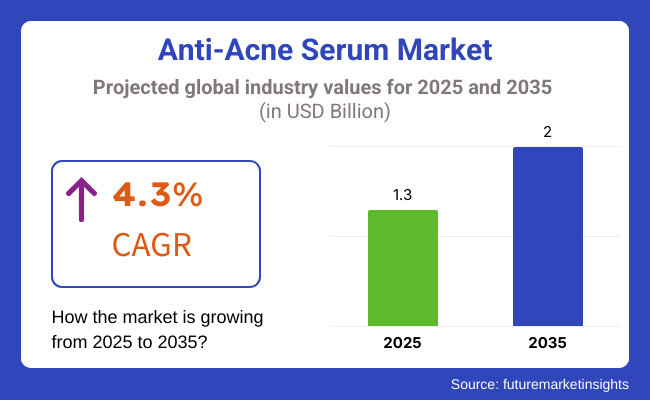

Rising instances of acne-related skin diseases, growing consumer awareness towards skincare, and increasing demand for efficient, natural formulations are paving the way for growth in the anti-acne serum market across the globe, to grow around 1.6x from 2025 to 2035. The landscape is shifting much more quickly now with a dermatological research boom and new skincare ingredients being revealed.

In 2035, the market is predicted to be worth approximately USD 1.3 Billion with a CAGR of 4.3% over the forecast period. Some of the other factors that drive the market include an increasing demand for organic and natural serums, rising disposable income, and social media influence on beauty trends.

North America is estimated to be the largest anti-acne serum market, owing to high consumer spending on skincare products, the presence of counter brands, and the growing adoption of customer-personalized skincare products. Rising demand for clean beauty and vegan skincare products across the region is expected to boost the market growth.

Newer dermatological research and the powerful impact of beauty influencers are also widening the market. The rise of e-commerce as an increasing proportion of such products allows both greater accessibility and competitive pricing.

The European region is projected to be steady due to the growing awareness about skincare, a robust regulatory environment assuring product safety, and the rising need for dermatologically tested products. The trend towards sustainable and cruelty-free formulas to also moving the needle when making a purchase. In addition, the growth of high-end cosmetic companies, rising consumer preference for organic elements, and government initiatives promoting sustainable beauty practices further drive the market.

Due to population growth in the outer class of citizens and a growing focus of consumers on skincare and beauty, this region is expected to have the highest growth rate of all regions in the Asia-Pacific region. Skincare innovation is concentrated in China, japan, and South Korea, and this is forging to be an impulse factor for the essence market.

Moreover, the rise of home-grown brands that provide affordable, quality solutions is also bolstering the market. The rise of anti-acne serums in the region can be attributed to social media marketing and K-beauty product trends that influence consumer preferences and contribute to their growing demand.

Advanced skincare is gradually finding its way into more regions, with places like Latin America, the Middle East, and Africa increasingly adopting the trend due to urbanization, increased consumer awareness, and growing e-commerce penetration.

Additionally, the increasing influence of global beauty trends is leading to market growth within these regions. Moreover, the emergence of local brands with budget-friendly, effective anti-acne formulations addresses region-specific skincare needs and preferences. Challenges and Opportunities

Challenges

High Costs and Logistical Complexities

The Anti-Acne Serum market development trends and marketing channels are analyzed. Manufacturers are subject to strict safety and efficacy regulations that can slow the introduction of new products and raise overall costs.

Consumer Sensitivity and Market Competition

Consumers are sensitive to skincare as they can have different skin types, thus, may have unwanted reactions especially on acne-related products. More and more brands with a variety of solutions make the competition between markets tougher, and it might become difficult for newcomers.

Opportunities

Rising Demand for Natural and Organic Formulations

Anti-Acne Serum Market: Regional Insights The Anti-Acne Serum Market has a growing preference for natural, organic, and clean beauty products, which provides a lucrative opportunity in the market. As more consumers search for products that do not contain harsh chemicals, the demand for organic and dermatologist-approved formulations is rising.

Technological Innovations in Skincare Solutions

Advancements in skincare technology, such as AI-driven personalized skincare recommendations and biotechnology-infused formulations also drive innovations. Businesses that focus on science-driven, high-performance research and development-based anti-acne serums will find the space to enter.

From 2020 to 2024, the Anti-Acne Serum Market witnessed growth owing to growing consumer awareness, booming skincare trends, and social media influence. Demand for targeted acne treatments soared, with brands rolling out new formulations loaded with actives like salicylic acid, niacin amide, and tea tree oil.

However, issues like misinformation, counterfeit products, and varying product efficacy acted as hindrances to market players. Brands that successfully built trust with their consumers adopted clear marketing and leveraged dermatologist recommendations and AI-driven skin analysis tools to allay concerns about their gardens of complexity.

Focusing on 2025 to 2035, the market will likely become increasingly competitive with new players as well as global brands looking to introduce personalized skincare, microbiome-friendly formulations, and more sustainable packaging into this area. The inclusion of AI-enabled virtual skincare consultations, DNA skin-care personalization, and probiotic-powered anti-pimple serums will dominate the industry.

Moreover, international e-commerce expansion, the proliferation of sustainable packaging, and the movement towards organic and mineral makeup will impact the future of the market, as will the growing popularity of sustainable beauty products and sourcing techniques. The development of the Anti-Acne Serum By investing in innovative formulations, digital skincare technology, and sustainable products would lead (or guide) the evolution of the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Complies with FDA, EU, Dermatological Safety Standards |

| Consumer Trends | Increase in demand for acne treatments recommended by a problem skin specialist |

| Industry Adoption | More active ingredients, such as salicylic acid or tea tree oil. |

| Supply Chain and Sourcing | Reliance on synthetic compounds and conventional supply chains |

| Market Competition | Well-known names in beauty along with up-and-coming indie beauty brands |

| Market Growth Drivers | Impact of social networks, influencer marketing, and digital |

| Sustainability and Energy Efficiency | Early emphasis on recyclable packaging and lower waste |

| Integration of Digital Planning | AI is not widely used in skin analysis and digital marketing. |

| Advancements in Skincare Technology | It utilizes traditional acne-fighting elements and topical treatments |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global regulations, AI-assisted compliance monitoring, and enhanced product safety standards |

| Consumer Trends | Expansion into microbiome-friendly and DNA-based skincare personalization |

| Industry Adoption | Rise of probiotic-infused, biotechnology-driven formulations and AI-powered skincare solutions |

| Supply Chain and Sourcing | Shift toward sustainable sourcing, eco-friendly packaging, and cruelty-free testing. |

| Market Competition | Growth of AI-driven skincare startups, direct-to-consumer brands, and personalized skincare services |

| Market Growth Drivers | Increased investment in AI-driven skin diagnostics, biotechnology-based skincare, and sustainable beauty innovations |

| Sustainability and Energy Efficiency | Large-scale implementation of zero-waste production, carbon-neutral skincare brands, and refillable packaging solutions |

| Integration of Digital Planning | Expansion of virtual skincare consultations, smart skincare assistants, and data-driven product recommendations |

| Advancements in Skincare Technology | Evolution of microbiome-friendly serums, DNA-personalized treatments, and AI-driven skincare formulations |

The anti-acne serum market in the USA is expanding steadily as consumer awareness of skincare grows, as well as a demand for organic and natural products, as well as hustlers and influencers in social media beautification. Privacy Overview The growing dermatology market and progress in skincare formulations are propelling product inclination.

Because of this, e-commerce platforms are enhancing accessibility, bringing premium and clinically proven serums to the masses. Moreover, the growing presence of major industry players along with the rising R&D investments in personalized skincare solutions is attributing to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

The UK market expansion is propelled by rising demand from consumers for potent acne remedies and a growing preference for clean-label, dermatologist-recommended formulations. Increasing disposable incomes and a growing ball of beauty swarm are on the market's boom.

Given that discounting rarely pays off, brands are turning to myriad social media influencers and digital marketing campaigns for visibility, spearheading the adoption of younger clientele who are willing to pay a premium for excellent anti-acne serums. The growing popularity of subscription-based skincare services and online retail channels is also contributing to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

The evolving image of anti-acne serums can be attributed to the rising trend of skin-care routines, increasing consumer preference for cruelty-free and sustainable beauty products, and regulatory backing for dermatologist-tested products across skin-care serum and skin-care serum markets in the region.

European countries such as France, Germany, and Italy are at the forefront of product innovation, with brands launching cutting-edge serums that incorporate natural ingredients and probiotics. Increased interest in K-beauty and tailored skincare routines are also propelling product demand. In addition, strict EU regulations on ingredient transparency are gaining consumer confidence in the formulation of high-quality products.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.2% |

The local market for anti-acne serums is growing quickly in South Korea, as the industry is a well-established part of the global beauty market, and innovation in skincare continues to progress. One factor behind the growth is the dominance of K-beauty, which focuses on high efficacy and innovative formulations.

The growing demand for multifunctional skincare solutions, as well as the preference for serums made with organic and fermented ingredients, also drive the market. The high penetration of e-commerce platforms and beauty influencers also plays a significant role, making South Korea the front-runner in the anti-acne skincare product market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The anti-acne serum market is expanding globally, driven by rising skincare awareness, growing consumer preference for natural and sustainable products, and advancements in dermatological research. The increasing adoption of personalized skincare and digital retail channels is shaping the future of this market.

Segmentation Outlook

The Organic segment is the fastest-growing segment and also dominates the anti-acne serum market due to a growing consumer preference for natural and chemical-free skincare products. Consumers prefer plant-based, non-toxic, natural skin care solutions while they avoid synthetic ingredients that contribute to their skin issues. Most organic anti-acne serums contain tea tree oil, aloe Vera, green tea extract, and chamomile - ingredients that have soothing and antibacterial properties.

With increasing awareness regarding clean beauty trends and synthetic chemicals being damaging to the skin, there is a strong leaning towards organic formulations. Increasingly, many brands help meet the needs of eco-conscious consumers by offering certified organic and cruelty-free anti-acne serums. In addition, the rising availability of organic skin care products due to the increasing number of e-commerce portals is further driving the growth of this segment.

One of the main factors that is boosting the demand for gentle, non-toxic solutions that are free from chemicals among consumers whose sensitive skin and acne breakouts are on the rise. This is why people have trust in organic anti-acne serums, as being non-harsh yet active ingredients make dermatologists suggest these. Since they are rich in anti-inflammatory and antioxidant-ed herbal extracts, these serums can not only reduce the existing acne but also prevent future breakouts and get you healthier skin.

With the increasing preference of consumers towards holistic and sustainable skincare routines, organic anti-acne serums are likely to maintain steady growth in the market. The organic sector is likely to surge further as it solidifies its position in the market as brands prioritize biodegradable packaging and eco-friendly formulation all the more.

The women segment holds the largest share in the anti-acne serum market, owing to the higher expenditure of women on skincare products and detailed skincare steps taken by them. Since females are more inclined to search for targeted acne treatments, thus the requirement for dedicated anti-acne serums is augmenting. Beauty influencer, skincare blogs, and dermatological endorsements have made women even more aware of the benefits of the best acne treatment serums.

The booming cosmetics and personal care market is also driving an upsurge in the number of acne serums for women. Why are brands focused on women-oriented marketing strategies nowadays, with anti-acne serums listed as a holistic skin-care routine?

A driving factor for the demand is the increasing cases of hormonal acne, pollution-associated skin issues, and stress-immune breakouts. Women have special considerations like hormonal cycles from menstruation, pregnancy, and menopause that can cause persistent acne that may need tailored solutions. Urban pollution and stress have aggravated skin issues, leading to a desire for newer, improved skincare with actives such as salicylic acid, niacinamide, and tea tree oil.

In addition, the rise in the number of premium as well as luxury brands of skin care products has also been a major contributor to the growth of the market. Prestige brands offer dermatologists - and clinically tested - anti-acne serums that appeal to women willing to pay a premium for high-quality, science-based skin-care solutions.

At the same time, the rising e-commerce platforms and subscription-based beauty services globally, as well as the accessibility of premium acne treatment serums on the market, have made them available to female consumers.

Due to personalized skincare, brands have developed custom anti-acne serums specifically for your skin types and concerns. Beauty brands are bringing AI and skin diagnostic technologies to consumers who are making personalized skincare recommendations. These innovations, combined with continued investment in innovation and the development of skincare for women, are expected to drive even higher growth rates in the women's segment of the anti-acne serum market.

You make sure to have most or even all of your base needs catered to at these stores, and they remain one of the most lucrative areas for growth in the retail market as their share of apparel purchasing and spending actually increases with each passing year.

Some of the key growth factors include increasing knowledge about dermatological health, social media's influence on skincare, and improvements in formulation technologies. This includes innovations in fast-acting and dermatologically tested serums as well as the rising demand for organic and natural ingredients driving the market.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| La Roche-Posay | 20-25% |

| The Ordinary (DECIEM) | 15-20% |

| Paula’s Choice | 12-16% |

| Neutrogena | 8-12% |

| Murad | 5-9% |

| Other Manufacturers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| La Roche-Posay | Dermatologist-recommended anti-acne serums with salicylic acid and niacinamide. |

| The Ordinary (DECIEM) | Affordable, science-backed serums featuring high-potency active ingredients like azelaic acid and zinc. |

| Paula’s Choice | Advanced formulations with BHA and retinol for targeted acne treatment and skin renewal. |

| Neutrogena | Drugstore-friendly acne serums with clinically tested benzoyl peroxide and salicylic acid. |

| Murad | High-performance acne-fighting serums incorporating botanical extracts and pharmaceutical-grade ingredients. |

Key Market Insights

La Roche-Posay (20-25%)

La Roche-Posay, a leader in dermatologist-backed anti-acne solutions, draws upon proven formulations that come recommended by experienced dermatologists.

The Ordinary (DECIEM) (15-20%)

Cheap, effective serums with strong active ingredients, The Ordinary has disrupted the skincare market.

Paula’s Choice (12-16%)

Paula’s Choice is known for its research-backed, effective acne treatment, particularly BHA-based serums.

Neutrogena (8-12%)

A Drugstore brand that is widely trusted, Neutrogena offers accessible and dermatologist-approved acne-fighting serums.

Murad (5-9%)

Murad is a holistic skincare line that takes pharmaceutical science and combines that with natural extracts, so treating acne from all angles.

Other Key Players (30-40% Combined)

The market is evolving with increased competition from emerging brands and natural skincare innovations, including:

The overall market size for Anti-Acne Serum Market was USD 1.3 Billion in 2025.

The Anti-Acne Serum Market is expected to reach USD 2.0 Billion in 2035.

The demand for the Anti-Acne Serum Market will grow due to rising consumer awareness of skincare, increasing preference for organic and natural ingredients, and the expanding male grooming segment. Online retailing will drive sales through influencer marketing and convenience, while drugstores and specialty stores will boost credibility. The shift toward eco-friendly formulations and dermatologist-recommended products will further propel market growth across various distribution channels and consumer segments.

The top 5 countries which drives the development of Anti-Acne Serum Market are USA, European Union, Japan, South Korea and UK.

Organic Ingredients demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Serum Separation Gels Market Size and Share Forecast Outlook 2025 to 2035

Serum Vials Market Size and Share Forecast Outlook 2025 to 2035

Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Serum Lactate Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Market Positioning & Share in the Serum Bottles Market

Serum Separating Tubes Market

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Hair Serums Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Cryo Serums Market Size and Share Forecast Outlook 2025 to 2035

Global Solid Serum Market Size and Share Forecast Outlook 2025 to 2035

Facial Serum Market Forecast and Outlook 2025 to 2035

Vitamin C Serums (Ascorbic Acid) Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Crimp Neck Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Anti-Aging Serums Market Analysis by Type, Application and Region from 2025 to 2035

Niacinamide Serums Market Size and Share Forecast Outlook 2025 to 2035

Hair Growth Serums Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Free Eye Serum Market Analysis – Growth & Demand 2024-2034

Hair Thickener Serum Market Insights – Growth & Demand 2025 to 2035

Fragrance-free Serum Market Report – Growth & Trends 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA