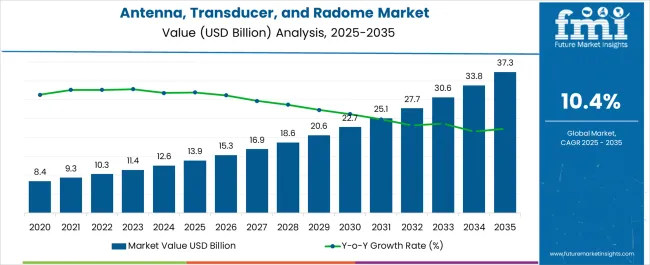

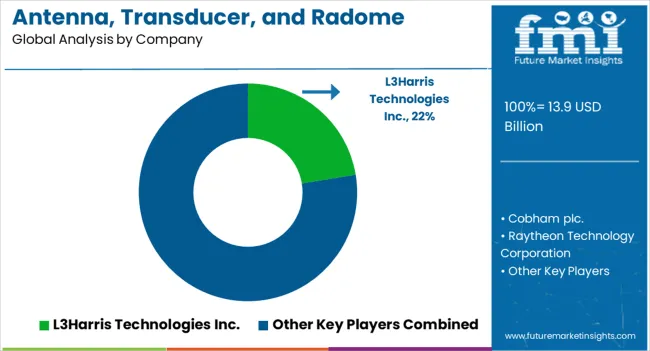

The Antenna, Transducer, and Radome (ATR) Market is estimated to be valued at USD 13.9 billion in 2025 and is projected to reach USD 37.3 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period.

| Metric | Value |

|---|---|

| Antenna, Transducer, and Radome (ATR) Market Estimated Value in (2025 E) | USD 13.9 billion |

| Antenna, Transducer, and Radome (ATR) Market Forecast Value in (2035 F) | USD 37.3 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

The antenna transducer and radome market is expanding steadily due to the increasing demand for advanced communication, navigation, and surveillance systems across defense and commercial platforms. Rising investments in next generation radar technologies, satellite communication systems, and high frequency data transmission infrastructure are driving market adoption.

Technological advancements in lightweight composite radomes, multi band antennas, and miniaturized transducers are improving operational performance while reducing maintenance costs. The market is further supported by growing reliance on unmanned systems, space exploration initiatives, and commercial aviation modernization programs.

Global security challenges and increasing aircraft and satellite deployments have accelerated the integration of ATR solutions across critical platforms. The future outlook remains strong as industries prioritize reliability, enhanced signal transmission, and cost effective protection solutions to meet expanding aerospace and defense requirements.

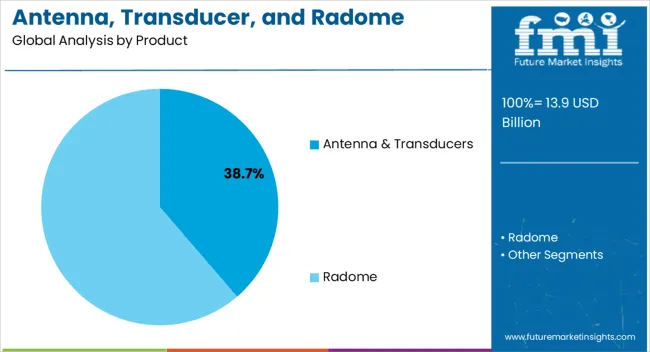

The antenna and transducers product segment is projected to contribute 38.70% of total market revenue by 2025, making it the leading segment. This dominance is supported by their critical role in enabling effective communication, navigation, and data transmission across diverse operational environments.

Ongoing advancements in frequency adaptability, miniaturization, and durability have enhanced adoption in aerospace, defense, and commercial applications. The ability of antennas and transducers to support high bandwidth requirements and resilient connectivity has further strengthened their position as essential components.

Continuous R and D investments and demand for advanced surveillance and communication systems continue to reinforce the leadership of this segment.

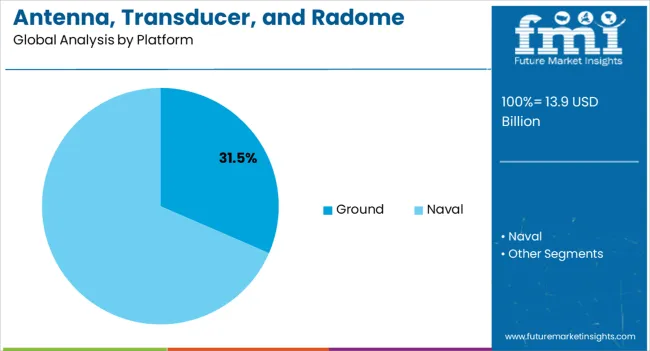

The ground platform segment is expected to hold 31.50% of total market revenue by 2025 within the platform category. This prominence is being driven by the extensive use of ground based radar, communication, and monitoring systems in both defense and commercial operations.

Rising demand for high performance ground stations for satellite communication and defense surveillance has further supported this segment. Technological innovations in radomes and antennas designed for long term ground deployment have enhanced efficiency, signal strength, and reliability.

The critical role of ground platforms in ensuring connectivity and supporting mission critical operations has reinforced their market position.

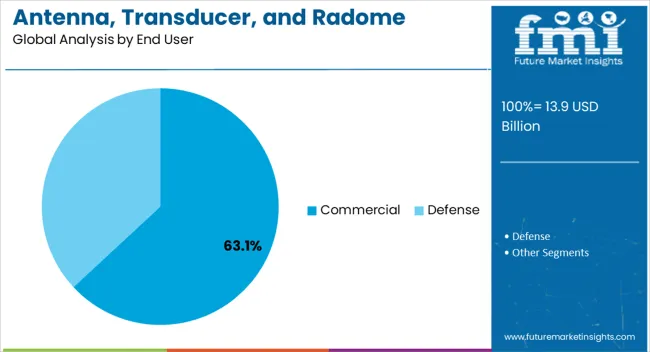

The commercial segment is projected to account for 63.10% of total revenue by 2025, establishing it as the dominant end user. This leadership is being propelled by rising air passenger traffic, fleet modernization programs, and the increasing deployment of satellite broadband and in flight connectivity solutions.

Commercial airlines, telecom providers, and space companies are investing in advanced ATR systems to ensure reliable communication, navigation, and customer experience. Additionally, the commercial sector has benefitted from regulatory support and growing demand for efficient and cost effective connectivity solutions across aviation and satellite services.

These factors collectively strengthen the commercial segment’s dominance in the ATR market.

The global antenna, transducer and radome market expanded at a CAGR of 8.3% over the last four years (2020 to 2025). According to SIPRI, the total global defense expenditure has gone up at least 0.7% in 2024. The sale of components is bound to increase by 2X as investments in technologically advanced systems that extensively use an antenna, transducer, and radome.

The United States will continue to be the largest user of Antenna, Transducer, and Radome Market throughout the analysis period accounting for over USD 18.7 billion absolute dollar opportunity in the coming 10-year period.

The development of advanced materials has revolutionized the market. These materials offer attributes like lightweight construction, durability, and enhanced performance. They are, therefore, perfect for radome application and antenna construction. The utilization of these innovative materials has led to improved antenna efficiency, increased transducer sensitivity, and superior protection for radomes.

The ATR market is witnessing a strong push toward miniaturization and integration to cater to the demands of compact and portable devices. Antenna manufacturers are diligently working on developing smaller and more efficient designs, while transducers and radomes are being integrated into the overall system to reduce size, weight, and complexity.

A noteworthy trend in the market is the increasing demand for customized solutions that seamlessly integrate into specific applications. Companies that provide customization services and collaborate closely with clients to develop tailored ATR solutions can gain a distinct competitive edge in the market.

The market is also experiencing a rising trend in the adoption of SATCOM technology, which has fueled the demand for space antennas. These antennas are instrumental in improving the capabilities of military intelligence, surveillance, and reconnaissance (ISR) systems, as well as communication systems. As a result, there is a need for upgraded radomes, such as the plasma radome, designed specifically to safeguard space antennas from potential external threats.

The United States Department of Defence boosted progress payments to contracting companies in 2024 from 80% to 90% in order to recognize task completion and initiated new contracts. In order to meet their commitments regarding delivery, market giants like Lockheed Martin Corporation hastened payment of more than USD 400 million weekly to its suppliers. This huge investment is bound to positively impact the Antenna, Transducer, and Radome market.

The advanced communications modules have clear advantages across many industries. The advanced antenna technique's used in such modules’ increase in coverage distance suggests lower CAPEX costs as fewer access points are required, lower deployment costs since less equipment and wiring are required and lower OPEX costs as less equipment needs to be maintained throughout the maintenance cycle.

Vector Fields Limited sent Ofcom a report on the use of smart antennas. The study's findings indicate that smart antenna technology has had a significant positive impact. These benefits can be broken down into three categories: a 40–70% increase in communication cell range, a 60–70% decrease in spectrum utilization, and a 50% network cost reduction, which can result in a 1/3 reduction in overall business costs. This has considerably boosted the smart antenna industry's drive.

Before introducing a new product to the market, ATR manufacturers must get product certification. Multiple tests and iterations are necessary for manufacturers to obtain the maximum level of safety which necessitates protracted approval processes, which in turn cause production delays and financial losses.

For instance, according to the key responders, it may take up to three years to get product approval from the Federal Aviation Administration (FAA), which oversees certification in North America. Such regulatory agency certification hold-ups may impede the market's expansion for ATRs.

Materials that least impede the electromagnetic signal sent or received by antennas are used to build radomes such as Polyurethane. The performance of radar and antenna systems can be impacted by even the smallest physical changes, which can also interfere with communication.

As a result, radome maintenance must be done on time. When radome repairs are made, care should be taken to maintain any original characteristics, like transmissivity and reflectivity. The issue for radome developers arises from the fact that maintaining radomes involves technical know-how, the use of appropriate tools, and simulation methods.

North America dominated the Antenna, Transducer, and Radome industry in terms of revenue. North America controlled the bulk of the worldwide market with around 27.2% of the global market share. The revenue through UAVs alone is approximately USD 1.3 billion.

Due to the rising demand for UAVs for commercial purposes and the aerospace modernization programs which have experienced significant policy relaxation in North America. Owing to this, the market for antennas, transducers, and radome in North America is expected to expand significantly.

The United States is the current leader in antenna, transducer, and radome market, geared toward assisting the manufacturing sector. The United States also have a high adoption rate of technologically advanced product designs.

For example, any three-dimensional laser incident surface may achieve a high-precision layout owing to LDS antenna technology, which is established and robust, with exceptional product performance. This technology has a larger design space and is appropriate for three-dimensional surfaces. Although LDS has a significant adoption rate, the cost is higher. It has made a significant contribution to revenue generation for the United States antenna, transducer, and radome market.

The country has witnessed an accelerated rollout of 5G networks across important cities. This creates a surge in demand for advanced antennas capable of supporting high-frequency bands and enabling lightning-fast data speeds. Antenna manufacturers are now focusing their efforts on developing compact, high-performance antennas to cater to the demanding requirements of 5G networks.

The United States is at the forefront of significant advancements in Millimeter Wave technology. It harnesses high-frequency bands for wireless communication. This breakthrough technology is finding applications in gigabit Wi-Fi, autonomous vehicles, and wireless backhaul solutions, thereby creating opportunities for antenna manufacturers to develop cutting-edge products.

Germany's leadership in Industry 4.0 is creating a strong demand for robust wireless connectivity solutions. This demand is translating into an increased need for antennas, transducers, and radomes in industrial applications.

Germany's robust automotive industry is witnessing a paradigm shift with the emergence of electric vehicles (EVs) and autonomous driving technologies. This shift is fueling the demand for antennas and radomes that support connected car functionalities. Furthermore, the integration of radar and other sensing technologies is driving the Germany antenna, transducer, and radome market.

Germany aims to become a leading electric vehicle market, with ambitious plans to reduce carbon emissions. This transition fuels the demand for antennas and radomes to support advanced telematics, V2X communication, and connectivity features in electric cars.

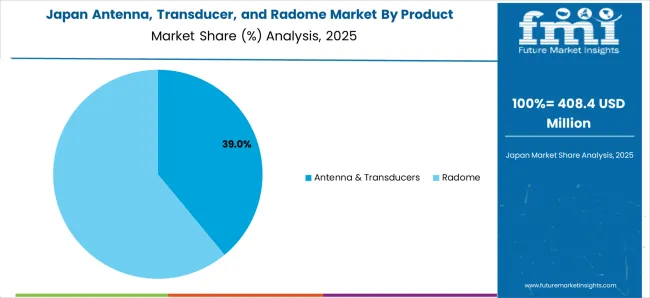

Japan's renowned automotive industry has significantly emphasized developing advanced radar systems for vehicles. Antennas and radomes play a pivotal role in automotive radar systems, enabling features such as collision avoidance, adaptive cruise control, and autonomous driving.

Japan has been an early adopter of 5G technology, which necessitates advanced antennas and transducers to facilitate high-speed wireless communication. The deployment of 5G networks across the country is driving the demand for cutting-edge antenna and transducer technologies.

While 5G is still deployed, Japan is already investing in research and development for 6G technology. This includes exploring advanced antenna and transducer technologies that can support higher frequencies, increased bandwidth, and ultra-low latency. This is likely to open up immense opportunities for market players in the Japan antenna, transducer, and radome market.

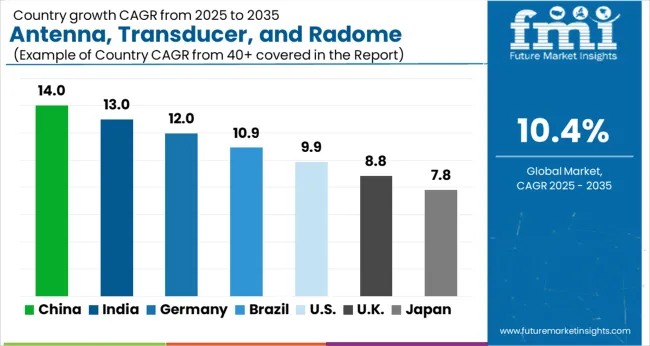

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 10.4% |

| China | 8.1% |

| India | 12.3% |

The United Kingdom has a thriving telecommunications and aerospace industry. It drives the demand for antenna, transducer, and radome technologies considerably. Antennas are vital components for wireless communication systems, while transducers play a crucial role in converting one form of energy to another. Radomes provide protection to sensitive equipment from environmental factors without compromising signal quality.

The automotive industry in the United Kingdom is experiencing a prototype shift with the rising popularity of connected cars and autonomous vehicles. This transformation has resulted in a growing demand for antennas and radomes, which enable seamless connectivity for in-vehicle infotainment systems, telematics, and vehicle-to-vehicle communication, thereby enhancing the overall driving experience.

China has emerged as a global powerhouse in the field of technology and telecommunications. As a result, the China antenna, transducer, and radome market is projected to experience significant growth during the forecast period. China's commitment to developing smart cities has created opportunities for the antenna, transducer, and radome industry.

China's commitment to building smart cities is likely to result in further investments and deployments of antenna systems, transducers, and radomes in various smart city projects across the country. Moreover, the integration of artificial intelligence with antenna systems is also gaining traction in China.

The India automotive market is undergoing a significant transformation, with a growing shift toward electric vehicles. This transition presents substantial opportunities for the antenna, transducer, and radome industry. The government's Make in India initiative aims to boost domestic manufacturing capabilities. This is likely to increase production of antennas, transducers, and radomes by local manufacturers.

The Indian defense sector is actively investing in advanced radar and communication systems, driving the demand for radomes. The government's emphasis on indigenization has resulted in collaborations between defense organizations and Indian antenna manufacturers, fostering innovation and boosting the domestic defense electronics industry.

| Segment | 2025 Value Share in Global Market |

|---|---|

| Antenna & Transducers | 76.5% |

| Ground | 65.5% |

The dominance of the antenna and transducers segment in the antenna, transducer, and radome market can be attributed to a multitude of factors. The ever increasing demand for wireless communication technologies, such as 5G, IoT, and autonomous vehicles, has been a key driving force. Antennas serve as vital components for transmitting and receiving wireless signals. This makes them indispensable for various applications in the telecommunications, aerospace, automotive, and consumer electronics sectors.

The exponential growth in connected devices has played a pivotal role in the prominence of the antenna and transducers segment. From smartphones and tablets to smart home devices and wearables, these devices heavily rely on antennas to establish wireless connectivity and facilitate seamless data transfer. As a result, antennas have become integral to delivering a superior user experience in the era of connectivity.

The demand for antennas, transducers, and radomes is particularly high in ground platforms such as land-based vehicles, fixed infrastructure, and ground-based communication systems. These platforms rely heavily on robust and dependable communication systems for various applications. These include military operations, telecommunications, transportation, and industrial sectors.

Ground platforms generally offer a more cost-effective deployment compared to naval platforms. This affordability factor makes them an attractive option for various industries, including commercial applications. The cost-effectiveness further solidifies the dominance of ground platforms in the market.

Antenna, Transducer, and Radome are used in an integrated form for several commercial activities. Due to the low cost, flexibility, and ease of installation compared to wired competitors, RFID tracking systems technology is utilized in 90% of the business sectors to track goods in e-commerce all around the world.

The market for RADAR is driven by the employment of these antennas in satellite communication and autonomous vehicles, which connects remote, inaccessible places with ease of network planning owing to the wireless software setup of frequency and power. Hence commercial segment is dominant in the antenna, transducer, and radome market.

At present, Antenna, Transducer, and Radome Market manufacturers are largely setting up Joint ventures/mergers for the development of innovative products. The key companies operating in the Antenna, Transducer, and Radome Market include AeroVironment Inc., Airbus S.A.S., Azimut Yachts, BAE Systems PLC, Ball Aerospace & Technologies Corp., Cobham PLC, General Dynamics, Honeywell International Inc., HR Smith Group of Companies, Iridium Communications Inc., L3 Technologies, Leonardo S.p.A, Lockheed Martin, Northrop Grumman, Orolia SA, Qinetiq Group PLC, Raytheon Technologies, Stt-systemtechnik GmbH, Thales S.A., The Boeing Company, Astronics Corporation, Finmeccanica SpA, and Exelixis Inc.

Some of the recent developments by key providers of the Antenna, Transducer, and Radome Market are as follows:

The global antenna, transducer, and radome (atr) market is estimated to be valued at USD 13.9 billion in 2025.

The market size for the antenna, transducer, and radome (atr) market is projected to reach USD 37.3 billion by 2035.

The antenna, transducer, and radome (atr) market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in antenna, transducer, and radome (atr) market are antenna & transducers, parabolic reflector antenna, flat plane antennas, others, radome, sandwich, solid laminate, dielectric space frame and metal space frame.

In terms of platform, ground segment to command 31.5% share in the antenna, transducer, and radome (atr) market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Atrial Fibrillation Device Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Antenna Switch Module Market Size and Share Forecast Outlook 2025 to 2035

Pediatric Measuring Devices Market Size and Share Forecast Outlook 2025 to 2035

Triacetylresveratrol Market Size and Share Forecast Outlook 2025 to 2035

Coastal Patrol Military Vessels Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Oncology Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Telepsychiatry Market Size and Share Forecast Outlook 2025 to 2035

Quad-ridge Horn Antenna Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Wheelchairs Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Walking Aids Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Rollator Walkers Market Size and Share Forecast Outlook 2025 to 2035

Bariatric Lifts Market Size and Share Forecast Outlook 2025 to 2035

Automotive Intelligent Antenna Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Antenna Module Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Resveratrol Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Collagen Skin Matrix Market Size and Share Forecast Outlook 2025 to 2035

Particle Reinforced Aluminum Matrix Composite Brake Disc for Electric Automobiles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA