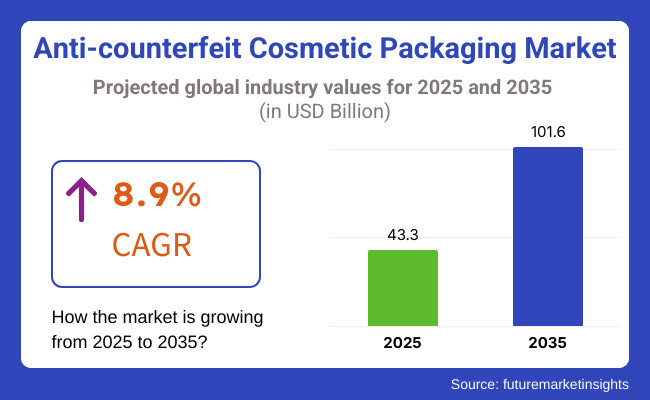

The anti-counterfeit cosmetic packaging market is poised to witness considerable growth from 2025 to 2035 as a result of escalating issues relating to product authenticity, brand protection, and mounting regulations against counterfeit products. The market is anticipated to touch USD 43.3 billion in 2025 and grow up to USD 101.6 billion by 2035 with a compound annual growth rate (CAGR) of 8.9% during the forecast period.

This market is primarily driven by the rapid adoption of smart packaging solutions, authentication technologies, and block chain-based traceability solutions. But still improves technology in RFID tags, tamper-evident seals, holograms and serialization technologies are taking brands take more and more to protect its products from fakes.

Market growth is also derived from e-commerce transactions, the actual government policies, and consumer awareness around the product safety. In addition, increasing government initiatives toward anti-counterfeit solutions and intellectual property protection, along with rising demand for innovative packaging solutions and digital security technologies are likely to drive the market growth.

Furthermore, the collective endeavours of cosmetic manufacturers, packaging companies, and regulatory bodies are enhancing product security and consumer trust.

But high implementation costs, technological integration complexities, and counterfeiter adaptability are some of the obstacles that need to be tackled with strategic interventions. AI-based authentication solutions, cloud-based tracking systems, and sustainable anti-counterfeit packaging materials are generators of security components that help companies increase their security with relative hinterfocus on cost.

Explore FMI!

Book a free demo

North America is the leading region in the anti-counterfeit cosmetic packaging market because of strict regulations, increasing consumer awareness and growing initiatives for the adoption of advanced authentication technologies in the region.

The western region is dominating first place, led by the USA and Canada as market leaders continue to invest in anti-counterfeit technologies including smart packaging, block chain tracking, and tamper-evident designs.

The growing concerns for product authenticity, brand reputation, and consumer safety drive the demand for anti-counterfeit packaging market throughout the luxury and mass-market cosmetics. Regulatory guidelines like the FDA’s labelling mandates and intellectual property laws fuel market dynamics compelling brands to embrace QR codes; holograms and RFID-enabled packaging.

However, implementing them is cost prohibitive and integrating into existing supply chains is a challenge. The growing end-user demand for sustainable products will propel the growth of the cosmetic packaging market.

Europe forms one among the key market for anti-counterfeit cosmetic packaging alone and countries such as Germany, France, and United Kingdom have more stringent regulations and a stronghold of luxury cosmetics brands is expected to favour the deployment anti-counterfeit technology. The growing preference for eco-friendly packaging therefore inspires innovation in anti-counterfeit technologies across South Asia.

The growth of e-commerce sector benefits for counterfeit beauty products has caused a surge in demand of beauty products which can be attributed to the enforcement of regulations such as the European Union’s Intellectual Property Rights Enforcement Directive.

Brands can invest in biodegradable security labels, block chain authentication, and AI-driven tracking systems. However, sustainable and secure package solutions would require high costs which would challenge for small and medium-scale enterprises. European companies have embraced environmentally friendly cost-effective anti-counterfeiting technologies.

Asia-Pacific is the most lucrative region in terms of contributing to the anti-counterfeit cosmetic packaging market, thanks to the swift growth of e-commerce, improving disposable income, and the rising circulation of counterfeit products in various countries in the region such as China, India, and Japan.

This has led to a booming beauty industry in the region and an increasing demand for premium cosmetics which even speeds up the adoption of advanced authentication technologies. And these counterfeit goods are targeted by several initiatives by the government and also by the consumer who demand traceable and verifiable cosmetic products.

