Growing incidence of product/package damage continue to fuel the demand for anti-static foam packaging that are much more sustainable. Anti-static foam packaging is commonly used to protect against electrostatic discharge (ESD) damage during shipment and storage of components, semiconductors, and circuit boards. Increasing manufacturing of electronic goods like smartphones, laptops, and wearables is also driving market growth.

As there is growing apprehension regarding product safety and compliance with ESD protection standards, industries are inclining towards anti-static foam packaging to ensure the safety of delicate equipment. The rising adoption of protective packaging solutions can also be attributed to the booming global e-commerce and expanding logistics networks. Key Product Type Based Insights These factors have also prompted producers to develop environmentally sustainable anti-static accommodation options, taking in sustainable and recyclable foam elements.

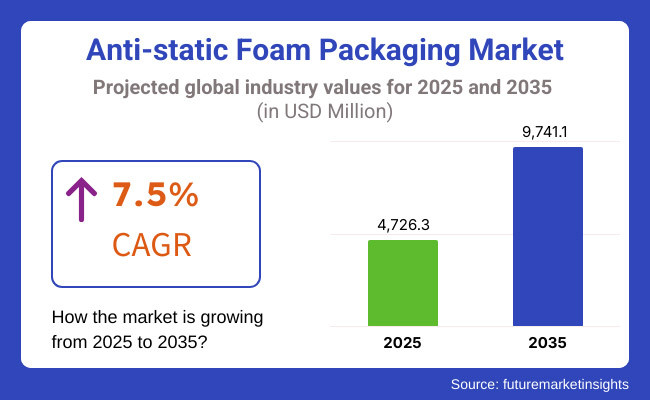

From 2025 to 2035, the expected 7.5% CAGR growth presents an increasing demand for ESD protection in several industries. Further material technology developments such as biodegradable and reusable anti-static foam are projected to provide a boost to market growth.

Explore FMI!

Book a free demo

The anti-static foam packaging market in North America is likely to be boosted by the increasing demand from the electronics and aerospace industries. In the United States and Canada, relevant industries such as semiconductor manufacturing, medical devices and industrial equipment have continued to adopt anti-static packaging.

Stricter regulations over ESD protection together with product safety standards are increasing the need for companies to use advanced protective packaging solutions. In addition, the market demand is fuelled by the rising e-commerce industry and widening supply chains.

The steady growth of European market is also expected based on the region's strong industrial base of automotive, electronics and high-precision manufacturing. Affected with: In countries such as Germany, France, and the UK, brand owners, package makers, and OEMs across industries such as semiconductor, aerospace, etc. drive the adoption of ESD-safe packaging solutions.

Both as sustainable packaging materials and in order to comply with waste management regulations in the European Union, manufacturers have a significant incentive to develop eco-friendly anti-static foam products. Ongoing Electric Vehicle (EV) growth and innovations in advanced battery technologies are also driving demand for specialized ESD-safe packaging.

Asia Pacific is expected to grow at the fastest rate for anti-static foam packaging market owing to the booming electronics or semiconductor industry in countries such as China, Japan, South Korea and India. Some of the key factors driving demand for anti-static packaging are rising urbanization, consumer electronics consumption in the region and increasing exports of high-tech components.

Additionally, the increasing investments in manufacturing infrastructure and government schemes to support domestic semiconductor production are driving the growth of the market in further. Moreover, the rise of e-commerce along with global supply chain networks in the region, is expected to boost the demand for protective packaging solutions.

Challenges

High Production Costs and Limited Recycling Infrastructure

Challenges exist within the anti-static foam packaging market for production costs and sustainability. Specialty materials used for ESD, like conductive or dissipative polyethylene (PE) and polyurethane (PU) foams, have a higher cost of manufacturing than conventional packaging solutions.

This cost consideration results in anti-static foam being less available for small and mid-sized enterprises (SMEs), who may resort to lower cost options with the risk of damage incurred by static.

Anti-static foam is made of poly plastic, which has a limited recycling infrastructure. Anti-static packaging is essential for safeguarding sensitive electronic components, yet the disposal and recyclability of these materials are still significant challenges.

Many foam-based solutions are non-biodegradable and hard to process in typical recycling plants. Moreover, the chemical additives of conductive and dissipative foam also pose a problem during the recycling, resulting in more waste.

To overcome these challenges, producers will have to invest in up to date production systems migrating to cost-effective production approaches such as automation and optimizing materials to reduce their manufacturing costs.

By using biodegradable or recyclable materials to produce the foams, developing environmentally safe anti-static foams is going to help with sustainability without sacrificing anti-static foams' efficiency. Building programs with waste management companies so more programs can be recycled can also improve the circular economy for anti-static forms of packaging.

Opportunity

Growing Demand from the Electronics and Automotive Sectors

Anti-static foam packaging is becoming increasingly popular as the use of electronic devices from consumer products to industrial equipment grows. The evolution of semiconductors, printed circuit boards (PCBs), and other sensitive electronic components drives the demand for adequate ESD protection.

As 5G networks, IoT (Internet of Things) devices, and high-performance computing continue to proliferate, manufacturers need dependable packaging solutions to avoid static-induced failures.

Apart from electronics, the automotive sector is one of the major contributors to the anti-static foam packaging market. The increasing demand for electric vehicles (EVs) has created a growing need for lithium-ion battery protection, which necessitates the use of specialized ESD-safe packaging to mitigate short circuits and component failures.

Automotive Manufacturers also use anti-static foam for transporting electrical control modules, sensors, and other vulnerable components.

Covered by ESD protective materials, products and people are at the forefront of ESD protection and awareness, and as customers look for innovative solutions, so too should ESD protection particularly in the areas of material science, for instance there will be an increase in bio-based conductive foams and hybrid packages that bring ESD protection together with other forms of protection such as barrier protection and mechanical robustness.

Strengthening of supply chain networks by expanding coverage and upgrading distribution networks would play an equally important role in catering to the rising demand from global electronics and automotive markets.

From 2020 to 2024, the anti-static foam packaging market underwent steady growth, primarily fuelled by the expansion of the consumer devices sector and increased understanding of ESD threats.

Manufacturers dispensed efforts to enable foam products to provide maximum protection while building lightweight and shock-absorbing transfer solutions for fragile electronic components. At the same time, the industry struggled with the environmental toll of foam waste and a nearly non-existent system for recycling on a large scale.

In 2025 to 2035, a trend from sustainability to innovation will dominate the market. Regulatory bodies will be tightening autogenous environmental policies, and the trend toward biodegradable and recyclable anti-static foams will therefore only trend stronger post-2023.

Particularly carbon-neutral conductive foams are high-performance materials increasingly invested in by companies looking to provide both ESD protection and eco-friendliness. Smart packaging technologies, including RFID-enabled tracking and tamper-evident packaging, will further support supply chain security and transparency.

Two major users of anti-static foam packaging include automotive and aerospace industries, and they will persist to do so, mainly for electric vehicle batteries and avionics systems.

From many emerging application domains including electric vehicles, 5G, AI, and IoT, the need for semiconductors and microelectronics is booming and package suppliers will need to provide cost-effective and scalable packages that also meet both performance and sustainability requirements.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Growing emphasis on ESD safety and packaging standards |

| Technological Advancements | Development of lightweight and high-impact-resistant anti-static foams |

| Industry Adoption | Widespread use in consumer electronics and semiconductor packaging |

| Supply Chain and Sourcing | Dependence on petroleum-based foams and synthetic additives |

| Market Competition | Dominance of established ESD packaging manufacturers |

| Market Growth Drivers | Demand from electronics and data centre infrastructure |

| Sustainability and Energy Efficiency | Early-stage research into recyclable and compostable foams |

| Integration of Smart Monitoring | Limited adoption of tracking and authentication technologies |

| Advancements in Experiential Packaging | Custom-molded ESD foam inserts for precision protection |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Strict environmental regulations for foam disposal, mandates for recyclable ESD packaging |

| Technological Advancements | Adoption of biodegradable conductive foams and hybrid materials for improved sustainability |

| Industry Adoption | Expansion into EV battery protection, aerospace components, and medical devices |

| Supply Chain and Sourcing | Shift toward bio-based foams, recycled polymers, and sustainable sourcing strategies |

| Market Competition | Entry of new players focusing on eco-friendly anti-static foam innovations |

| Market Growth Drivers | Growth in EV production, semiconductor advancements, and aerospace electronics |

| Sustainability and Energy Efficiency | Large-scale commercialization of biodegradable ESD-safe foam solutions |

| Integration of Smart Monitoring | RFID-enabled anti-static packaging, real-time shipment monitoring, and tamper-proof solutions |

| Advancements in Experiential Packaging | Interactive packaging with embedded tracking and condition-monitoring sensors |

The USA anti-static foam packaging market is anticipated to witness significant growth due to the proliferation of the channels of protective packaging in the electronics sector, automotive sector, and aerospace sector. Demand for ESD-safe packaging is increasing as semiconductor manufacturing processes multiply and e-commerce sales of electronic components (including semiconductors) rise dramatically.

In addition, the healthcare industry is using anti-static foam packing to shield sensitive medical devices and equipment. With stricter regulation on Sustainable Packaging, the demand for recyclable and biodegradable anti-static foam materials is also on the rise.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.8% |

The high-tech manufacturing sector (electronics, defence, and telecommunications) in the UK is largely driving the demand for anti-static foam packaging in the UK. The emergence of industry along with the growing emphasis on data centres and semiconductor manufacturing is fuelling the demand for electrostatic discharge (ESD) protection solutions.

Moreover, sustainable initiatives and plastic waste reduction strategy are motivating companies to come up with eco-friendly alternatives like biodegradable and reusable anti-static foam materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.4% |

Because of their robust electronics, automotive, and aerospace sectors, Germany, France, and the Netherlands dominate the market for anti-static foam packaging in the EU. With the EU placing an increasingly emphasis on sustainability and circular economy principles, companies are becoming much more interested in recyclable anti-static foam solutions.

German and French production of electric vehicles (EVs) and semiconductors is also driving demand for ESD-safe packaging. Moreover, the growth of e-commerce across Europe is further increasing the demand for secure packaging solutions for electronic goods.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.6% |

Japan's market for anti-static foam packaging is expanding as the country leads in semiconductor technology, consumer electronics, and precision manufacturing. These industries need to implement advanced packaging solutions that effectively protect high value electronics components from Electric Discharge Damage.

The need for ultra-thin and high-performance ESD foam materials in Japan is being propelled by its commitment to technological advancement. Further driving market growth is the automotive industry's growing adoption of electronic elements, such as EV battery systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

Running major semiconductor and electronics companies, South Korea is stimulating the growth of anti-static foam packaging market. The growing requirements for robust ESD protection strategies in turning out high-performance electronic devices are in line with the country’s global leadership in display panel manufacturing and advanced computing technologies.

Moreover, the growing production of electric vehicles and batteries in South Korea is also driving demand for anti-static foam packaging with properties to protect lithium-ion batteries and electronic components.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.8% |

On the basis of end-use industry, the global anti-static foam packaging market can be segmented into consumer electronics and industrial applications, where in consumer electronics is the prominent segment in the anti-static foam packaging market as the manufacturers and business are seeking for the reliable electrostatic discharge (ESD) protection for sensitive components.

This packaging solution protects electronic devices and keeps components from failing, such as when you have stored or transported a product but was damaged. As the emphasis on damage prevention and safe handing grows, anti-static foam packaging has become increasingly important in all sectors, from consumer electronics to automotive and healthcare.

Consumer Electronics Lead Market Demand as Safe Packaging Solutions Become Industry Standard

Anti-static foam packaging is increasingly used in the consumer electronics segment for safe packaging of devices such as smartphones, tablets, laptops, semiconductors, among others, and it is one of the fastest-growing segments in the anti-static foam packaging market.

Traditional packaging materials do little to prevent electrostatic discharge from damaging components, but anti-static foam allows charges to dissipate in a controlled manner, significantly reducing the chance of electrical damage to electronic components.

Growing requirement for long-lasting and protective packaging solutions for high-value electronic products such as circuit boards, microprocessors, and connectors has driven market adoption.

Market demand for tailored anti-static foam solutions, with precision cut inserts, multi-layer protection, etc., will be further strengthened by global trade, as it delivers enhanced cushioning and high durability while ensuring delicate storage and transportation of products.

Furthermore, the incorporation of more eco-friendly bio-based anti-static foam materials, both renewable and recyclable, has also fostered adoption in-line with sustainable packaging initiatives that companies have made to their shareholders to be more in tune with corporate sustainability objectives.

AI-based quality control systems have been developed for anti-static foam packaging, capable of automatically detecting defects, monitoring them in real-time, and optimizing materials, which is promoting the growth of the market by promising higher reliability and improved efficiency in production.

In the consumer electronics segment, these factors can be problematic as they generate high production costs, fluctuating raw material prices, and foam disposal and waste management has continued to become more problematic due to excess waste and environmental concerns.

However, for the mean-time these materials still offer better component protection, durability, and compliance with recent changes in regulations. Nonetheless, new developments in sustainable anti-static foams, enhanced material recyclability, and nanotechnology-enabled static dissipation are providing efficiencies, minimizing waste, and fuelling sustainable market growth for consumer electronics packaging solutions.

ESD protection to maintain desired performance levels must be preserved in industrial applications, business application areas, or in the aerospace or healthcare industry.

Anti-static foam packaging is a unique form of packaging that provides precise yet determined protection for circuit boards, heavy-duty electrical components, and precision equipment, in contrast to other indignant packaging applications that rely on these anti-static properties in extreme industrial environments.

Moreover, the growth of the industrial automation sector is likely to contribute towards the increasing use of anti-static foam solutions owing to safe packaging for robotics, power modules and electrical enclosures during the upcoming years, which further helps in equipment long-term performance and operational efficiency.

The proliferation of advanced ESD-safe packaging solutions including multi-layer conductive foams, high-density cushioning, and tailored industrial packaging designs have reinforced market demand as they can offer enhanced adaptability across industrial applications.

The adoption of RFID-enabled anti-static foam packaging for real-time tracking, supply chain transparency, automated inventory management, etc., has further encouraged the adoption as it guarantees advanced logistics and better security.

Growing demand for lightweight, high-performance anti-static foam packaging solutions owing to developing high-temperature rum reflection and regard stop qualities have optimized the development of the market that guarantees the great degree of put away rates of the mechanical segments during transportation.

This market opportunity has further extended as the demand for anti-static foam packaging for the packaging of medical device manufacturing (notably in implantable electronics, diagnostic equipment, and lab instruments) is on the increase. In the healthcare sector, anti-static packaging plays a vital role in ensuring product sterility and avoiding contamination.

Even as the segment with solid benefits of static protection, customization, and industrial safety, the industrial applications segment also faces challenges like evolving ESD protection standards compliance, supply chain disruptions, and limitations in foam recyclability.

Nonetheless, advancements in biodegradable static-dissipative foams, AI-capable predictive maintenance solutions for warehousing/packaging materials, and pitch-based anti-static solutions are enhancing sustainability, efficiency, and overall market share, maximizing the opportunity for industrial-focused anti-static foam packaging applications worldwide.

Antistatic foam packaging market has been projected to witness a soaring demand across various applications where electronics components require packaging. Important changes include sustainable, biodegradable foam materials, a better shock-absorbing process, and improved electrostatic discharge (ESD) protection.

Companies are targeting high-performance conductive and dissipative foam solutions to ensure product safety and adherence to ESD regulations.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sealed Air Corporation | 18-22% |

| Pregis Corporation | 12-16% |

| Storopack Hans Reichenecker | 10-14% |

| Smurfit Kappa Group | 8-12% |

| ACH Foam Technologies | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sealed Air Corporation | Develops high-performance anti-static foam packaging with superior ESD protection and cushioning for sensitive electronics. |

| Pregis Corporation | Specializes in custom-engineered foam packaging solutions with advanced static dissipation properties. |

| Storopack Hans Reichenecker | Offers sustainable and biodegradable anti-static foam materials for industrial and electronic applications. |

| Smurfit Kappa Group | Focuses on eco-friendly anti-static foam packaging with recyclable and lightweight designs. |

| ACH Foam Technologies | Manufactures expanded polystyrene (EPS) and polyurethane (PU) anti-static foams with strong shock absorption and ESD protection. |

Key Company Insights

Sealed Air Corporation (18-22%)

Sealed Air leads in high-performance anti-static foam packaging, offering ESD-compliant and impact-resistant solutions for electronics and industrial applications.

Pregis Corporation (12-16%)

Pregis specializes in custom anti-static foam solutions with superior static dissipative properties to ensure the protection of delicate components.

Storopack Hans Reichenecker (10-14%)

Storopack focuses on sustainable anti-static foam packaging, integrating biodegradable materials while maintaining high ESD protection.

Smurfit Kappa Group (8-12%)

Smurfit Kappa provides recyclable and lightweight anti-static foam packaging solutions, catering to electronics and medical device industries.

ACH Foam Technologies (5-9%)

ACH Foam Technologies develops EPS and PU-based anti-static foams with advanced shock-absorbing properties for safe transport.

Several manufacturers contribute to the anti-static foam packaging market with specialized ESD-protection and eco-friendly solutions. These include:

The Anti-static Foam Packaging Market was valued at approximately USD 4726.3 million in 2025.

The market is projected to reach USD 9741.1 million by 2035, growing at a compound annual growth rate (CAGR) of 7.5% from 2025 to 2035.

The demand for Anti-static Foam Packaging Market is expected to be driven by the rising need for electrostatic discharge (ESD) protection in consumer electronics, expanding use in industrial applications for sensitive components, and growing demand for secure and damage-resistant packaging solutions in global supply chains.

The top 5 countries contributing to the Anti-static Foam Packaging Market are the United States, China, Germany, Japan, and South Korea.

The Consumer Electronics and Industrial Applications segment is expected to lead the Anti-static Foam Packaging market, driven by the increasing demand for protective packaging in semiconductors, circuit boards, and precision electronic devices, along with heightened focus on safe transportation of industrial components.

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Ventilated FIBC Market Growth - Demand & Forecast 2025 to 2035

Telescopic Tool Boxes Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.