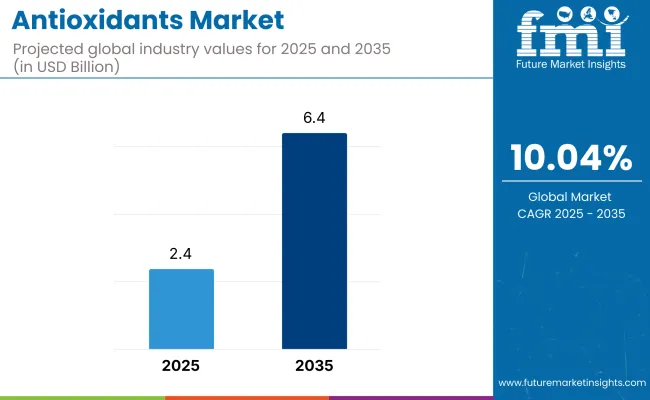

The global antioxidants market is estimated to be worth USD 2.4 billion by 2025 and is projected to reach a value of USD 6.4 billion by 2035, reflecting a CAGR of 10.04% over the assessment period 2025 to 2035.

The market has been witnessing sustained momentum owing to increased demand for oxidative stability in food, beverage, pharmaceutical, and personal care applications. A growing awareness of free radical damage and its link to aging, chronic inflammation, and degenerative diseases has played a pivotal role in shaping consumer preferences toward products enriched with antioxidants.

Rising consumer demand for natural preservation systems and functional health benefits is being leveraged by food and nutraceutical manufacturers to reformulate and extend product shelf life without synthetic additives.

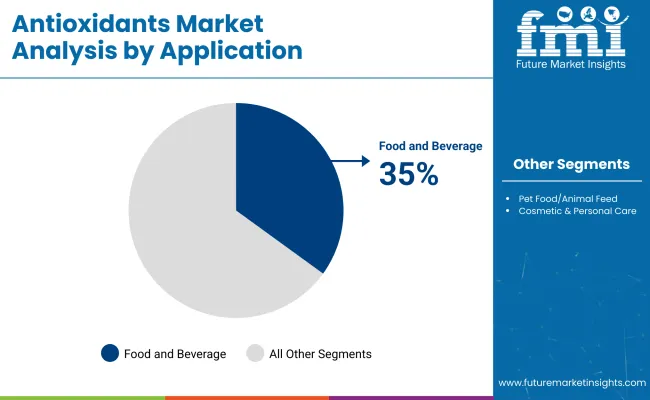

The food and beverage sector continues to dominate the market, where antioxidants are increasingly utilized not only to delay lipid oxidation and extend shelf life but also to promote nutritional and clean-label value.

Preference has gradually shifted from synthetic antioxidants such as BHA and BHT toward naturally derived compounds like tocopherols, rosemary extract, green tea polyphenols, and ascorbates. This transition is being reinforced by consumer skepticism around chemical additives and the growing availability of plant-based antioxidant systems.

Within the pharmaceutical and dietary supplement space, antioxidants are being positioned as vital compounds for preventive health, immunity support, and cellular defense. This has created new opportunities for innovation in encapsulation technologies, bioavailability enhancement, and the development of multifunctional antioxidant formulations.

The personal care and cosmetics sectors are also playing a crucial role, as antioxidants are increasingly being integrated into anti-aging and skin protection formulations to address concerns related to pollution and UV-induced oxidative stress.

Geographically, while North America and Europe have historically led the market, Asia Pacific is emerging as a key growth hub due to dietary diversification, rising health consciousness, and increased consumption of processed and fortified foods. Governments and regulatory bodies across regions are further supporting the transition to natural antioxidants by enforcing stricter labeling regulations and permissible usage limits for synthetic additives.

The competitive landscape is marked by a blend of global ingredient manufacturers and specialized botanical extract companies. Emphasis is being placed on traceability, clean-label certifications, and sustainable sourcing of raw materials.

