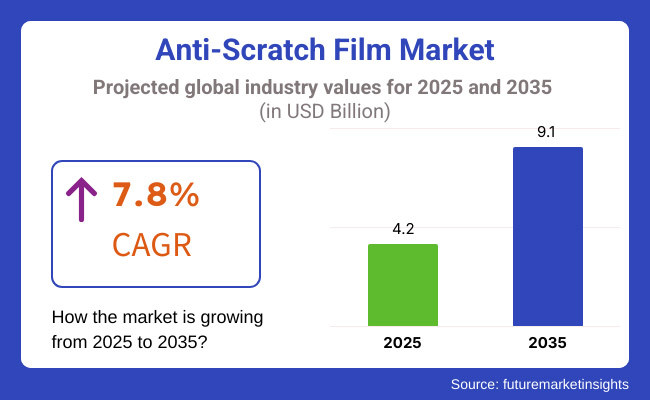

The anti-scratch film is projected to grow from USD 4.2 billion in 2025 to USD 9.1 billion by 2035, registering a CAGR of 7.8% during the forecast period. Sales in 2024 reached USD 3.8 billion, underscoring the sector's resilience and rising application across electronics, automotive, and construction sectors.

This growth is attributed to the increasing need for durable, transparent, and protective surface solutions that enhance product lifespan and preserve aesthetic appeal. Strategic investments are being undertaken by manufacturers to expand production capabilities and introduce high-performance variants. With a new generation of its black and white protective films, POLIFILM PROTECTION is raising the bar in terms of sustainability and efficiency. The company’s innovative High Strength Plus films are significantly thinner than their conventional counterparts.

This reduces the amount of virgin material needed, improves the carbon footprint of the value chain and saves logistics costs all whilst providing optimal surface protection and uncompromising processing properties.

“Our new High Strength Plus offers our customers more benefits than ever before: It has never been easier to protect the environment whilst enjoying superior surface protection and simultaneously benefiting from lower transportation and labor costs, as well as any potential tax savings if a tax is in operation in the respective country”, says Thomas Mähner, Head of Development at Polifilm Protection.

Sustainability targets are being integrated into product design, with recyclable base films and solvent-free adhesives being increasingly introduced. Anti-scratch films with multi-layer coating technology are being developed to improve resistance without increasing film thickness.

Moreover, self-healing coatings, originally used in luxury automotive films, are being adapted for broader consumer electronics use, driving innovation across price points. The adoption of water-based coatings is also being accelerated to align with environmental compliance norms.

The anti-scratch film market is anticipated to expand steadily, supported by increasing product demand from fast-moving electronics, architectural glazing, and premium automotive segments. Companies that emphasize surface innovation, eco-compliant materials, and customized film functionalities are expected to capture higher market share. As product lifespans and visual quality become more critical to consumer purchase decisions, anti-scratch films are set to play a central role in modern surface protection strategies.

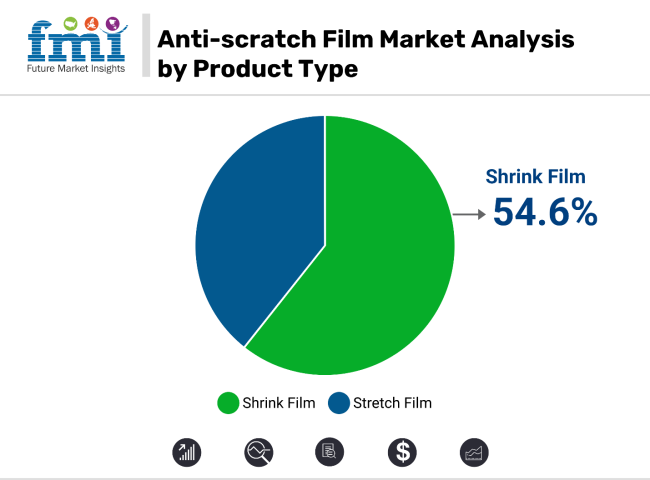

Shrink film is projected to account for 54.6% of the anti-scratch film market by 2025, driven by its superior conformability, clarity, and protection capabilities across packaging and industrial applications. Designed to shrink tightly around a product when heat is applied, shrink films provide a secure, tamper-evident, and scratch-resistant barrier that preserves surface finish and aesthetic appeal.

Widely used in the electronics, consumer goods, furniture, and automotive sectors, shrink anti-scratch films are favored for protecting high-gloss surfaces and delicate finishes during transportation and retail display. Their ability to create a form-fitting layer reduces friction and prevents scuffing, dust accumulation, and mechanical abrasion, which are critical concerns for high-value and visual-centric products.

Shrink film is compatible with automated packaging lines, making it suitable for large-scale manufacturing environments where speed and consistency are paramount. It also supports multi-layer constructions and UV-blocking formulations, enhancing its versatility in both indoor and outdoor storage settings.

As global demand for product protection, presentation quality, and minimal secondary packaging increases, shrink film continues to lead the anti-scratch category with its balanced performance, ease of use, and adaptability to different product shapes and sizes.

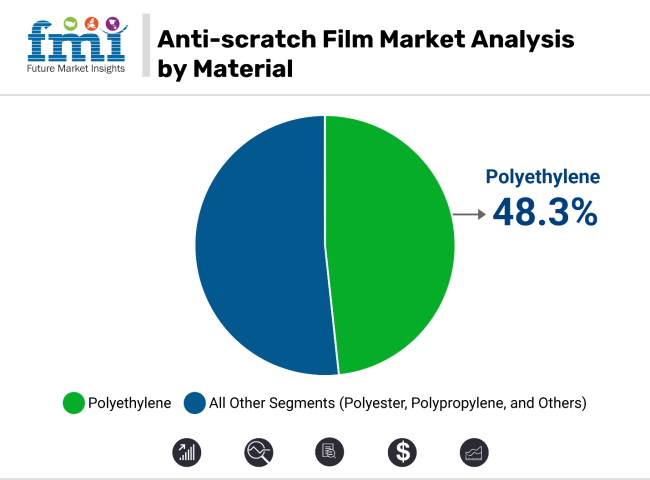

Polyethylene is projected to dominate the material segment of the anti-scratch film market with a 48.3% share by 2025, owing to its flexibility, impact resistance, and cost-effective manufacturing. As one of the most widely used thermoplastics, polyethylene films LDPE (Low-Density Polyethylene) offer a reliable solution for surface protection across diverse sectors such as appliances, automotive parts, electronics, and coated metals.

Known for its excellent tear strength and stretch ability, polyethylene provides a robust yet gentle layer that shields surfaces from scratches during handling, shipping, and installation. It conforms easily to irregular contours, making it ideal for custom-cut applications or products to complex geometries.

Polyethylene based anti-scratch films are compatible with UV inhibitors, anti-static coatings, and easy-peel adhesives, allowing manufacturers to tailor films for specific product lifecycles and protection levels. Its recyclability and lower carbon footprint compared to multi-layer composites also support the push toward sustainable packaging practices.

With industries increasingly focused on reducing cosmetic defects, warranty claims, and customer dissatisfaction caused by surface damage, polyethylene continues to be the go-to material. Its blend of mechanical durability, processing ease, and environmental compatibility ensures its leadership in the evolving anti-scratch film landscape.

Challenges

High Cost of Production and Raw Material Limitation

The biggest issue in anti-scratch film production is high cost of production. More sophisticated anti-scratch films, like self-healing films, have more complex manufacturing processes and superior raw materials and, therefore, are costlier to manufacture. Luxury films become too costly for price-conscious segments.

Additionally, some scratch-proofing coatings impair optical clarity and surface finish, especially in uses like on display screens and glass surfaces. The requirement is to keep innovating to offer inexpensive products without compromising quality, transparency, or usability. Market volatility because of supply chain disruption and price volatility of raw materials also typically goes against future market growth.

Sustainability and Environmental Issues

The environmental impact of conventional anti-scratch films has also been a source of concern as they are primarily petroleum-based polymers. Plastic pollution worldwide has been caused by packaging films that contain no biodegradable material, thus the demand by the international customers and governments for green protective films.

As high as there is so much optimism with biodegradable and bio-based protection films, they are expensive to make and yet not entirely scalable, thus making them difficult to implement in bulk. Businesses need to balance between strength, sustainability, and cost but in a manner that they can keep up with the changing needs of green consumers without compromising on regulatory standards.

Opportunities

Growing Demand for Self-healing Films

Self-healing scratch-resistant films have been of much interest, but to a larger extent in the automobile and electronics industries. Self-healing films possess microcapsules within them that heal small scratches automatically, adding surface life with less maintenance.

Luxury automobile makers are currently using self-healing films on body surfaces of automobiles, dashboard panels, and infotainment screens to add lifespan to luxury cars. Consumer electronics makers are also using self-heal screen protectors for smartphones, tablets, and wearables. Future self-healing polymers will revolutionize the market with cutting-edge technology to keep surfaces in their original state in a wide variety of applications.

New Emerging Applications Growth

Uses of anti-scratch film are now extending to new frontier applications such as AR, VR, and medical along with along with their traditional industries. Anti-scratch films are being increasingly depended on for screen readability preservation and device life in AR/VR headsets, driving demand for high-quality protection films. The healthcare sector is also witnessing increased adoption of anti-scratch films for medical devices, diagnostic screens, and wearables to render them rugged and germ-free. Application diversification provides good growth prospects in terms of revenue for businesses, particularly due to the fact that such sectors still keep getting developed and add protection solutions to their product lines.

The USA anti-scratch films market has grown at a very high rate, and it is largely driven by the consumer electronics and automotive industries. Giant companies such as Apple have integrated anti-scratch films into their products to guarantee longevity of screens and customer satisfaction.

Giant auto players such as Tesla have also utilized the films to safeguard touchscreens and car screens from scratches, realizing long-term performance and maintenance cost savings. Continuous expansion in premium, tough product demand keeps propelling the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

United Kingdom's anti-scratch film market has grown with a robust automotive sector and a growing consumer electronics sector. Jaguar Land Rover, for instance, utilized anti-scratch films for the interiors of cars as a means of sustaining visual integrity and enhancing user experience.

Aside from this, work-from-home has been the driving factor in laptop and tablet sales, hence propelling demand for protective films. The market is graced with customer affinity towards product quality and product durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.8% |

Germany and France in the European Union have witnessed widespread use of anti-scratch films, especially in consumer electronics and automobiles. German automobile giants like BMW use such films to shield car screens and control panels from day-to-day wear and tear.

French fashion designer brands also use anti-scratch films to keep luxury items in top condition to attain customer satisfaction and brand reputation. Priorities of quality and durability in European markets are behind the boost in demand for the highest protection solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.9% |

There was increased demand for anti-scratch film in Japan after realizing that Japan is strategically located in electronics and car manufacturing companies. The firms such as Sony and Toyota incorporated anti-scratch films into their products in an attempt to make their products last longer and be sold in the market.

Japan is technology- and quality-conscious, and there is application of quality processes and materials in protection film to ensure products are preserved in pristine condition, even according to Japanese consumer standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

The South Korean anti-scratch film industry has evolved with the entry of top electronics producers such as Samsung and LG. Samsung and LG apply anti-scratch films on their mobiles, tablets, and domestic electronics to achieve maximum product life and customer satisfaction.

South Korean consumer electronics rivalry guarantees ongoing advancement in protective technology with emphasis on functionality and design compatibility. Growth in the market is also influenced by growing customer demands for high-performance and long-lasting electronic products.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

3M (12-15%)

3M possesses the biggest anti-scratch film share among its huge portfolio of products it has to satisfy electronics as well as motor companies. 3M's drive for innovation has separated customer wants through improved guarding products.

Avery Dennison Corporation (10-13%)

Avery Dennison has a long history of long-term anti-scratch films and green films with broad applications in other industries. Its green orientation comes to meet the growing need for low-carbon protective products.

LINTEC Corporation (8-11%)

LINTEC Corporation is an R&D-focused protective film company with superior scratch resistance, and it is primarily applied in automobile and electronics industries. Its technology gives it a leadership position in the market.

Nitto Denko Corporation (7-10%)

High-quality repair anti-scratch films are manufactured by Nitto Denko Corporation for use primarily in consumer electronics. Its second-generation anti-scratch films ensure more product life and customer satisfaction.

Saint-Gobain Performance Plastics (5-8%)

Saint-Gobain Performance Plastics manufactures anti-scratch barrier films and has a leadership role in manufacturing the surface durability in industrial applications. Its product plays a critical part in maintaining industrial parts' integrity.

Specialty and regional firms bring specialty products and value-added solutions to the anti-scratch film market. These include:

The overall market size for the Anti-Scratch Film market was USD 4.2 Billion in 2025.

The Anti-Scratch Film market is projected to reach approximately USD 9.1 Billion by 2035.

The demand for the Anti-Scratch Film market will be driven by the growing use of protective films in electronics, automotive, and packaging industries, as well as increasing consumer demand for durable and long-lasting products.

The top 5 countries driving the development of the Anti-Scratch Film market are the United States, China, Germany, Japan, and South Korea.

The electronics and mobile devices segment is expected to lead the Anti-Scratch Film market, due to the rising demand for scratch-resistant screens and protective covers for smartphones, tablets, and other devices.

Table 01: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 02: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 03: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 04: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 05: Global Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 06: Global Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 07: Global Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 08: Global Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 09: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 32: Latin America Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 42: Western Europe Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 44: Western Europe Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Western Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 54: Eastern Europe Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 56: Eastern Europe Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 78: East Asia Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 80: East Asia Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 82: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 84: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Tons) Forecast by Material, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 01: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 02: Global Market Value (US$ Million) by Material, 2023 to 2033

Figure 03: Global Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 04: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 05: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 06: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 07: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 08: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 09: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 16: Global Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 20: Global Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 24: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 28: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Material, 2023 to 2033

Figure 33: Global Market Attractiveness by Thickness, 2023 to 2033

Figure 34: Global Market Attractiveness by Application, 2023 to 2033

Figure 35: Global Market Attractiveness by End Use, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Material, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 52: North America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 56: North America Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 60: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 64: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Material, 2023 to 2033

Figure 69: North America Market Attractiveness by Thickness, 2023 to 2033

Figure 70: North America Market Attractiveness by Application, 2023 to 2033

Figure 71: North America Market Attractiveness by End Use, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Material, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 88: Latin America Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 92: Latin America Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 96: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 100: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Material, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Thickness, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 107: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 124: Western Europe Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 128: Western Europe Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 136: Western Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Material, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Material, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Material, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Material, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Material, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Thickness, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Material, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 228: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 232: East Asia Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 236: East Asia Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 240: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 244: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Material, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Thickness, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 251: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Material, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Tons) Analysis by Material, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Material, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Thickness, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PE Film Market Insights – Growth & Forecast 2024-2034

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PBS Film Market Trends & Industry Growth Forecast 2024-2034

APET Film Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thin-film Platinum Resistance Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Platinum Resistance Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar Cells Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaics Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar PV Backsheet Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA