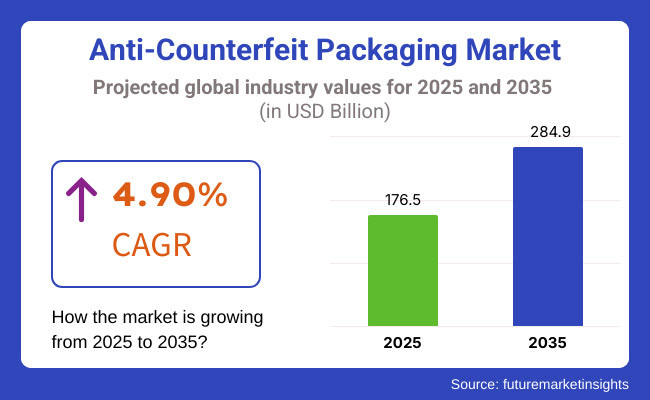

The anti-counterfeit packaging market will experience substantial growth between 2025 and 2035 due to the increasing interest in product security, brand protection, and heightened regulations against counterfeits. The market is projected to hit USD 176.5 billion in 2025 and grow to USD 284.9 billion by 2035 at a compound annual growth rate (CAGR) of 4.90% during the forecast period.

The increasing acceptance of smart packaging solutions, authentication technologies, and block chain based traceability solutions is substantial in driving market growth. Brands in multiple industries are progressively protecting their products against counterfeiting through the use of RFID tags, tamper evident seals holograms, and serialization methods.

Regulatory policy pressure, increased e-commerce transactions, and growing awareness of product authenticity and product safety among consumers also help drive the market.

Government initiatives fostering anti-counterfeit protocols, supply chain traceability, and intellectual property safeguarding enable and propel market growth, in addition to an upsurge in investments towards innovative packaging solutions and digital security technologies. Also, partnerships among manufacturers, packaging firms, and regulatory agencies are improving product safety and consumer trust.

However, issues with significant implementation expenses, technology integration complexities, and counterfeiter adaptability necessitate the need for strategic interventions. Many companies have begun to emphasize AI-driven authentication solutions, cloud-based tracking systems, and eco-friendly anti-counterfeit packaging materials as effective solutions to boost security without sacrificing profitability.

Explore FMI!

Book a free demo

The largest revenue share in the anti-counterfeit packaging market is in North America, which is mainly due to the strict regulations, increasing consumer awareness, and the growing use of the advanced authentication technologies in a variety of industries.

The USA and Canada hold the leading position in the region, with prominent manufacturers investing in smart packaging solutions, blockchain-based tracking, and tamper-resistant designs to prevent counterfeit products in the market.

The demand for anti-counterfeit packaging originates from multiple industries, including food and beverages, pharmaceuticals, and luxury goods, driven by concerns regarding product authenticity, protection of brands from counterfeiters, and consumer safety.

Regulatory frameworks like FDA’s Drug Supply Chain Security Act (DSCSA) and intellectual property laws can impact market dynamics, compelling brands to implement features like QR codes, holographic labels and RFID-enabled packaging. However, some key obstacles are high implementation costs and difficulty integrating supply chains. Furthermore, this is expected to fuel more market growth to happen where strategic alliances between manufactures and packaging solution providers would take place.

Europe is a prominent market for anti-counterfeit packaging solutions owing to the strong presence of prominent brands, premium brand facility and robust regulatory enforcement in countries such as Germany, France, and the United Kingdom. The emphasis on sustainability and eco-friendly packaging throughout the region also drives innovation with anti-counterfeit technologies.

Driving market growth is the growing occurrence of substandard products ranging from pharmaceuticals and cosmetics to food products as well as stringent regulation enforcements like that of the European Union’s General Product Safety Directive.

To ensure integrity, brands are spending on blockchain authentication, biodegradable security labels and AI-driven tracking systems. Nonetheless, the price of sustainable development (in terms of both secure packaging and the existing countries' packaging laws) will be good for small and medium-sized enterprises. They believe European companies most prioritize cost-effective anti-counterfeiting technologies that reflect their environmental sustainability goals.

The Asia-Pacific held the largest market share in terms of revenue, and is expected to be the fastest growing region during the forecast period due to the rapid growth of the e-commerce industry supported by rising disposable income and increasing circulation of counterfeit products in Asia-Pacific nations including China, India, South Korea, and Japan.

The booming consumer goods industry and growing demand for premium products in the region accelerate adoption of ground-breaking authentication technologies.

This market benefits from government efforts to fight counterfeit goods in various industries and increased consumer demand for products that can be traced back and verified. Digital authentication methods like NFC-enabled packaging, serialization, and AI-powered tracking are becoming increasingly prominent.

Nevertheless, inconsistencies in regulations as well as the existence of unregulated markets hinder market penetration. Future growth is foretold through the continued efforts to develop harmonised anti-counterfeiting standards and increasing technological advances in smart packaging.

Challenge

Evolving Counterfeit Tactics and High Implementation Costs

Ongoing innovation in counterfeiting techniques and exorbitant costs of incorporating advanced security features act as a challenge to the adoption of the anti-counterfeit packaging market. Fake products are a major blow to brand credibility and can also put consumers at health and safety risk.

On the other hand, novel technologies like RFID, holographic security labels, and blockchain verification come with a high price tag that may not be accessible to smaller companies, rendering such solutions a poor fit for them. Minimizing the threat from emerging technologies will escalate demand for solutions, necessitating a trade-off between economic security and high-tech mediations, alongside a tougher regulatory arm.

Opportunity

Advancements in Smart Packaging and Digital Authentication

The growing demand for smart packaging is one of the lucrative opportunities for anti-counterfeit packaging market. AI-driven product verification, QR code-based traceability, and blockchain-enabled transparency can help deliver greater security at the same time as streamlining operations in supply chains.

The growth of sustainable and tamper-proof packaging and growing demands for biodegradable security and digital watermarking also contributing towards market growth. With regulators tightening anti-counterfeit measures, businesses that implement these advanced solutions will stand out among competitors and increase consumer trust.

The market witnessed growth during this period (2020 to 2024) due to the surge in counterfeiting menace for different industry sectors and the implementation of several security features including serialization, holograms, UV-sensitive inks, among others. But implementing auto-pilot tech requires expensive machines, coupled with different regulations in different market.

For 2025 to 2035, ten years into the future, the market is going to be changed by AI-powered authentication, blockchain traceability, and based real-time monitoring with the internet of things. The adoption of anti-counterfeit packaging solutions across sectors such as pharmaceuticals, food, electronics and luxury goods will be accelerated by an improved regulatory environment, better consumer awareness and more advanced technologies.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter enforcement against counterfeiting |

| Technological Advancements | Holograms, barcodes, and RFID |

| Industry Adoption | Focused on premium and high-risk sectors |

| Supply Chain and Sourcing | Limited traceability and manual verification |

| Market Competition | Dominated by established packaging firms |

| Market Growth Drivers | Increasing counterfeiting incidents and brand protection efforts |

| Sustainability and Energy Efficiency | Initial exploration of eco-friendly security solutions |

| Integration of Smart Monitoring | Basic serialization and QR code-based tracking |

| Advancements in Authentication Technologies | UV-sensitive inks and holographic seals |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Standardized global anti-counterfeit regulations |

| Technological Advancements | AI-powered verification, blockchain authentication, and IoT tracking |

| Industry Adoption | Widespread use across all consumer and industrial segments |

| Supply Chain and Sourcing | AI-driven transparency and blockchain-based product authentication |

| Market Competition | Rise of AI and tech-driven anti-counterfeit solution providers |

| Market Growth Drivers | Consumer demand for transparency and product authenticity |

| Sustainability and Energy Efficiency | Full-scale integration of biodegradable and smart packaging solutions |

| Integration of Smart Monitoring | AI-driven predictive analytics and real-time authentication tools |

| Advancements in Authentication Technologies | Smart labels, IoT-enabled tracking, and biometric authentication |

North America dominates the anti-counterfeit packaging market, especially due to the USA region, which has more stringent regulations and greater types of products getting counterfeited in other sectors.

In order to mitigate counterfeiting, the FDA, USA Customs and Border Protection (CBP), and Drug Supply Chain Security Act (DSCSA) have all come a long way with the application of track-and-trace solutions, tamper-evident seals and smart packaging.

In particular, the e-commerce boom, especially in pharmaceuticals, food and beverages, and luxury goods, topology being especially prone to counterfeiting, has led to the growth of demand for verification technologies (RFID, QR codes, holographic labels, blockchain-authentication, etc.). Which, in turn, has propelled the market in the United States due to active consumer awareness on the authenticity and safety of products.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

The UK anti-counterfeit packaging market has been growing at a steady pace, largely owing to government regulation of the same through UK Intellectual Property Office (IPO) and with the assistance of Food Standards Agency (FSA).

Companies increasingly invest in high-security packaging solutions such as forensic markers, serialized barcodes and NFC-enabled packaging in response to growing adulteration of pharmaceutical products, alcoholic beverages and luxury goods. Moreover, the rise of direct-to-consumer (DTC) sales channels through online marketplaces has aggravated the demand for anti-counterfeit packaging technologies to offer supply chain transparency and prevent fraudulent activities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

Significant opportunity is also for anti-counterfeit packaging solutions, which are the primary drivers of this market, in countries in the European Union (EU), where regulatory frameworks like the Falsified Medicines Directive (FMD) and methods of the European Anti-Fraud Office (OLAF) initiative remains a lodestone.

Key markets like Germany, France, and Italy have increased efforts to introduce advanced authentication measures such as digital watermarks, holographic security features, and blockchain-integrated tracking systems.

The increase of counterfeit food, beverages and personal care products has led major brands to use tamper-proof packaging and serialization technology. The EU’s focus on sustainable and smarter packaging solutions is also shaping the growth of the market, as manufacturers are emphasising on eco-friendly anti-counterfeit technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

Driven by rising concerns over product safety, especially in the pharmaceutical, cosmetics, and food sectors, the anti-counterfeit packaging market in Japan is expanding. To curb counterfeiting, the Japanese government has enforced strict regulations, which is fuelling the demand for tamper-proof packages, RFID-enabled tags, and blockchain technology based tracking systems.

As cross-border e-commerce has become more popular, manufacturers are adopting state-of-the-art authentication systems to uphold consumer trust and meet regulatory requirements. Moreover, the concentrated presence of technology-led packaging companies in Japan has accelerated the adoption of AI-powered anti-counterfeit solutions, thus, driving market growth in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The South Korean anti-counterfeiting packaging market is expanding as a result of the growing counterfeiting of electronics, cosmetics, and luxury food items. Measures by governments to impose more stringent labelling requirements and monitor online retail categorically has forced industries to adopt secure packaging technologies.

Regionally it is becoming a part of our daily practice as QR code verification and use of smart labels and NFC enabled tracking have become common. Drive for K-beauty and K-food "Packaging Makes the Brand" and enter the international market with a "greeting" secure packaging has entered the trend.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The Bottles and Jars category is becoming a strong segment in the anti-counterfeit packaging market, as the industry for these products is extensive; including but not limited to the pharmaceuticals, cosmetics, food & beverages, and personal care products.

As counterfeiting increasingly poses a serious threat, filler and closures packaging solutions are being enriched with advanced security features, tamper-evident closures, and smart authentication technologies, all designed to improve the packaging, provide product integrity in filler, and more.

Higher-value products, particularly pharmaceuticals and premium cosmetics, are popular with counterfeiters, so demand for more secure packaging is growing. Brands are embracing innovations such as RFID-enabled smart bottles, holographic seals and serialized QR codes so that consumers and retailers can quickly ascertain whether the product is genuine or not.

Tamper-evident caps, shrink sleeves and breakable seals are also being introduced to prevent product refilling, repackaging or resealing by unauthorized persons.

Another factor promoting innovations in segment is the increasing demand for sustainable and eco-friendly anti-counterfeit packaging solutions. In response to this demand, manufacturers are on their toes to provide options like biodegradable security labels, UV-sensitive authentication inks, and integrated blockchain traceability systems, perfectly striking a balance between security and environmental sustainability.

Even so, significant challenges such as cost constraints, the complex integration with existing packaging lines and the requirement for regulatory compliance remain.

However, there are challenges related to brand protection which will restrain the market and may even lead to market downfall, a challenge overcome by the advancement in anti-counterfeiting solutions using an AI-powered approach, and emerging digital authentication technologies along with tamper-proof smart caps that are likely to address these issues and facilitate further market expansion.

Brand protection and consumer safety remain the key focus areas as bottles and jars segment to remain dominant in anti-counterfeit packaging market providing higher safety standards and reducing counterfeiting scenarios across sectors.

The RFID technology segment is also essential for anti-counterfeit packaging, providing real-time tracking, supply chain visibility, and authentication for tackling counterfeiting in various industries.

Unlike traditional anti-counterfeit measures, and RFID technology helps trace services all the way from product manufacture to the final purchase by customers limiting the chances of duplicate products at lower costs and unauthorized distribution.

RFID tags are used to see growing adoption in pharmaceuticals, high-end beverages, luxury cosmetics, and premium food products, where authenticity is extremely important. These smart labels enabled with radio-frequency, store unique product information and allow instant verification through both RFID scanners and mobile applications.

RFID solutions are being widely adopted by pharmaceutical companies to follow strict regulatory requirements, as well as to avoid counterfeit drugs from being in the supply chain.

Moreover, manufacturers can identify counterfeit attempts at any stage of distribution due to batch-level and unit-level tracking, which is one of the biggest advantages of RFID technology. Blockchain-powered RFID solutions have been integrated to create tamper-proof digital records that cannot be manipulated by counterfeiters.

But resistance in certain industries has slowed adoption due to higher implementation costs; compatibility with existing packaging lines; and potential data security issues. To mitigate these challenges, Manufacturers are adopting cost-effective RFID tags, cloud-based data management systems, and AI-driven predictive analytics to maximize tracking efficiency while minimizing cost.

With the growing demand for smart packaging and real-time authentication, it is only a matter of time before RFID technology becomes the industry standard for anti-counterfeit packaging.

As government authorities implement more stringent track-and-trace measures, furthering the trust and safety quotient that all brands across industries are aiming to convey, the RFID segment is projected to experience swift uptake, re-establishing its stature of quintessential technology in the anti-counterfeit packaging market

The anti-counterfeit packaging market is experiencing a surge in demand and growth driven by the growing emphasis on product safety, brand protection, and regulatory compliance across multiple sectors including food & beverages, pharmaceuticals, cosmetics, and consumer goods. Increasing instances of counterfeiting have created a demand for security-enhanced packaging solutions.

By using technology including RFID-based tracking, tamper-evident seals and holograms, serialization, forensic markers, and blockchain-enabled supply chain management, companies are improving product authenticity and traceability. Moreover, increasing environmental concerns are propelling the development of eco-friendly and recyclable Anti-Counterfeiting Packaging solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Avery Dennison Corporation | 18-24% |

| CCL Industries | 14-18% |

| 3M Company | 12-16% |

| SICPA Holding SA | 10-14% |

| Zebra Technologies | 8-12% |

| Other Industry Players (Combined) | 28-34% |

| Company Name | Key Offerings/Activities |

|---|---|

| Avery Dennison Corporation | Provides RFID-based smart labels, tamper-evident packaging, and track-and-trace authentication. |

| CCL Industries | Develops holographic security labels, QR code verification, and digital authentication for various industries. |

| 3M Company | Specializes in covert security markers, micro-optic films, and tamper-resistant packaging solutions. |

| SICPA Holding SA | Offers secure inks, blockchain-based traceability solutions, and authentication features to prevent fraud. |

| Zebra Technologies | Focuses on barcode serialization, smart packaging, and AI-driven tracking solutions for product security. |

Key Company Insights

Avery Dennison Corporation (18-24%)

Avery Dennison is a leading provider of anti-counterfeit packaging solutions, offering RFID and smart labelling technologies that enhance product traceability and brand security.

CCL Industries (14-18%)

CCL Industries plays a crucial role in security labelling, providing holograms, encrypted QR codes, and real-time authentication solutions across multiple sectors.

3M Company (12-16%)

3M Company is a key innovator in high-security packaging, offering micro-structured films, forensic authentication markers, and tamper-proof labelling solutions.

SICPA Holding SA (10-14%)

SICPA specializes in secure printing and blockchain-integrated tracking systems, enhancing product authentication and reducing counterfeiting across various industries.

Zebra Technologies (8-12%)

Zebra Technologies focuses on digital serialization, barcode authentication, and AI-powered anti-counterfeit packaging solutions for industries such as pharmaceuticals, food, and consumer goods.

Innovative solutions, including AI-driven supply chain monitoring, smart packaging, and forensic-level security markers, are shaping the anti-counterfeit packaging industry. Key contributors include:

The overall market size for the anti-counterfeit packaging market was USD 176.5 billion in 2025.

The anti-counterfeit packaging market is expected to reach USD 284.9 billion in 2035.

The anti-counterfeit packaging market is expected to grow at a CAGR of 4.90% during the forecast period.

The demand for the anti-counterfeit packaging market will be driven by increasing concerns over product authenticity, rising cases of counterfeit goods, advancements in smart packaging technologies, stringent regulatory frameworks, and growing consumer awareness regarding product safety.

The top five countries driving the development of the anti-counterfeit packaging market are the USA, China, Germany, France, and Japan.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.