Worldwide antimicrobial regenerative wound matrix market will see vast growth between 2025 and 2035 with increased incidence of chronic wounds and advances in wound care technology. Advances in disease control in diabetes and obesity have stimulated application of advanced care solutions for prevention of infection and healing of wounds with protective action against infection and tissue repair.

This demand is also enhanced because of health care programs for improved patient outcomes and high-technology material applications in wound therapy.

Antimicrobial regenerative wound matrices are second-generation scaffolds employed in tissue regeneration and removal of microbial infection. They are made up of biocompatible polymers like chitosan and collagen and antimicrobial fillers like silver nanoparticles. They work synergistically to provide a healing environment, minimize the chance of infection, and increase the rate of recovery.

Explore FMI!

Book a free demo

North America has the lion's share in the market for antimicrobial regenerative wound matrix because it has a very well-established base of medical facilities and rising consciousness towards new technologies in wound healing.

It is a nation beset by epidemic chronic diseases in wounds; even with just 6.5 million cases of these being tolerated every year alone in the United States, they've had to incorporate very technologically advanced devices in their very advanced healthcare setup at a very fast rate.

In the war of this endemic problem, the USA Department of Health and Human Services launched programs that allowed development and deployment of new wound care technologies that are intended to minimize hospital stay and improve patient quality of life.

Furthermore, market leaders such as 3M and Johnson & Johnson's plan to construct highly competitive markets provokes competition that requires ongoing innovations for wound care products.

Cooperations between medical professionals and hospitals continue to push the market ahead, ensuring the most recent scientific advances are translated into practice. This integration of public enthusiasm and private ingenuity puts North America at the forefront of the antimicrobial regenerative wound matrices market in

Europe also has a high demand for antimicrobial regenerative wound matrices as a result of a rising population of aging people along with the high prevalence of diabetes foot ulcers. Germany and the United Kingdom are among the nations that have adopted national policies that promote the utilization of advanced wound care products.

The UK National Health Service (NHS), for example, had already included antimicrobial regenerative wound matrices in regular treatment packages for chronic wounds because they could minimize healing time and prevent infection.

Both cost-effectiveness and patient-oriented healthcare typify Europe, propelling more spending on wound care technology. Intercontinent collaboration also leads to coming up with new treatments and materials, spurring the creation of the market anew.

The European Wound Management Association (EWMA) makes meaningful contributions to imparting best practice and education such that the care providers are better equipped with data concerning the application of these newer treatments. The approach is, thus, reflects Europe's commitment towards better results for the patient in wound healing.

Asia-Pacific will most likely experience the most growth in the antimicrobial regenerative wound matrix market during the forecast period. This is due to the fact that more urbanization has occurred, there has been greater spending on health care, and there has been greater knowledge about advanced wound care treatments.

In India and China, diabetes has increased, causing a high number of chronic wounds. The government of India initiated the "National Program for Prevention and Control of Diabetes," for which diabetic foot ulcer care forms one of the elements through hi-tech wound care products.

Chinese healthcare reforms thus center on expanding access to quality medical care, such as high-tech wound care therapy. Locally, affordable alternatives are being produced with growing competition.

Technology transfer and product adaptation based on local needs through international-local business transactions make the products adaptable. With upgrading healthcare infrastructure in the works, the Asian-Pacific market has a market to evolve antimicrobial regenerative wound matrix.

Challenge

High Cost and Reimbursement Issue

The biggest challenge to the antimicrobial regenerative wound matrix market is high cost of the new products. Most health care systems, particularly in developing nations, are confronted with budget constraints and excessive utilization, thereby becomes an issue.

Unpredictable reimbursement policy also discourages health care providers from using such products. For example, patients in some areas might not be reimbursed for the full price of expensive advanced wound care products, and it would be costly and limit access.

Such a cost barrier would discourage patients from switching to newer, better therapies and, thus, restrict market growth. These roadblocks are eased by collaborative action by the producers, payers, and policymakers in establishing cost-effective mechanisms and enforcing consistent reimbursement policies that enable greater access to high-tech wound care technology.

Opportunities

Technological Advancements and Product Innovations

Despite all these challenges, the market is full of excellent opportunities for product development and technology advancements. Researchers are creating methods to embed smart technology into wound matrices, such as infection markers monitoring sensors that feedback in real time to doctors.

For instance, a top-ranked medical school has paired with a biotech company to create a model for a "smart" wound matrix with pH sensors that change color in the event of infection, allowing intervention to occur in a timely fashion. Apart from this, biodegradable and biocompatible matrix formation is less painful for patients and decreases the frequency of dressing.

The inclusion of antimicrobial medications in these matrices, including silver nanoparticles, provides prolonged infection protection. With telemedicine and online platforms increasing their presence in healthcare, they pave the way for patient remote monitoring and individualized treatment regimens, again driving demand for advanced wound care devices.

The developments not only contribute towards better patient outcomes but set the industry on course for record-breaking growth in the coming years.

During the period 2020 to 2024, the market for antimicrobial regenerative wound matrices increased exponentially due to excessive use of complex wound care devices and repeated occurrence of chronic wounds. Despite this, high product prices and weak penetration in emerging economies kept the entire market potential in check.

During the period 2025 to 2035, the market would witness a shift towards affordable products and better accessibility. Industry players will also place a focus on research and development as a means of developing less costly wound matrices without compromising effectiveness.

Additionally, government, provider, and industry collaboratives will be tasked with developing standardized reimbursement policies, which will lead to increased utilization. The merging of telemedicine and electronic health platforms will also be tasked with educating patients and healthcare professionals on the advantages of antimicrobial regenerative wound matrices, thereby maximizing their use.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adoption of simple wound care principles with an emphasis on infection control and routine treatment protocols. |

| Technological Advancements | Incorporation of natural and synthetic polymer-based wound matrices with antimicrobial agents such as silver and iodine. |

| Industry Adoption | Expanded use of antimicrobial wound matrices in specialized care environments, especially diabetic foot ulcers and pressure sores. |

| Supply Chain and Sourcing | Reliance on specialist suppliers of antimicrobial agents and biocompatible materials, increasing production costs and supply chain risk. |

| Market Competition | Dominance of established players in the medical device space providing antimicrobial wound care products with minimal competition from new entrants because of heavy R&D expenditure and regulatory hurdles. |

| Market Growth Drivers | Increasing incidence of chronic wounds due to the aging population, which is further compounded by higher rates of diabetes and obesity leading to more non-healing wounds. |

| Sustainability and Conservation | Minimal emphasis on the green footprint of wound care products, with most matrices being single-use, non-biodegradable ones. |

| Integration of Smart Monitoring | Low integration of digital technologies in wound management, using manual assessment and documentation. |

| Advancements in Experiential Travel | Not applicable to the market for antimicrobial regenerative wound matrices. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Adoption of strict legislation mandating the use of antimicrobial regenerative wound matrices in chronic wound management, driven by rising rates of healthcare-associated infections. |

| Technological Advancements | Bioengineered matrix design using nanotechnology and growth factors to facilitate tissue regeneration and antimicrobial effects, reducing healing time and improving patient outcomes. |

| Industry Adoption | Expansion into home health and outpatient environments, with ease of use products and telemedicine integration for remote monitoring and treatment of chronic wounds. |

| Supply Chain and Sourcing | Producers' integration vertically in order to produce in-house antimicrobial parts and establish sustainable source practices, decreasing prices and sustaining an assured source channel. |

| Market Competition | Entry of biotech start-ups to supply novel, cheap antimicrobial regenerative wound matrices, thereby instigating growing competition and accelerating market development. |

| Market Growth Drivers | Growing familiarity with patients and physicians of enhanced solutions for wounds, combined with favorable reimbursement rates and government legislations supporting use of antimicrobial wound matrices. |

| Sustainability and Conservation | Develop towards green and biodegradable antimicrobial wound matrices as corporations invest in green technology to meet environmental regulations and consumer expectations. |

| Integration of Smart Monitoring | Incorporation of intelligent sensors in wound matrices to monitor healing and detect infections in real-time, enabling individualized treatment protocols and reducing hospital readmissions. |

| Advancements in Experiential Travel | Not relevant to the market for antimicrobial regenerative wound matrices. |

In the United States, the demand for antimicrobial regenerative wound matrices has grown substantially with a rise in diabetic and elderly patients suffering from chronic wounds. The Centers for Disease Control and Prevention approximated the number of people with diabetes in America to be around 34.2 million and at risk of developing diabetic foot ulcers.

These companies such as 3M have shifted towards producing new wound products of improved antimicrobial quality with the aim of reversing such setbacks. Moreover, American healthcare sector interest in avoiding infections intensified after the hospital noticed the utilization of newer matrices employed in healing the wound without any infection and swiftly.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.4% |

The UK antimicrobial regenerative wound matrix market has been expanding because of efforts by National Health Service (NHS) to enhance wound care and infection prevention.

NHS has set standards for the use of advanced devices, such as antimicrobial matrices, in wound care procedures to achieve maximum patient outcomes. Firms like Smith & Nephew, based in the UK, have come up with such products as DURAFIBER Ag, an antimicrobial gel fibre wound dressing for exuding wound care and infection control. Rising incidences of chronic wounds and government support consistently drive regional market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.8% |

Within the European union market, France and Germany and other nations have seen increased applications of antimicrobial regenerative wound matrix driven by an increasing health infrastructure and a high increase in old age people.

It has also been one of the key drivers that are prompting member nations to adopt best practice and bring new devices for wound care via the European Wound Management Association (EWMA). F. rms such as DSM Biomedical have made antimicrobial matrices of collagen, which are employed in wound treatment and tissue regeneration and infection prevention.

Emphasis on the quality of life of the patients along with not contributing to healthcare costs by decreasing the length of hospital stays drives this market within this country.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.7% |

Japan's antimicrobial regenerative wound matrix market has expanded with Japan's fast-growing aging population and the rising prevalence of chronic diseases causing non-healing wounds.

The Pressure Ulcer Society of Japan established guidelines favoring the application of high-tech wound care products to prevent and treat pressure ulcers. Organizations such as KCI, which is owned by Acelity, have been pioneers in wound antimicrobial matrices to address the unique Japanese healthcare system. Blending technology, tradition, and patient-friendliness assists in business growth in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

The South Korean wound antimicrobial regenerative matrix market has grown dramatically with a focus by government on the healthcare industry's quality as well as developing new medical technology.

Policies by the Ministry of Health and Welfare endorsing the use of new products in the treatment of wounds have been pursued to manage the rising case load of chronic wounds. Hyundai Bioscience and others have launched antimicrobial matrices of natural polymers that induce healing and infection prevention. Doctor and patient awareness for the worth of luxury wound care products support regional market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

Higher incidence of acute and chronic wounds has increased significantly to fuel demand for advanced antimicrobial regenerative matrices. Incision surgery or trauma wounds need to heal instantly and properly to prevent any complication. Diabetic foot ulcers, pressure ulcers, and venous leg ulcers are more difficult because they are brought about by infectedness, compromise in the flow, or diabetic condition.

The chronic wounds also have the potential for infection and delayed healing, which jeopardizes healing. Antimicrobial regenerative matrices such as Aroa Biosurgery's Endoform™ Dermal Template are a justified solution with tissue regeneration induction and infection limitation capacity.

The dermal template enhances healing by stimulating cell growth together with vascularization allowing tissue to heal at a faster rate. The ever-growing population of the elderly worldwide necessitates increased use of burden on chronic disease and trauma, and therefore such use of advanced wound therapy is inevitable.

The matrices not just promote healing but also minimize infection complications and hence become the most superior in the clinic management of acute and chronic wound care treatment.

Natural polymers, i.e., collagen matrices, are the market leaders in wound therapy as they are more biocompatible and have been clinically proven to provide tissue regeneration ability. Collagen is a protein of the extracellular matrix that is implicated in growth, cell migration, and tissue formation. Collagen wound dressings, therefore, e.g., Integra LifeSciences, are effective to cure acute as well as chronic wounds.

The dressings can provide adequate vascularization and cellular ingrowth, which ultimately results in better healing. Chitosan, a bio-derived polymer employed in wound healing, has been reported to be antimicrobial in nature. It inhibits infection and enhances quicker healing, particularly in infectible-prone wounds.

Algin, the second seaweed ingredient, to a large extent is being used as the seaweed possesses the capability in forming a gel structure that characterizes moist phases of the wound that are an elictor of new tissue and also scarring-reducing. The capacity of these biologic polymers to replicate the body's natural healing process enables them to become a central part of modern wound therapy, with maximum healing and minimal complications.

Synthetic polymers like Poly ε-Caprolactone (PCL) and Poly Lactic Acid (PLA) are becoming increasingly important in wound healing because they can be designed to be compatible with a specific rate of degradation along with improved mechanical properties. The polymers can be designed depending on the individual requirement of each type of wound and thus can respond very well to the clinical use.

PCL is most useful in situations where the tissues need prolonged support before total tissue regeneration is achieved. It degrades at a slow pace yet can continue to provide structural support to the scaffold without any break for an increased period so that tissues grow and regenerate.

PLA works optimally on its improved mechanical properties and works optimally to be used to support tissue regeneration under bad conditions. Synthetic hydrogels made from Polyvinyl Alcohol (PVA) have some further benefits in terms of elasticity as well as water content.

The hydrogels introduce water into the wound, resulting in improved healing, less pain, and less scarring. The ease with which, and the durability and strength with which, synthetic polymers are able to be selectively synthesized quite easily make them easily usable as effective tools in wound management of all kinds.

Market development of antimicrobial regenerative matrix is driven by ongoing technological improvement and expanded clinical use of second-generation wound care. Technological advancements in the recent past of using antimicrobial drugs in natural and artificial matrices have enhanced their infection protection and healing considerably.

In combining bioactive molecules, growth factors, and antimicrobials, 3M and Smith & Nephew are constructing the second wave of wound dressings to do more than prevent infection from entering and also do the best to provide an optimum environment for tissue repair.

These technologies are revolutionizing the conventional mechanisms of wound healing so that healing and recovery of patients become faster with less chance of complications in the form of chronic infection. Besides that, application of these newer wound healing products saves healthcare costs by reducing the repeat procedures as well as hospitalization.

With increasing numbers of medical practitioners employing such sophisticated products on a wider scale, the antimicrobial regenerative matrices market will keep expanding. The future is wound healing when technology is utilized, and the future has a lot to heal and cure better patients with acute or chronic wounds.

The antimicrobial regenerative wound matrix market is growing strongly with rising prevalence of chronic wounds, enhanced healthcare setup, and swelling population. Clinics, hospitals, and ambulatory surgery centers are the important markets implementing antimicrobial regenerative wound matrices for enhancing the quality of healing while declining infection incidence.

With enhancements in technology, the matrices exhibit high biocompatibility, biodegradability, and antimicrobial activities in order to confer quality tissue regeneration. Firms are making investments in product development, strategic mergers and acquisitions, and expansion of geographies to address changing patient and healthcare professional demands.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| 3M | 15-20% |

| Smith & Nephew plc | 12-16% |

| Integra LifeSciences | 10-14% |

| Aroa Biosurgery Ltd. | 8-12% |

| Avita Medical | 5-9% |

| Other Companies (combined) | 30-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| 3M | Provides a range of advanced wound care products, including antimicrobial dressings and regenerative solutions. |

| Smith & Nephew plc | Offers innovative wound management products, focusing on antimicrobial therapies and tissue repair technologies. |

| Integra LifeSciences | Develops regenerative technologies and surgical instruments, including dermal regeneration templates and wound matrices. |

| Aroa Biosurgery Ltd. | Specializes in regenerative healing solutions using proprietary extracellular matrix technology for soft tissue repair. |

| Avita Medical | Markets autologous cell harvesting devices for skin regeneration, notably the ReCell system for treating burns and wounds. |