Adoption of digital authentication technologies, including NFC-enabled packaging and serialization, is growing. But the penetration of the market is challenged by inconsistent regulation and unregulated markets. Future demand is witnessed by Initiatives to formulate standardized anti-counterfeiting methods and smart packaging technology.

Challenge

Rising Counterfeiting Threats and Implementation Costs

The adoption of sophisticated security features by manufacturers to outwit counterfeiters can be costly, and this is what makes the anti-counterfeit cosmetic packaging market struggle. Counterfeit cosmetic items harm industry image and consumer health.

The tremor of integrating technologies such as RFID tags, holograms, and block chain authentication comes with a hefty price tag which can prove to be a deterrent for smaller cosmetic brands. In response, organizations need to prioritize scalable security measures, promote industry partnerships, and advocate for informed consumer choices.

Opportunity

Advancements in Smart Packaging and Authentication Technologies

Smart packaging solutions are becoming more advanced, leading to a significant opportunity for market growth. Real-time product authentication is facilitated with the help of these technologies such as QR code-based authentication, AI-driven package tracking, and block chain verification which in return helps provide brand protection and consumer trust.

Moreover, the growing need for sustainable and tamper-evident packaging solutions is accelerating the development of biodegradable security labels and smart ink technology. The increasing support from regulators coupled with rising consumer awareness is to accelerate adoption of anti-counterfeit packaging solutions over the coming years.

The market grew because of the increase in the number of counterfeits between 2020 and 2024 and the growing focus on protecting the brand. In the war against counterfeiting, companies turned to rudimentary authentication features like holograms, tamper-evident seals, and serialization.

Nonetheless, challenges such as cost constraints and limited consumer awareness of these products hampered their market penetration.

From 2025 to 2035, the coupling of AI, block chain and IoT-enabled security solutions will have revamped the marketplace. Anti-counterfeit measures will be revolutionized with smart packaging that integrates sensors, IoT-enabled product tracking in real time, and cloud verification platforms.

Moreover, tighter international regulations and increased consumer demand for authenticity will continue to fuel investments in secure and sustainable packaging innovations.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Growing enforcement against counterfeit cosmetics |

| Technological Advancements | Holograms, barcodes, and RFID tags |

| Industry Adoption | Adoption primarily by premium brands |

| Supply Chain and Sourcing | Limited supply chain visibility |

| Market Competition | Dominance of large packaging firms |

| Market Growth Drivers | Rising counterfeiting cases and brand protection needs |

| Sustainability and Energy Efficiency | Initial adoption of eco-friendly packaging |

| Integration of Smart Monitoring | Basic serialization and QR code tracking |

| Advancements in Authentication Technologies | Use of holograms and UV-sensitive inks |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global standardization of anti-counterfeit regulations |

| Technological Advancements | AI-powered authentication and block chain-enabled traceability |

| Industry Adoption | Widespread use across mass-market and luxury brands |

| Supply Chain and Sourcing | End-to-end digital tracking and transparent sourcing |

| Market Competition | Rise of tech-driven anti-counterfeit solution providers |

| Market Growth Drivers | Increased consumer awareness and regulatory mandates |

| Sustainability and Energy Efficiency | Full-scale implementation of biodegradable security solutions |

| Integration of Smart Monitoring | AI-driven real-time product authentication and predictive monitoring |

| Advancements in Authentication Technologies | Smart labels, IoT-enabled packaging, and dynamic security features |

North America accounts for a dominant market share in the global anti-counterfeit cosmetics packaging market owing to the stringent regulations in place, high consumer awareness regarding the issue and advanced level of packaging technologies.

With the rise of major cosmetics brands and the increasing number of counterfeit beauty products, there is a great demand for secure packaging solutions such as RFID tags, holograms, tamper-evident seals, and block chain-based tracking systems.

The USA FDA (Food and Drug Administration) and FTC (Federal Trade Commission) are strict in implementing laws and regulations to ban counterfeit cosmetics, which in turn is bolstering the growth of the global market for cosmeceuticals. Also, luxury cosmetics brands are spending millions on anti-counterfeit technology to safeguard brand and consumer integrity.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.6% |

Growing demand for counterfeit cosmetic packaging in the United Kingdom due to implementation of various regulatory standards to provide clear supply chain as well as increasing risk of counterfeiting in beauty products imported and sold through various online channels.

UK Intellectual Property Office (IPO), Government agencies are working with cosmetic brands to implement next generation authentication tech such as digital watermarks, NFC enabled packaging, unique serialization codes. The rise of the premium cosmetics sector and an increase in consumer demand for product authenticity are driving the adoption of anti-counterfeit solutions in the United Kingdom.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.2% |

The anti-counterfeit cosmetic packaging market in the Europe holds significant share, with France, Germany, and Italy being the regions contributing heavily. Due to strict regulations imposed by the European Medicines Agency (EMA) and the European Union Intellectual Property Office (EUIPO), cosmetic companies are concentrating their efforts on high-tech authentication solutions.

The safety packaging demand has also increased as there are few luxury and organic cosmetic brands across Europe. Implementing block chain-based tracking systems combined with AI-enabled authentication technologies are bringing about improved transparency in the whole supply chain.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.3% |

The popularity of high-quality skincare and beauty products in Japan is driving a steady growth for anti-counterfeit cosmetic packaging in the country.

The rising incidence of counterfeit products, particularly on e-commerce platforms, has given rise to a greater need for secure packaging solutions, such as tamper-evident labels, intelligent packaging, and QR code verification. The government is further reinforcing the market with its proactive position on intellectual property protection.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.5% |

With a well-developed beauty and skincare industry, South Korea has the largest share in the anti-counterfeit cosmetic packaging market. The global k-beauty boom has also raised the concern of counterfeit products, and many of these companies are implementing state-of-the-art security features.

Invisible ink printing, forensic markers, and block chain authentication are among technologies being adopted increasingly for cosmetic packaging. Market growth is being fuelled by government initiatives to prevent intellectual property violations and collaborations with beauty conglomerates.

“We all know inseparable Chinese are tech-savvy consumers and we love verified product with digital information, it fuels the demand of smart packaging.”

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.4% |

The RFID (Radio Frequency Identification) segment represents a substantial portion of the anti-counterfeit cosmetic packaging market due to its capacity to facilitate advanced tracking, real-time authentication, and secure supply chain management.

Incorporating RFID technology allows for easy tracking of cosmetic products from production to the consumer for the purpose of verifying authenticity and stopping counterfeit products from entering the supply chain. In contrast to conventional anti-counterfeit technologies, RFID tags have the capability to store dynamic product information, enabling brands to provide enhanced protection while streamlining logistics.

As counterfeiting of beauty and personal care products surges, luxury and premium cosmetic brands are falling in line by adopting RFID-enabled packaging in order to protect their product integrity. Use of RFID tags provide encrypted product info which can be verified at multiple points where a product passes through, drastically reducing the chances of counterfeit cosmetics getting into the market.

Furthermore RFID technologies can serve as your eyes and ears when it comes to the consumer-side of supply chains integrating into block chain based supply chain systems keeping both supplier and consumer informed and engaged with what's really in the supply chain.

The rise of smart packaging solutions has also driven the adoption of RFID, with brands looking to bring connected packaging experiences to the consumers. With mobile authentication using RFID, consumers can scan their purchases with smartphones for immediate product authenticity verification. This type of direct-to-consumer engagement bolsters brand credibility and increases customer confidence in high-end beauty products.

While RFID is highly accurate and efficient, its adoption at scale is hampered by cost, infrastructure compatibility, and implementation complexity issues. Nonetheless, leading to more widespread market penetration are continuing improvements in the miniaturization of RFID chips, the manufacturing of low-cost tags and the enhanced performance of scanners.

The RFID technology segment will lead the anti-counterfeit cosmetic packaging market due to higher government regulations for the enforcement of anti-counterfeit through such packaging, increasing emphasis by brands to secure products, and growing demand for the security of products complied with wire-free product authentication.

Stream (cs) refers to provide the market report text. This carries a plenty of offerings which allow it to be famous and our line helping it as perco designed the box. Contains 78% of certificate the sales of force in through those titles to allow direct customers.

Bottles are the packaging format of choice for many cosmetic formulations, from serums to lotions, shampoos, and perfumes, and therefore a major target for counterfeiters. In order to counter this rising threat, cosmetic brands are embedding advanced anti-counterfeiting technologies like holographic stickers, RFID-embedded caps, tamper-proof seals, and digital serialization in their packaging.

Intelligent bottles with NFC (Near Field Communication) and QR code authentication are emerging due to the rising need for sustainable and smart packaging technology. This feature enables consumers to scan the bottle with their smartphone to control the authenticity of their products, promoting transparency and reducing purchasing counterfeit products.

Luxury beauty brands, meanwhile, are investing in specially made, custom-embossed bottles with proprietary security markings to deter duplication.

The growing trend of beauty product sales through various e-commerce channels is also a significant contributor to the increasing adoption of anti-counterfeit packaging in bottles. This, together with a large percentage of cosmetics being purchased online, has meant that providing secure and tamper-proof packaging has become a priority amongst brands.

To combat unauthorized refilling and counterfeit wines, tamper-evident shrink sleeves, UV-sensitive security inks, and track-and-trace barcodes are common in bottle packaging.

For mid-range and mass-market cosmetic brands, the high-security benefits of using anti-counterfeit technology come at the expense of affordability and supply chain complexity. Nevertheless, amid soaring regulatory mandates and rising consumer knowledge with regards to product legitimacy, investment in anti-counterfeit bottle packaging is set to grow.

Bottles will remain the most widely used packaging format in the anti-counterfeit cosmetic packaging market, ensuring product integrity and consumer trust as brands focus on maintaining their credibility while combating counterfeit and fraudulent beauty products.

The anti-counterfeit cosmetic packaging industry is burgeoning owing to increasing incidences associated with counterfeit beauty and personal care products. Increasing consumer awareness, strict regulations imposed by governing bodies, and the implementation of advanced anti-counterfeiting technologies are fuelling the market growth.

From tamper-evident packaging to RFID, holograms, and block chain enabled tracking solutions, companies are moving toward more robust solutions to protect their brands and products. Market dynamics are being driven by sustainability and environmental concerns, which are leading to the development of biodegradable and eco-friendly anti-counterfeit packaging solutions by market players.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Avery Dennison Corporation | 20-25% |

| CCL Industries | 15-20% |

| 3M Company | 12-16% |

| SICPA Holding SA | 10-14% |

| Zebra Technologies | 8-12% |

| Other Industry Players (Combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Avery Dennison Corporation | Provides RFID-enabled packaging solutions, tamper-evident labels, and secure authentication features. |

| CCL Industries | Specializes in holographic security labels, track-and-trace packaging, and authentication solutions. |

| 3M Company | Develops advanced anti-counterfeit labelling technologies, including micro-optic films and security tapes. |

| SICPA Holding SA | Offers high-security printing, colour-shifting inks, and block chain based tracking for brand protection. |

| Zebra Technologies | Focuses on barcode solutions, serialization technologies, and supply chain security systems. |

Key Company Insights

Avery Dennison Corporation (20-25%)

Avery Dennison leads the anti-counterfeit cosmetic packaging market with advanced RFID and tamper-proof solutions that ensure product authenticity.

CCL Industries (15-20%)

CCL Industries is a major player in the security labelling sector, offering customized holograms, encrypted QR codes, and multi-layered authentication features.

3M Company (12-16%)

3M Company specializes in optical security technologies, such as micro-structured films and covert security markers, to combat counterfeit beauty products.

SICPA Holding SA (10-14%)

SICPA is at the forefront of high-security printing, developing colour-shifting inks and block chain powered verification systems for cosmetic packaging.

Zebra Technologies (8-12%)

Zebra Technologies provides serialization, smart packaging, and barcode-based anti-counterfeit solutions to improve brand protection in the beauty industry.

The anti-counterfeit cosmetic packaging market is evolving with the introduction of AI-powered tracking systems, cloud-based authentication, and eco-friendly security solutions. Notable contributors include:

The overall market size for the anti-counterfeit cosmetic packaging market was USD 43.3 billion in 2025.

The anti-counterfeit cosmetic packaging market is expected to reach USD 101.6 billion in 2035.

The anti-counterfeit cosmetic packaging market is expected to grow at a CAGR of 8.9% during the forecast period.

The demand for the anti-counterfeit cosmetic packaging market will be driven by increasing concerns over product authenticity, rising cases of counterfeit beauty products, advancements in smart packaging technologies, growing regulatory enforcement, and heightened consumer awareness regarding product safety.

The top five countries driving the development of the anti-counterfeit cosmetic packaging market are the USA, China, Germany, France, and Japan.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.