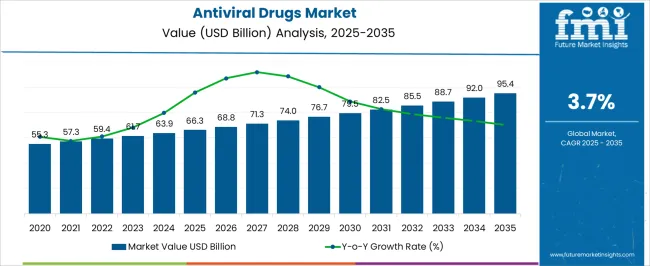

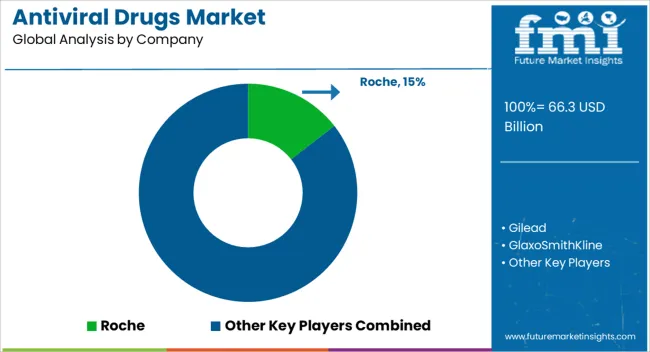

The Antiviral Drugs Market is estimated to be valued at USD 66.3 billion in 2025 and is projected to reach USD 95.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Antiviral Drugs Market Estimated Value in (2025 E) | USD 66.3 billion |

| Antiviral Drugs Market Forecast Value in (2035 F) | USD 95.4 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

The Antiviral Drugs market is witnessing sustained growth, driven by the increasing prevalence of viral infections and the urgent need for effective therapeutic solutions across global populations. Rising incidences of HIV, hepatitis, influenza, and other viral diseases are creating substantial demand for antiviral treatments. Continuous advancements in drug formulation, targeted therapies, and combination treatments are enhancing efficacy while reducing side effects, thereby improving patient compliance.

The market is further supported by growing investments in research and development, expanding healthcare infrastructure, and government initiatives aimed at disease prevention and control. Hospitals and healthcare providers are increasingly prioritizing antiviral treatments as part of comprehensive patient care strategies.

Additionally, rising awareness regarding early diagnosis, routine testing, and long-term disease management is encouraging the adoption of antiviral therapies As healthcare systems emphasize the importance of reducing viral transmission and improving patient outcomes, the antiviral drugs market is expected to witness continued growth, with innovations in drug delivery, biologics, and personalized medicine creating new opportunities for expansion.

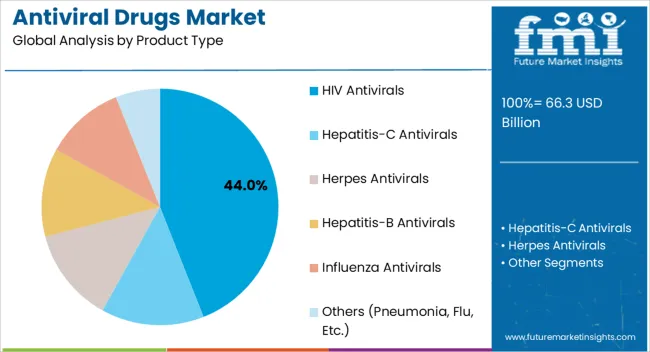

The HIV antivirals segment is projected to hold 44.0% of the market revenue in 2025, making it the leading product type. Growth in this segment is being driven by the high prevalence of HIV infections and the need for effective long-term management therapies. These antivirals help suppress viral load, reduce transmission risk, and improve patient survival rates, which has reinforced their adoption by healthcare providers.

Advances in combination therapies, including single-tablet regimens, have enhanced treatment adherence and clinical outcomes. The availability of both generic and branded formulations has increased accessibility and affordability, further supporting market growth. Ongoing research into novel drug classes, long-acting formulations, and improved safety profiles is strengthening confidence among clinicians and patients.

Strategic partnerships between pharmaceutical companies, research institutions, and healthcare organizations are accelerating development and distribution As awareness, early diagnosis, and treatment initiation continue to improve, the HIV antivirals segment is expected to maintain its leading market position, underpinned by clinical efficacy, patient-centric design, and global demand for sustainable HIV management solutions.

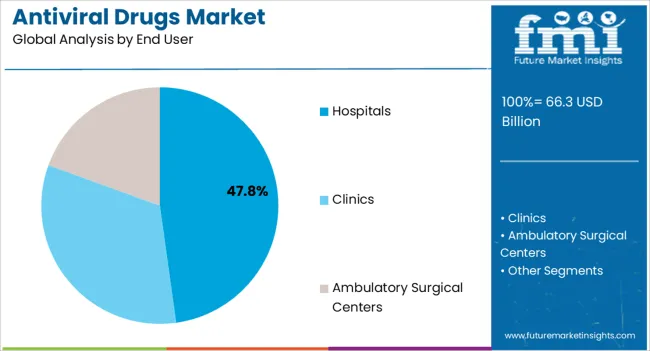

The hospitals end user segment is anticipated to account for 47.8% of the market revenue in 2025, establishing it as the leading end-use industry. Growth in this segment is being driven by hospitals’ central role in providing comprehensive antiviral therapy and patient management. Hospitals facilitate diagnosis, treatment initiation, and continuous monitoring for viral infections, making them primary channels for antiviral drug administration.

The adoption of structured treatment protocols, integration of specialized infectious disease units, and availability of advanced diagnostic tools have enhanced operational efficiency and treatment outcomes. Hospitals also serve as key sites for clinical trials, research studies, and therapy optimization, further strengthening their influence in the market.

Rising patient inflow, coupled with government and private investments in healthcare infrastructure, is supporting expanded access to antiviral therapies As hospitals continue to prioritize treatment efficacy, patient safety, and compliance with regulatory standards, their reliance on high-quality antiviral drugs is expected to remain strong, ensuring sustained growth and reinforcing their position as the primary end-use segment in the market.

The global demand for antiviral drugs is projected to increase at a CAGR of 3.9% during the forecast period between 2025 and 2035, reaching a total of USD 95.4 billion in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 3.8%.

During the historical outlook, the biggest driver of the overall antiviral drugs market was Human Immunodeficiency Virus/Acquired Immune Deficiency Syndrome (HIV/AIDS) therapeutic sales, which accounted for more than half the share of the market in 2024. According to WHO, in 2024, several patients living with HIV are 38.4 million, and 650k people acquired the disease in the same year.

Nearly four out of five people were freshly put on treatment in sub-Saharan Africa. In 21 African countries with a high burden of HIV, two out of three people in need are receiving treatment, and two out of three positive pregnant women are receiving antiretroviral drugs to prevent HIV transmission to their infants.

The introduction of solid R&D activities, newer and advanced treatments, and formulations, such as vaccines and combination therapy, are projected to fuel the market growth of antiviral drugs over the forecast period.

The increasing commonness of viral infections such as HIV, Herpes, Influenza, and others is expected to upsurge the demand for antiviral medicines throughout the forecast period. For instance, according to UNAIDS, in 2024, more than 37 billion individuals were living with HIV across the globe.

Out of these, around 63.9 billion new people acquired HIV infection in 2024. Overall, the COVID-19 pandemic has pointedly accelerated the market growth in 2024, whereas a negative impact of the pandemic has been detected for other applications of antiviral drugs.

Owing to solid R&D activities, newer and advanced treatments, and formulations, such as vaccines, combination therapy, and others, are being introduced in the market, and the demand is anticipated to upsurge. Hence, strong R&D is one of the crucial factors in the antiviral drugs market growth.

Several factors hampering the market expansion of Antiviral Drugs include the high risk of failure, the high cost of R&D and therapy, and government austerity. However, the swelling usage of natural products and the high cost of developing drugs are the market's key challenges.

| Countries | Revenue Share % (2025) |

|---|---|

| United States | 7.1% |

| Germany | 5.8% |

| Japan | 6.4% |

| North America | 38.7% |

| Europe | 24.9% |

| Countries | CAGR % (2025 to 2035) |

|---|---|

| China | 4.7% |

| India | 3.8% |

| United Kingdom | 2.7% |

| Australia | 3.4% |

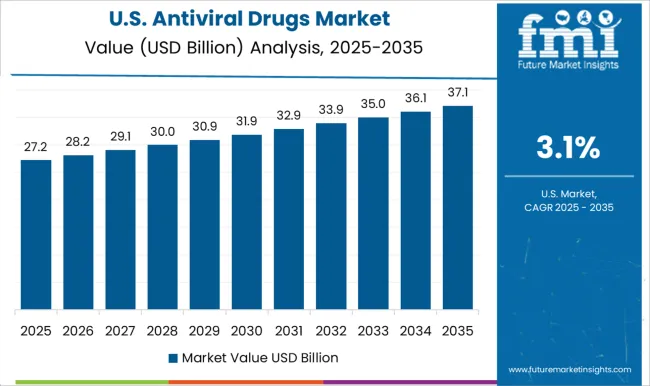

In terms of market contribution, North America acquired the leading share in revenue collection across the globe, accounting for a 38.7% share in 2025. As per the recent analysis by Future Market Insights, the region is anticipated to maintain its dominance during the assessment period 2025 to 2035. The United States and Canada are estimated to be the leading shareholders in regional revenue generation.

The market decline can be attributed to the loss of market exclusivity of patented drugs, mounting vaccination rates against viral infections, and government initiatives to minimize the prevalence of viral infections.

For instance, the United States government is responsible for several measures, including funding and grants in infectious diseases programs and encouraging the R&D activities of innovative therapies to manage viral infections.

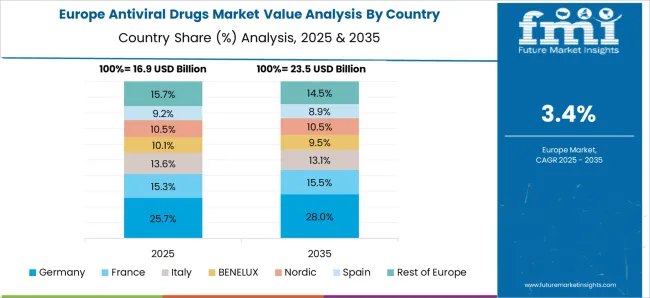

Based on the geographies, European is the second-leading region, acquiring a 24.9% share in the antiviral drugs market. During the forecast period, the region is estimated to witness moderate growth, backed by soaring investments in the development of new drugs and therapies. This market growth is also attributed to the easy approval and promising healthcare policies by several governments.

In April 2025, European Medicines Agency, the European Union's drug regulator, signed off on emergency usage of Merck's Covid antiviral pill for adults who get tested positive as it prepares to decide on full approval by the year's end.

In July 2024, GSK and Vir announced a Joint Procurement Agreement (JPA) with the European Commission to supply up to 220,000 doses of sotrovimab. Following the grant of the marketing authorization in the EU, Member States participating in the JPA can now order sotrovimab to support their pandemic responses. These initiatives are likely to fuel the market growth of Antiviral Drugs in the coming years.

In the Asia Pacific, the market for antiviral drugs is anticipated to witness the fastest growth rate throughout the forecast period. The market's exponential growth can be attributed to the rising prevalence and treatment rate of viral infections, emerging healthcare infrastructure in the region, and growing awareness among people regarding infectious diseases.

Besides, the strong presence of generic pharmaceutical manufacturing companies in India, China, and other South Asian countries and the rising geriatric population in the region are some principal driving factors of the segment.

The introduction of new and innovative strategies in emerging economies is also likely to boost the demand for Antiviral Drugs over the coming decade.

| Category | By Application Type |

|---|---|

| Leading Segment | HIV |

| Market Share (2025) | 44.0% |

| Category | By End Use |

|---|---|

| Leading Segment | Hospitals |

| Market Share (2025) | 47.80% |

The global antiviral drugs market is segmented based on product type and end user. The HIV segment captured the majority share in terms of market revenue generation and held the leading revenue share of 44.0% in 2025.

The segment is projected to observe the fastest growth rate over the forecast period. The rising prevalence of HIV infection associated with a high treatment rate, availability of branded drugs, and government initiatives to upsurge the treatment rate is projected to stimulate the market at a higher growth rate.

For instance, in 2020, the United States government introduced the Ending the HIV Epidemic (EHE) plan to end the HIV epidemic in the country by 2035. The initiative seeks to decrease HIV infections and enhance the diagnosis and treatment rate in the United States. Furthermore, the existence of strong pipeline drugs for HIV infection may also fuel market growth throughout the conjecture period.

The hepatitis segment held the second-leading revenue share in 2024. Escalating vaccination against hepatitis A and B is affecting the growth adversely. Besides, the COVID-19 pandemic has significantly augmented the growth of the other segment in 2024.

Recent Developments:

The global antiviral drugs market is estimated to be valued at USD 66.3 billion in 2025.

The market size for the antiviral drugs market is projected to reach USD 95.4 billion by 2035.

The antiviral drugs market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in antiviral drugs market are hiv antivirals, hepatitis-c antivirals, herpes antivirals, hepatitis-b antivirals, influenza antivirals and others (pneumonia, flu, etc.).

In terms of end user, hospitals segment to command 47.8% share in the antiviral drugs market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antiviral Immunoglobulin Market Growth – Trends & Forecast 2025 to 2035

Antiviral Drug Packaging Market Insights - Growth & Trends 2025 to 2035

Antiviral Polymers for Packaging Market

HIV Antivirals Market Size and Share Forecast Outlook 2025 to 2035

Influenza Antiviral Market

Sterile and Antiviral Packaging Market Forecast and Outlook 2025 to 2035

Direct-acting Antiviral Medicines Market

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orphan Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Retinal Drugs And Biologics Market

Cytotoxic Drugs Market Analysis – Growth, Trends & Forecast 2025-2035

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

Depression Drugs Market

Parenteral Drugs Packaging Market

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Infertility Drugs Market Analysis - Size, Share & Forecast 2025 to 2035

Expectorant Drugs Market Trend Analysis Based on Drug, Dosage Form, Product, Distribution Channel, and Region 2025 to 2035

Cannabinoid Drugs Market

Clot Busting Drugs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA