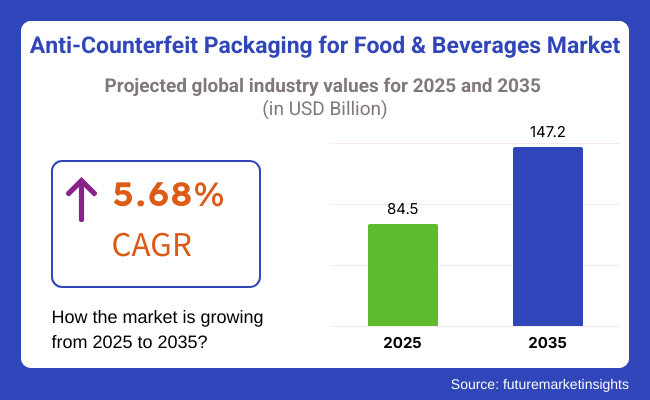

The anti-counterfeit packaging for food & beverages market is poised to witness strong growth from 2025 to 2035, fuelled by the growing need for food safety, brand protection, and stringent regulations against counterfeit goods. The market is anticipated to grow from USD 84.5 billion in 2025 to USD 147.2 billion in 2035, with a compound annual growth rate (CAGR) of 5.68% during the forecast period.

Increasing implementation of intelligent packaging solutions, anti-counterfeit technology, and block chain enabled traceability systems will play a vital role in buying up the market. With the use of RFID tags, tamper-evident seals, holograms and serialization techniques, food and beverage brands are in fact doing more to secure their products against counterfeiting than if theft in a stockroom or other internal issue were a bigger problem.

Growth of e-commerce transactions, strict government policies, and increasing consumer awareness about food authenticity and safety are also some of the factors that have dented this market.

The increasing adoption of supporting regulations focussing on anti-counterfeiting measures, food traceability and protection of intellectual property and the existing trend of investment into innovative packaging solutions and digital security technologies are other factors fuelling market growth. Moreover, food manufacturers, packaging companies, and regulatory bodies are working together to strengthen product security and consumer trust.

Nonetheless, issues of high implementation costs, technological integration intricacies, and counterfeiter adaptability necessitate strategic solutions. The new solutions are provided by companies focused on AI authentication systems, cloud-based tracking mechanisms, and eco-friendly anti-counterfeiting packaging.

Explore FMI!

Book a free demo

Food and beverages packaging anti-counterfeit market is dominated by North America due to the stringent food-safe laws, increasing consumer awareness, and adoption of authentication techniques. The United States and Canada dominate the region, with major market stakeholders focusing on smart packaging solutions, block chain-enabled tracking, and tamper-proof designs to fight against fake products.

Natural growth in various segments organic baby food packaging, fresh meat packaging, will fuel the demand for anti-counterfeit packaging in food and beverage sector Protection of consumer health, food safety risks, and brand value maintenance are some of the factors driving it.

Regulatory frameworks including the FDA’s Food Safety Modernization Act (FSMA) and intellectual property laws shape the market, compelling brands to implement QR codes, holographic labels, and RFID-enabled packaging. But the high implementation costs and difficulty integrating the supply chain stills significant barriers.

Furthermore, along with food manufacturers need for packaging solution providers are anticipated to promote the growth of the market in the coming years.

Europe is one of the main consumers of anti-counterfeit packaging in food and beverage market mainly due to the presence of penalizing norms and regulations in the countries such as Germany, France and the United Kingdom, which urges strict compliance in food packaging, and high-end food brands using anti-counterfeit features.

The region's commitment to sustainability and environmentally friendly packaging also plays a role in driving innovative anti-counterfeiting technologies.

The rise of counterfeit food products and regulatory enforcements like European Union’s General Food Law Regulation, drive the market growth. To bolster product integrity, brands are investing in biodegradable security labels, block chain authentication, and AI-driven tracking systems.

However, sustainable and secure packaging solutions are costly, which might present difficulties for small and medium-sized enterprises. Now European companies are focusing on more eco-friendly, low-cost anti-counterfeit techniques that comply with this sustainability drive.

The anti-counterfeit packaging market for food and beverages is dominated by North America, Asia-Pacific, and Europe in with Asia-Pacific becoming the fastest-growing region due to rapid e-commerce expansion, rising disposable income, and rising circulation of counterfeit products across the Asia Pacific region (China, India, South Korea, and Japan).

The thriving packaged food sector and increasing consumer demand for high-end beverages in the region further expedite the utilization of advanced authentication technologies.

The Market is also helped by government efforts to curtail counterfeit food products and consumer demand for traceable and verifiable goods. Digital authentication solutions like NFC-enabled packaging and serialization are also hitting their stride. Yet mismatched regulations and unregulated markets may impede market penetration.

The need for unified anti-counterfeiting standards along with the implementation of smart packaging technologies is anticipated to fuel the future growth rate.

Challenge

Increasing Complexity of Supply Chains and Counterfeit Risks

While the anti-counterfeit packaging market for food and beverages is arguably challenged by the increasing complexity of global supply chains, and the sophistication of counterfeit operations, such companies remain in high demand. Imitation foodstuffs harm not just brand confidence but also can have major health risks for those who eat them.

The food manufacturers need to create an extra level of safe technology (RFID tracking, tamper-evident seals, and encryption) that also requires an investment of time and money for small and mid-size businesses. Addressing these challenges necessitates a concerted effort between regulators, industry stakeholders, and technology providers to develop cost-effective and scalable anti-counterfeit solutions.

Opportunity

Integration of Smart Packaging and AI-based Authentication

There is significant promise for fighting food and beverage fraud in the form of smart packaging. AI solutions, QR-code traceable supply chain, and block chain based transparency tools empower the real-time verification of product authenticity guaranteeing consumer safety and protection of brands.

This contributes toward sustainability of packaging and advances the visibility of the supply chain & biscuits. As governments tighten measures on food safety and authentication, the global anti-counterfeit packaging market is one that will only win big through innovations.

2020 to 2024: The market has witnessed growth owing to rising counterfeit of food and beverage products, which pushes stricter regulations and brand protection initiatives. Businesses implemented holograms, barcodes, and serialization to protect their goods. But, cost constraints and inconsistent global regulatory frameworks delayed their adoption in some regions.

The Transformation 2025 to 2035 through AI, block chain verification and smart packaging solutions supply chain transparency, AI threat detection, and IoT-enabled packaging are reimagining anti-counterfeit measures. In addition, rising concerns around sustainability and traceability of food products among consumers will present growth opportunities for investing in sustainable security solutions and real-time authentication platforms, as these products can provide eco-friendly safety measures.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 202 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter enforcement on food safety and counterfeit prevention |

| Technological Advancements | Holograms, barcodes, and serialization |

| Industry Adoption | Predominantly adopted by premium brands |

| Supply Chain and Sourcing | Limited transparency and fragmented tracking systems |

| Market Competition | Dominance of major food and beverage brands |

| Market Growth Drivers | Rising counterfeit cases and brand protection efforts |

| Sustainability and Energy Efficiency | Introduction of biodegradable and tamper-proof packaging |

| Integration of Smart Monitoring | Basic tracking through serialization and QR codes |

| Advancements in Authentication Technologies | UV-sensitive inks and holographic seals |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global harmonization of food authentication standards |

| Technological Advancements | AI-driven authentication, block chain verification, and IoT-based tracking |

| Industry Adoption | Widespread adoption across all segments of the food and beverage industry |

| Supply Chain and Sourcing | Real-time traceability through block chain and AI analytics |

| Market Competition | Rise of specialized anti-counterfeit technology providers |

| Market Growth Drivers | Increased consumer demand for transparency and food safety regulations |

| Sustainability and Energy Efficiency | Full-scale implementation of eco-friendly security solutions and smart monitoring |

| Integration of Smart Monitoring | AI-driven predictive monitoring and real-time product authentication |

| Advancements in Authentication Technologies | IoT-enabled packaging, dynamic security features, and real-time verification tools |

North America, led by stringent regulations enforced by the USA Food and Drug Administration (FDA) and the Food Safety Modernization Act (FSMA), dominates the anti-counterfeit packaging for food and beverage market. Increasing Food fraud, mislabelling, and contamination concerns are pushing manufacturers to incorporate advanced authentication solutions like tamper-proof seals, holographic labels, block chain based traceability, QR code verification, etc.

Moreover, explosive growth of e-commerce has increased the imperative for stringent anti-counterfeit measures to guard consumers from counterfeit food and beverage products. Rising consumer awareness regarding the authenticity of products, along with the growing demand for organic and premium food products, further drives the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

The food and beverages anti-counterfeit packaging market in the United Kingdom is witnessing a fair growth, which can be attributed to rising focus on food safety and increasing incidences of counterfeit products structured in the e-commerce channels.

There are much stricter guidelines to prevent food fraud, enforced by regulatory bodies like the UK Food Standards Agency (FSA) and the Intellectual Property Office (IPO). Food and beverage manufacturers are increasingly turning to intelligent packaging solutions such as smart labels, NFC-enabled tracking, and serialization technology to boost transparency and traceability. Increased demand for sustainable packaging along with the features of anti-counterfeit is anticipated to drive the growth of this market substantially.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.0% |

EC regulations on food safety and traceability, along with the EU Food Fraud Network, provide strong legal parameters in this regard, creating key opportunities for anti-counterfeit packaging.

Germany, France, and Italy are leading the way in the development of secure packaging technologies such as blockchain-enabled authentication, tamper-proof packaging, and forensic markers. In 2019, the adoption of advanced anti-counterfeit solutions is primarily being driven by increased focus on cross-border food safety and growing incidences/volumes of counterfeit wine, spirits and organic food products.

European consumers are also especially invested in food authenticity which has been driving brands to take further and innovative security packaging measures.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.1% |

Japan’s anti-counterfeit packaging market for food and beverage products is increasing, owing to food safety standards and technological development in the country. Japanese manufacturers have been industry leaders in the adoption of smart packaging solutions including: edible security markers, tamper-proof radio-frequency identification (RFID) tags, and laser-etched serialization for food and beverage products.

There has been rising investment into authentication technologies due to the increasing risk of counterfeit sake, imported luxury food items and functional beverages on the market. Furthermore, the government's approach towards maintaining food quality for domestic consumers and exports also reinforces market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The anti-counterfeit packaging for food and beverage market in South Korea is emerging at a fast pace due to the rising number of counterfeiting cases for the alcoholic beverages, dairy products, and functional drinks. The Ministry of Food and Drug Safety (MFDS) and other regulatory authorities in the country of late have adopted stronger measures to prevent food fraud.

AI-based verification technology, QR code-based tracking, block chain enabled authentication solution adoption is on the rise. Moreover, consumers in South Korea have a high level of food safety awareness, particularly in urban areas, driving demand for anti-counterfeit solutions as they are willing to pay extra for products with authentication features that are visible to them.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The segment of track and trace technology emerging as a large contributor towards anti-counterfeit packaging market for foods & beverages due to its growing ability to ensure product tracing, supply chain transparency and provide verification of products for any possible counterfeit threats in real time.

In addition, as the global trade of food and beverage products grows, and the incidence of food fraud increases, tracking mechanisms have become essential for both manufacturers and consumers.

Track and trace technology uses unique identifiers such as serialized QR codes, barcodes, and RFID tags that capture the movement of products through every node in the supply chain. Brands can utilize this technology to institute end-to-end visibility, making it much harder for counterfeit products to infiltrate the supply chain and for food and beverage items to be repackaged without authorization.

Track and trace technology does not simply serve as an authentication measure, it tracks product origins and movement and provides valuable data about the efficiency of logistics, regulatory compliance, and consumer engagement that traditional authentication measures cannot.

The growing adoption of traceability solutions integrated with block chain is driving the market as manufacturers are looking to provide enhanced security for immutable records of product journeys. Mobile-friendly track and trace applications are becoming the new frontier for consumers, who can scan packaging to verify purchases and confirm the completeness of a food or beverage product.

In addition, governments and regulatory authorities globally are implementing strict labelling regulations to enhance food safety, which is further pushing end-user industries towards advanced track and trace systems.

In addition to its high effectiveness, the integration of track and trace systems entails high integration costs, complex data management, and the need for scalable infrastructure. But cloud-based tracking systems, AI-powered predictive analytics and IoT-enabled smart packaging will likely boost adoption of the tech enclave across the food and beverage industries, analysts predict.

With increasing concerns over product integrity, track and trace technology is expected to dominate the Anti-Counterfeit Packaging Market for Food & Beverages, providing secure, transparent, and tamper-proof packages that bolster consumer trust.

The Invisible Printing segment is experiencing significant growth in the food & beverage anti-counterfeit packaging market, as it enables discrete, tamper-proof authentication without compromising the aesthetic appeal of the packaging. Invisible printing methods include UV-sensitive inks, infrared markings, micro text, and hidden codes that can only be verified with special scanning devices or even mobile applications.

Invisible printing also offers the added benefit of seamlessly fitting into existing packaging designs, minimizing disruption while bolstering security.

Food and beverage brands are leveraging invisible printing solutions for anti-counterfeiting, particularly for high value products like organic foods, premium beverages, and dairy and infant nutrition. It allows brands to stamp hidden security features that verifies authentic products and blocks counterfeit efforts.

The increased demand for digital interactive packaging has augmented the growth of the invisible printing market as manufacturers are deploying AI-based authentication solutions and scanner technologies compatible with smartphones to provide consumer engagement. These multi-layered security solutions utilise invisible watermarks and embedded micro text, enabling retailers and authorities to easily verify product authenticity.

Though effective, the prevalence of invisible printing is hindered by the requirement of specialized detection equipment, production cost limitations, as well as the regulatory considerations for food labelling. In order to solve these problems, the industries emphasize the development of environment-safe invisible ink, economical security printing, and AI-exercised validation programs.

This combined with increasing food safety concerns, regulatory requirements, and growing consumer demand for tamper-resistant packaging is predicted to drive widespread adoption of invisible printing throughout the food and beverage industry in the coming years.

Despite counterfeiting challenges, invisible printing will be a key anti-counterfeiting solution in the Anti-Counterfeit Packaging Market for Food & Beverages with ongoing investments by brands in high-security packaging technologies.

Anti-counterfeit Packaging for Food & Beverages Market Scenario: The anti-counterfeit packaging for food & beverages market is anticipated to grow over the forecast period due to increasing concerns about food safety, brand protection, and compliance to regulations.

The growing number of counterfeit food and beverage products is also pushing demand for next-generation security solutions. The enterprises are implementing advanced technologies like RFID-based tracking, holograms, serialization, tamper-evident seals, and block chain supported supply chain management which guarantees monitoring the products back to their original manufacturers.

Moreover, the increasing trend for eco-friendly and biodegradable packaging is driving sustainable anti-counterfeit solutions in the industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Avery Dennison Corporation | 18-24% |

| CCL Industries | 14-18% |

| 3M Company | 12-16% |

| SICPA Holding SA | 10-14% |

| Zebra Technologies | 8-12% |

| Other Industry Players (Combined) | 28-34% |

| Company Name | Key Offerings/Activities |

|---|---|

| Avery Dennison Corporation | Provides RFID-based smart labels, tamper-evident packaging, and track-and-trace authentication. |

| CCL Industries | Develops holographic security labels, QR code verification, and digital authentication for food brands. |

| 3M Company | Specializes in covert security markers, micro-optic films, and tamper-resistant packaging solutions. |

| SICPA Holding SA | Offers secure inks, block chain based food traceability, and authentication features to prevent fraud. |

| Zebra Technologies | Focuses on barcode serialization, smart packaging, and AI-driven tracking solutions for food safety. |

Key Company Insights

Avery Dennison Corporation (18-24%)

Avery Dennison leads the anti-counterfeit packaging market for food and beverages with its RFID and smart labelling solutions that enhance product traceability and brand security.

CCL Industries (14-18%)

CCL Industries is a major player in security labelling, offering holograms, encrypted QR codes, and real-time authentication solutions tailored for food products.

3M Company (12-16%)

3M Company specializes in high-security labelling solutions, including micro-structured films and covert authentication markers for counterfeit prevention.

SICPA Holding SA (10-14%)

SICPA develops secure printing and block chain integrated tracking systems that improve food product traceability and prevent counterfeiting in the global supply chain.

Zebra Technologies (8-12%)

Zebra Technologies provides digital serialization, barcode authentication, and AI-powered anti-counterfeit packaging solutions for food and beverage safety.

Innovative solutions, such as AI-based supply chain monitoring, smart packaging, and edible security markers, are transforming the anti-counterfeit packaging landscape. Notable contributors include:

The overall market size for the anti-counterfeit packaging for food & beverages market was USD 84.5 billion in 2025.

The anti-counterfeit packaging for food & beverages market is expected to reach USD 147.2 billion in 2035.

The anti-counterfeit packaging for food & beverages market is expected to grow at a CAGR of 5.68% during the forecast period.

The demand for the anti-counterfeit packaging for food & beverages market will be driven by increasing concerns over food safety, rising incidents of food fraud, advancements in smart packaging technologies, stringent regulatory requirements, and growing consumer awareness regarding product authenticity.

The top five countries driving the development of the anti-counterfeit packaging for food & beverages market are the USA, China, Germany, France, and Japan.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.