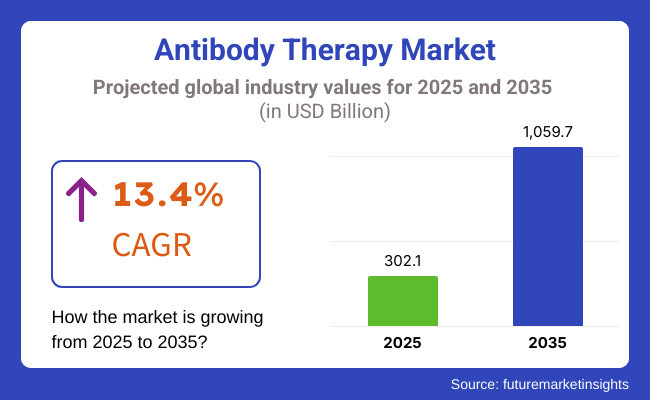

The Antibody Therapy Market is set for substantial growth between 2025 and 2035, driven by increasing advancements in biopharmaceutical research, rising prevalence of chronic diseases, and growing demand for targeted therapies. The market is expected to reach USD 302.1 billion in 2025 and expand to USD 1,059.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 13.4% over the forecast period.

Increasing uptake of monolithic antibodies, antibody-drug conjugates and immunotherapies are also propelling the market expansion. Exciting science in oncology, auto immune disease and therapeutic for infectious Disease build on these foundation antibody therapies, and these on advances in all of these fields. Other factors driving the market include growing investments in biopharmaceutics, ongoing advancement in recombinant DNA technology, as well as a strong pipeline of innovative antibody-based therapies.

Other drivers of the market include growing investments in biopharmaceutical products, constant advancements in recombinant deoxyribonucleic acid (DNA) technology and a strong pipeline of innovative or novel antibody-based therapies. Market growth is also driven by government efforts to promote drug development and accelerate approvals, and increased investment in biotechnology and precision medicine.

Collaborations between pharmaceutical companies, research institutions and biotech start-ups, also help drugs become more effective, affordable and accessible. Yet high production costs, complex regulatory pathways, and risks of negative outcomes pose challenges that demand targeted solutions. Biosimilar development, new antibody engineering technologies, and AI-based drug discovery are giving companies something to do, as they could make drugs more potent and cheaper to make.

Explore FMI!

Book a free demo

North America holds a very prominent spot when compared to the other regional markets for the antibody therapy market, and this can be credited to the rapidly developing biotechnology research, the already existing pharmaceutical infrastructure, along with the increasing prevalence of chronic diseases like cancer and auto immune diseases. North America has been segmented into USA and Canada.

With FDA approvals, clinical advances, and government funding for precision medicine beating a path for us, the use of antibody-based treatments for cancer, infectious disease, and rare disease (and, no doubt, many more indications) is accelerating. Global regulatory hurdles, high development costs, and stringent approval processes act as obstacles to market expansion. Growing partnerships between biotech companies and health systems are projected to drive growth in the years to come.

Recent years have seen robust growth in antibody therapy across Europe, especially in Germany, France and UK, supported by strong biopharma research and favourable government policies to advance innovative products. The region’s focus on personalized medicine and immunotherapy also adds to the demand for antibody-based therapies.

A growing prevalence of chronic diseases and a rising investment in the development of biosimilar are the key drivers fuelling the growth of the market. Nevertheless, strict regulatory frameworks, pricing pressures, and reimbursement challenges affect the market growth. In terms of R&D, European companies are pivoting towards next-gen antibody technologies such as bispecific antibodies and antibody drug conjugates to remain competitive.

Asia-Pacific is the fastest-growing market for antibody therapies due to growing awareness of healthcare spending, growing pharmaceutical and biotech sectors, coupled with increasing prevalence of cancer and infectious diseases in countries such as China, Japan, South Korea, and India. Market acceleration is also supported by increasing adoption of biosimilar, government efforts for the biopharma development, and growing clinical trials.

The region has a strong pharmaceutical manufacturing base which makes competitive production of the antibody therapies possible. In contrast, market dynamics are affected by regulatory hurdles, intellectual property concerns, and pricing constraints. Initiatives to accelerate approval processes, foster research partnerships, and support local biotech innovation are projected to fuel future growth in the area.

Challenges

High Development Costs and Regulatory Complexities

There are vital challenges in the antibody therapy field such as the high cost of research and development and stringent regulatory requirements. The time-consuming and expensive process of creating, testing and approving antibody-based treatments requires putting in a large amount of money and time.

Additionally, differing legal requirements imposed by jurisdictions that range from municipalities to countries impede the growth of markets. To effectively meet these growing issues, businesses need to develop new bio manufacturing methods in partnership with some key groups.

Opportunities

Rising Demand for Targeted and Personalized Therapies

Rising prevalence of chronic diseases (cancer, autoimmune disorders, and infectious diseases) will be major factor driving the antibody therapy market growth. Emerging companies are investing heavily in research and development of antibody therapies. Biotechnology and genetic engineering:

Owing to the advances of biopharmaceutical and genetic engineering, the methods for developing antibody production have taken the forefront and we are now achievable to develop antibody as the most specific and personalized therapy on the market. Other important aspects likely to be fostered during the forecast period include integration of artificial intelligence and machine learning for drug discovery, increasing investments in monoclonal and bispecific antibodies and their target market.

Antibody therapy market grew significantly between 2020 and 2024 due to the high funding for biologics besides urgent demand for COVID-19 antibody treatment(s). But production bottlenecks, high costs and supply chain disruptions continued to be major obstacles. Companies worked to ramp up production capacity and speed clinical trials to meet demand.

Future Outlook 2025 to 2035: Antibody engineering innovation (eg. bispecifics, multipurpose platforms), bio manufacturing efficiency improvement, and AI-driven drug discovery will all play a role in the market. The further advances in multi-functional, immune-checkpoint inhibitors, and cheaper versions of the drugs biosimilar will greatly increase availability and affordability of the treatments. As well as the consistent growth will be driven by government policies promoting biotech research and alliances between pharmaceutical companies.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Rapid approvals for emergency use therapies |

| Technological Advancements | Expansion of monoclonal and polyclonal antibodies |

| Industry Adoption | Focus on COVID-19 and oncology applications |

| Supply Chain and Sourcing | Dependence on limited bio manufacturing hubs |

| Market Competition | Dominance of major biotech and pharma companies |

| Market Growth Drivers | Increased investment in biologics and immunotherapies |

| Sustainability and Energy Efficiency | High resource usage in antibody production |

| Integration of Smart Monitoring | Limited real-time tracking of therapy outcomes |

| Advancements in Drug Delivery | Traditional intravenous administration |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined global regulatory harmonization for biologics |

| Technological Advancements | AI-driven antibody design and next-gen antibody conjugates |

| Industry Adoption | Broader use in neurodegenerative and rare diseases |

| Supply Chain and Sourcing | Decentralized production and increased local biopharma capacity |

| Market Competition | Growth of start-ups and mid-sized biotech firms |

| Market Growth Drivers | Advancements in precision medicine and AI-assisted drug discovery |

| Sustainability and Energy Efficiency | Eco-friendly bioprocessing and sustainable manufacturing practices |

| Integration of Smart Monitoring | AI-powered patient monitoring and predictive analytics |

| Advancements in Drug Delivery | Development of long-acting and self-administered antibody formulations |

North America accounts for the largest share of the global antibody therapy market due to strong healthcare infrastructure, high spending in research & development and presence of major biopharmaceutical companies in the region. Ever-increasing prevalence of chronic diseases, including cancer and auto immune diseases, has the growth of monoclonal antibodies and targeted therapies.

The Food and Drug Administration (FDA) plays a critical role in expanding markets, which often results in approvals of drugs at a faster pace and more innovation coming into the marketplace. In addition, collaboration between biotech and large pharmaceutical companies solidifies the development pipeline. As consumer education improves and more biosimilar enter into use, the USA antibody therapy market should continue to demonstrate strong growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 13.2% |

As for the United Kingdom, factors such as, government-supported healthcare systems, research colleges, and mounting inclination towards precision medicine, drive the antibody therapy market in the region. Patients can expect to see more biologics and monoclonal antibody treatments in the NHS in the UK.

Existing biotech clusters in Cambridge and London position the nation well to capitalize on new advances in next-generation antibody therapies. The movement toward personalized medicine and favourable regulatory policies of the Medicines and Healthcare Products Regulatory Agency (MHRA) are promoting the steady growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 12.7% |

A lucrative market for antibody therapy, EU offers a developed biopharma industry as well as increased public funds to assess immunotherapy-led trials in hospitals. Now it is countries such as Germany, France and Italy that have lead the clinical testing and drug commercialization.

It has had particular success in paving the way for novel biologic products to be approved allowing patients access to lifesaving antibody drugs as quickly as possible through this approach. In addition, the rising acceptance of biosimilar and emphasis on targeted therapies in oncology and auto-immune diseases are expected to propel the market growth in EU region.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 12.8% |

The Japanese antibody therapy market is benefiting from the rapid development of biopharmaceutical research and strong governmental supports in regenerative medicine. It has sparked significant growth in the use of monoclonal antibodies for cancer treatment, particularly in gastric and lung cancers.

Leading drug makers Takeda and Astellas have bet big on antibody-drug conjugates (ADCs) and new immunotherapies. Due to the aging population and increasing burden of chronic diseases, Japan is expected to provide favourable demand for antibody-based therapies over the coming ten years, as per the report.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.0% |

The advanced bio manufacturing capabilities and increasing government investments, South Korea is rising as a competitive player in the antibody therapy market. Under the innovative biopharmaceutical development policy, the country is also emerging among the global leaders in biosimilar, with the likes of Celltrion and Samsung Biologics earning first places in shipments.

In addition, strategic partnerships among universities, research institutes and biotech companies are advancing the discovery of new antibody therapeutics. With its population increasingly elderly and growing rates of chronic conditions, South Korea is set for stable growth in antibody therapy.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 13.1% |

Monoclonal antibodies [mAbs] have steadily became the corner stone of the antibody therapy market and revolutionised modern medicine by facilitating targeted therapies which can be directed to a wide range of disease types. They continue to lead the vanguard of the market with breakthroughs in biotechnology and the increasing demand for precision medicine as seen by the growth factors, which have also produced fantastic results in cancer, autoimmune disease and infectious disease.

Monoclonal antibodies provide very high specificity to patients and can bind specific antigens, inhibiting unwanted side effects, which in turn increases the overall therapeutic efficacy against late stage cancer. This enables much more targeted action than traditional therapies, which tend to hit broader targets that can be undesirable.

Monoclonal antibodies oncology applications yield the biggest growth drivers Monoclonal antibodies (mAbs) to target malignant tumours have proven extremely successful in anticancer therapies, greatly improving patient prognosis for different types of malignancies (lung, breast cancer, lymphoma, etc.).

Immune checkpoint inhibitors (PD-1/PD-L1 and CTLA-4 inhibitors), in particular, have been an important part of the revolution in oncology, and their introduction has brought about major advances in cancer treatment. These therapies stimulate the immune response against the tumour cell and provide superior outcomes compared with conventional chemotherapy.

Interestingly, its area of expertise are also witness to the wider development of therapeutic antibodies; agents such as trastuzumab in HER2-positive breast cancer and rituximab in B-cell lymphoma are opening new access points for care in oncology, rapidly sharpening this segment's leadership deposition in the antibody therapy block.

Monoclonal antibodies are used to modulate the immune response, reduce inflammation, and prevent tissue damage in many autoimmune diseases. Subsequently, a number of conditions, including rheumatoid arthritis, multiple sclerosis, Crohn's disease, and psoriasis have also experienced a rise in monoclonal antibodies, with multiple biologics like adalimumab and infliximab hyper-competitive in the vertical.

As the incidence of autoimmune disease is on the rise - aided largely by a mix of genetics and environmental triggers that lead to conditions such as rheumatoid arthritis and multiple sclerosis - this segment is expected to drive demand for monoclonal antibodies even higher.

Monoclonal antibodies are also an increasingly important part of infectious disease therapy. The COVID-19 pandemic accelerated progress towards many antibody-based therapies, dominating as potent interventions against life-threatening infections in the form of monoclonal antibodies.

The field of monoclonal antibodies has also aimed to broaden their use against conditions such as respiratory syncytial virus (RSV), HIV, and emerging viral infections in recent studies. Different from vaccines and antiviral drugs, companies and research institutions are investing in new types of antibody therapy that could improve immunity and be a new treatment for virus.

The future of monoclonal antibodies is bright as antibody engineering forms the basis of next-generation biologics. Monoclonal antibodies are set to be further explored within various novel technologies such as bispecific antibodies, labelled antibody fragments and antibody-drug conjugates (ADCS), further enhancing the therapeutic promise of this class of drugs.

These innovations allow for dual targeting mechanisms, improved efficacy and reduced immunogenicity and help circumvent some of the major drawbacks for conventional monoclonal therapies. In addition, the market is also anticipated to witness significant growth due to the efforts made to improve production efficiency and lower costs and increase accessibility. Monoclonal antibodies will keep dominating the antibody therapy market as the pharmaceutical industries keep making investments in research and development.

As a large end-user segment of the antibody therapy market, hospitals constitute a major share of the administered treatments. The rising demand for advanced biologic therapies, higher hospitalization rates for chronic diseases, and specialized care have established hospitals as the foremost centers for antibody-based therapies.

Both monoclonal antibodies and antibody-drug conjugates (ADCs) are typically infused intravenously into the patient or injected subcutaneously by healthcare professionals, making the hospital the most common point-of-use environment for these drugs.

Hospital clinics dominate the antibody therapy market mainly due to oncological treatment. Types of cancer therapies such as monoclonal antibodies, immune checkpoint inhibitors, and targeted biologics also need close monitoring, dose adjustments and management of potential side effects, which are better provided in a hospital setting.

With cancer on the rise across the globe and dependence on immunotherapy at an all-time high, hospitals deal with increasing patient intake for monoclonal antibody administration. Hospitals are also prominent research institutes as they conduct clinical trials on new antibody therapies, which further drives the market growth.

Aside from oncology, hospitals are also crucial for the management of autoimmune conditions. Many patients with diseases like rheumatoid arthritis, multiple sclerosis, and inflammatory bowel disease need long-term biologic therapies, which typically start in the hospital, then move to outpatient or home settings. Additionally, the proliferation of hospital-based infusion centers with expertise in biologics administration to optimize patient outcomes through dosing and adverse effect management further adds to this observation.

Hospital-based administration of antibody therapy is also largely driven by infectious disease treatment. Monoclonal antibodies for viral infections, (COVID-19 and RSV, in particular) have been used mainly in hospital settings or used for high-risk patients requiring intensive care. The infrastructure in the hospital setting for such therapies is already well established with infrastructure, intensive care, and know how.

Hospitals also are leading the charge in a rapidly growing area of personalized medicine that adapts the treatment to individual patients based on their genetic profiles and biomarkers. A number of hospitals are adopting precision medicine strategies, allowing for the most effective monoclonal antibody therapies for particular patient cohorts to be chosen. In-hospital advanced, diagnostic capability allows for improved disease characterization, enabling better treatment success rates.

However, they have high treatment costs, resource constraints, and their own specialized infrastructure challenges. The increasing prevalence of outpatient infusion centres, specialty clinics, and home-based biologic administration baubles demand to hospital setting. Nevertheless, hospitals remain the major hubs for administering the first dose of antibody therapy, particularly for high-risk patients and more complicated cases of the disease.

Antibody therapy in hospitals will evolve, driven by technology such as AI-driven diagnostics, robotic-assisted drug administration, and telemedicine integration for remote monitoring. As hospitals work to streamline their biologics offerings and develop their capabilities for personalized medicine, they will continue to be key players in the antibody therapy market. With continued investments in hospital-based research, clinical trials, and biological drug development, they will only continue to play an increasingly prominent role in bringing innovative antibody therapies to patients around the globe.

The antibody therapy market is expected to increase as an honest increase within the Demand of targeted therapies and with the rise within the antibody therapy market. The rising adoption of monoclonal antibodies (mAbs) for the treatment of cancer, autoimmune disorders, and infectious diseases is significantly driving the market growth.

The focus of biopharmaceutical companies on R&D can potentially improve the therapeutic efficacy, minimize treatment side effects, and optimize patient outcomes. The market is primarily driven by strategic collaborations, regulatory approvals, and investments in next-generation antibody technologies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roche Holding AG | 20-25% |

| Bristol-Myers Squibb | 15-20% |

| AbbVie Inc. | 12-16% |

| Amgen Inc. | 10-14% |

| Johnson & Johnson | 8-12% |

| Other Biopharmaceutical Companies (Combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roche Holding AG | Focuses on monoclonal antibody treatments for oncology, immunology, and infectious diseases. |

| Bristol-Myers Squibb | With a focus on immuno-oncology therapies, such as checkpoint inhibitors and targeted antibody treatments. |

| AbbVie Inc. | Also fuels next-gen antibody-based therapeutic development for autoimmune disorders as well as oncology indications. |

| Amgen Inc. | Development of 2nd Generation Therapeutic Antibodies (e.g. Bispecific Antibodies for Cancer Therapeutic) |

| Johnson & Johnson | Offers a diverse portfolio of antibody therapeutics across immunology, oncology, and rare diseases. |

Key Company Insights

Roche Holding AG (20-25%)

Roche is the leader in the Antibody Therapy Market helped by a strong portfolio of monoclonal antibodies in oncology and immunology.

Bristol-Myers Squibb (15-20%)

Bristol-Myers Squibb focuses on immune checkpoint inhibitors and targeted antibody therapies for cancer.

AbbVie Inc. (12-16%)

AbbVie specializes in autoimmune disease treatments with biologics, such as TNF inhibitors and IL-targeted antibodies.

Amgen Inc. (10-14%)

Amgen, a pioneer of bispecific antibodies that transform cancer therapy through dual-targeting mechanisms, as a provider of cutting-edge services in this field.

Johnson & Johnson (8-12%)

Johnson & Johnson provides cutting-edge antibody therapies in multiple fields, from immunology to rare diseases.

Other Key Players (25-35% Combined)

Antibody therapy development is being driven by emerging biotech firms and pharmaceutical companies. Notable players include:

The overall market size for the antibody therapy market was USD 302.1 billion in 2025.

The antibody therapy market is expected to reach USD 1,059.7 billion in 2035.

The antibody therapy market is expected to grow at a CAGR of 13.4% during the forecast period.

The demand for the antibody therapy market will be driven by advancements in biologic drug development, increasing prevalence of chronic diseases, rising investment in personalized medicine, expanding applications in oncology and autoimmune disorders, and growing government support for biopharmaceutical research.

The top five countries driving the development of the antibody therapy market are the USA, China, Germany, Japan, and the UK.

The Soft Tissue Repair Market is segmented by Synthetic, Allograft, Xenograft and Alloplast from 2025 to 2035

Anti-hyperglycemic Agents Market: Growth, Trends, and Assessment for 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.