The international antimicrobial coil coating market will go on expanding forcefully in 2025 to 2035 with increased demand for clean and corrosion-resistance products by all industries. Medical, food processing, and HVAC industries are leading top-line antimicrobial coil coatings in more volumes to provide extra protection from mold, mildew, and bacteria on the surface.

The growth drivers are primarily augmented health and safety awareness, formulary to coating systems innovation, and stringent government regulation propelling the antimicrobial products market. Building and construction, HVAC, transport, and automobiles are the point-of-use application for the market, wherein the companies work to enhance product longevity and provide hygiene conditions.

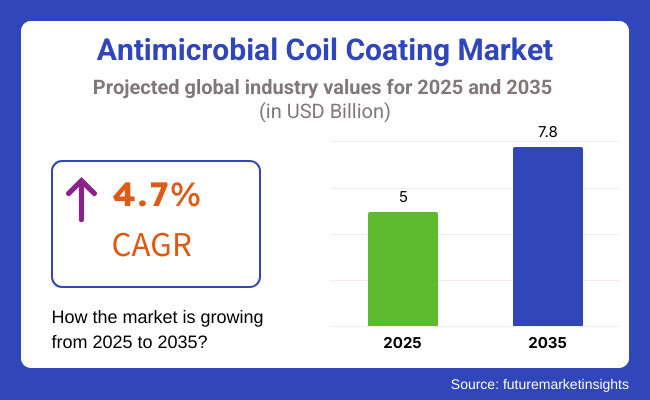

Annualized to a compound growth rate of 4.7% during 2025 to 2035, antimicrobial coil coating is being used more and more by various industries. The internet and social networking now join the ranks as market trend-makers since the players are employing the avenues to promote the benefit of antimicrobial coatings.

Market size is expanding to include specialty end-use markets such as consumer electronics, food packaging, and medical devices as antimicrobial coil coating technology increasingly penetrates high volume.

Explore FMI!

Book a free demo

The North American antimicrobial coil coating market is increasing exponentially as a result of the highly advanced health system and codes of hygiene that permeate the region. United States and Canada are the forerunners in applying high concentration antimicrobial coatings to hospitals, food plants, and air conditioning systems.

Its application in air conditioning is most applicable in the sense that it enhances indoor air quality by inhibiting the growth of mold and bacteria on coils and hence ensuring clean airflow within and through public and private buildings. It's one of those things that is hand-in-hand with the growing movement for using smart building technology to improve health as well as efficiency.

Besides this, the policies of the government towards the goal of enhancing public health and safety have also been at the forefront in driving up the level of growth in antimicrobial coil coating use. For instance, the Environmental Protection Agency (EPA) has constructed policies that have helped enhance the use of antimicrobial products as a means of managing outbreaks of infectious diseases and thus driven regional market expansion.

The antimicrobial coil coatings market in Europe is expanding at a significant rate as the continent has placed a lot of emphasis on health standards and sustainability. Germany, France, and the UK are leading the front with the application of antimicrobial coil coatings to all industries from healthcare facilities to public transport to food industries.

European Union's environmental sustainability needs and antimicrobial resistance have been among the most powerful stimuli for extreme development and use of environmentally friendly antimicrobial coatings. Advances in technology, with the nanotechnology impregnated coatings, have added to the plate the value of the product in offering long-lasting protection against a wide range of microorganisms.

Besides optimizing the ability of antimicrobial coatings to enhance performance, the technologies optimize the application range to confront a vast spectrum of industry requirements that focus on delivering cleaner levels with relentless conformity to the requirements of environment-friendly regulations.

Asia-Pacific is also able to achieve the fastest rate of the growth of antimicrobial coil coatings during the predicted years. This is because of the fact that there is more industrialization, urbanization, and more investments in healthcare infrastructure in countries such as China, India, and Japan.

Higher middle-class consumption spending and health and hygiene awareness have fueled good antimicrobial product growth in commercial building construction and residential building activity. Government initiatives towards public health infrastructure development and tough food safety regulations are also the key market drivers for growth.

For instance, national level health unit retrofitting and stringent sanitation systems in food processing facilities have enabled the use of antimicrobial coil coatings, thus facilitating local market development.

Challenges

Maintaining Effectiveness while Meeting Environmental Demands

The greatest challenge to the antimicrobial coil coating market is developing highly effective products against a wide range of microorganisms and remain environmentally friendly. The antimicrobial agents have been subjected to testing on application for possible toxicity and environmental concerns.

Regulation is also tightening where the regulatory bodies are calling for strict protocols non-harmful to human life and the environment as a result of antimicrobial coatings. The formulators are thus compelled to manufacture products that will meet the regulations and provide improved performance.

It involves a significant amount of R&D to plan and employ effective and environmentally friendly antimicrobial agents to provide sustainable growth for the business.

Restraints due to Cost and Market Penetration

Producing high-performance antimicrobial coil coatings can be costly, particularly utilization of novel materials such as silver nanoparticles. Subsequently, transmit high costs of production to customers through higher costs and may hinder market penetration, particularly in price-inelastic markets.

Companies are attempting to bridge this limitation through cost-cutting measures and technology that can be scaled up for low-cost manufacture of antimicrobial coating to penetrate many markets. New products with antimicrobials at reduced cost without loss of performance, fewer processes of manufacture for cost reduction of manufacture, and raw material optimization are some of the most important measures.

With this, the producers would realize cost-quality parity and hence enhanced penetration and cover in the market.

Opportunities

Breakthroughs in Nanotechnology and Materials Science indicate

Breakthroughs in nanotechnology and material science create gigantic opportunity for the antimicrobial coil coating business. Emerging antimicrobial technology and products will probably translate to more resistant, high-performing, and sustainable products.

For instance, research in the area of bio-based antimicrobial coatings can provide environmentally sustainable yet effective coatings. Also, expansion in consumer electronics and textiles industries can probably drive new revenues to producers.

With each rising need for intelligent technologies, such as response, and self-cleaning coatings, product functioning will be more advanced as an attempt to address new consumers' and industrialists' needs.

Growing Demand in the Emerging Economies

Such Asia-Pacific and Latin American emerging markets are expanding at neck-snapping rates. It is fueled by increasingly more heightened levels of hygiene consciousness as well as a growing middle class with better disposable incomes.

These are second-order drivers of growing demand for antimicrobial products used in household, industrial, and commercial application. Such firms focused on such markets by investing in such markets independently and providing geography-specific products that are appropriate for local needs and meeting local regulatory needs will be in a good position to take advantage of this growth.

Local research, local distributors, and local manufacturing bases are some of the means through which potential can be unleashed in such emerging economies.

The antimicrobial coil coating market expanded at a modest rate from 2020 to 2024 primarily due to rising awareness about health during the beginning of worldwide health pandemics. The health care and food sectors drove demand for antimicrobial coatings in a bid to maintain heightened cleanliness and safety. Strictly prohibitive high costs of production and regulation compliance were the growth retarders.

The business would be developed on the principles of technology and sustainability according to the 2025 to 2035 future strategy. Corporate R&D expenditures would be proportional to the manufacturing cost of green antimicrobial coatings with strict environment protection policies.

Inelligences of coatings, i.e., responsive coatings and self-cleaning coatings, would be likely drivers to improve the performance of a product. Besides, coordination among research institutions and industry stakeholders will facilitate the upgrading of standard test procedures and performance to permit increased market penetration and customer confidence.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Implementation of basic hygiene standards in HVAC and food processing industries. |

| Technological Advancements | Adoption of silver and copper-based antimicrobial agents in coil coatings. |

| Industry Adoption | Increased use of antimicrobial coil coatings in healthcare and food processing sectors to prevent contamination. |

| Supply Chain and Sourcing | Reliance on specialized suppliers for antimicrobial agents, leading to higher production costs. |

| Market Competition | Dominance of established chemical companies supplying antimicrobial coatings to niche markets. |

| Market Growth Drivers | Demand driven by healthcare facilities and food processing plants requiring contamination control. |

| Sustainability and Conservation | Limited focus on the environmental impact of antimicrobial agents used in coatings. |

| Integration of Smart Monitoring | Minimal integration of monitoring technologies in antimicrobial applications. |

| Advancements in Experiential Travel | Use of antimicrobial coatings in transportation to enhance passenger safety and comfort. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Regulation of tough requirements for antimicrobial coatings in public buildings and hospitals to contain the spread of pathogens. |

| Technological Advancements | R&D of superior nanocoatings and environmentally friendly antimicrobial technologies with extended duration and lower environmental footprint. |

| Industry Adoption | Growth into domestic building and consumer appliances, where producers incorporate antimicrobial capabilities as default products to capture consumer interest. |

| Supply Chain and Sourcing | Manufacturers' vertical integration to manufacture internal antimicrobial agents at lower cost and with a guaranteed supply chain. |

| Market Competition | Influx of new players providing economical and innovative antimicrobial solutions, raising competition and propelling market growth. |

| Market Growth Drivers | Heightened consumer recognition of cleanliness, causing heightened demand for antimicrobial coatings in products used on a daily basis and in public facilities. |

| Sustainability and Conservation | Transition toward green and degradable antimicrobial agents, as firms invest in green technologies in order to keep up with environmental legislation and customer tastes. |

| Integration of Smart Monitoring | Implementation of smart sensors within HVAC systems and public spaces to track microbial activity and antimicrobial coating effectiveness in real-time. |

| Advancements in Experiential Travel | Creation of self-cleaning and antimicrobial surfaces on public transport and travel lodgings, enhancing hygiene levels and passenger confidence. |

In the USA, there has been growing demand for coil coating with high sensitivity to levels of health and cleanliness. The health care industry itself has adopted antimicrobial coatings in an effort to minimize hospital-acquired infection rates.

Among the companies that brought about improved quality antimicrobial coil coatings for airflow through the use of hospital HVAC systems to provide cleaner airflow are PPG Industries. Besides that, food processing introduced shoe coating to offer sanitary conditions and the same specialty services are offered by such companies as Sherwin-Williams.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

United Kingdom's market demand for antimicrobial coil coating has been increasing due to increased hygiene needs for public buildings, and the same for hospitals. Antimicrobial coating has also been applied by the National Health Service (NHS) to guard against airborne pathogens that are spread through HVAC.

Firms like AkzoNobel have brought antimicrobial coil coatings to the UK alone to serve some particular requirements of hospitals and schools. The building industry has even used such coatings to design healthier indoor environments.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.2% |

Germany and France, for example, among others, in the European Union have seen antimicrobial coil coating growth grow manyfold in all segments. The automobile sector, being one of the focus sectors by such economies, requires antimicrobial car HVAC system products to provide protection to the occupant.

Revolutionary antimicrobial coil coatings in accordance with EU's extremely stringent requirements have led the way by BASF SE. Public health and well-being are also starting to find their way into application in schools, and even public transport.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.3% |

Japanese antimicrobial coil coatings market developed on the back of public health emphasis and Japanese technology development. Antimicrobial HVAC coatings have widespread applications in hospitals and mass transportation to gain protection against transmission of infection.

Nippon Paint Holdings and others created novel antimicrobial coil coatings for homeowners and businesses with cleaner air and surface cleanliness. The coating applied to the electronics industry to render cleanliness on items.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

South Korea's market for antimicrobial coil coatings has expanded significantly because its government cares about public health and safety.

School and hospital HVAC equipment is currently antimicrobial-coated as a priority to help stop the spread of infectious disease. KCC Corporation has introduced highly antimicrobially active coil coatings for South Korean market demand. Smart building and infrastructure development have also triggered demand for smart coating.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

Polymer-based antimicrobial or polyester or polyurethane coatings are applied to the maximum extent due to economy as well as flexibility.

Antimicrobial coatings slow down microbial growth, and this is a most useful property when applied in HVAC systems where they are applied on coils for insulation.

Microbial growth on air handling equipment lowers air and system quality as well as system efficiency and thus the cost of maintenance rises. Antimicrobial polymer coatings optimize HVAC efficiency with cleaner air in place. A single HVAC company has reported total indoor air quality and cost savings on maintenance after coating their coils with them.

It signifies the value and cost-saving advantage of polymer-based products for the majority of uses. Copper finishes have been found to have extremely high antimicrobial activity and thus are best utilized in high sanitation conditions such as hospitals. Copper-coated air conditioner coils will eliminate fatal bacteria and other fatal pathogens which would otherwise have been in the air.

An American hospital introduced copper antimicrobial coating into air conditioners in one case study. Their results were nothing less than miraculous reduction in disease of infection acquired in the hospitals, and enhanced safety of patients and staff. The long-lasting antimicrobial activity of copper does not allow surfaces to get contaminated with germs during the day or night and serves as a secondary barrier where hygiene is most needed.

Silver antimicrobial coatings are thus best suited for healthcare facilities where greater hygiene is needed. Silver antimicrobial coatings offer long-lasting protection against different microorganisms. Silver antimicrobial coatings are best suited where hygiene is at its maximum, i.e., food processing.

For instance, in the dairy industry, a processing plant applied silver antimicrobial coatings to the refrigerator. It gave antibacterial contamination and therefore quality and safe milk products. Silver coatings also give long shelf life with longer antimicrobial actions. By inhibiting the microbic growth, the coatings offer aseptic conditions and prevention of product spoilage such that food is edible for a longer duration while wastage is reduced.

Increased need for antimicrobial coil coatings is establishing the new normality in overwhelmingly wide bases of markets across the globe. This is causing market innovation. Home appliances and medical appliances today are utilized with coatings coated over multiple applications.

Although hygiene and cleanliness may be an issue, more and more today industries don't like to apply coating on multiple contact points but rather using antimicrobial coatings. In medicine, for instance, antimicrobial coils keep airborne sickness from reaching individuals, and buyers of home appliances require products of improved-hygiene when purchasing.

And, food processing plants and construction trades equally require antimicrobial sizes of coatings to realize protection and stewardship. All these uses of innovation in antimicrobial technology create demands in industries.

In medicals, prevention of infection is most critical, and an antimicrobial coil coat is a reasonable choice for it. Antimicrobial coil coatings applied in HVAC facilities inhibit the growth of microorganisms and air-borne transmission of infection. Antimicrobial coatings sanitized the air and infection levels reduced in the air handling unit of a European hospital.

These systems are of particular interest in the construction of hospital clean air units, where infection transmission is hazardous. Disease-transferring microorganism preventive antimicrobial coil coatings are part of cleaner and healthier healthcare environments.

With customer concern over hygiene-related issues on the rise, people voluntarily choose home appliance product types with antimicrobial characteristics. It is also being applied by manufacturers under the guise of using antimicrobial paint on appliances, including refrigerators and air cleaners.

A highly rated home appliance company rolled out a line of refrigerators whose evaporator coils are coated with antimicrobial-coated coils. The coating is effective to reduce mold and bacteria growth quite significantly, maintaining the kitchen cleaner and healthier.

The humongous consumer demand from health-conscious consumers is indicative of the enormity of demand for the feature. Since cleanliness can never be a problem in a home environment, antimicrobial-coated appliances are highly ranked in customer choice with better safety and cleanliness.

The food and beverages industry tries its best to have cleanliness levels sufficient so that it can serve customers the same. Antimicrobial coil coatings are applied on cooling and refrigeration units as a control measure to prevent microbial spoilage of food when stored.

Food and beverage firms, for example, employed antimicrobial coating on refrigerator coils and realized immense minimization of food spoilage and food safety control. Coatings provide aseptic condition at low temperature where bacteria operate efficiently and minimize the quality standards of products.

Antimicrobial coil coatings also provide prolonged food shelf life by inhibiting microbial growth and allow companies to offer the high standards the marketplace requires.

Antimicrobial coil coatings are used in the construction and building sectors to provide longevities and sanitizing of commercial and residential HVAC systems. Antimicrobial coil coating is used on the coils of an HVAC system in order to prevent the growth of microorganisms, enhance odor, and restrict the efficiency of a system.

In one application, a new office building, which utilized antimicrobial-coated coils in its HVAC system, achieved greater occupant comfort and improved air quality. As indoor air quality is increasingly becoming a factor of concern to occupants of buildings, application of antimicrobial coating on HVAC is increasingly coming as a means of delivering a healthier and more comfortable indoor environment.

Textile production poses unique challenges in maintaining equipment cleanliness during production. Antimicrobial coating is applied to equipment components such as drying machines to avoid such microorganism growth such as mold, bacteria, and other microbials from developing.

Antimicrobial coatings were employed by one of the production organizations for use in textiles in a move to surround their dryers with the objective of preventing microbial contaminations of garments when processing textiles. This renders the edible processed cloths to be sanitary.

Antimicrobial treatments prevent offending microbe growth, and thus it is possible to produce cleaner cloths, reduced contaminating capacity, and overall product quality. Coatings are needed in terms of levels of hygiene in the textiles industry.

Antimicrobial treated coil coatings are experiencing a faster growth rate as well as rising awareness in terms of anti-corrosive as well as hygiene products in all industries. Heavily weighted industries such as building and construction, HVAC, transportation, and automotive sectors are using antimicrobial coil coatings for enhancing product durability and sanitizing.

Technological advancements have enabled the use of coatings that are more antimicrobial in nature, sustainable, and durable. Innovation in products, cooperation, and globalization are the drivers being utilized by the companies to counter changing customer needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Akzo Nobel N.V. | 15-20% |

| BASF SE | 12-16% |

| PPG Industries Inc. | 10-14% |

| The Sherwin-Williams Company | 8-12% |

| DuPont | 5-9% |

| Other Companies (combined) | 30-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Akzo Nobel N.V. | Provides a range of antimicrobial coil coatings designed for various applications, emphasizing sustainability and performance. |

| BASF SE | Offers innovative antimicrobial solutions focusing on durability and environmental compatibility for industrial applications. |

| PPG Industries Inc. | Develops advanced coil coatings with antimicrobial properties tailored for the automotive and construction sectors. |

| The Sherwin-Williams Company | Supplies antimicrobial coil coatings that enhance surface protection and aesthetics across multiple industries. |

| DuPont | Specializes in high-performance antimicrobial coatings aimed at improving hygiene and longevity in HVAC systems and appliances. |

Key Company Insights

Akzo Nobel N.V. (15-20%)

Akzo Nobel N.V. is leading the antimicrobial coil coating sector with its complete line of sustainable high-performance solutions. Its innovation and sustainability leadership lead it to the head of the most wanted in a very long list of firms.

BASF SE (12-16%)

BASF SE is a strong and resilient antimicrobial products provider. Its R&D concentration guarantees maximum compliance with market norms and satisfaction products.

PPG Industries Inc. (10-14%)

PPG Industries Inc. launched novel antimicrobial coil coatings for construction and automotive markets. Its technological focus is mirrored in the form of improved product performance and longevity.

Sherwin-Williams Company (8-12%)

Sherwin-Williams Company sells an enormous range of coil coatings, which are surface-protective and attractive. They find a wide range of applications in industries because they are functional and long-lasting.

DuPont (5-9%)

DuPont, the market leader in long life and long hygiene antimicrobial coil coatings of superior performance, is responding to new industries' applications' evolving requirements. Its pioneering coating addresses the evolving needs of new industries' evolving requirements.

Specialty and regional players enter the antimicrobial coil coating industry with solution-based new-age solutions and specialty products. They are:

The overall market size for the Antimicrobial Coil Coating market was USD 5.0 Billion in 2025.

The Antimicrobial Coil Coating market is projected to reach approximately USD 7.8 Billion by 2035.

The demand for the Antimicrobial Coil Coating market will be driven by the growing need for hygiene and cleanliness in building materials, increased awareness of antimicrobial properties, and the rising construction and automotive industries.

The top 5 countries driving the development of the Antimicrobial Coil Coating market are the United States, China, Germany, Japan, and India.

The building and construction segment is expected to lead the Antimicrobial Coil Coating market due to the increasing use of antimicrobial coatings in architectural and structural applications for improved sanitation and longevity.

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.