Key Company Insights

3M (15-20%)

3M dominates the antimicrobial regenerative wound matrix market with its entire portfolio of innovative wound care products. It is the innovation and quality leader, offering high-quality products to address a variety of clinical needs.

Smith & Nephew plc (12-16%)

Smith & Nephew has been renowned for its cutting-edge wound care products for long, with a special focus on antimicrobial therapy and tissue repair science. Its research and development division is also focused on the increasing demand for advanced wound care.

Integra LifeSciences (10-14%)

Integra LifeSciences operates in the regenerative technologies and surgical solutions company with a range of products which fluctuates between dermal regeneration templates and matrices of wound healing. Integra LifeSciences products are the kings of the kingdom of the optimal best in optimization of the healing outcome for the challenging case of the status of the wound.

Aroa Biosurgery Ltd. (8-12%)

Aroa Biosurgery is a regenerative products firm engaged in healing through its patented ovine forestomach-derived extracellular matrix technology. Its products are helping in rebuilding the soft tissue and are increasingly popular with surgical as well as wound care indications.

Avita Medical (5-9%)

Avita Medical provides autologous cell harvesting solutions utilizing the ReCell system, which enables skin regeneration for burn and wound victims. Its solution is a rapid healing one that has been embraced across different clinical platforms.

A number of local and specialist businesses cover gaps within the market for antimicrobial regenerative wound matrix using specialist products and innovative thinking. They comprise:

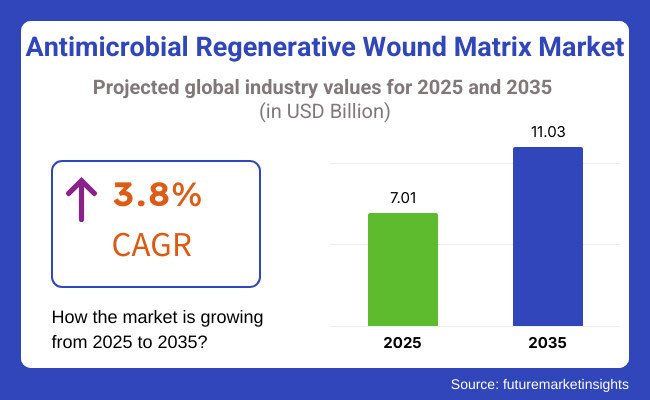

The overall market size for the Antimicrobial Regenerative Wound Matrix market was USD 7.01 Billion in 2025.

The Antimicrobial Regenerative Wound Matrix market is projected to reach approximately USD 11.03 Billion by 2035.

The demand for the Antimicrobial Regenerative Wound Matrix market will be driven by the increasing prevalence of chronic wounds, advancements in wound care technology, and growing awareness of infection control in wound healing.

The top 5 countries driving the development of the Antimicrobial Regenerative Wound Matrix market are the United States, Germany, Japan, the United Kingdom, and France.

The chronic wound care segment is expected to lead the market, with a significant demand for antimicrobial regenerative wound matrices to treat conditions such as diabetic foot ulcers and venous leg ulcers.

The Intraoperative Radiation Therapy Systems Market Is Segmented by Disease Indication and End User from 2025 To 2035

The Cirrhosis Management Market is segmented by Corticosteroids, Analgesics and Dialysis from 2025 to 2035

The Soft Tissue Repair Market is segmented by Synthetic, Allograft, Xenograft and Alloplast from 2025 to 2035

Anti-hyperglycemic Agents Market: Growth, Trends, and Assessment for 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.