The market for anti-osteoporosis fracture healing is moderately concentrated. The top three players in this market hold around 40% market share. Mainly because of the extensive portfolios of products, developed research and development capabilities, and robust global distribution networks, top Players in 2024 Amgen Inc., Eli Lilly and Company and Novartis International AG.

Merck & Co., Sanofi S.A., and UCB Pharma also capture the remaining market share through cost-efficient production, innovative therapies, and strategic collaborations that enhance their competitive advantage in the market.

The market for anti-osteoporosis fracture healing is anticipated to expand at a consistent compound annual growth rate of 4.2% and is projected to attain USD 23,558.5 million by 2035. Rising incidence of osteoporosis and fractures, especially among the elderly; growing awareness regarding bone health; The future of the industry becomes more dependent on the emerging trends of biologics, parathyroid hormone analogues, and monoclonal antibodies developed for osteoporosis treatment.

Where foreign pharmaceutical companies lead, other drug firms from the same countries as China and India have started entering the market to introduce generic versions and innovative drug treatments. Some Chinese producers have also localized its products, where they provide Traditional Chinese Medicine (TCM) drugs for fracture rehabilitation, and for the care of osteoporosis, in order to serve local markets.

Emerging companies will be able to carve out some niche markets by specifically targeting certain demographics, such as pediatric osteoporosis treatments or environmentally sustainable packaging. They will be forming alliances to expand their reach across broader distribution channels. This is a continuing pattern of innovation and cooperation which will propel the market forward and mold its future.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 23,558.5 million |

| CAGR (2025 to 2035) | 4.2% |

Explore FMI!

Book a free demo

Global Market Share & Industry Share (%)

| Category | Industry Share (%) |

|---|---|

| Top 3 Vendors (Amgen Inc., Eli Lilly and Company Novartis International AG) | 42.1% |

| Rest of Top 5 (Amgen Inc., Eli Lilly, Novartis, Pfizer Inc. and F. Hoffmann La Roche Ltd.) | 50.7% |

| Emerging Players (Teva Pharmaceutical and others) | 20.0% |

| Niche Providers | 29.3% |

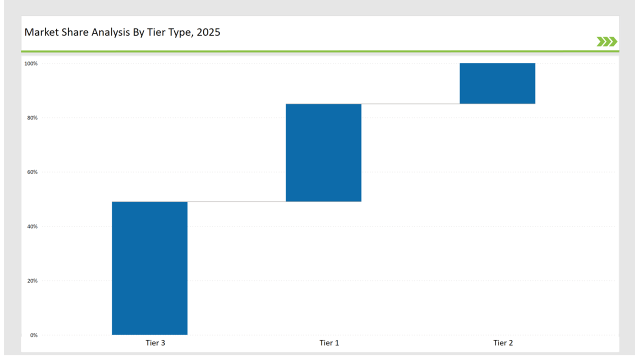

The anti-osteoporosis fracture healing market exhibits moderate concentration, with Tier 1 players dominating through innovative therapies and robust networks. Tier 2 and Tier 3 players cater to localized and niche demands, fostering market diversity.

Bisphosphonates lead the anti-osteoporosis therapy and fracture healing market because of several important reasons. Their efficacy has been well established as the primary treatment in osteoporosis management.

Medications in this class are Alendronate, Risedronate, Ibandronate, and Zoledronic Acid amongst others which act by hindering bone resorption thus enhancing bone mineral density as well as reducing fracture prevalence, notably among women after menopause and aged patients.

Anti-osteoporotic drugs and fracture healing therapies are the therapeutic area where the route of distribution for most of the medicines is dominated by hospital pharmacies.

For acute fractures and other orthopedic conditions, a great demand for immediate drugs is created, as hospitals are a primary care setting for individuals with osteoporosis-related fractures, trauma, and post-surgical rehabilitation. It is in these health care settings, where the need for treatment occurs immediately and patients are numerous, that hospital pharmacies become the prime entry point for osteoporosis drugs.

Fast Expansion in the Anti-Osteoporosis Fracture Healing Market through E-commerce Channels

E-commerce will register tremendous growth in the anti-osteoporosis fracture healing market as more consumers find online pharmacies helpful in purchasing the required medications without having to go to physical pharmacies. This trend of drug sales through e-commerce facilitates greater accessibility, a comprehensive portfolio, and convenience through competitive pricing.

The number of osteoporosis treatment options, with bisphosphonates and biologics being some, will continue increasing with the exponential growth of internet pharmacies, creating steady expansion within the market - especially in markets where physical pharmacies have less access.

Oral Dosage Forms Continue Dominating the Market

Oral dosage forms are likely to continue dominating the anti-osteoporosis fracture healing market with the largest market share. Not only are these forms cost-effective, but also very convenient for patients, and flexible dosing regimens with daily, weekly, or monthly dosing make them very popular among patients.

From both the practitioner and patient standpoint, oral bisphosphonates, such as Alendronate and Risedronate, are highly popular. The area of oral forms of dosing is going to further gain from development of extended release and combination preparations designed to maximize compliance and outcomes in patients.

Continued Leadership of Key Players

The key players in the global anti-osteoporosis fracture healing market will remain continue to hold the dominant share owing to their powerful product portfolios and large distribution network. Such companies include Amgen, Eli Lilly, Novartis, and Merck & Co.

These companies have taken on a competitive edge by continually innovating and introducing new therapies in osteoporosis, including the use of monoclonal antibodies and parathyroid hormone analogs. Through the well-established brands and global presence, they ensure a solid place in the market while making continuous annual growth with strategic collaborations, research, and development.

Increased Concern for Environmentally Friendly Manufacturing Process With the strong demands of the consumers toward environmental-friendly products

Many manufacturers of anti-osteoporosis drugs are finding their way into green manufacturing practices. Green technologies like eco-friendly packaging and sustainable modes of production are increasingly manifesting in the industry.

Companies are now spending their available resources on green initiatives aimed at decreasing the environmental footprint to attract and engage end-users of a product who possess enhanced sensitivities for sustainability. These efforts go along with a growing trend of "green" products and allow brands to compete in a saturated marketplace, giving them a degree of brand loyalty and market differentiation.

| Tier | Market Share (%) |

|---|---|

| Tier 1 (Amgen Inc., Eli Lilly and Company) | 35.7% |

| Tier 2 (Novartis International AG, Pfizer Inc., F. Hoffmann La Roche Ltd.) | 15.0% |

| Tier 3 (Regional & Emerging Anti-Osteoporosis Fracture Healing products manufacturers) | 49.3% |

| Company Name | Unique Initiative |

|---|---|

| Amgen Inc. | Innovator of biologic treatment of osteoporosis and innovations in Prolia® of Denosumab, further innovating with research in the area of bone health. |

| Eli Lilly and Company | to force treatment of osteoporosis with Forteo® (Teriparatide) and focus R&D on developing the next generation of bone anabolic agents. |

| Novartis International AG | Spending for regenerative medicine in fracture repair and increasing availability of osteoporosis treatments everywhere in the globe. |

| Pfizer Inc. | Biosimilars for the treatment of osteoporosis and precision medicine for bone health. |

| F. Hoffmann-La Roche Ltd. | Roche Ltd. Developing antibody drugs for treatment of osteoporosis, while giving importance to drug personalization for the particular treatment. |

| Teva Pharmaceutical Industries Ltd. | Because it is relatively cheap, there is manufacture of generic drugs and biosimilars for the treatment of osteoporosis alongside increased access. |

Innovative products in the anti-osteoporosis fracture healing market are being developed at advanced levels, including high-formulation tablets such as rapid-release, pediatric-specific, and combination therapies.

These innovations cater to diverse patient needs and will play a crucial role in expanding the market. To effectively penetrate high-growth regions like Asia-Pacific and Latin America, localized production and distribution strategies will be essential, ensuring that osteoporosis treatments are both accessible and affordable in these emerging markets.

The Anti-Osteoporosis Fracture Healing Market grows at a CAGR of 4.2% from 2025 to 2035.

The market will reach USD 23,558.5 million by 2035.

North America (45%) and Europe (30%) dominate, with Asia-Pacific (20%) showing significant growth.

Key vendors include Amgen, Eli Lilly, Novartis, UCB, and Radius Health.

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.