advantages that the primary packaging segment possess such as protection to drugs, patient adherence and regulatory compliance, some of the key challenges that primary packaging segment may face include higher production costs, stringent approval processes for the material and disruptions in the supply chain.

However, innovations in high-performance polymers, advanced manufacturing processes, and automation of packaging processes are improving efficiency, quality, and scalability that would continue to drive demand for primary antiviral drug packaging world over.

Secondary packaging has emerged as the key market segment, with a major focus for logistics, branding, and regulatory compliance. Secondary packaging, in contrast to primary packaging, provides an extra protective layer that aids in the management, storage, and distribution of drugs, in addition to acting as a communication tool for pharmaceutical branding and patient education.

The increasing requirement for strong secondary packaging formats such as folding cartons, corrugated boxes, multi-dose packaging, and shrink wraps has stimulated adoption, which ensures improved structural integrity and simple transportation of antiviral drug shipments.

Growing serialization and anti-counterfeiting solutions in secondary packaging such as 2D barcode, QR code, and tamper-proof labels have bolstered the demand for this market aided by better drug authenticity verification and regulatory compliance with global pharma-tracking regulations.

The growing adoption of automation and AI-powered packaging solutions, such as robotic secondary packaging systems and intelligent labelling technology, is further driving demand, as they guarantee higher productivity while reducing packaging errors.

Moreover, increasing carve outs and launch of recyclable and compostable secondary packaging solutions with focus on fibre-based cartons, bio-based adhesives, and minimalistic eco-packaging designs have segmented lucrative market growth, ensuring that pharmaceutical manufacture sustainability targets are well aligned with these secondary packaging solutions.

The secondary packaging segment, although benefitting from improved drug safety, branding, and compliance, also contends with rising raw material costs, increasing packaging waste concerns, and changing global regulatory standards.

However, developing sustainable materials, digital packaging technologies, and automated packaging solutions are making secondary antiviral drug packaging cost-effective, environmentally conscious, and regulation-compliant and will create growth opportunities for secondary antiviral drug packaging in all the regions.

Packaging of antiviral drugs is motivated by the significant demand for secure, resistant and long shelf-life antiretroviral drug packaging for corresponding oral tablets, injectable and liquid releases. Waste reduction and sustainable packaging materials, child-resistant and senior-friendly designs, and enhanced barrier protection to maintain drug efficacy are just some of the key transformation areas.

Organizations are concentrating on aligned regulations in pharmaceuticals worldwide, serialization to permit a track-and-trace response, as well as workable and eco-friendly medical options to decrease and dispose of malady waste.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amcor Plc | 18-22% |

| West Pharmaceutical Services, Inc. | 12-16% |

| Hergesheimer AG | 10-14% |

| Schott AG | 8-12% |

| Berry Global Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amcor Plc | Creates sustainable, high-barrier blister packs, vials, and pouches to protect antiviral drugs. |

| West Pharmaceutical Services, Inc. | Syringe ranges, Plug & Seal high containment rubber stoppers and other injections. |

| Gerresheimer AG | Provides glass and plastic packaging for delivering antiviral medications, such as ampoules, cartridges, and vials. |

| Schott AG | Specializes in high-purity pharmaceutical glass packaging, featuring advanced barrier protection for liquid antivirals |

| Berry Global Inc. | Child-resistant & Senior-friendly closures, bottles, & unit-dose packaging for solid & liquid antivirals. |

Key Company Insights

Amcor Plc (18-22%)

Amcor offers cutting-edge, sustainable, tamper-proof pharmaceutical packaging solutions to optimize drug stability and compliance, making up for almost half of the total market.

West Pharmaceutical Services, Inc.(12-16%)

West focuses on high-performance injectable drug packaging, which includes containment solutions for biologics and antiviral vaccines.

Gerresheimer AG (10-14%)

Gerresheimer supplies a broad selection of medications packaging with high-barrier glass as well plastic containers for antiviral drugs.

Schott AG (8-12%)

Schott specializes in premium pharmaceutical glass packaging as a way to improve the stability and shelf life of antiviral liquid formulations.

Berry Global Inc. (5-9%)

Berry Global specializes in economy and child-resistant packaging for antiviral solid doses and liquid drugs.

Several pharmaceutical packaging companies contribute to the antiviral drug packaging market with specialized and regulatory-compliant solutions. These include:

The Antiviral Drug Packaging Market was valued at approximately USD 30.7 billion in 2025.

The market is projected to reach USD 53.4 billion by 2035, growing at a compound annual growth rate (CAGR) of 5.7% from 2025 to 2035.

The demand for Antiviral Drug Packaging Market is expected to be driven by the rising prevalence of viral infections, increasing demand for secure and contamination-free drug packaging, advancements in blister packs and vial technologies, and stringent regulations ensuring drug safety and stability.

The top 5 countries contributing to the Antiviral Drug Packaging Market are the United States, China, Germany, India, and Japan.

The Primary and Secondary Packaging segment is expected to lead the Antiviral Drug Packaging market, driven by the increasing demand for tamper-evident, moisture-resistant, and extended-shelf-life solutions for antiviral medications, including tablets, injectable, and liquid formulations.

Sustainable Packaging Market Trends – Innovations & Growth 2025 to 2035

Thermoforming Machines Market Trends - Demand & Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Silicone Elastomer Market Insights – Growth & Forecast 2025 to 2035

Tableware Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.