As market dynamics evolve, antioxidants are expected to transition from being viewed solely as stabilizing agents to multifunctional ingredients central to health-forward and label-transparent product formulations.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global industry. This analysis highlights key shifts in industry performance and indicates revenue realization patterns, providing stakeholders with a clearer view of the industry growth trajectory over the year. The first half of the year, or H1, spans from January to June, while the second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 8.7% (2024 to 2034) |

| H2 2024 | 9.0% (2024 to 2034) |

| H1 2025 | 9.1% (2025 to 2035) |

| H2 2025 | 9.4% (2025 to 2035) |

The above table presents the expected CAGR for the global product demand space over a semi-annual period spanning from 2024 to 2035. In the first half (H1) of the year 2024, the business is projected to grow at a CAGR of 8.7%, followed by a slight increase to 9.0% in the second half (H2) of the same year. Moving into 2025, the CAGR is expected to rise to 9.1% in H1 and maintain a steady increase to 9.4% in H2.

In the first half (H1 2025), the industry witnessed an increase of 4 BPS, while in the second half (H2 2025), the industry observed a rise of 4 BPS, indicating a consistent upward trend. These variations suggest strong industry momentum, driven by advancements in antioxidant extraction technologies, increasing demand for natural and plant-based products, and regulatory support for clean-label products across key global markets.

Accounting for over 35% of the total market share in 2025 and expanding at an estimated CAGR of 9.6% through 2035, the food and beverage segment is poised to retain its leadership in antioxidant consumption. Demand growth is being accelerated by rising concerns over product freshness, nutrient stability, and the health implications of oxidative stress among increasingly label-conscious consumers.

This segment has undergone a fundamental transformation from basic shelf-life management to multifunctional ingredient positioning. Antioxidants are no longer limited to preventing rancidity; they are now being embedded into functional food narratives, offering added nutritional value and clean-label positioning.

Their application in fortified snacks, beverages, and dairy-alternative products has expanded due to shifting dietary habits and rising demand for natural, bioactive compounds. Emerging food preservation technologies, such as nanoencapsulation and active packaging, are enabling better stability, bioavailability, and controlled release of antioxidants, which further supports their application diversification. Regulatory support for natural antioxidants over synthetic variants is expected to reinforce this transition.

As consumer scrutiny over ingredient origin and transparency intensifies, food and beverage manufacturers are increasingly relying on antioxidants not just as additives, but as strategic tools for reformulation, health claims, and brand differentiation in a competitive global landscape.

Expected to grow at a CAGR of 10.8% between 2025 and 2035, the personal care and cosmetics segment has emerged as one of the fastest-growing applications within the global antioxidants market. Although it represents a smaller revenue share than food or pharma, its contribution is increasingly strategic due to evolving consumer preferences toward bioactive, natural, and science-backed formulations.

The integration of antioxidants into skincare and dermo-cosmetic products is being driven by their ability to neutralize free radicals, enhance skin protection, and delay visible signs of aging. Aided by rising awareness of pollution-induced skin damage and UV-triggered oxidative stress, antioxidants have been positioned as essential components in anti-aging and daily defense routines. The shift toward plant-based and cruelty-free formulations is further boosting demand for botanical antioxidant extracts with proven efficacy.

This segment is also benefiting from technological advancements in formulation science, including stabilized emulsions and encapsulated delivery systems, which enhance the potency and shelf-life of antioxidant ingredients in creams, serums, and sunscreens.

As the clean beauty movement gains regulatory and commercial traction, antioxidants are set to evolve into not only protective agents but also holistic contributors to wellness-driven cosmetic narratives, backed by transparent sourcing, efficacy validation, and eco-conscious brand strategies.

Rising Demand for Biofermented Products in High-Absorption Skincare Formulations

The cosmetics industry is witnessing a surge in demand for biofermented products, as brands seek high-absorption, naturally derived ingredients for anti-aging and pollution-defense skincare formulations. Unlike traditional products, which often degrade before fully penetrating the skin, biofermented products enhance cellular uptake, prolong efficacy, and improve stability in formulations.

This trend is gaining traction in North America, Europe, and Asia-Pacific, where clean-label and biotech-driven skincare solutions are reshaping consumer preferences. High-performance ingredients like fermented resveratrol, astaxanthin, and CoQ10 are being integrated into luxury serums, creams, and facial oils, targeting free radical damage, UV-induced aging, and collagen preservation.

Moreover, South Korea’s K-beauty industry is pioneering fermented antioxidant innovations, driving global cosmetic companies to invest in fermentation-based R&D. By 2035, biofermented products will play a pivotal role in next-generation, scientifically validated beauty formulations, further enhancing their appeal in premium and dermatologically tested skincare products.

Expanding Use of Antioxidant-Infused Packaging for Prolonging Product Shelf Life

With the rising focus on sustainability and product longevity, the cosmetics and food industries are shifting toward antioxidant-infused packaging to extend product shelf life and protect against oxidative damage. Unlike conventional packaging, which only acts as a barrier, new biodegradable packaging materials infused with products actively combat free radicals and environmental contaminants.

This innovation is particularly gaining momentum in Europe and North America, where brands are under regulatory pressure to reduce preservatives in cosmetic and food products while maintaining product stability. Companies are incorporating polyphenols, vitamin E, and tocopherols into bio-packaging films, preventing ingredient degradation in premium skincare, organic beauty products, and plant-based foods.

Additionally, biotech firms are developing natural antioxidant coatings for glass and biodegradable bottles, further reducing the reliance on synthetic stabilizers. By 2035, antioxidant-driven smart packaging will be an industry standard, helping brands enhance sustainability while improving product integrity.

Surging Demand for Antioxidant-Infused Functional Beverages in Beauty Nutrition

The global beauty and wellness industry is increasingly incorporating antioxidant-rich functional beverages, driven by consumer demand for ingestible skincare and collagen-boosting formulations. Unlike traditional beauty products that focus solely on topical application, nutritional beauty drinks infused with vitamin C, polyphenols, and flavonoids are becoming essential in holistic skincare routines.

This trend is particularly accelerating in the USA, Japan, and South Korea, where nutricosmetics are seeing widespread adoption among health-conscious consumers. Brands are launching ready-to-drink (RTD) antioxidant shots, plant-based elixirs, and collagen-enhanced teas, positioning them as daily skin-rejuvenating solutions.

The incorporation of marine-derived products like astaxanthin and algae extracts is further elevating the efficacy of these formulations, offering anti-inflammatory, anti-aging, and UV-protective benefits. By 2035, antioxidant beverages will dominate the beauty-from-within segment, creating a new consumer category that merges skincare and functional nutrition into a seamless daily routine.

The antioxidants market has a variety of major risks, including regulatory difficulties, supply chain disruptions, fluctuating raw material prices, industry competition, and consumer perception changes. One of the most important risks is compliance with regulations.

Since the food, pharmaceutical, and cosmetic products have to conform to the strict safety rules imposed by the organizations such as FDA, EFSA, and WHO this is the most important risk. In case any changes are made on the law like forbidding synthetic products (e.g. BHA, BHT) due to health issues, product permits and formulations would in turn be affected.

Supply chain disruptions, especially for plant-sourced products from natural sources (e.g., tocopherols, flavonoids), are the main risk that is posed due to the impacts of climate change, agricultural challenges, and geopolitical insecurity. Any interruption in sourcing may increase costs and reduce production capacity.

The industry is also competitively traded with a wide array of firms marketing both synthetic and natural products catering to the food, cosmetic, and pharmaceutical industries. Firms should give preference to product differentiation, innovation, and clean-label solutions to sustain competitiveness.

Another factor is as the consumers' perception shifts toward clean-label, natural, and organic products and it puts pressure on companies to replace synthetic products with plant-derived smaller number of products. This transition involves R&D investments and reformulation efforts since these changes are necessary to fulfil the evolving industry demands.

With increasing consciousness of skin microbiome wellness, the potential for bioactive natural products seems promising. This trend is particularly true in North America and Europe, with dermatology-driven brands like Caudalie, Drunk Elephant, and Biossance bringing to ingredients like prebiotic-rich resveratrol, adaptogenic astaxanthin, and fermented tea polyphenols. K-beauty and J-beauty brands like Sulwhasoo and SK-II are launching products based on antioxidant microbiome care.

The beverages segment is growing, driven largely by a rise in demand for cold-stabilized antioxidant beverages with high bioavailability and prolonged efficacy. Where traditional antioxidant-rich beverages become less potent when exposed to heat and oxygen, cold-stabilized tech enables longer shelf life and a more potent combo of polyphenols, flavonoids, and vitamin C derivatives for optimal absorption.

This movement has been ramping up in North America, Japan, and Europe, where major brands - including PepsiCo (Naked Juice), Suja Juice, and POM Wonderful - are introducing cold-pressed antioxidant shots, enzyme-fortified berry elixirs, and fermented botanical drinks. Moreover, sports and wellness brands focus on cryogenic processing methods to preserve products like astaxanthin, curcumin, and resveratrol in high-performance hydration beverages.

The industry is experiencing strong growth in the functional food and nutricosmetic markets with growing concern for oxidative stress, aging, and the immune system. Skin care companies increasingly produce serums and sun-blocking lotions with antioxidant-rich ingredients such as resveratrol, glutathione, and astaxanthin.

Increased popularity of edible beauty supplements further amplifies the size of the nutricosmetic industry. Functional food and beverage companies are incorporating products into ready-to-drink (RTD) drinks, organic superfood blenders, and plant-based polyphenols to keep pace with clean-label and organic food schemes. The industry is transforming at a fast pace as biotech innovation increases the bioavailability of products in supplements and fortified foods.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Expansion of Nutricosmetic Industry | Products are widely used in skincare, supplements, and ingestible beauty products. |

| Increased Demand for Functional Beverages | RTD beverages, superfood powders, and plant-based polyphenols contain antioxidant ingredients. |

| Rising Consumer Awareness | People seek antioxidant-rich products to support aging, immunity, and overall health. |

| Biotech Advancements in Products | Improved bioavailability enhances efficacy in fortified foods and supplements. |

The industry continues to expand in skin care and food uses, with a keen interest in adaptogenic products and arctic plant polyphenols. Wild-harvested botanical products like cloudberry extract, sea buckthorn oil, and black spruce polyphenols are being used more and more in high-performance skin care products.

Clean beauty trends prefer antioxidant-rich, preservative-free products, particularly in pollution defense and sensitive skin categories. The top ones among the customers are functional wellness drinks, antioxidant-enriched herbal teas, and bioactive berry extract. Cold processing of antioxidant enrichment in the functional food ensures maximum retention of the nutrients.

Growth Factors in Canada

| Key Drivers | Details |

|---|---|

| Adoption of Adaptogenic Products | Botanicals like cloudberry and sea buckthorn are used in high-efficacy formulations. |

| Clean Beauty Preferences | Consumers favor preservative-free, antioxidant-rich skincare. |

| Popularity of Functional Beverages | Herbal teas and wellness drinks incorporate natural products. |

| Cold-Processing Technology | Enhances nutrient retention in antioxidant-infused functional foods. |

There is a transition taking place in the antioxidant industry toward sustainable plant-based sources, especially in cosmetics and skincare. As natural regulations curtail synthetic products like BHA and BHT, companies resort to biofermented polyphenols, plant-based resveratrol, and algae-derived astaxanthin in anti-aging, blue light protection, and pollution-defense products.

Green packaging solutions with antioxidant-based stabilizers are becoming increasingly popular, giving longer shelf life without synthetic preservatives.the functional foods are making greater use of organic tocopherols, rosemary extracts, and vitamin C derivatives to maintain plant-based materials and functional snacks. Clean-label cosmetics as well as biodegradable packaging continue to be at the vanguard of industry transformation.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Shift to Natural Products | Biofermented polyphenols and plant-based extracts replace synthetic compounds. |

| Growth of Clean-Label Beauty | Consumers prefer skincare products free from artificial preservatives. |

| Demand for Functional Foods | Tocopherols, rosemary extracts, and vitamin C derivatives improve shelf life and health benefits. |

| Sustainability and Eco-Friendly Packaging | Antioxidant-based stabilizers extend product longevity naturally. |

China's antioxidant market is developing due to increasing Chinese consumers' demand for natural food for health and functional food. Emerging nutraceuticals are combined with TCM philosophies to develop increasing demand for herbs that are antioxidants.

Green tea polyphenol, goji berry extract, and ginseng antioxidant are sold in supplements, food and beverage ingredients, and cosmeceuticals. The food industry extends the application of antioxidants in fortified milk, plant protein, and nutrition powders to meet an aging population and increasing middle class demanding preventive health care.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Combination of TCM with Contemporary Nutraceuticals | Herbal antioxidants like green tea polyphenols and goji berry extracts are applied in health foods. |

| Functional Food Trends | Fortified milk, plant protein, and nutrition powders become popular. |

| Increasing Middle-Class Health Awareness | Consumers increasingly look for antioxidant-rich foods and supplements. |

| Natural Skincare Market | Natural plant actives dominate the scene in beauty and wellness products. |

India's antioxidant market is growing at a very rapid speed with Ayurvedic actives extensively being used in nutraceuticals and personal care. Turmeric-root curcumin, amla extracts, and ashwagandha-based antioxidants are extremely popular in dietary supplements, herbal infusions, and immunity drinks.

Increasing urban consumer base necessitates natural and organic food, which boosts the demand for antioxidant-based functional food and beverages. Ayurvedic treatment with saffron, neem, and sandalwood antioxidants is sought by the cosmetics industry. Cold-press extraction of these products enhances their bioavailability in food as well as cosmetics.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Development of Ayurvedic Antioxidants | Turmeric curcumin, amla, and ashwagandha are utilized in nutraceuticals. |

| Increased Demand for Functional Beverages | Herbal tea and immunity drinks contain antioxidant-loaded ingredients. |

| Development of Natural and Organic Products | Chemical-free functional foods and cosmetics are retailed to urban consumers. |

| Cold-Pressed Processing Methods | Enhances bioavailability of food and cosmetic antioxidants. |

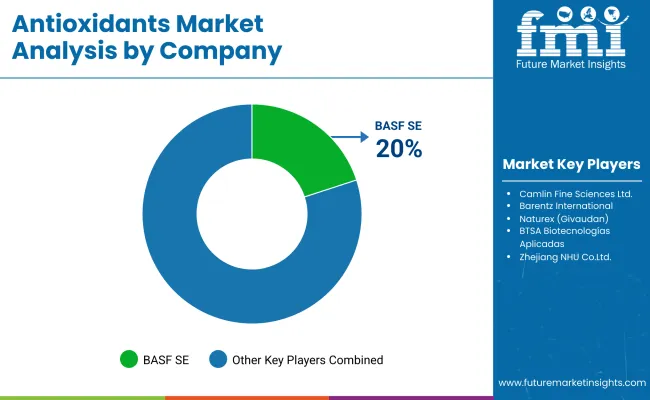

BASF SE (20-25%)

They are renowned for providing natural and synthetic products. They invest heavily in sustainable solutions and ingredient innovating factions.

Koninklijke DSM N.V. (15-20%)

For bio-based antioxidant formulations, research and development know-how are being used to cultivate high-purified, functional ingredients.

Kemin Industries (10-15%)

They are well established in both nutraceutical and food preservation markets, and they offer high-efficacy natural products.

Archer Daniels Midland (ADM) (8-12%)

This is a leading supplier of plant-based products for functional food and health applications.

DuPont (IFF) (5-10%)

In the fields of food, pharmacy, and personal care, they are innovating in clean-label as well as natural products.

Other Key Players (30-40% Combined)

The industry is segmented by product type into natural antioxidants and synthetic antioxidants.

The industry is segmented by application into food products, beverages, pet food/animal feed, and cosmetic & personal care products.

The industry is segmented by region into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is slated to reach USD 2.4 billion in 2025.

The industry is predicted to reach USD 6.4 billion by 2035.

Key companies include BASF SE, Koninklijke DSM N.V., Kemin Industries, Archer Daniels Midland (ADM), DuPont (IFF - International Flavors & Fragrances Inc.), Camlin Fine Sciences Ltd., Barentz International, Naturex (Givaudan), BTSA Biotecnologías Aplicadas, and Zhejiang NHU Co., Ltd.

They are majorly used in beverages.

Natural antioxidants are being widely used.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antioxidants Cosmetic Market (Personal Care Actives) Analysis - Size and Share Forecast Outlook 2025 to 2035

Antioxidants Reagent Market Analysis – Trends & Future Outlook 2024-2034

Food Antioxidants Market Analysis by Product, Application and Form Through 2035

Phenolic Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Moringa Oil Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antioxidants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Tocopherol-Rich Antioxidants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Blueberry Extract Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA